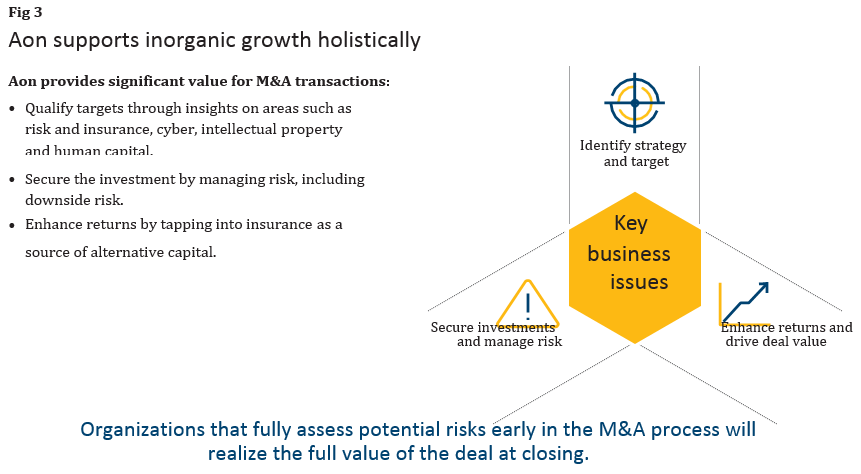

Organizations may face many types of transactions, including traditional mergers and acquisitions to joint ventures or spin-offs. The overarching requirement through all of these situations is ultimately securing the value in the deal (Fig 3).

To ensure deal objectives are met, the business will need to consider adopting a holistic approach to truly assess all relative risks involved in the transaction, including the crucial human capital aspects of the deal.