Singapore Medical Benefit Trend Growth to Drop in 2021: Aon Survey

SINGAPORE (29 October 2020) –

Aon plc (NYSE: AON), a leading global professional services firm providing a broad range of risk, retirement and health solutions, today announced that a nationwide decrease in medical plan utilisations due to the novel coronavirus (COVID-19) pandemic is likely to decrease medical trend rates in Singapore next year. Growth in employer-provided medical benefit costs are expected to drop 30% in 2021 compared to the previous year’s forecasts made prior to the COVID-19 pandemic, according to Aon’s

2021 Global Medical Trend Rates Report.

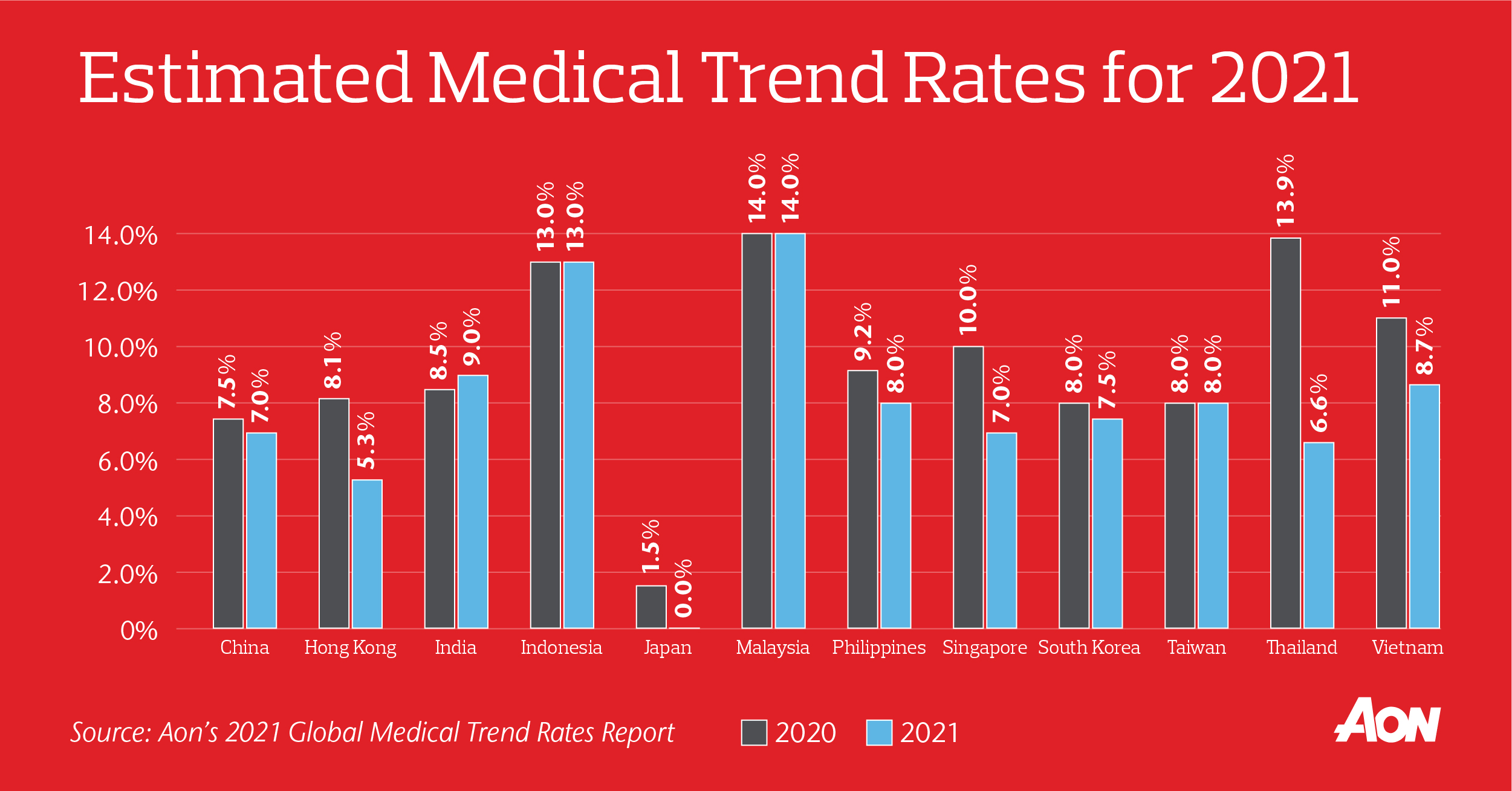

Health plans saw significantly less utilisation in 2020 as people avoided hospitals in fear of COVID-19 infection and delayed their elective procedures. This community-wide decrease in plan utilisation is expected to reduce Singapore’s 2021 medical trend costs to 7% from the previously projected 10% in 2020. The expectation for the new year is that inpatient care will spike back up whereas outpatient care will return to approximately 70 percent of pre-COVID-19 levels, and eventually normalise.

In Asia Pacific, medical trend costs will drop to 8% in 2021 from the 8.7% projected for 2020. However, projected medical trend rates vary significantly by location in the region. Hong Kong is projected to see the lowest at 5.3% in 2021. This, too, is due to a decrease in elective surgeries and outpatient routines.

In China, the medical trend rate in 2021 is expected to be 7%. COVID-19 has resulted in better self-protection measures taken by patients, decreasing the incidence ratio of common diagnoses. Additionally, outpatient utilisation has depreciated while online consultations have dramatically increased during the pandemic.

Forecasted Health Care Benefit Cost Growth

| Location |

2020 |

2021 |

| China |

7.5% |

7.0% |

| Hong Kong |

8.1% |

5.3% |

| India |

8.5% |

9.0% |

| Indonesia |

13.0% |

13.0% |

| Japan |

1.5% |

0.0% |

| Malaysia |

14.0% |

14.0% |

| Philippines |

9.2% |

8.0% |

| Singapore |

10.0% |

7.0% |

| South Korea |

8.0% |

7.5% |

| Taiwan |

8.0% |

8.0% |

| Thailand |

13.9% |

6.6% |

| Vietnam |

11.0% |

8.7% |

In Asia Pacific, cardiovascular, gastrointestinal, and musculoskeletal diseases, cancer, and ear, nose & throat (ENT) issues are the most prevalent health conditions driving healthcare claims.

Leading Medical Conditions Driving Medical Plan Costs

| |

Asia Pacific |

| 1. |

Cardiovascular |

| 2. |

Cancer/Tumour Growth |

| 3. |

Gastrointestinal |

| 4. |

Musculoskeletal/Back |

| 5. |

ENT/Lung Disorder/Respiratory |

Aon’s report also confirms the growing prevalence of health risk factors in Asia Pacific, including high blood pressure, physical inactivity, and bad nutrition, which may drive future medical plan costs.

Leading Health Risk Factors Driving Future Medical Plan Costs

| |

Asia Pacific |

| 1. |

High Blood Pressure |

| 2. |

Physical Inactivity |

| 3. |

Ageing |

| 4. |

Bad Nutrition |

| 5. |

High Blood Glucose |

Tim Dwyer, CEO of Health Solutions, Asia Pacific, Aon said, “COVID-19 has underscored the need for better design and management of employee health and benefit programmes. To mitigate medical costs by reducing chronic conditions, employers in Asia Pacific must invest in wellbeing programmes to promote mental health, physical activity, healthy eating, and preventive strategies like physical check-ups and screenings. This could supplement traditional strategies, such as controlling unreasonable plan utilisation, adjusting plan designs, narrowing networks and adding flexible benefit plans.”

Methodology

The survey was conducted among 107 Aon offices, each one representative of a country, that broker, administer, or otherwise advise on employer-sponsored medical plans in each of the countries covered in this report. The survey responses reflect the medical trend expectations of the Aon professionals based on their interactions with clients and carriers represented in the portfolio of the firm’s medical plan business in each country.

About Aon

Aon plc (NYSE:AON) Aon is a leading global professional services firm providing a broad range of risk, retirement and health solutions. Our 50,000 colleagues in 120 countries empower results for clients by using proprietary data and analytics to deliver insights that reduce volatility and improve performance.

Aon has five specific global solution lines: Commercial Risk Solutions, Reinsurance Solutions, Retirement Solutions, Health Solutions and Data & Analytic Services.

For further information on our capabilities and to learn how we empower results for clients, please visit

https://www.aon.com/apac