The insurance industry largely relies on catastrophe models to provide a robust method of risk accumulation to quantify extreme, yet plausible loss potential from catastrophic events. Outputs from catastrophe models, such as tail probable maximum loss indications and average annual loss are relied upon by insurers for rate indications, capital management, and risk transfer decisions. However, considerable uncertainty is inherent in models that is not always well understood by the stakeholders who rely on modeled loss estimates to make business decisions.

To fully capitalize on the many benefits of catastrophe models, it is essential that insurers take ownership in understanding the inherent assumptions in each model and how they interact with each insurer’s unique exposure profile. Since there is incomplete data, engineering and scientific judgement are often used to define event parameters such as hazard, frequency, severity and the vulnerability of exposure. Differences in model methodologies and the resulting loss estimates across vendors demonstrate the uncertainty and range of reasonable outcomes. Through the process of developing a bespoke view of risk, insurers reduce their dependence on model vendors to measure their catastrophe risk and gain greater confidence in their risk tolerance thresholds. A bespoke view of risk that is explainable and defensible can be used to manage portfolios and transfer risk.

Catastrophe models are an important base-line; when customizing a view of risk, it is beneficial to benchmark catastrophe models against each other and secondary data sources. Secondary data sources can include claims data, loss history, scientific publications, and university research – however these can be time consuming and challenging to discern as a technical understanding of each topic is needed.

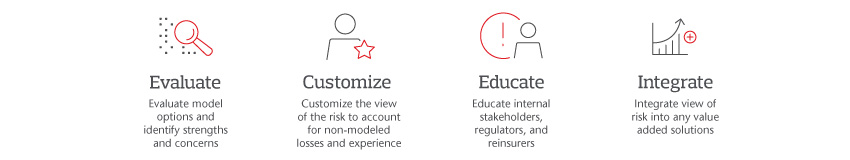

Insurers can begin to customize their View of Risk through Aon's framework of evaluation, customization, education and integration to enhance insights and internal operations while becoming better prepared to support policyholders during challenging times.

About the authors

Sara Rausch is a Senior Managing Director in Aon’s Reinsurance Solutions group, supporting client strategy for the US Catastrophe Management Practice group. Sara advises insurers on the management of catastrophe risk and optimal use of models. Areas of focus include how to interpret and use output from multiple models, and the development and deployment of a customized view of risk. She also supports clients in utilizing model outputs for primary pricing, and reinsurance and capital cost allocation.

Sara earned an undergraduate degree in economics from the University of Minnesota, Morris. She has been a member of the catastrophe management group since joining the firm in 2000 and is based in Aon’s Minneapolis office.

Katie Carter has more than 20 years of professional experience in construction management, engineering and reinsurance. She leads the U.S. Model Evaluation team with Aon Reinsurance Solutions in Minneapolis, MN. Katie has knowledge of peril model science and methodology globally, with deep expertise in the U.S. peril regions. Katie oversees the change management of new model versions and works with clients on custom view of risk strategies.

Katie has a Bachelor of Science in Civil Engineering from Michigan Technological University and a Master of Science in Civil Engineering from the University of Central Florida.