The intersection of climate risk and credit risk: How are credit insurers responding?

Rethinking access to capital, Capital & Economics, Financial Services

The impact of climate change has been a key priority for financial institutions: from understanding and reporting the links between climate risk and credit risk, to capturing opportunities from the significant client demand for sustainability-linked lending and green loans. The credit risk insurance market has invested in its capabilities to support financial institutions in financing the green economy. We highlight some of the developments in this space:

- Rise of green credit insurance: Insurers are increasingly allocating capital to finance green transactions. Earlier this year, two insurers provided capital to launch an independently-run underwriting platform focused solely on green project finance transactions. This new market entrant has underwriting capacity of up to $50m per transaction and demonstrates that new credit insurance capital is being deployed in this space. Another trend has been the development of “green cycle” solutions where premiums earned from insuring the financing of green assets are reinvested by the insurer into the green economy via certified green bonds.

- Robust risk appetite for renewables project finance: Renewable energy projects in Asia represent a large component of our new transaction volumes. Insurers can provide both non-payment and political risk cover for project financings. There is also considerable market depth ($500m+) and capability to meet the tenor (15+ years) requirements of this asset class. Insurer demand for renewable assets has been amplified as they want to diversify away from historical concentrations in the oil and gas sector. For project finance lenders, the use of credit insurance allows them to manage internal credit limits, increase lending ticket sizes and obtain capital relief (in some jurisdictions).

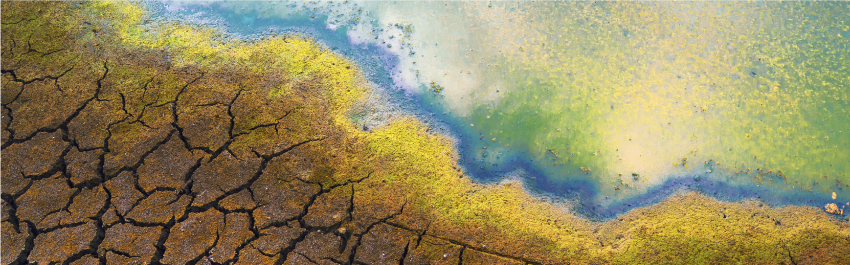

- Managing weather and agriculture risks for lending portfolios: Banks with a portfolio of agricultural credit exposures can use parametric solutions to mitigate the risk of crop failure to the insurance market. A crop failure greatly increases the likelihood of a loan default (by borrowers dependent on cashflows from crop sales) and can be caused by changes in rainfall levels (e.g. drought or excess rainfall) or an adverse weather event. Agricultural lenders are managing the impact of such climate risks on their credit portfolios by partnering with insurers.

In 2015, Mark Carney discussed climate risk and financial risk with insurers at Lloyd’s of London: “The horizon for monetary policy extends out to 2-3 years. For financial stability it is a bit longer, but typically only to the outer boundaries of the credit cycle – about a decade. In other words, once climate change becomes a defining issue for financial stability, it may already be too late.”

The credit insurance market has made meaningful progress since then and we expect the partnership between credit insurers and lenders in green finance to continue.