Steve Bowen

Director & Meteorologist | Head of Catastrophe Insight, Impact Forecasting, Aon

One of the more visible challenges around COVID-19 was the insurance industry response regarding the claims process. Varying restrictions around social distancing and public health safety limited the number of assessors that were deployed in the aftermath of events. This inevitably led to delays in some claims being processed and/or approved. Many re/insurers began to incorporate new technologies to aid the claims process. Among the most notable was the introduction of drones to conduct survey assessments from the air. Other companies relied on their clientele to take numerous pictures or videos of the damage to support the approval process.

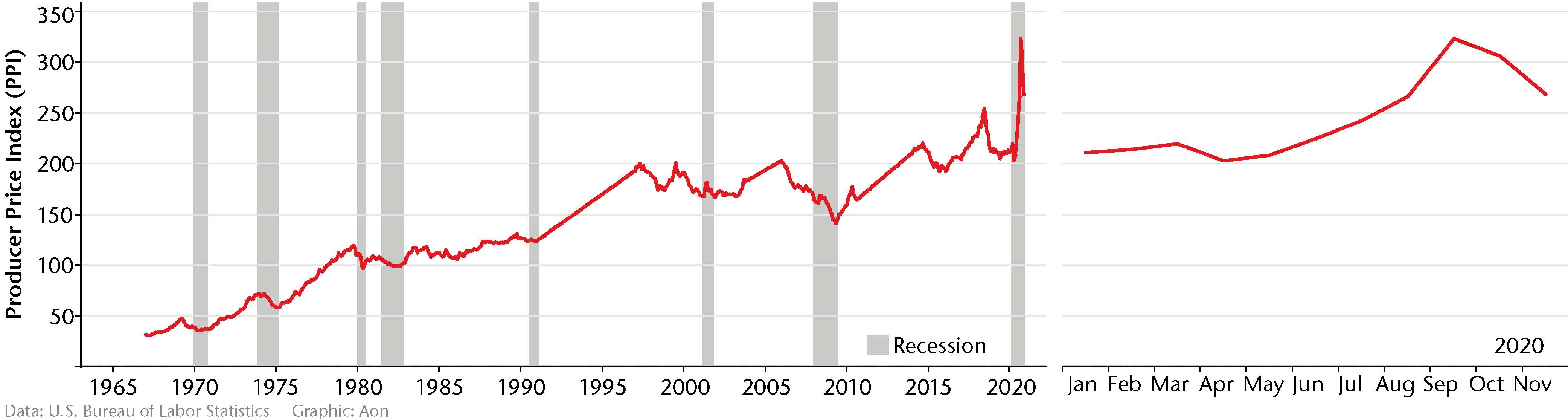

From a payoff cost perspective, one of the additional challenges faced by re/insurers surrounded shortages of lumber and other construction material during the rebuilding process. The high frequency of natural disaster events in combination with global supply chain disruptions due to COVID-19, a reduction in factory productivity, changes in tariff structures, an increase in home construction and remodeling projects, beetle infestation in valuable forested areas, and recent major wildfires all contributed to a limited volume of construction material. This reduction in supply inevitably led to higher replacement costs, and subsequently, an increase in the payout by re/insurers. The replacement cost increase faced in 2020 is not dissimilar to what re/insurers faced in 2017 with the Assignment of Benefits (AOB) topic.

Seasonally adjusted U.S. commodity data - lumber and wood products (1967-2020)

Access blogs

About the author

Steve Bowen currently serves as Director, Meteorologist, and the Global Head of Catastrophe Insight at Aon, and is based in the Impact Forecasting division. An increasingly important part of his work includes providing expertise to new strategies focused on combating the growing hazard, physical, societal, and financial challenges posed by climate change. He is a frequent collaborator with governmental agencies, academia, and industry groups, and has co-authored several published peer-reviewed scientific studies (including in the Bulletin of the American Meteorological Society, Nature Climate Change, and the Journal of Insurance Regulation). He was previously invited to participate in a White House initiative that sought to better prepare various sectors for emerging risks associated with climate change and extreme weather.

Steve serves on the Board of Directors for the American Red Cross of Illinois, and also sits on the Society of Actuary’s Research Executive Committee and Climate & Catastrophe Steering Committee.