Strategic Use of Tax Liability Insurance in Offshore Indirect Share Transfers in China

Navigating new forms of volatility

On 6 February 2015, the People’s Republic of China (PRC) State Taxation of Administration (SAT) issued Public Notice [2015] No. 7 (PN7)1 in relation to PRC income tax issues relating to the indirect transfer of Chinese taxable assets by a non-resident enterprise.

PN7 rules were set up to ensure that tax in China cannot be avoided through the interposition of an offshore intermediary holding entity that holds the Chinese assets. If such arrangements were set up without reasonable commercial purposes, PN7 would seek to re-characterise and deem the transfer a direct transfer, and the gains on the Chinese assets would be subject to PRC corporate income tax (CIT).

In mergers and acquisitions (M&A) transactions, PN7 is often a contentious issue for both buyers and sellers, when there is a PRC asset involved. The buyer, seller or the PRC company are left with the decision on how they intend to report an indirect share transfer due to different interests. Tax insurance can be utilised to bridge the gap, allowing both buyers and sellers to speed up the negotiation process and obtain an optimal outcome.

PN7 provides for safe harbour rules and additional rules whereby some transactions are automatically deemed to lack reasonable commercial purpose. If neither the safe harbour rules nor the automatic deeming provisions apply, the transaction would be evaluated under the reasonable commercial purpose test.

Reasonable Commercial Purposes (RCPs) From a PN7 Perspective2

The main uncertainty for PN7 is to determine whether the transaction has RCPs. The seven factors to be considered as part of PN7 are as follows:

| Factors for Analysing RCPs Under PN7 | |

| 1 | Whether the main value of the transferred offshore company’s equity is mainly directly or indirectly derived from PRC taxable property. |

| 2 | Whether the assets of the transferred offshore company mainly comprise of direct or indirect investments situated in PRC, or whether the revenue of the transferred offshore company is mainly sourced directly or indirectly from PRC. |

| 3 | Whether the actual functions performed by, or actual risks assumed by the transferred offshore company and its underlying affiliates that directly or indirectly hold PRC taxable property, can prove that the enterprise structure has economic substance. |

| 4 | Whether the transferred offshore company’s shareholders, business model and relevant organisational structure have stable duration. |

| 5 | Whether the indirect transfer is subject to foreign income tax. |

| 6 | Whether the indirect transfer can be substituted with a direct transfer of the relevant PRC taxable properties. |

| 7 | The applicable tax treaties or arrangements in PRC with respect to the income of indirect transfer PRC taxable property. |

These factors should be analysed before arriving at a conclusion of whether RCPs exists in the transaction.

Insurers’ Appetite for PN7 Tax Risk

- The Board, C-suite and strategic management of the group to be transferred is outside of PRC.

- PRC operations (i.e., net asset value (NAV), equity value or gross value of the assets) do not constitute a major part of the business being transferred.

- Business to be transferred does not derive a significant portion of its revenue directly or indirectly from PRC.

- The group has substance or activities outside of PRC in addition to its PRC operations.

PN7 Tax Risk – Illustrative Example

Background

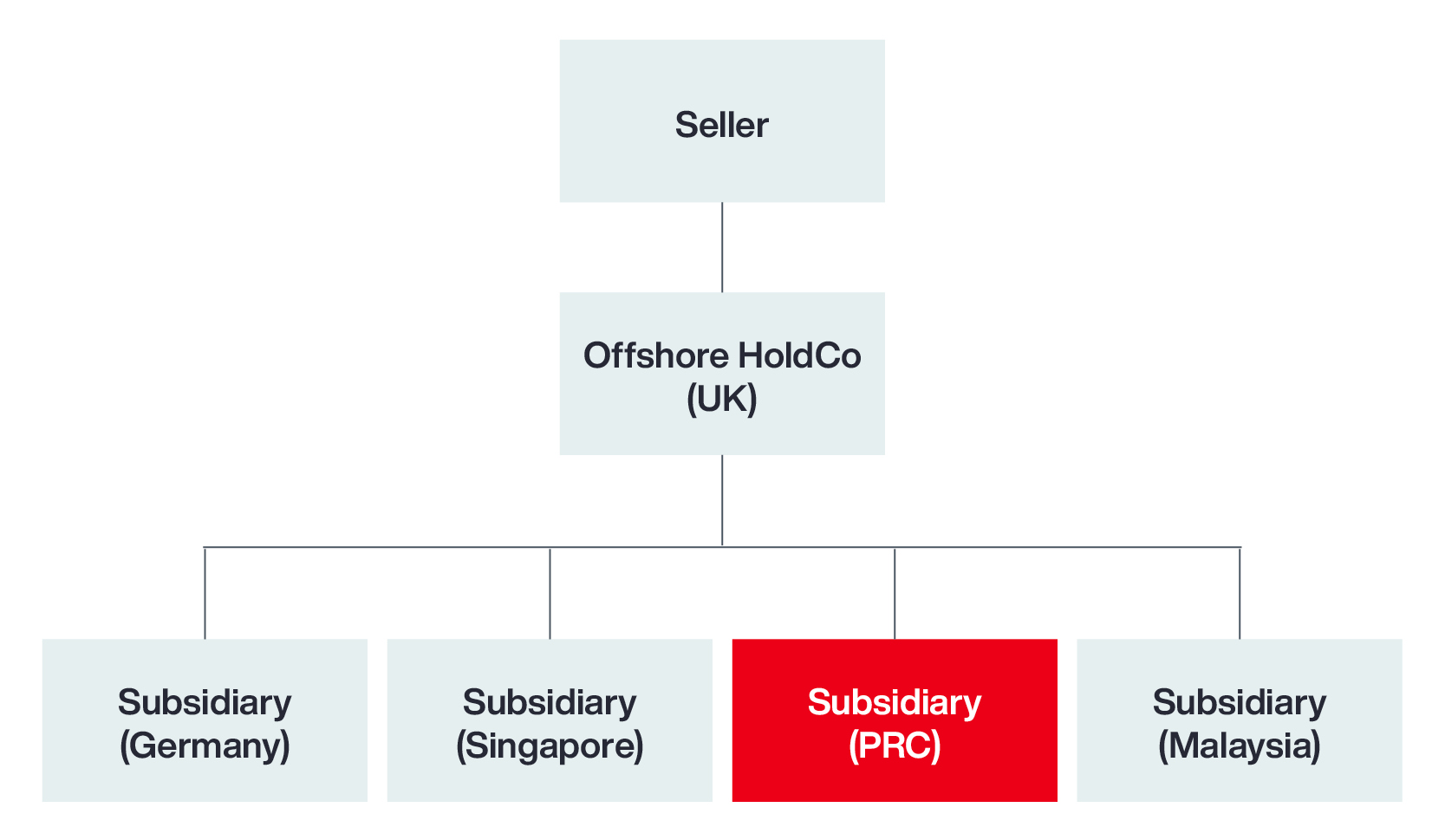

- A multinational PE fund was selling an offshore company (non-PRC – Offshore HoldCo) shares to another offshore buyer.

- Offshore HoldCo holds shares in a PRC resident company

- Majority of Offshore HoldCo’s NAV and revenue are derived from its subsidiaries in Germany, Singapore and Malaysia

- Offshore HoldCo has economic substance in UK with the Board, C-suite and strategic management of the group located there

- The group’s holding structure has been in place for several years.

- Given that the transaction involved a PRC asset (indirect transfer of shares in a PRC resident company), PN7 risk could arise.

- Where the transaction lacked RCPs (based on the seven factors above), PRC tax authorities have the right to re-characterise and deem any gains as direct transfers of PRC taxable property in accordance with the PN7 rules, and subject the said gains to PRC CIT.

- Seller was confident that the risk was low and was able to obtain an opinion from external advisors and the analysis of various factors fit within the appetite of insurers.

- Aon was able to obtain terms from the insurers and the client was able to efficiently solve this issue.

Favourable Outcome for Both Parties

- Seller was protected against the risk that the Buyer would seek to recover the tax liabilities and penalties, and the Seller was able to wind up its PE fund.

- Buyer was protected against the potential PRC tax risk and its obligations and therefore agreed to release the escrow, which improved the IRR for the Seller and enabled the Seller to close its PE fund.

- Both Buyer and Seller were able to speed up the negotiation process with the Seller achieving a clean exit, as well as having sales proceeds fully distributed to its LPs/ investors.

If No Tax Insurance Policy for PN7 Tax Risk

- Notwithstanding the Seller’s position being supported by external advisors, the Buyer may put forward that the PRC tax authorities could take a different view and successfully argue the lack of RCPs. As such, the Buyer may require the Seller to set aside the potential tax liabilities and penalties in escrow which would have adversely impacted the Seller’s IRR and may potentially result in the Seller not being able to close the PE fund.

“In Q4 2023, Aon successfully placed the first tax liability insurance policy for a PN7 exposure. This is a strong testament to the increase in insurer appetite to underwrite complex tax risks. Effective management of tax risks will complement an organisation’s overall risk management strategy, helping to unlock greater value for investors and shareholders.”

Vijay Nair, Director, Head of Tax Insurance, Asia

Costs

A one-time premium payment for PN7 tax risk ranges between 5.5 percent to 8 percent of the limit of tax liability insured. Generally, pricing depends on factors such as strength of the tax opinion and the amount of the financial exposure (e.g., tax liability and penalties).

For more information on tax risk management, talk to our specialists today: