Climate Risk: What Asia can do today to plan for tomorrow

Navigating new forms of volatility

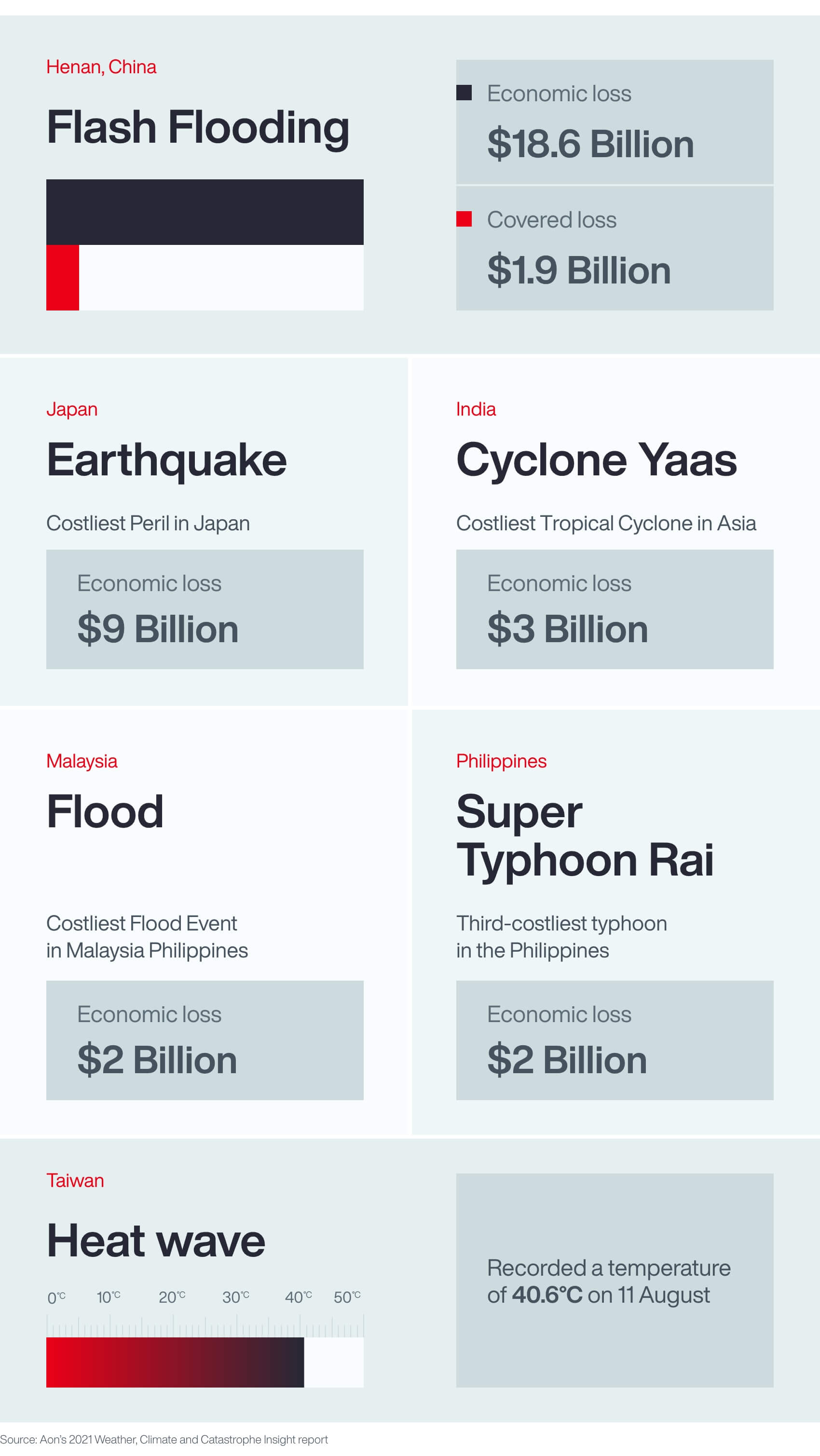

For Asia, 2021 was not only a year defined by the COVID-19 pandemic but also one underscored by economic losses resulting from weather and climate-related events.

China recorded another above average year of catastrophe losses in the year, with flash flooding in Henan leading to an economic loss of $18.6 billion, and a record-breaking $1.9 billion in covered losses. Japan had an economic loss of nearly $9 billion due to earthquakes, its most expensive peril. India’s Cyclone Yaas was the costliest tropical cyclone in the region that year, resulting in almost $3 billion in economic losses. The list goes on.

Organisations, governments, and communities are beginning to realise that our interconnected world is becoming more directly — and indirectly — affected by the environment around us.

“Many Asian communities are exposed to increasingly volatile weather conditions that are in part enhanced by the growing effects of climate change," says Brad Weir, Asia head of analytics for reinsurance solutions at Aon. “With physical damage loss costs rising, this is also leading to lingering global disruptions to supply chains and various humanitarian and other asset-related services.”

Protection gap is widening

For Asia, after three consecutive years (2018-2020) of economic losses resulting from weather and climate-related events, topping $100 billion, the toll in 2021 dipped to $72 billion in 2021. However, insurance only covered 9% of the 2021 Asia losses compared to 38% of losses covered globally.

With one of the lowest levels of insurance coverage and rapidly evolving urbanised centres, addressing vulnerabilities related to climate risk is not only critical but also presents many challenges.

“We can no longer build or plan to meet the climate of yesterday,” Weir cautions.

He added that there is an ongoing need for public and private entities to collaborate and help bridge the gap of insurance protection. “The path forward for organisations and governments must include sustainability and mitigation efforts to navigate and minimise risk as new forms of disaster-related volatility emerge.”

Quantification and Catastrophe Modelling

As catastrophic events increase in severity, the way that businesses assess and ultimately prepare for these risks cannot depend solely on historical data. “We need to look to artificial intelligence and predictive models that are constantly learning and evolving to map the volatility of a changing climate and its interaction with a complex and everchanging urban environment,” says Owen Belman, Head of Asia, Aon.

With scalable solutions, organisations can make better decisions that make them more resilient as they continue to face interconnected and increasingly volatile risks. One such solution is the development of frameworks. This will help businesses to achieve the most comprehensive quantification of the changes in all atmospheric risks due to climate change possible, and will provide insurers with a more informed degree of risk management as well as an established and sound forum for discussion, with all stakeholders to achieve a sustainable market in the future.

Catastrophe models are one of the best available tools to help business leaders quantify and qualify catastrophe-related risk. Disciplines like model development, model evaluation, calibration and validation are becoming more and more relevant as modelling tools increase their complexity, to reduce the uncertainty around climate change impact.

The world is becoming more volatile and uncertain, leading investors and regulators towards increasing their requirements for more disclosure of the climate-related impacts on businesses.

The (re)insurance sector, with its deep knowledge of catastrophe risk, has the possibility of tackling this challenging topic from an angle of growth and opportunity, increasing transparency with customers, and developing products on the primary side to leverage new solutions to hedge some of that risk.

The Importance of Resilience

Insured losses caused by some natural hazards can be reduced through improving the resilience of the built environment. As only a proportion of the built environment is exposed to bushfires, floods or typhoons and cyclones, this ‘at-risk’ proportion can be focused on for improvement.

Cost-effective resilience measures for other severe weather perils such as thunderstorms (hail) and common synoptic storms (low pressure systems) that can impact anywhere remain a challenge.

The insurance industry is well placed to promote education and awareness across the community of extreme weather risk, associated costs, and measures to improve resilience amid an increasingly volatile climate.

For more APAC insights on the effects of a changing climate, download Aon's 2021 Weather, Climate and Catastrophe Report: Asia Pacific Regional Insights.

For global perspectives on climate risk, Aon’s 2021 Weather, Climate and Catastrophe Insight report, is also available now.

As your organisation looks to address the risks and impacts of climate change holistically, Aon is here to support your journey towards a resilient and sustainable future.