Using DB schemes to get the best from redundancy

As the economic consequences of COVID-19 continue to bite, many employers are making difficult decisions in relation to the size and shape of their workforce. At the same time, job prospects for those who find themselves unemployed are bleak – many older employees are finding themselves needing to cover a financial gap that could stretch for 10 years or more until they receive their State Pension. Others may simply be looking for increased flexibility – perhaps to give financial help to family. Andy Gaskell explores how DB pensions can help members and employers improve outcomes.

Member options at the point of retirement have become increasingly popular in recent years as a win-win-win for members, trustees and employers alike - providing members of defined benefit (DB) pension schemes with choices around the timing and form of pension benefits while simultaneously reducing risk, improving benefit security and reducing the ultimate cost of the pension scheme to the employer.

Providing members with access to financial advice to understand their options – particularly where they are facing redundancy and may have choices to make in relation to redundancy payments, can be exceptionally valuable. The advice can simply cover the existing options available at-retirement, or include new options specific to the circumstances (for example, bridging pensions).

How could bridging pensions help?

There is really nothing new in bridging pensions. Some schemes have always offered this and they do what they say - they shape a member's standard scheme pension to bridge the gap between their retirement and their state pension date.

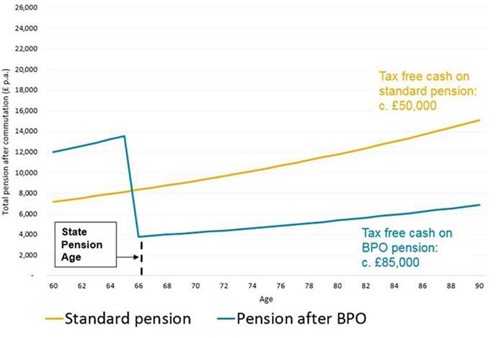

A bridging pension option (BPO) allows members to smooth their income so that their total income (from the scheme and the State) is broadly equal before and after their State Pension age. This offers a smoother overall pattern of pension payments across retirement and also enables individuals to take a bigger tax-free cash lump sum. Most schemes experience a liability saving when a member takes a tax-free cash lump sum - so allowing members to take a larger sum increases these savings for the scheme.

In the chart below the yellow line represents the standard scheme pension for an example member and the blue line represents the scheme pension after BPO.

If we overlay this chart with total pension from scheme and State (broken lines), we see the smoothing impact of BPO on the member’s overall retirement income.

Optimising redundancy outcomes

Where redundancies are necessary, integrating bridging pensions into the member's options can optimise the process:

- Bridging pensions can incentivise take-up of voluntary redundancy programmes and/or provide options for those subject to compulsory redundancies. They permit members to take immediate retirement at ages where it would not otherwise not have been affordable.

- Where individuals receive redundancy payments in excess of the £30k tax-free limit, these could be ‘spent’ buying a bridging pension in the scheme in a way which actually reduces the liabilities. The redundancy payment might not actually need to be paid by the employer, leading to immediate cash savings.

Of course, with many DB schemes, many non-pensioner members are no longer employed by the scheme sponsor - members can be in variety of roles across many different industries. So bridging pensions can be a valuable option to this group even if the specific sponsor of the scheme is not as significantly impacted by current challenges as others. We are also seeing significant trustee interest in making bridging pensions available as a way of giving more flexibility to members, particularly in current circumstances - and without requiring a transfer outside of the DB environment.

What about transfer values?

Transfer values remain popular with members as a means of accessing their DB benefits in a way which suits their circumstances.

In this challenging economic environment – where flexibility is valued so highly – the transfer value option, coupled with paid-for, independent financial advice, can ensure that members make the right financial decisions which meet both their short-term and longer-term retirement needs.

For employers, enhanced transfer value exercises can be used to assist with workforce management goals without necessarily requiring a formal redundancy programme.

The right course of action will depend on circumstances, but DB pensions can help!

Andy Gaskell is a senior consultant at Aon.

For Further information on this and all aspects of member options Please contact the Aon Member Options Team.

Aon Solutions UK Limited - a company registered in England and Wales under registration number 4396810 with its registered office at The Aon Centre, The Leadenhall Building, 122 Leadenhall Street, London EC3V 4AN.