Aon | Professional Services Practice

PSP Content Center

The Professional Services Practice at Aon’s Content Center contains thought leadership insights and PSP author biographies, team contacts, news and practice updates.

Our Featured Insights address risk management and insurance issues associated with law, accounting and consulting firms.

The Insight Archive provides searchable access to the complete inventory of our Featured Insights.

PSP Capability Highlights – Human Capital

Attorneys and professionals are in the forefront of everything that a law firm does. To protect their businesses and ensure the wellbeing of their people , law firms should challenge legacy thinking and consider innovative health and benefits solutions.

Featured Insights Subscribe to our insights

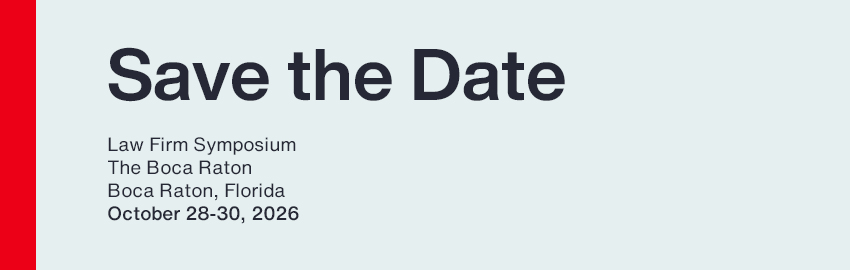

Upcoming Events

Join us for a two-part Aon webinar series, Simplifying Digital Assets: Understand the Basics and Their Impact, with speakers Bhuma Patel, Dan Serota, Glenn Morgan, and Rupert Poland. Designed for risk, treasury, and finance leaders at financial institutions, this series will provide a clear, practical view of stablecoins and tokenized assets, explain how they fit into today’s U.S. monetary and payments system, and explore real-world use cases and operating considerations. Attendees will gain practical vocabulary and actionable insights to help them evaluate digital asset opportunities and risks without needing to become crypto specialists.

Register for the eventProfessional Services Practice In The Press

Aon in the Press

Risk & Insurance's Power Brokers program recognizes and promotes outstanding risk management and customer service among the brokerage community based on an application of recent accomplishments and client testimonials. Catherine Jones has been named a 2026 Specialty Power Broker.

See all Risk & Insurance's Power Brokers here.Featured Content

Helping professional service firms build resilience

The Professional Services Practice at Aon explores Enterprise Risk Management and Professional Service firms in a series of articles.

Featured Author

Aon Affinity Insights

The 2026 Risk Outlook: Emerging Exposures and Priorities for CPA Firms

CPA firms that do not evolve their risk management strategies are going to find themselves exposed in ways they might never have anticipated.