Stuck in the Suez: The impact on marine insurance covers

Navigating new forms of volatility, Risk & Innovation

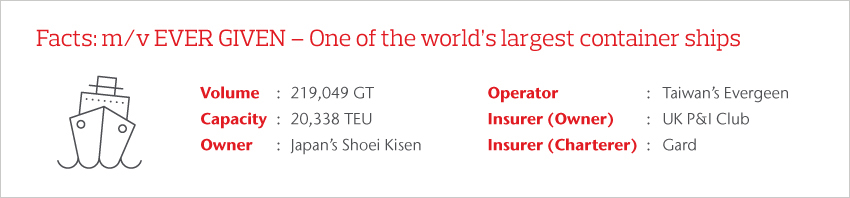

On 23rd March 2021 at approximately 0540 GMT, one of the world’s largest container ships, the m/v EVER GIVEN, ran aground 151km north in the Suez Canal. It effective blocked passage through the canal and immediately caused a backup of more than 100 other vessels either already in or entering the canal from either end. She was finally refloated some 6 days later with the help of an array of salvage companies, led by SMIT Salvage.

Every day the Suez Canal was blocked, an additional 50 vessels added to the backlog of traffic entering the canal from either end, resulting in potentially US$10-15m of additional losses per day. What is the marine insurance position of the m/v EVER GIVEN and the vessels whose passage had been hindered?

m/v EVER GIVEN

- H&M:

- Though understood to not be severe, damages to the vessel as a result of the grounding will give rise to a H&M claim.

- Salvage operations as a result of the grounding would be added to the claim, and the salvage award will be borne by H&M underwriters.

- General Average costs will certainly be incurred in order to complete the common adventure, and these would be recoverable from cargo interests as per the New Jason Clause. Due to the volume of packages on board and Bills issued, owners could have opted, depending on their H&M conditions, to recover these funds from H&M underwriters through their General Average Absorption Clause. The vessel has now formally declared General Average.

- P&I:

- Any cargo damage will be covered by the vessel’s P&I Club. As the cargo is not thought to be damaged due to the grounding, presumably this will mainly be relevant for perishable cargo.

- Consequential loss of late delivery (of sound cargo) is not covered. In any case, this will likely be excluded under the relevant Force Majeure provisions and the Hague/Hague-Visby Rules.

- Fines imposed by the Suez Canal Authority could be covered under Rule 2, Section 22.

- Unrecoverable General Average contributions (e.g. from H&M, Cargo interests) are covered. It will be interesting to see, now that the vessel has declared a GA, to what extent this Rule will be used.

- Damage to the Suez Canal itself (e.g. the banks of the canal) would be covered as a result of a collision to a fixed or floating object.

- There is an argument of third party liability, i.e. a duty of care, to other vessels and their cargo, in tort. Such an action would have to be heard by the Egyptian courts, under Egyptian Law. Even following English Law and the Tort of Negligence, a claimant’s argument would be difficult to prove.

- There is a strong argument that consequential damages i.e. business interruption to the canal as a result of the blockage, would also be covered as a result of the same FFO peril.

- Should this be the case, the collision claim would quickly become a claim on the International Group Pooling Agreement.

- Loss of Hire (if purchased)

- There is a valid claim under the policy subject to the excess period – generally 7 days for Japanese shipowners, with typical limits of 90, 120 or 180 days.

- Delay Insurance (if purchased)

- There is a valid claim (Grounding, Collision) under the policy subject to the excess period, typically 4 days with limits of 10-20 days.

All other vessels:

- H&M:

- As no damage has arisen to any other vessels, no H&M claims are expected.

- P&I:

- Cargo claims are expected for perishable cargo, and these are expected to be covered by the vessels’ P&I Clubs, with recourse action potentially being taken against the owners of the m/v EVER GIVEN and their P&I Club.

- Consequential loss of late delivery (of sound cargo) is not covered. As mentioned above, this would likely be excluded under the HR/HVR.

- As the m/v EVER GIVEN sat in the Suez and its quick recovery looked unlikely, several vessels set sail for a passage around the Cape of Good Hope. Such a voyage would at the very least raise the question of deviation or the duty of utmost despatch, and the legal issues that come with it, as well as the unprejudiced continuance of Club cover.

- The journey around the Capes is more dangerous by nature, and hence if any cargo was damaged as a result of the more perilous journey, Clubs would have had to agree to this in advance for members to enjoy uninterrupted Club cover.

- Loss of Hire (if purchased)

- With no H&M damage, owners’ Loss of Hire policies would not be triggered.

- Delay Insurance (if purchased)

- Delay Insurance would be triggered as the blockage of the canal constitutes a physical obstruction to a navigable waterway, a covered peril for Shoreside events. This is typically subject to a 1-day excess period and limit of up to 20 days.

This is an unfortunate incident and certainly one which will be discussed for many weeks and months to come. What is evident is the need to look at products which might be outside the scope of typical H&M and P&I covers, such as Delay Insurance, with typically niche products offering a sleep-easy solution to shipowners and charterers.

Learn more about our risk solutions for the Marine industry or contact your nearest Aon Marine team for assistance.