Base Erosion and Profit Shifting (BEPS)

What is Base Erosion & Profit Shifting?

In June 2012, the Organisation for Economic Co-operation and Development (OECD) initiated a project to prevent and counter BEPS. BEPS refers to tax planning strategies that exploit gaps and mismatches in tax rules to artificially shift profits to low or no-tax locations where there is little or no economic activity, thus leveraging down the overall corporate tax paid. A first draft Action Plan was then produced by OECD in July 2013.

The OECD produced a Final Action Plan on BEPS. It encompasses 15 action items that cover topics such as the digital economy, treaty abuse, substance, transfer pricing, and transparency; calling for fundamental changes to prevent and counter BEPS.

Implications for Captives

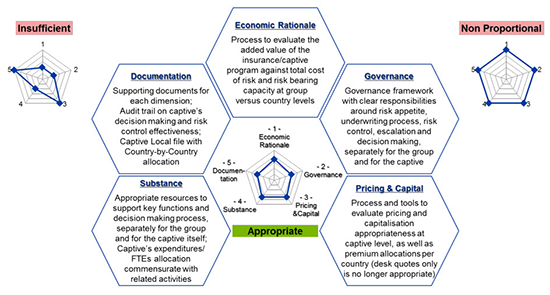

We believe there are five critical dimensions for captive owners to address when considering the BEPS measures:

- The economic rationale of the risk transfer transaction

- The governance around decision making and risk control

- The appropriateness of risk pricing and capitalization

- The substance of the captive activity and establishment

- Proper documentation and audit trail on all the above

These changes create a need for captive owners to take action pro-actively (in some cases, urgent action) to ensure there is alignment with the new requirements.

Download Aon’s White Paper on BEPS here