Aon | Professional Services Practice

A Strategy for Professional Service Firms to Consider - Shared Ownership Life Insurance to Fund Partner Retirement

Release Date: October 2022 Corporations have been using life insurance to finance executive benefit plans for at least 40 years. Why? The unique tax attributes of life insurance make it a vehicle that can provide above market returns on an after-tax basis.

Using permanent life insurance (see below) to fund benefits requires a significant cash investment, and a long-term holding strategy. These two requirements have typically prevented professional services firms from using life insurance to finance partner retirement benefits.

The ability to source capital to fund the initial insurance investment may change the dynamic for professional services firms. Sources for the capital investment may include third-party financial institutions, or even a firm’s captive insurance company. Increased efficiency in the ability of insurance products to make living distributions means that policy owners do not have to wait so long to enjoy the rewards of this strategy.

In this way, firms may enjoy the benefits of the above market returns that life insurance can create, without the burden of the significant initial investment.

Background

To avoid bogging down this article with a primer on life insurance taxation and the various types of life insurance products, it’s best to think of life insurance this way:

- At its core, it is a financial vehicle where proceeds paid upon the death of an insured are excluded from gross income for taxes. All life insurance contracts involve receiving a death benefit in exchange for paying a premium.

- What is different across life insurance contracts is everything else – the relationship of the premium to the death benefit, whether extra premium is paid to build cash value within the vehicle, and how that cash value is invested. Contracts that allow or require extra premium to be paid, and therefore build cash value, are typically referred to as permanent life insurance. The cash value grows free of income taxes.

These permanent life insurance products can be complex financial instruments. But the tax-free growth in value, the different types of underlying investments, other varying attributes are also what provide planning opportunities. The attributes may be segregated among multiple parties to best meet the diverse objectives of different parties.

In the context of a professional services firm, the ability to bifurcate ownership of interests in a life insurance policy creates some very attractive retirement planning opportunities.

By examining and segregating the various parts of a permanent life insurance policy, we can effectively create a funding approach to the insurance policy that meets the diverse needs of different parties.

To understand how different funding approaches may create value, we need to first understand the growth mechanism in the insurance policy, and how that mechanism varies across different policy types. For purposes of this discussion, we will reference three types of permanent insurance policies:

- Traditional universal life (UL) or whole life (WL)

- Variable universal life (VUL)

- Indexed universal life (IUL)

In a traditional life insurance policy, the policy cash value grows at an amount determined by the insurance company based upon the return on the insurer’s invested reserves. Because the insurer’s reserves are typically invested in a conservative manner, these policies generally produce a modest rate of steady growth.

In a variable universal life policy, the policy cash value grows based on the performance of investment funds selected by the policy holder from a menu of options curated by the insurer. The options generally range from stable value funds to equity choices. Because of the range of options, policy cash values may grow, or decline by significant amounts each period.

In an indexed universal life policy, the policy cash value is credited with a collared return based on the performance of a market index, typically the S&P 500. These policies generally grow at a rate of up to 10% per year, but they also have a downside limit of 0%. They are designed in such a way that they have some limited upside, but also protection against any loss of value.

While some buyers of insurance may be perfectly content with the slow and steady growth of a UL or WL policy, and others may appreciate the potential of VUL, we believe the IUL chassis provides a platform to customize attributes to meet policy objectives.

It is with indexed universal life policies that we see the most significant opportunity to segregate the policy benefits to maximize the utility to various parties.

Two Parties with Separate Interests

Both traditional UL and WL and IUL policies provide downside protection. This attribute makes the policies a very attractive asset to lend against. Lenders can take a security interest in the insurance policy and know that they have an asset that will maintain its value and that can be quickly and easily liquidated if necessary to satisfy any collateral obligation of the borrower.

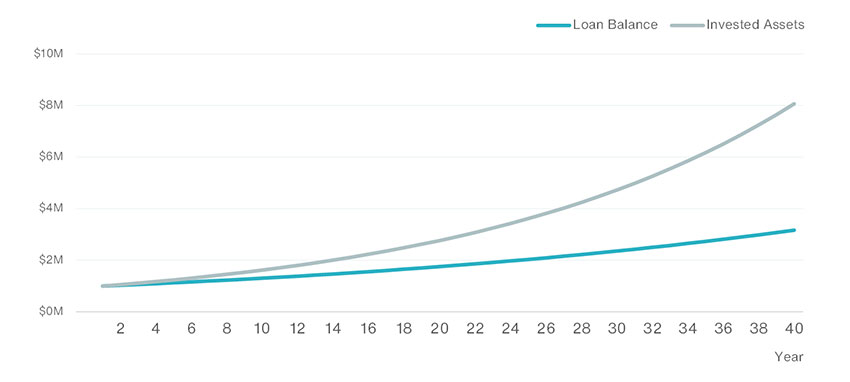

However, traditional UL and WL policies are unlikely to provide a return that is meaningfully greater than the cost of borrowing. IUL, on the other hand, has historically produced returns that exceed the cost of borrowing by several hundred basis points. The IUL policy may not produce returns every year that exceed the cost of borrowing, however, historically over any period of 10 – 15 years, this positive arbitrage has always been present.

We can take advantage of this arbitrage to accomplish the following:

- Provide a modest but stable, secure and predictable return to an investor that finds such a return attractive

- Provide a long-term above market rate of return to an investor who is comfortable with limited market fluctuation

Stable return investors may include financial institutions, employers or captive insurance companies. Depending on the context, one or more of these parties may provide funding for a permanent life insurance policy. The funding entity can expect to receive a stable and predictable return on its investment. It holds a secured interest in the policy as collateral for advancing the policy premiums.

Policy returns in excess of those promised to the stable value investor can accrue to the benefit of another party to the transaction. This party may be a key employee, an individual funding wealth transfer, or a partner (or partners) in a professional services firm funding retirement savings.

Excess Return on Invested Assets Creates Wealth Accumulation

By securing funding from a stable return investor, the excess return investor can lever up returns to make life insurance a particularly attractive vehicle for long-term wealth accumulation or transfer needs.

Partner Retirement

Enlisting a third-party financial institution or captive insurance company to advance premium contributions in exchange for a modest, but predictable and secure return, allows a professional firm or its partners to participate in the tax-advantaged growth of life insurance values with only modest cash contributions.

The lender has a secure interest in a financial instrument that is designed to never lose value, and which is easily liquidated in the unlikely event that the loan ever needs to be called. This type of loan appears to be particularly attractive to financial institutions and may also be quite an attractive investment to a captive insurer.

The firm can enjoy the tax-sheltered growth and use the arbitrage between the borrowing and earnings rate to generate funds to support partner benefits over an extended time horizon.

In other scenarios, a special-purpose entity may be established to own the policies. If the firm does not want to commit to this long-term investment on behalf of its partners, a group of partners may choose to independently pursue such a strategy by establishing and funding a trust to do so.

Wrap-Up

We believe the bottom line is as follows:

- Permanent life insurance is a complex multi-faceted financial instrument

- Life insurance enjoys favorable tax treatment

- It is possible to segregate elements of the life insurance financial instrument and assign them to parties with different objectives

- This ability to segregate elements of the policy makes life insurance an instrument that firms should consider for funding partner obligations.

Securities offered through Aon Securities LLC | Member FINRA & SIPC

3550 Lenox Road NE | Suite 1700 | Atlanta, Georgia 30326 | t: 404.240.6074

Contact

The Professional Services Practice at Aon values your feedback. If you would like to discuss any of the topics raised in this article, please contact Eric Wittenmyer.

Eric Wittenmyer

Senior Vice President and Executive Director

Virtual