20 years on from the devastating floods which had a large impact on Germany’s and Austria’s economy and became the costliest natural disaster event on record in the Czech Republic, we look back on the event and how flood models have evolved to provide better risk management.

Introduction

Even though windstorms remain historically the costliest natural peril for insurers in Central Europe, the largest overall economic losses in the region are caused by flooding. This is largely due to a significant protection gap, where many homeowners are not insured against flood. For example, the German Insurance Association (GDV) notes that only 50% of properties in Germany are insured against flooding as of 2022.

Large flooding events in Central Europe have had the potential to cause a paradigm shift in how we look at flood protection, and also how we approach risk in the insurance industry. One such event was the destructive 2002 flood in the Elbe and Danube River basins, which remains the costliest natural disaster on record in the Czech Republic. It was also the costliest event in Germany until the disastrous floods of July 2021 and remains the costliest flood on record in Austria.

Table: Costliest Flood Events in Central Europe (Source: Aon’s Catastrophe Insight Database)

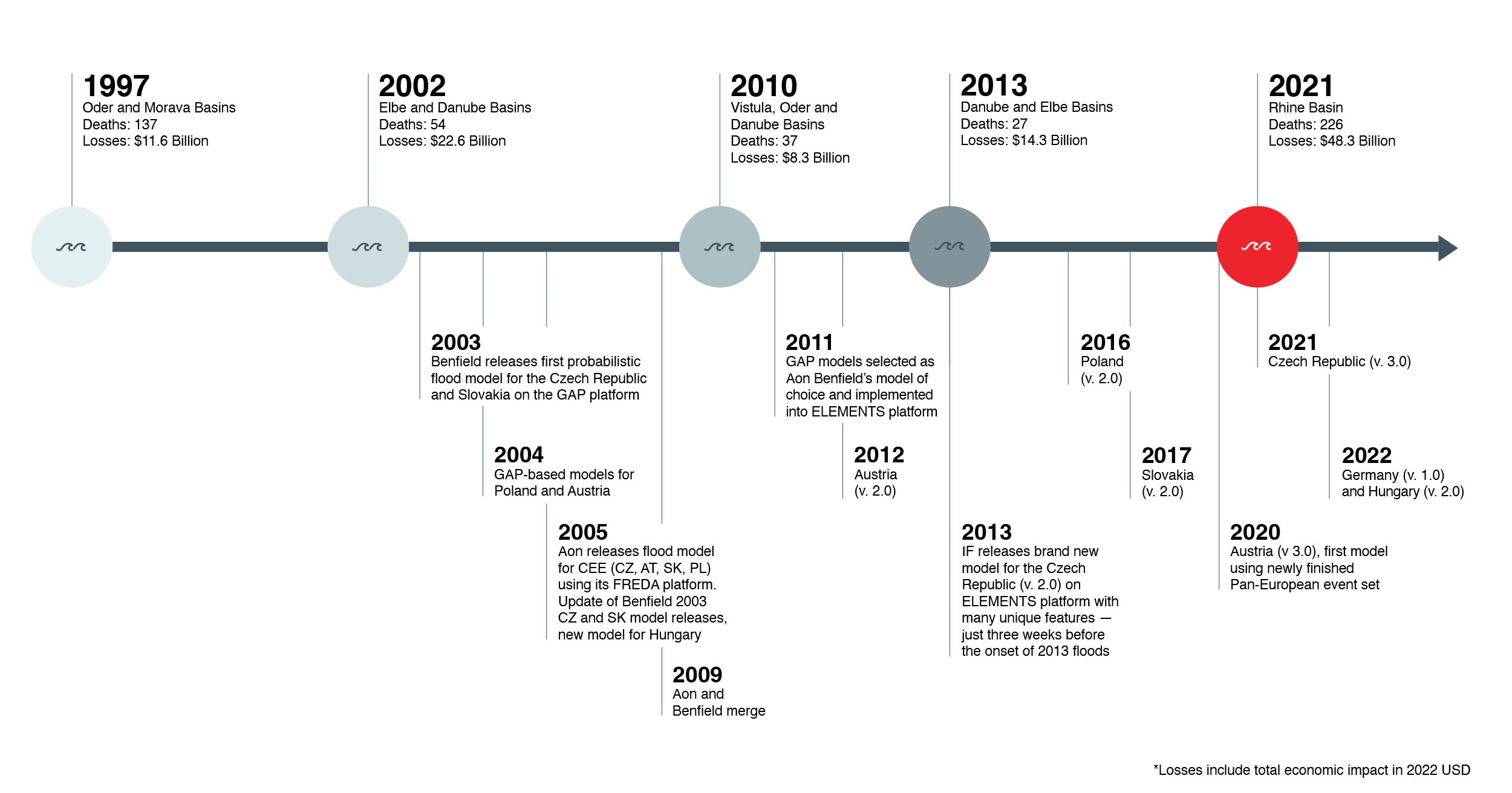

Milestones of the flood model development in Central Europe

Back in 1997, another devasting flood event in the Czech Republic, Poland and Germany started a discussion about suitable flood insurance products amongst insurers and opened the market to catastrophe reinsurance covers, to help protect insurers (and ultimately homeowners and businesses) against large events. Five years later, in August, an even more catastrophic event engulfed entire towns, destroyed infrastructure, and left thousands of people displaced. The year 2002 was a turning point for better flood management and planning on governmental level, including construction of large-scale flood defence systems.

On the commercial side, the situation called for a solution which would help mitigate similar market shocks in the insurance industry. Insurers started looking for tools to help guarantee their solvency and quantify potential losses from natural catastrophes to assess the protection of their property portfolios. In the Central European region, the 2002 floods marked an important milestone, launching a new era of probabilistic catastrophe model development.

Innovation since 2002: the importance of scientific research and development

The past 20 years illustrates the evolution of flood models and shows how dynamic the catastrophe modelling space has become. Over the two decades, each model release has brought new methodologies and enhancements in the development and calculation engines, from event-based models to open-platform support and year-based models (which are better suited to annual insurance contracts).

The first flood models covered fluvial (riverine) flood hazard solely, largely as a result of the experience in 1997 and 2002, but also due to inability to model other flood types flooding, such as pluvial (heavy rainfall) flooding etc. The flood models used a crude flood hazard resolution, generally around 90 or 100 meters, and some generic bathtub of inundation determination (not taking into account hydraulic flows). Event sets were generated through a simple statistical perturbation and models were often designed to provide an ‘undefended view’ of flood risk. Teams developing flood models only had a few members, with individual colleagues working on many different aspects of a model.

Current development process could not be more different; there are large teams of specialists from various ffields, including hydraulic and civil engineering, hydrological and other sciences, programming, GIS and other, all utilizing research from leading institutions and academia. The teams have the ability to model all types of floods including pluvial, coastal, tsunami, dam breaks etc., using detailed 2-dimensional hydrodynamic modelling, heavy computational practices, clouds of computers and GPU cards. This technical progress allows for an accurate inundation modelling on the resolution of several meters only, with a possibility to combine different resolutions and including river bathymetry.

The simulated hazard maps in the most exposed cities, as well as the rural areas with less exposure, are available in high detail, suitable to be used for primary underwriting and many other flood-related analytical tasks. There are advanced engines, building specific vulnerabilities and emphasizing regional differences within a country. This unique region-specific vulnerability approach helps clients to quantify losses for risks with unknown characteristics and modifiers in a very accurate way.

Flood protection

The 2002 event emphasized the significance of flood protection. Even more damaging losses in Prague were avoided as the first stage of Prague’s flood protection was already built as a response to 1997 flooding. Massive extension of the project followed post-2002 and extensive financial amounts have been massively invested in flood defence construction in all the affected countries.

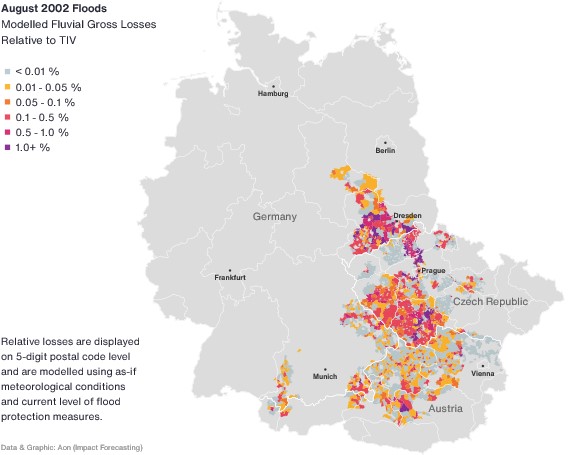

In the current flood models, the flood defences are already considered in the hazard simulation or in other model components and bring precise loss view for the exposed but well protected areas. The image below shows the simulated 2002 flooded areas (in red) in the centre of Prague, whereas the blue footprint represents a probable flood extent if a 2002 event occurred today.

The innovative approach of taking updated flood protection into account can be used not only to visualize but also to quantify the financial impact. From the Czech market perspective, we see a 40% decrease of potential losses from an event similar to the August 2002 floods. This is solely driven by the implementation of several types of flood protection, including mobile walls.

Looking ahead

The Impact Forecasting team delivers solutions which support clients throughout the catastrophe risk management process. The primary rationale for the probabilistic model development after 2002 was to provide clients with a quantitative tool for the purpose of reinsurance pricing. Impact Forecasting probabilistic models are comprehensively documented, designed to be suitable for internal decision making and strategic analyses, which are increasingly required to account for current climate and future climate views. A detailed and clear response to regulatory requirements by insurers to show they understand and are prepared for flood risk under climate change is essential.

Including climate change scenarios for various time horizons, along with adaptation measures, is a crucial part of flood model development in a time of rapid changes of climate and hazard behaviour. Impact Forecasting pioneers physically robust and complex modelling of flood risk under climate change, utilizing latest science and translating it into losses on a company portfolio directly in probabilistic analyses.

This comprehensive solution provides (re)insurers with an estimate of loss amounts and their probability in the current and future climate. (Re)insurers can benefit from Impact Forecasting’s models by quantifying uncertainty and managing expectations of what can be seen in the future. The physically based loss calculation has been implemented into the ELEMENTS modelling platform, where users can observe how flood losses will change and what patterns in regions and seasonality will drive those changes.

Impact Forecasting Models in Central Europe

The flood model development journey is illustrated by the chart below with the first models released in 2003. Since 2009, all models have been deployed on the ELEMENTS catastrophe modelling platform. The current new generation model suite incorporates latest scientific approaches, considers local data and studies, uses 2D hydrodynamic flood extent simulation, and enables analysing portfolios on location levels. The recent model releases calculate losses caused by fluvial as well as pluvial hazard considering different types of buildings, construction, and other modifiers, while the high-resolution model outputs (pure premium, flood depth) might support pricing in primary underwriting processes.

Central Europe: The Story of Floods and Flood Model Development

About the Authors

Ladislav Palán leads Aon’s climate change quantification for flood to bring the climate change view of risk into Impact Forecasting’s flood models. Prior to joining Aon in 2014, he participated in a project for the Czech Republic that dealt with flood risk evaluation and mapping.

Michal Lörinc is a senior catastrophe analyst in the Catastrophe Insight team. Using data anatlytics, modeling, visualization and historical research, he helps clients and colleagues understand natural disaster risk in the past, present and future. He leads the award-winning Automated Event Response solution which brings together numerical weather forecast data and catastrophe modeling. Michal co-authors Aon’s Catastrophe Reports including the annual Weather, Climate and Catastrophe Insight.

Alice Hladíková is an account manager in business development in Impact Forecasting. She works with clients and prospects across Europe supporting the adoption of Impact Forecasting data, models and services. She previously worked as an analyst at the Centre of Informatics at Jan Evangelista Purkyne University and also spent nine years working in cat modelling with Guy Carpenter. She has experience in flood modelling and hydrology.