Thinking of a US IPO? Five Actions for Asian Companies to Consider

In the remainder of 2023 how can private companies better prepare for a successful US IPO?

- With the capital markets continuing to be quiet compared to past years, private companies have more time to prepare for becoming publicly listed entities.

- Companies should consider using this time to do preparatory work such as looking at their cyber security and cyber insurance coverage, putting in place best practices around governance, and revisiting their Directors and Officers (D&O) liability insurance.

- It is important for private companies to understand the obligations of a US publicly traded company and work with advisers with the right expertise to manage risks when the company’s profile changes from private to public.

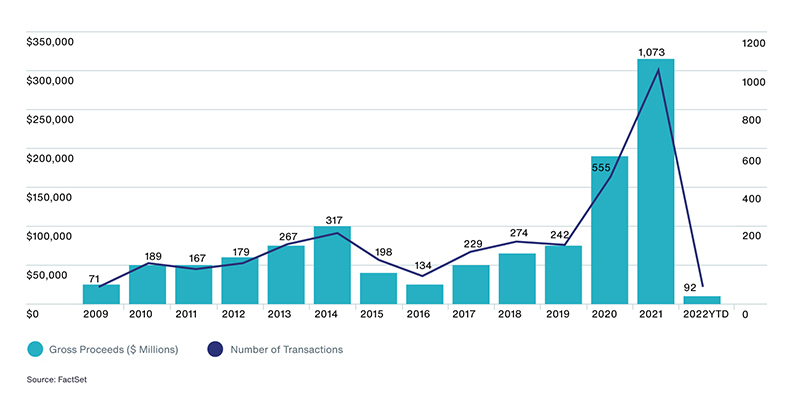

The market uncertainty that has caused the longest US technology Initial Public Offering (IPO) drought in more than two decades (as illustrated in the chart below) has continued into 2023, with the Federal Reserve’s focus on interest rate rises hitting stock valuations. Other factors such as the war in Ukraine, and complicated Chinese internet and foreign listing regulations have also played a part in the contraction of US IPO activity.

The number of IPOs in the US decreased by more than 90% in 2022

“While companies are putting off going public, it is an opportune time to start planning for it, ensuring the right processes are in place so that companies are ready to take swift action when market conditions improve,” says Wei-Lin Ho, Aon’s Head of Digital Economies for Asia.

An IPO or deSPAC process comes with heightened scrutiny of governance, risk processes, and financial and other statements made in the course of the transaction.

Preparatory work - such as reviewing cyber security and cyber insurance coverage, putting in place best practices around governance, revisiting Directors and Officers (D&O) liability insurance, and looking closely at talent retention approaches - will allow companies to take advantage of the current “downtime” and avoid any rush when going public in the near future.

Five Actions to Take Now to Prepare for a US IPO

1. Build a Robust Cyber Resilience Strategy

Cyber is now considered a top business risk. This is further complicated by stricter regulatory regimes implemented by governments, making it even more important for digital economy companies to address the need for a robust cyber resilience strategy for prevention, detection, and response.

“But those building up to a liquidity event, such as an IPO, are more vulnerable owing to the greater scrutiny they are under in the near term, by shareholders and regulators.”

The impact cyber attacks have on revenue, licenses to operate, or brand equity, can materially influence future valuations and consequently the success of an IPO. Recent liquidity events in the technology and hotel industries saw negative adjustments to enterprise value in the order of hundreds of millions of dollars and further regulatory expense following the disclosure of cyber breaches.

A pre-IPO cyber resilience strategy should consider the following:

- Assess: Assess cyber threats to the business and determine how security controls directly impact balance sheet exposure

- Mitigate: Employ targeted security controls against industry standards to enhance security maturity, reduce exposure, and minimise financial impact from key cyber risks

- Transfer: Incorporate reasonable risk transfer solutions for cyber risk to safeguard the balance sheet and protect shareholder equity

- Recover: Implement a range of business continuity, incident response, and claims protocols to expedite any future operational and financial loss recovery from a cyber attack

2. Engage in Human Capital Due Diligence

A crucial component of executing a successful IPO is no doubt having an agile and a resilient workforce that can adapt to the shifting needs of the business.

“Investing in employees and instilling in them a sense of belonging will set companies up for success. Ultimately, a resilient workforce is essential for a resilient business.”

There are several areas to be mindful of:

- The Great Convergence – What strategy is in place to manage external forces such as the impact of skills convergence, industry convergence, social and work-life convergence, and macroeconomic and stakeholder convergence?

- Leadership and behaviours – What capabilities are desirable for the organisation as it goes public?

- Development and personal growth – Are opportunities provided to employees to ensure career growth? Do employees have a defined job architecture? Are career paths aligned to capability and skills needed within the organisation?

- Rewards and well-being – Are the compensation philosophy and rewards programs well-defined to drive necessary behaviours in employees? Are equity programs being leveraged to drive a sense of ownership amongst employees?

- Hire for culture – Is the organisation culture and experience driving brand advocacy within employees and the market?

- Measure the right metrics – Is return on value being measured alongside return on investment?

Addressing these different aspects of human capital strategy will help underpin the successful transition to becoming a public company.

3. Proactively Address ESG Matters

With the US Securities and Exchange Commission (SEC) more focused on developing rules for environmental, social and governance (ESG) matters, and investors increasingly interested in how companies address ESG issues, identifying and addressing them prior to an IPO or deSPAC can be a factor in drawing support for the transaction and for the share price beyond.

“Failure to do so can lead to unsolicited scrutiny and an opportunity for others to craft your narrative.”

While governance has always been regulated through the stock exchange a company lists on, it is also critical to disclose material ESG risks. Companies can proactively address these issues by:

- Evaluating material ESG risks relevant to their specific industry and organisation

- Assessing how these risks are currently addressed internally, among peers and against best practice guidelines

- Developing substantive policies to reduce material risks while capitalising on business opportunities they may create

- Ensuring that boards are well-rounded, with constituents who have public company experience

- Establishing oversight procedures, charters and committees at the executive and board levels specifically for ESG

4. Manage Heightened Intellectual Property Risk

Intangible assets, which now make up 90 per cent of the value of the S&P 500, have become the foundation of our global economy. This has significantly changed the business risk landscape and companies now face the growing challenge of recognising, preserving, and protecting the value created by their intangible assets, including their intellectual property (IP).

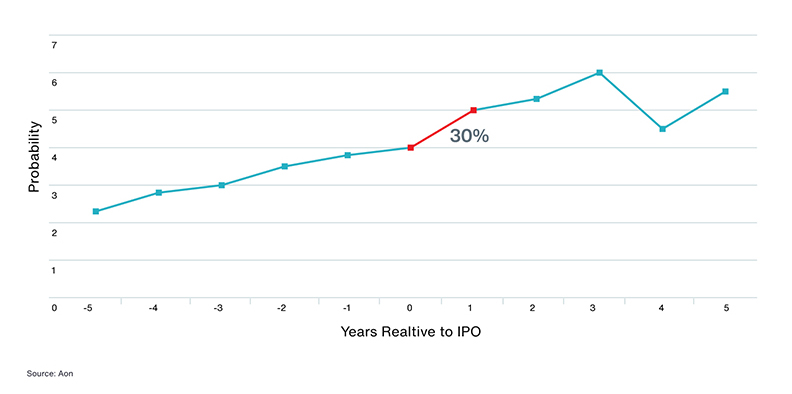

This is even more critical when companies look to go public as the risk of patent litigation increases in years leading up to and immediately following IPOs. The highest jump is observed in the year following the IPO, where the chances of being sued surge by 30%.

Chances of Getting Sued for Infringement on Third-Party Intellectual Property

“Current non-IP specific insurance products are insufficient given the significant IP exclusions within those policies,” Rafferty explains. For example, patent infringement is almost always excluded from insurance policies, as are other forms of IP infringement. “IP infringement allegations that occur during the normal course of business are also usually excluded from these types of policies,” he adds.

5. Evaluate your Directors & Officers (D&O) Liability Insurance Needs

The risk of a claim for a breach of an individual’s duties as a director of a public company are greater than as the director of a private entity, and this is particularly so for companies listed in the USA, as borne out by the following data points:

- 20% of US-based newly public companies have experienced securities litigation1

- There were 218 class actions in the USA in 2022 against public companies and their boards2

- Average settlement of $28M for claims against a public company/its directors and officers3

Ensuring a company has the appropriate D&O insurance in place should be a key part of mitigating the risk of claims against both directors and the company itself. Cover for claims arising from a public offering of securities, and cover for claims against the company itself in relation to the sale and purchase of securities, are examples of issues that should be addressed.

Another factor will be insurer appetite for covering D&O risks for US listed companies. Many D&O insurers in Asia will not offer cover so it is important to identify those insurers who will and build relationships with them early.

Entrepreneurial, fast-growing companies should ensure attention is paid to the wording of their D&O insurance and limits of cover. Two examples from Aon’s experience, that highlight the importance of this include a tech-enabled logistic company whose existing private D&O limit was found to be 25x less than that of their competitors, and a digital economy company who had restricted coverage and onerous exclusions in their D&O insurance program.

Plan, plan, plan

With more time ahead of a listing, private companies now have a better preparatory period to be ready for public transition.

In the ramp up to going public, companies should review their risk management practices, evaluate their insurance programs and consider whether it is broad enough to adequately protect their balance sheet against the heightened risks that come with being a public company.

1 Aon proprietary data

2,3 Cornerstone Research, 2023, “Securities Class Action Filing Activity Fell for Third Straight Year as Volume of M&A Class Actions Declined”