Navigating uncertainty in pandemic-fuelled M&A deals

Navigating new forms of volatility

Digital transformation remains at the top of the global corporate agenda as the surge and ebb of COVID-19 continues to trap businesses in a state of flux. This has fuelled a wave of consolidations and M&A activity, driven in part by increasing demand for innovation, technology, and digital and data-driven assets.

In fact, according to Aon’s 2021 Global Risk Management Survey (GRMS), 41% of respondents across all regions say their company plans to acquire or divest assets within the next 12 months. However, few businesses are consistently and proactively assessing their most critical and emerging risks as part of the deal-making process.

Despite their inherent risks, M&As and divestitures are still lacking an appropriate risk management component. This lack of risk oversight in corporate deal making can cost businesses of all sizes and across all industries, leaving much room for improvement.

Unequal caution across industries

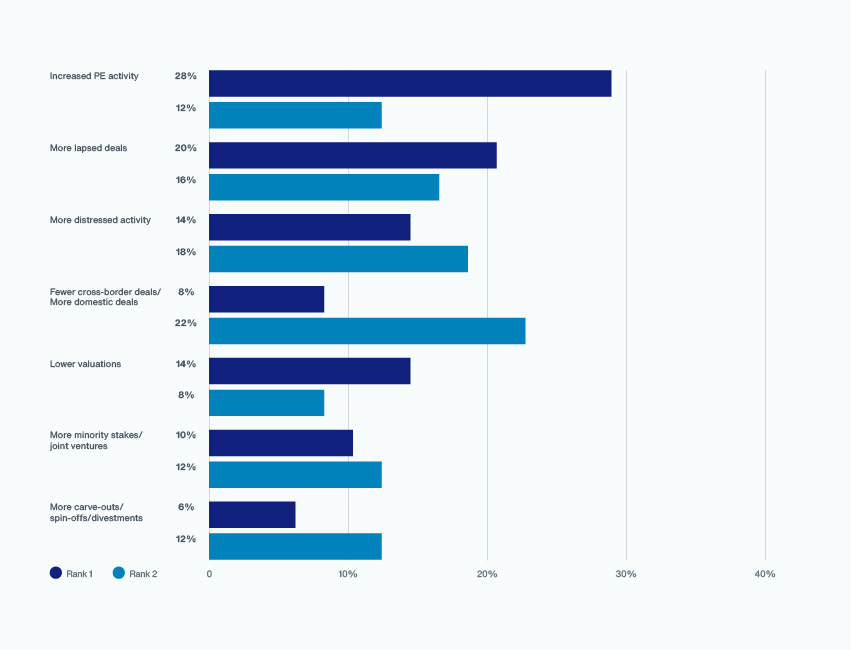

Asia is a hotbed for M&A but with a macroeconomic outlook that is far from certain, this may challenge deal processes, causing them to lapse. In fact, a rise in higher-value deals is driving up M&A claims in the region. Unsurprisingly given the current climate, most of these claims stemmed from losses relating to financial statements, tax issues, compliance with law, stock, and inventory, as well as material contracts. Such uncertainty calls for robust due diligence to test and reinforce investment theses, a process made more difficult by distancing measures and reduced travel.

Risk is a key driver of divestitures. With distressed transactions emerging from industries that are struggling most under the weight of pandemic restrictions, it is surprising to note which industries are falling short in their risk planning.

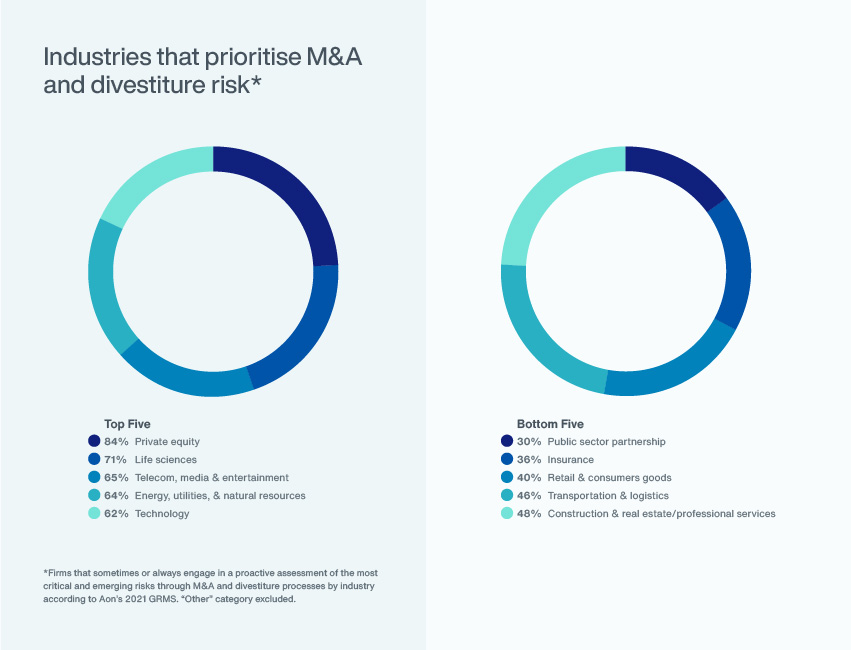

Despite the expected rise in distressed transactions from pandemic-stricken businesses in hospitality, travel and leisure, Aon’s 2021 GRMS revealed that businesses in retail and logistics were in fact among the least likely to conduct risk assessment as a key part of their M&A and divestiture processes. A respective 40% and 46% responded that their company always or sometimes took this action.

In contrast, private equity and life sciences firms, were most likely to conduct proactive assessment of critical and emerging risks in their corporate deals, with 84% and 71% respectively responding that their company always or sometimes took this action. Telecom, media and entertainment companies came in a close third, with 65% prioritising M&A and divesture risk.

As investors continue to seek new opportunities, particularly in pharmaceuticals, renewable energy, technology, and biotech, claims activity will likely continue upwards, driven by deal makers exercising the appropriate caution regarding risk and potential losses. How can these businesses make better decisions about the best course of action moving forward?

Transfer M&A liability

With hard market conditions expected to persist, corporate investors are becoming increasingly cognisant of critical and emerging risks associated with M&As and divestitures. This has given rise to an exponential increase in warranty & indemnity (W&I) insurance utilisation and seller-flip buy-side policies among sellers seeking a clean exit.

In addition to lowering the risk profile of negotiations, W&I insurance can accelerate drawn-out deals by providing buyers with relief. The same could be said of tax liability insurance and litigation risk solutions, which are also on the rise as risk transfer mechanisms in M&A transactions.

The key is to engage with a consultant early in the M&A process to determine the most effective way to manage current and potential risks, especially given the current business climate. By the same token, insurers are taking a more commercial approach to underwriting such risks, and hard market conditions are expected to persist.

The key is to engage with a consultant early in the M&A process to determine the most effective way to manage current and potential risks, especially given the current business climate. By the same token, insurers are taking a more commercial approach to underwriting such risks, and hard market conditions are expected to persist.

While premiums are expected to stabilise despite the uptick in M&A transactions, now could be the perfect time to dial up risk planning in your M&A and divestiture processes and ride on post-pandemic growth opportunities in Asia.

Discover how you can navigating uncertainty in pandemic-fuelled M&A deals: https://www.aon.com/2021-global-risk-management-survey/apac