Making ESG Matter through Metrics

Navigating new forms of volatility, Rethinking access to capital

Advancing from its 2016 efforts in promoting the adoption of sustainability reporting among listed companies, Singapore Exchange (SGX) has recommended a core set of ESG metrics as a starting point for companies to consider in their sustainability reports. These core ESG metrics are intended as a common and standardised set of ESG metrics, which in turn will help better align users and reporters of ESG information.

Measure what matters

To start, there is a need for metrics that measure the desired outcome of ESG imperatives as a part of business strategy. However, the lack of access to reliable data, limited clarity on measurable metrics, and inconsistent ratings by different parties remain the biggest barriers to adoption.

An objective, reliable system of measurement can accurately and consistently assess how stakeholders perceive a company’s ESG credentials and represent those credentials in a useful way. Recent studies have found that while companies in Singapore have improved their ESG reporting, there is room for improving the quality and depth of disclosure on quantifiable sustainability targets.

Investors are also looking for increased accountability and transparency from boards and C-suite executives regarding ESG risks. Not surprisingly, when identifying the most important features of ESG reporting systems, stakeholders cite quantification of the financial impact of ESG programmes. Robust and comprehensive sustainability disclosures are the key to driving this.

With the proliferation of reporting frameworks and standards, companies often decide for themselves which ones they wish to apply.

Beyond making the measures transparent, holding the C-suite accountable is to put pay at risk subject to ESG performance. Paying for ESG performance through executive compensation begins with understanding how a company creates value and, in this case, evaluating how ESG contributes to long-term stakeholder value.

A recent study by Pay Governance examined the use of ESG metrics in the incentive compensation plans of a select sample of companies in the UK, EU, and US. The study found that UK and EU companies are well ahead of the US when it comes to including ESG metrics in incentive plans and have a higher prevalence rate and rate of inclusion in long-term incentive plans. Specifically, the study showed that:

- Both UK/EU and US companies prefer to incorporate ESG metrics into short-term incentive (STI) plans via a balanced scorecard framework that uses a combination of quantitative and qualitative targets.

- However, some ESG performance areas are not well suited to assessing performance over a single financial year, such as carbon emission reduction targets and reduction of reliance on carbon fuels. As companies look beyond annual targets, UK companies are increasingly including ESG metrics in long-term incentives (LTI) as well.

- Of the major UK and EU companies surveyed in the study, 41% were using ESG metrics for LTI plans. The corresponding percentage for US companies was 5%.

In Singapore, an exploratory research survey in 2020 found that it is common to find ESG measures in STI design via a balanced scorecard framework. Increasingly, however, a few large enterprises have begun to include ESG metrics in their corporate LTI plans and long-term transformation incentive plans. The use of LTIs is expected to increase as pressure on ESG increases.

How companies can tie ESG to executive pay

The first step is to align ESG targets with business strategies and goals. Companies can retain their existing measures, no matter how simple, and enhance them as they move forward.

Setting targets is often challenging. Some targets are easily measurable on an annual basis, such as instituting a diversity policy or achieving employee well-being targets. From a pay perspective, these can be tied into annual incentives. However, other longer-term targets might have an ultimate outcome, such as cutting emissions or reducing fossil fuel consumption across the business. These are the targets that should be linked to LTI plans.

Ideally, ESG targets need to be as measurable as financial targets, preferably using audited numbers – a language shareholders can identify with – based on established standards. But many areas of ESG activity are not represented in easily reportable figures, or do not have generally accepted measurement criteria, or defy clear definition.

This is where qualitative measures come into play. There are often-used social equity metrics such as activities in conflict zones, distribution of fair-trade products, health and access to medicine, workplace health safety and quality, labour standards in the supply chain, child labour, human trafficking, community building, human capital management, industrial relations, diversity and inclusion, freedom of association and pay equity.

Whether covered under annual incentives or LTIs, ESG measures tend to have relatively modest weightage (10% to 20% of overall performance assessment) in plan design. This is because of two main reasons. First, investors still expect most performance assessment to be weighted towards financial metrics. Second, ESG measures are often not as quantifiable, causing remuneration committees to exercise discretion in performance assessment. Thus, some companies choose to employ ESG measures as a modifier to financial performance.

The use of ESG metrics in executive compensation is still at an early stage. Companies need to determine their state of readiness to be able to select the appropriate metrics, define performance standards, and monitor their outcomes for pay purposes.

Once implemented, boards need to be confident that the metrics used, and the performance standards set, are justifiable and defensible to stakeholders. This is especially important because Singapore listed companies are encouraged in the Practice Guidance (complement to the Singapore Code of Corporate Governance) to disclose the relationship between remuneration, performance, and value creation, including how performance is measured and why the metrics were chosen.

ESG and incentive compensation

Every company is at a different phase in their ESG journey. Companies can start by assessing where they stand on the ESG maturity curve. As a company matures in its approach to addressing ESG risks over time, so too, should its incentive design.

Some of the activities in which companies typically engage as they move up the ESG maturity curve include:

- ESG metrics tied to executive compensation.

- ESG business strategy integration.

- Dedicated ESG report and/or webpage.

- Proactive stakeholder engagement.

- Utilisation of ESG reporting framework (TCFD, Diversity, ESG Metrics).

- Commitment to ESG pledges and/or coalitions.

- Ongoing board education on ESG related topics.

- Integrated disclosure of ESG strategy/progress (SGX Listing Rules).

- Standardise metrics and goals to measure and collect data.

- Formal board/committee oversight of ESG strategy and accomplishments.

- Diversity, equity and inclusion, human capital management, supply chain strategies.

- ESG dashboarding, including peer benchmarking.

- CSR reporting and philanthropic initiatives.

The first step might be reporting sustainability initiatives publicly (such as climate reporting and board diversity disclosure that SGX has mandated for identified sectors), while more advanced steps include integrating ESG risks with business strategy and incorporating ESG goals into executive pay design. However, not all of these steps need to be done sequentially; it is likely that companies will achieve some steps further along the curve before others.

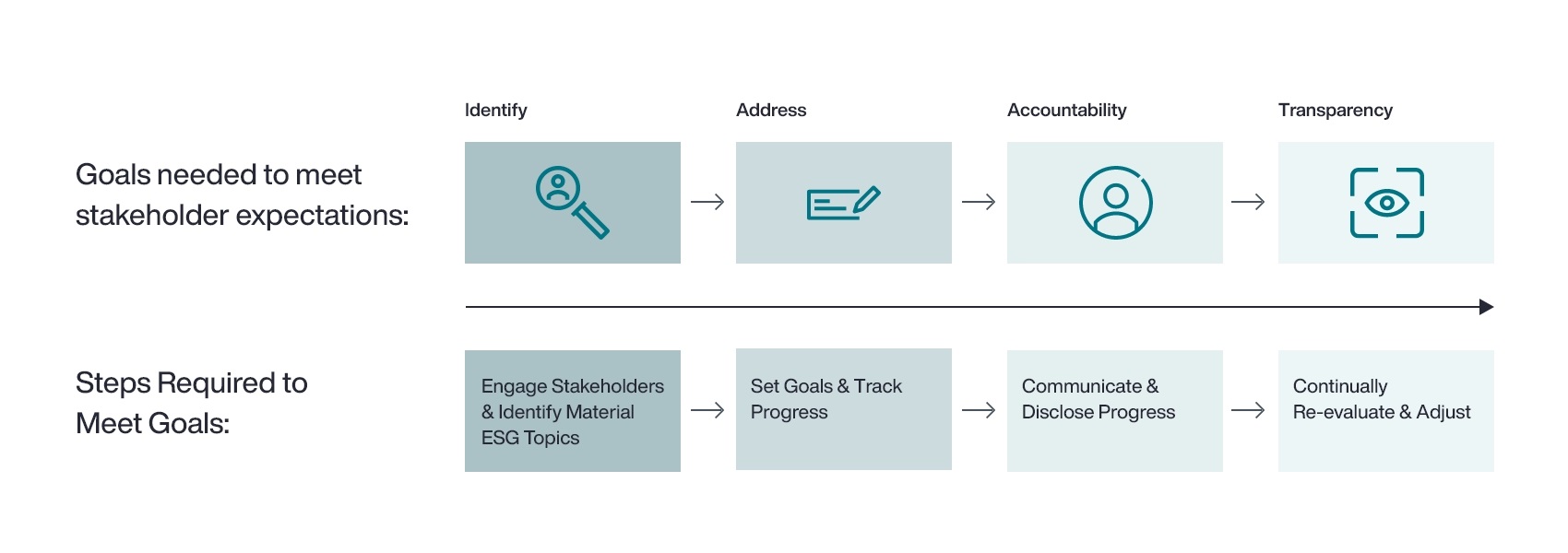

Stakeholders expect companies to identify, address, be accountable and make transparent the process and outcome of ESG initiatives. These will not be met through incentive compensation alone. ESG-based incentives are the icing on the cake – and establishing plans, processes and disclosures are the main ingredients.

Grounding decisions based on readiness and potential impact will be the most effective barometer for success. Thoughtful analysis and discussion will also be necessary to ensure efficiency and mitigate the unforeseen consequences of rushing to implementation.

To determine which metrics will be most effective, consider the following:

- Importance to investors and other stakeholders.

- Clarity of accountability at the board and senior leader levels; the ESG measures and processes may be sponsored by different board committees and/or senior leaders, but ultimately owned by all.

- Commitment of the board and senior leaders.

- Ability to systematically track progress and make course corrections.

- Utilisation of ESG reporting framework (TCFD, Diversity, ESG Metrics).

- Expected timeframe for achieving goals, i.e., achievability within the one- and three-year timeframes of most executive incentive plans.

- Messaging and perceptions of metrics included and excluded in compensation plans.

- Current and anticipated ability to establish quantifiable goals.

- Risks to reputation if goals are not achieved.

Determining how potential metrics and goals will impact disclosure forms an important part of assessing a company’s readiness. A proper link between ESG and compensation will ensure higher transparency and accountability than disclosure alone.

Investors generally expect transparent information, as with any non-financial goal used in an incentive programme, on how a company determines its ESG success at the end of a performance period.

Additionally, there is increased expectation for companies to provide ongoing reporting for the ESG metrics used within their incentive programmes, whether in a separate sustainability report and/or in the “remuneration matters” section in the annual report.

For instance, companies using diversity- related metrics will be expected to provide ongoing diversity statistics and practices in ESG disclosures throughout the performance period.

If a company is not ready to establish goals and measure performance against ESG metrics, or if it is not fully prepared for related disclosures, taking an “exploratory” approach may be the best option. A reasonable solution is to delay tying ESG metrics to executive compensation for at least another year. Most large institutional investors have signalled an understanding of the challenges in linking ESG metrics to compensation and, in the immediate term, are more interested in what companies are doing and their communications through public disclosures.

Other than environmental issues, social issues have gained the most attention in the last two years. While the internal workforce is a key focus in addressing social equity, it also extends to customers, suppliers, and the larger community.

If ESG materiality risk factors are considered an umbrella term, human capital management (HCM) and diversity, equity, and inclusion (DEI) are initiatives that fall under it. HCM refers to the set of practices a company uses to manage all of its activities and goals surrounding attraction, retention and development of their people. DEI involves a range of topics, including race, ethnicity, sexual identification, experience, and access.

While these terms overlap to some degree, stakeholders expect boards to be savvy about how they individually address each of these risk categories without lumping them into one general category.

Continuous monitoring and evaluation

After the design and implementation considerations, the board must ensure there is a compelling narrative that is consistently applied across internal and external communication channels. To oversee effective reporting of risks and opportunities that are material to the company and the broader industry, board members must stay up to date on evolving ESG topics and regulatory developments.

This article was first published in the Q2 2022 issue of the SID Directors Bulletin of the Singapore Institute of Directors.