Competing for Talent in Private Companies

The type of management needed and compensation offered by private companies differ not only from that of publicly listed companies but would also vary depending upon the particular growth stage of the company. Understanding these factors can help attract, retain and reward the right talent.

In recent years, the lacklustre performance of public markets has driven businesses to seek funds in private markets. Private capital grew by 44 per cent in the five years leading up to 2019.

Equity in private companies remains concentrated among a few shareholders and investors, such as angel investors, venture capitalists (VC), and private equity (PE) firms. Other types of investors interested in accelerating or incubating new businesses include sovereign wealth funds, pension and endowment funds. Corporations are setting up their own VC funds to invest strategically, propel growth and extend their reach.

As money pours into private markets, it is essential to understand what makes these companies different from listed companies. The various investor types have a diverse range of operating styles and investment objectives, making human capital issues of talent and rewards equally diverse. Compensation and rewards in private companies need to be aligned to the business growth cycle – from the early developmental stage to growth and then the maturity stage.

The specific needs and priorities of each growth stage will drive the company’s human capital agenda. As the company grows, an increasingly formal structure with deliberate people practices and policies should develop.

Early stage

At the early or developmental stage, the key is to prove that the company has a viable business model. Startups will focus on product development, identify a target market, and generate early revenue to prove their concepts.

The company is organised around the founding members who have pre-established norms of working with each other and take on multiple roles. The working dynamic is agile and ambiguous. Team members collectively hold each other to performance expectations, bound by a common goal.

Usually, the members draw a small base salary, if any, without any bonuses. Equity in the company tends to be equally distributed amongst the founding members and a few early angel investors.

Growth stage

The growth stage begins after receiving the first round of Series A funding, which typically comes from venture capitalists looking for ideas that can scale and generate profits and are no longer just “proof of concept”. Series A is crucial as it signifies that the company has a product with a viable market as well as the ability to scale rapidly.

At this stage, the compensation package for prospective candidates is predominantly based on affordability. While this is a practical approach, not considering market standards of pay could risk attracting the wrong calibre of talent.

Many startups try to make up for lower cashin-hand salaries by offering equity in their company to their employees. This is a great way to build ownership, retain talent, and ensure that they have skin in the game. The most common equity programme is the employee stock options scheme, as it rewards for growth in the company’s valuation. At this stage, it is tricky to quantify equity in terms of dollar value, and so, they are usually benchmarked against a percentage of company ownership.

Equity can seem like an economical solution to an expensive problem, but it is the most valuable resource for a startup. So, it is important to establish and cap equity overhang for employees early on. Monitoring the burn rate and establishing guiding principles of equity share for each of the key roles will ensure that there is enough to go around. It is critical to factor in potential growth in headcount when establishing these guidelines.

Strategy and increased financial discipline at this stage are also largely driven by investors, who will often nominate a director for the board. The board will likely consist of the co-founders along with nominee directors from the investors. More formal governance structures and processes will enable the board to play its role. This, in turn, helps to attract further funding because it conveys to potential investors that the business is sustainable and well-managed, indicating lower investment risks.

Maturity stage

At this stage, the line between a private company and a listed entity gets increasingly blurry. The company may have multiple business units across offices in the region, increasing complexity and risk exposure. The need for rigorous corporate governance becomes imperative. Recent high-profile cases, such as WeWork, demonstrate how corporate governance failures can upset initial public offering (IPO) plans. Investors pay more attention, and corporate governance is no longer a topic reserved for post-IPO discussions.

Talent needs, too, will evolve accordingly – beginning with the board of directors. Companies need to nominate independent directors for their boards to represent the interests of all shareholders, and increasingly, the larger material stakeholders. This is done not only to act as a check and balance but also to provide strategic stewardship, including culture oversight. Neglecting company culture has frequently resulted in reputational risk and business decline.

In the previous stages, the board usually consists of nominated directors from the investors and the co-founders, who may not always be paid director fees. However, this may change due to the expanded responsibilities, liabilities and additional demands on the directors’ time. This is the right stage to benchmark remuneration against the market and to determine a sustainable director’s fee structure that will last well into the IPO stage.

Companies will also need effective board structure and processes to foster a healthy dynamic between the executive team and the board, wherein they can constructively challenge each other. This relationship is critical, so the executive team does not feel that the board is taking away their mandate to be agile or different in managing the company. The board needs to conduct regular critical self-evaluation exercises to reflect and continuously improve based on feedback. That is the hallmark of a resilient board.

This stage requires recruiting a different kind of talent group, including corporate warriors who are well versed in managing listed companies. This brings the company into uncharted territory as they compete for talent with big tech and large multinational companies who may offer different employee value propositions.

Compensation and equity are two of the most pressing issues at this phase.

Cash vs equity compensation

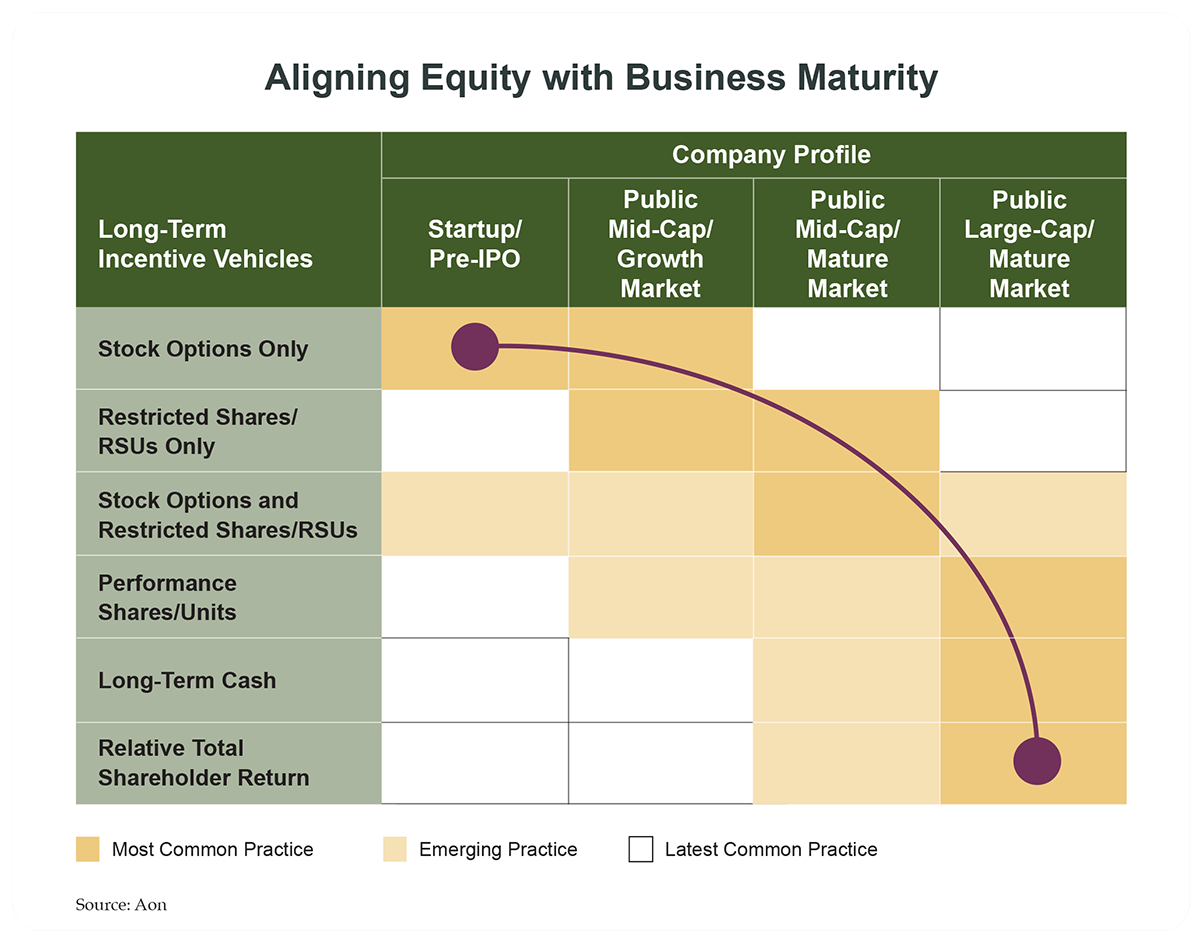

The relative significance of cash vs equity compensation and type of equities varies with the company’s profile (see diagram, “Aligning Equity with Business Maturity”.

In general, at the growth stage, cash compensation is conservative, but equity is lucrative. At the maturity stage, increasing competition for top talent and the perception of a decreasing upside makes equity less attractive than cash.

Private companies can address this in two ways.

First, they can increase their focus on cash compensation and benchmarking salaries against selected peers in the market. There is more pressure to match cash compensation to market standards to convince potential recruits to give up their job security for a new challenge. However, startups must be cautious not to be held at ransom and overpay in the pursuit of talent. Having reliable market information instead of anecdotal evidence will help. Competitive cash packages should not be the main motivator for a talent to join. Instead, the unique culture of agility, innovation, experimentation and resilience found even in mature stage startups, should be the key attraction for the right talent.

Second, it is common for the equity component to switch from an options scheme to restricted shares. At the growth stage, the options scheme works, but as the company matures, the potential for upside may reduce. Moreover, established listed companies typically offer restricted shares to retain their top talent. These are usually time vested and have no forward performance conditions with a set value. Therefore, it is difficult to persuade them to forfeit it in favour of limited upside options with uncertain future value.

Full value restricted shares are then offered as part of the sign-on package to ease the pain for prospective employees. This comes with the promise of an annual grant of additional restricted or performance shares, leading up to an IPO. The size of the equity award is determined by the value of the equity instead of a percentage of ownership. This approach aids in communicating the award value to facilitate a market comparison and helps to manage dilution by using fewer shares.

As performance measures evolve, it is no longer adequate to only look at revenue growth and profitability. While earnings continue to be important in determining the company’s valuation, there is an increased focus on measures like return on equity and return on invested capital. As the company moves closer to an exit, investors want to see good returns on the capital and equity that they have invested in the company. It is also a good indicator of how efficiently a mature stage company is deploying its capital to generate future cash flow.

Compensation during Covid-19

According to Aon’s Covid-19 pulse surveys conducted from March to June 2020, the virus outbreak has had a definite impact on the workforce plans of businesses, even more so for startup companies.

About 16 per cent of private companies reported having resorted to layoffs compared to only 8 per cent of public organisations; 12 per cent of private companies reported furloughs as compared to just 7 per cent among public organisations. And more private companies conducted longer-term restructuring of their operations and workforce than public organisations. That might lead to a talent backflow into listed companies that offer more job security and stability via their rewards programme.

Under such circumstances, how can private companies manage cash flows yet keep their rewards offering compelling? Both private and public companies will have to be more judicious with cash compensation in these difficult times. In the short term, governmental job support can help contain the costs. But this will eventually run out.

Private companies may have an advantage in managing staff compensation as they have more flexibility in deploying equity for employees.

For example, OYO recently offered stock options to its furloughed employees to recognise their contributions to the company. They also removed the vesting conditions such that departing employees with stock options can become shareholders. While some public-listed companies are readjusting their equity grant size, startups can double down on it to entice potential recruits as the profit-and-loss impact is comparatively less.

In other words, startups and private companies may, in many respects, be better off than listed companies in staff management and remuneration. A startup’s success is futureoriented and depends on investment in new products and services. Investors do not expect a dividend in the short run and are in it for the longer term. Therefore, they have a natural advantage in ensuring that their future earning is not jeopardised. Their resilience will help them outlast the big players in the market.

As some big names may flounder due to insufficient cash to repay debts, a new generation of startups may yet emerge to replace them with innovative business models.

This article first appeared in the Q4 2020 issue of the SID Directors Bulletin published by the Singapore Institute of Directors.

The authors are from Human Capital Solutions, Aon.

Na Boon Chong is Managing Director and Partner; Ravi Nippani is Associate Partner; and Jacob Tan is Director.