Salaries expected to recover to pre-COVID-19 pandemic levels in Southeast Asia in 2022, Aon study reveals

- Salary increases in 2021 were lower than in 2020; bonus pay-outs dropped approximately 25 percent.

- Some industries, such as private banking, saw continued increases in salaries while retail and professional services faced challenges.

SINGAPORE (15 December 2021) – The COVID-19 pandemic has weighed heavily on talent strategies with muted salary increases across Southeast Asia, according to a study by

Aon plc (NYSE: AON), a leading global professional services firm. The second edition of Aon’s

2021 Salary Increase and Turnover Study was conducted from June 2020 to June 2021, surveying the salary movements and turnover rates of more than 870 companies across Singapore, Malaysia, Thailand, Indonesia and Vietnam.

Companies must prepare for potential talent risks in 2022 following a muted 2021

In Singapore, salary increases across industries dropped to 3.3 percent in 2021 from 3.8 percent in 2020. Similar trends were seen in Malaysia and Thailand, with 2021 salary increases of approximately 4.5 percent and 4.4 percent, compared to 4.7 percent and 4.9 percent in 2020, respectively. Bonus pay-outs, which were relatively insulated in 2020--calculated for the previous performance year--also dropped between 20 - 25 percent in 2021 across Southeast Asia.

However, as organisations settle into new and agile workforce models, compensation policies are expected to normalise to pre-pandemic levels in 2022. The study showed that salary increases for Singapore, Malaysia and Thailand are forecasted to recover to 3.8 percent, 4.9 percent and 4.9 percent, respectively, in the coming year.

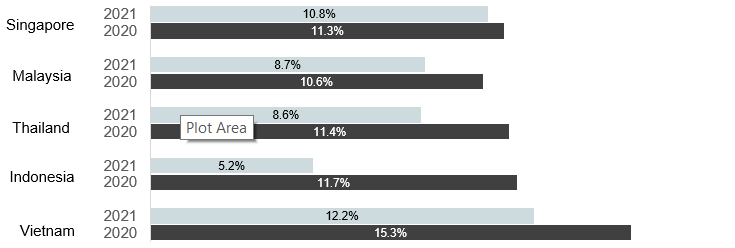

Voluntary turnover in 2021 remained either mostly flat or declined, as reported in Singapore (from 11.3 percent in 2020 to 10.8 percent in 2021) and Malaysia (from 10.6 percent in 2020 to 8.7 percent in 2021), demonstrating there is hesitation in switching employers amid an uncertain business landscape.

However, as the Southeast Asian economy

is poised to recover, Aon expects turnover to increase following the current downturn. Rahul Chawla, Managing Director, Aon’s Human Capital Solutions, Southeast Asia, said: “Organisations need to prepare for and have the right strategies for global talent trends such as ‘The Great Resignation.’ This will be further complicated by other factors introduced by the pandemic, such as new working models and a higher demand for digital skills. However, these extraordinary times also present opportunities for companies to stay ahead of the curve in the war for talent as they continue to build resilient workforces. We expect to soon see a surge in hiring and turnover activity so rethinking compensation and benefits strategies will be a critical success factor to prepare for the next year.”

Retail, hospitality, and professional services continue to face headwinds

The study also revealed how the pandemic impacted individual sectors. In financial services, the consumer banking industry saw minimal salary increases due to prevailing macro-economic conditions and the business performance of banks. However, private banking saw continued salary growth on the back of continued wealth creation in the region and the need for sophisticated financial planning.

Similarly, the life sciences and medical devices industries saw salary increases in Singapore, Malaysia and Thailand of 3.6 percent, 4.6 percent, and 5.0 percent respectively. In contrast, retail, hospitality, and professional services continue to face headwinds; for example, the Singapore market saw a salary increase of just 3.0 percent in the consulting and professional services industry.

To address some of these challenges, data from Aon shows that organisations have invested in different talent groups and skillsets. For example, in response to the growing importance of digital solutions in new working models and the need to address the increased risk to employee health and wellbeing, salaries in IT and human resources in certain economies such as Thailand showed the strongest recovery, with salaries for junior employees increasing by up to 20 percent.

Median Salary Increase in 2020 and 2021

| Country/Territory |

Salary Increase 2020 |

Salary Increase 2021 |

| Singapore |

3.8% |

3.3% |

| Malaysia |

4.7% |

4.5% |

| Thailand |

4.9% |

4.4% |

| Indonesia |

7.5% |

6.5% |

| Vietnam |

8.5% |

7.5% |

Median Voluntary Turnover in 2020 and 2021

“The trends observed for 2021 reflect the phases of react, recover and reshape that most companies have experienced in the last 18 months. With higher vaccination rates across Southeast Asia and the resumption of travel, the expectation in 2022 is for a long-awaited recovery where we will see more movements in the talent market. While continuing to fight the war for talent, organisations can leverage these data and insights to make better, more informed decisions as they build roadmaps to deliver enhanced value for employees in the future,” said Chawla.

To view the study, please click

here.

About the Study

Aon’s Salary Increase and Turnover Study provides clients with actionable insights to ensure their pay cycles are aligned with overall market trends. Conducted twice a year, the study spans more than 130 countries/territories and 4,100 companies globally.

The Salary Increase and Turnover Study covers the following key market practices:

- Actual overall and merit-based salary increases

- Budgeted overall and merit-based salary increases

- Expected hiring and workforce growth trends

- Key talent identification and rewards differentiation practices

- Performance management practices

- Promotion practices

- Salary structure movement trends

- Voluntary and involuntary turnover rates

About Aon

Aon plc (NYSE:AON) Aon is a leading global professional services firm providing a broad range of risk, retirement and health solutions. Our 50,000 colleagues in 120 countries empower results for clients by using proprietary data and analytics to deliver insights that reduce volatility and improve performance.

Aon has five specific global solution lines: Commercial Risk Solutions, Reinsurance Solutions, Retirement Solutions, Health Solutions and Data & Analytic Services.

For further information on our capabilities and to learn how we empower results for clients, please visit

https://www.aon.com/apacSign up for News Alerts

here