Overview

Insurance Business Transfer and Division Statutes enable a US insurance company to divest itself of legacy liabilities using transactions that provide finality to the company’s exposure to adverse loss development. Historically, there have been limited strategies available for management to deploy. Primary options have included retroactive reinsurance such as a loss portfolio transfer (LPT), an adverse development cover (ADC), or a sale of a legal entity to a run-off specialist. While the reinsurance structures can be very effective capital management tools they do not provide finality since the amount of risk transfer is not unlimited, resulting in the cedent retaining tail risk. A novation of underlying policies can provide finality, but the process to locate and obtain consent for each insured is challenging for most companies, particularly for long-tail liabilities whereby the underlying policy may have been written decades ago. Traditional M&A transactions also provide finality but are restricted to the books of business in the subject entity.

Legislators and regulatory insurance departments are acknowledging that insurers need new tools to effectively manage legacy liabilities, whether it is for finality, capitalization, solvency, or operational efficiency. To completely remove adverse loss development risk and achieve finality, insurers need a mechanism that will facilitate separating liabilities into a different entity through a sale or spin-off.

Modeled after the UK Part VII transfers, recent legislation passed in 10 states (and growing) substantially expands a US insurance company’s ability to manage these risks. This legislation enables an insurance company to either:

- Divide its book of business, including liabilities, into a separate entity (Division Statute); or

- Transfer business, including liabilities, into a separate entity (Insurance Business Transfer)

Both transactions are made through a regulatory process, rather than receiving approval of a policyholder (i.e., novation), In short, these statutes give US insurance companies the ability to permanently remove liabilities from their balance sheets through a regulatory-sanctioned novation.

The states enacting these statutes are focused on stimulating economic development and/or assisting key domiciled companies in achieving their risk and capital management strategies.

Division Statute vs Insurance Business Transfer

Division Statute

Currently, the most common legislation is the Division Statute, which has been enacted in seven states: Arizona, Connecticut, Illinois, Iowa, Georgia, Michigan, and Pennsylvania. (Arizona's legislation permits both IBT's and Divisions). The new entity will still be owned by the holding company but can now be sold to achieve full legal finality. Using the division statue, an insurance company can separate books of business into a different legal entity. Liabilities eligible for a division can be located across several legal entities, providing insurers with more flexibility than a traditional M&A transaction.

In the first illustration, Operating Company 1 (OpCo 1) writes three books of business (A, B and C). The holding company desires to strip out Book C and place its premium, associated liabilities and capital into a new company for capital management and operational purposes. Under a Division, OpCo 1 can ‘divide’ the company and move Book C to another operating company, ‘NewCo 1’, under the same holding company. While the holding company still owns and manages NewCo 1, the Division provides a path toward finality (if desired) whereby it can be divested or sold.

It is important to note that the Division Statute is not limited to merely transferring liabilities on discontinued lines but can also be used to concentrate both the legacy liabilities and future live business of a line of business in a new company. This can be used to segregate a line which the company intends to continue writing but wishes to insulate from other books of business.

Insurance Business Transfer

Insurance Business Transfers (IBTs) arguably have more flexibility in their function. IBTs allow books of business to be transferred out of the company into a separate entity not owned by the transferring company. This eliminates the need to sell an entity after the transaction. As of now, Oklahoma, Rhode Island, Arizona and Vermont have passed this legislation, but the company transferring the liabilities does not need to be domiciled in these states to initiate an IBT. (Arizona legislation permits both IBT and Division). If the entity acquiring the transferred reserves is domiciled in OK, RI, AZ or VT, then an IBT plan can be executed.

In the second illustration, OpCo 1 has two books of business and transfers one of the books (premium, reserves, capital, etc.) to another company, ‘OpCo 2’, that is owned by a separate holding company. This concept is similar to a loss portfolio transfer (LPT) whereby a cedent transfers reserves to a third party. However, under an IBT, the reserves, capital and potential adverse development of Book C have been fully transferred to OpCo 2. Unlike utilizing an LPT, if OpCo 2 is not able to meet the obligations of the transferred liabilities, there is no recourse back to the original company (OpCo 1).

For both mechanisms, the domiciliary DOI of the policyholder and company would likely need to approve this transaction.

Motivation

Achieving legal finality is a primary motivator for insurance companies to engage in a Division or IBT. While retrospective reinsurance such as ADCs and LPTs are effective tools to protect capital in the event of adverse reserve development, retroactive accounting rules do not permit a netting of the ceded reserves against the reinsurance recoverable. In addition, the limits under these covers keep the cedent liable for any tail risk and adds credit risk from the reinsurer. Also, there is no credit for these transactions in the RBC framework except in limited circumstances. In contrast, IBT/Division mechanisms separate liabilities into a different entity so the reserves are no longer on the original insurance company’s balance sheet, thus achieving finality.

Novations offer the opportunity for an insurance company to achieve finality on outstanding liabilities but with near impossible logistical challenges. With the consent of the policyholder, the insurance company can enter into an agreement to replace the coverage on outstanding liabilities of a policyholder or reinsurance agreement with another company from inception of the coverage period. The novated contract replaces the original policy or agreement. When scaled up to run-off books of business, there may be thousands of policies with little to no information on how to contact the policyholder. The novation then becomes impossible to achieve finality due to the administrative burden. In contrast, Divisions and IBTs give insurance companies the option to reduce this administrative burden and require only a DOI and/or court approval for what is effectively a mass novation of the subject liabilities.

In addition to legal finality, there is also potential for capital benefit from engaging in one of these transactions. Due to rating agency and regulatory capital requirements, long-tail runoff books of business may trap capital creating inefficiencies which can be alleviated by transferring these liabilities to another entity.

Capital requirements are not specifically stated in any state’s legislations. The NAIC has created a Restructuring Mechanism working sub-group to establish capital requirements and financial surveillance tools for these mechanisms. Regulators are concerned whether RBC is sophisticated enough to adequately address capital requirements. While required capitalization has not been decided, the main premise is to make sure the policyholder is not materially adversely impacted. Companies and regulators are evaluating reinsurance as a material source of capital when analyzing capital requirements.

Divisions and IBTs allow an insurance company to consolidate and restructure books of business and create a more efficient insurance operation. Companies that have multiple legal entities with run-off books of business can gain substantial management, claims, regulatory and administrative efficiency by relocating books of business into one entity.

Regulatory Process

The approval process for Divisions or Insurance Business Transfers involves multiple parties and can take anywhere from 12 to 24 months. Currently, no company has completed one of these transactions in the US under the recent legislation, although a special-case division of Cigna/Brandywine occurred in 1996 under the PA corporate division law. Insurance Business Transfers have multiple phases until a sanctioned-novation is approved. The first stage involves data collection and plan submission. The company will approach the state’s Department of Insurance (DOI) and begin drafting an IBT plan for submission. In conjunction with the IBT plan, an Independent Expert (IE) will be consulted as a third party to ensure there will be no negative impact on policyholders. The IE will draft their own report on their opinion of the transaction. The IE selection process varies by state.

Once the report has been submitted, the Department of Insurance will review the IBT plan and the IE report. If the commissioner deems that the IBT will not negatively impact the policyholder and passes other general requirements, the plan will be approved. Upon approval, the submission is sent to court for judicial review. During the process, every policyholder subject to the transaction must be notified. While the policyholder will have the option to comment or object in court, the decision for approval is at the judge’s discretion. Once approved, the novation is final, and the Insurance Business Transfer is complete.

Divisions Statutes follow the same general procedure except there is no court review process. Additionally, while an IE is not required, a DOI may consult with a third party depending on the complexity transaction. Once the commissioner approves the plan, the division can be executed. This is the advantage of a Division. While the IBT provide more flexibility managing liabilities, the Division Statute has fewer regulatory hurdles.

Regulatory & Rating Agency Implications

To address the many capital and legal concerns, the NAIC has created the Restructuring Mechanism Working Group and Subgroup under the Financial Condition Committee. The groups are being tasked with:

- Evaluating and preparing a white paper

- Reviewing and proposing changes to the Guaranty Association Model Act to ensure that policyholders that have guaranty fund protection prior to a restructuring continue to have it after the restructuring

- Reviewing and proposing changes to the Protected Cell Companies Model Act to allow for restructuring mechanisms

- Developing financial solvency and reporting requirements for companies in run-off (sub-group)

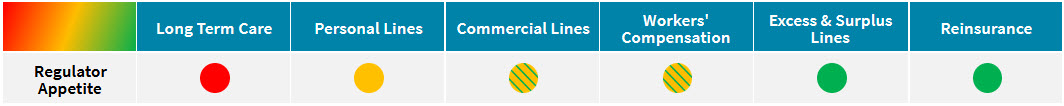

While the NAIC is taking action to understand the implications of the restructuring mechanisms, it will likely take years before a model law is created. The model law will have to address sophisticated legal concerns, particularly guaranty fund coverage. In situations where the acquiring entity is not licensed in the state of the transferring book’s origination, it is still unclear which state’s guaranty fund would be liable for claims in the event of an insolvency. Given this uncertainty, regulators will be more eager to work on deals with lines of business that are not subject to guaranty fund coverages such as surplus lines and reinsurance. The table below generalizes the regulatory appetite for each line of business.

Rating agencies are still developing their view and treatment of these mechanisms in the ratings process. Depending on the agency, companies can be rated on a consolidated basis, individual basis, or both. A division would likely have no immediate impact for an insurer that is rated under a consolidated approach as the new entity would still be within the consolidated group. If a company is rated on an individual basis, then a division has more potential to improve its Financial Strength Rating. IBTs will have a more impact on a company’s rating as the transaction provides the insurer with economic and legal finality instantly. A Division would have a similar result after the divided entity is sold.

Aon’s Role

Insurance Business Transfers and Division Statutes are sophisticated transactions that require expertise from numerous parties. Aon is positioned to provide capital advisory support, including M&A advisory, rating agency guidance, and structured reinsurance solutions throughout the transaction. UK insurers have traditionally placed an ADC/LPT on reserve subject to the division/transfer to eliminate any volatility in the reserves during the regulatory process. Additionally, to meet regulatory capital requirements, the resulting entity may need a structured solution with capital maintenance features. It is common for a reinsurance contract to have a clause that would void any current contracts. The NewCo and OldCo could potentially need new reinsurance treaties post transactions. Finally, if the company goes through a division, the organization will still own the liabilities until the NewCo is sold. Aon is positioned to guide the new entity through a credit rating process and M&A transaction.

About the Authors

Kelly Superczynski is an Executive Managing Director with Aon’s Reinsurance Solutions business. She is the head of Aon’s Capital Advisory team for the Americas and works to identify and implement holistic capital solutions for our re/insurance clients. Kelly’s team consists of experts in structured reinsurance solutions, M&A advisory and transactions, and rating agency and regulatory capital requirements. Together, they understand a companies' capital framework, identify potential strains on capital or opportunities to better leverage capital, and work across Aon to develop and implement solutions.

Matt DiSanto is a Senior Analyst with Aon’s Reinsurance Solutions business. He is a member of Aon’s Capital Advisory team for the Americas and provides analysis on capital adequacy projections. He is responsible for advising clients on financial strength and issuer credit ratings, rating agency criteria, and capital management strategies.