December 2023

Based on insights from our insurer outlook survey, the Financial Services Group at Aon provides a recap of the directors and officers (D&O) market in 2023 – including a look at what is ahead in 2024 for capacity, coverage, rates and underwriter market sentiment. We hope you find this overview valuable for your 2024 renewal cycle.

Key Takeaways

- Reduced initial public offerings (IPOs) and corporate transactions have limited new opportunities for public D&O insurers resulting in a buyer-friendly market.

- Companies going through their first or second public D&O renewal continued to experience deductible reductions and material premium decreases, while established public companies experienced flat to modestly decreased pricing.

- Abundant capacity will continue to strengthen competitive dynamics in 2024, although some insurers have indicated an intention to decelerate price reductions.

- While supply has maintained pressure on D&O premiums, exposures remain elevated. Defense costs and settlement values continue to increase, while the allegations underlying D&O litigation continue to diversify.

Introduction

Last year, we anticipated that the competitive pressures resulting in swift D&O price decreases would continue but advised that overall volatility and risk in the system remain. Macroeconomic issues kept capital market activity low in comparison to prior years, and as a result, reduced initial public offerings (IPOs) and corporate transactions have limited new opportunities for insurers resulting in pressure to chase opportunities.

Reflections for 2023

Despite elevated risks (e.g., geopolitical, inflation and interest rates, regional banking impact, supply chain, equity market volatility, litigation trends and an active regulatory framework), D&O pricing eased in 2022 and that easing persisted in 2023. Abundant capacity supply, combined with a lack of new buyers (IPOs, deSPACs, etc.) continue to weigh on price points. Newly public companies going through their first or second renewal continued to experience deductible reductions and material premium decreases, while established public companies experienced flat to modestly decreased pricing.

Capacity continued to expand, with most new entrants increasing activity while focused on mid/high-excess attachments. Insurers continued to closely monitor limit aggregation on any single risk and maintained their reduced capacity for high-risk segments. Limits were generally flat, but some insureds opted to increase their limits using reinvested premium savings. Underwriters remained concerned with the rise of Event-Driven Litigation (Cyber breaches; #MeToo; COVID-19 claims; Board Diversity; ESG). Broad coverage remained available, and alternative structures (e.g., higher retentions, coinsurance, quota shares, and alternative capital solutions such as captives) continued to serve as useful levers for some programs.

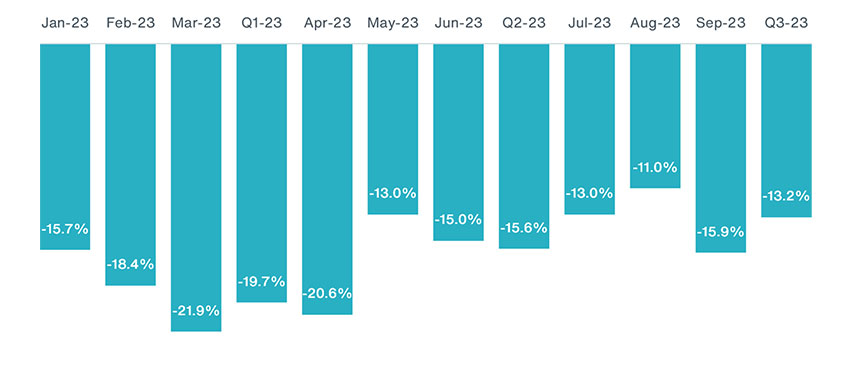

Aon’s public D&O pricing index for Q3 2023 dropped 16.3% year-over-year, representing six consecutive quarters of pricing decreases following nearly 4 years of premium increases. Decreases were more moderate for mature public companies than new public companies.

Monthly Public D&O Price Changes – Primary Only

* Aon | Financial Services Group - Quarterly Public D&O Pricing Index Report

Looking Ahead to 2024 – Insurer Outlook Survey Results

Looking ahead, with continued robust capacity, competitive dynamics will continue to strengthen and the market will remain favorable; however, some insurers have indicated an intention to decelerate their reductions. Insurers will remain disciplined about capital deployment and will closely monitor results and profitability.

Aon surveyed more than 40 D&O underwriters about risk issues, appetite, and pricing expectations. We are pleased by the number of responses and hope that insights and comments from the survey help you prepare for your 2024 renewal cycle.

Survey Results

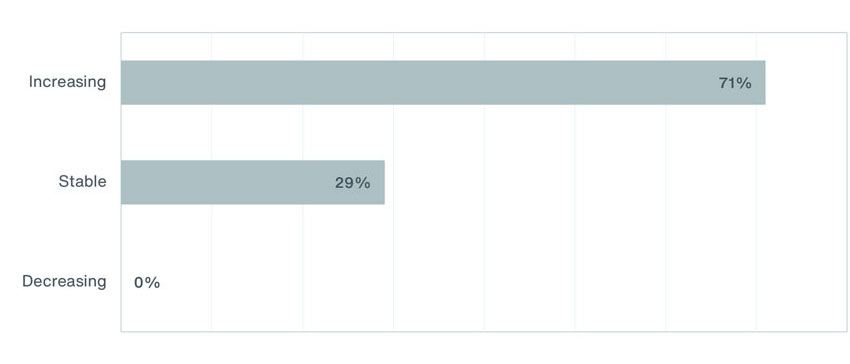

How do you view D&O exposures for public companies? Most underwriters view public companies’ D&O exposure as increasing.

Most survey respondents view public companies’ D&O exposures as increasing in 2024, with fewer respondents noting a stable trend, while none view a decrease in exposure. This is unsurprising given new and pending SEC rules, an uptick in corporate bankruptcies, increased defense costs, stock volatility and a growing wave of environmental, social and governance (ESG) litigation, including anti-ESG and diversity, equity and inclusion (DEI) matters. Derivative settlements are also increasing and remain an area of concern for insurers.

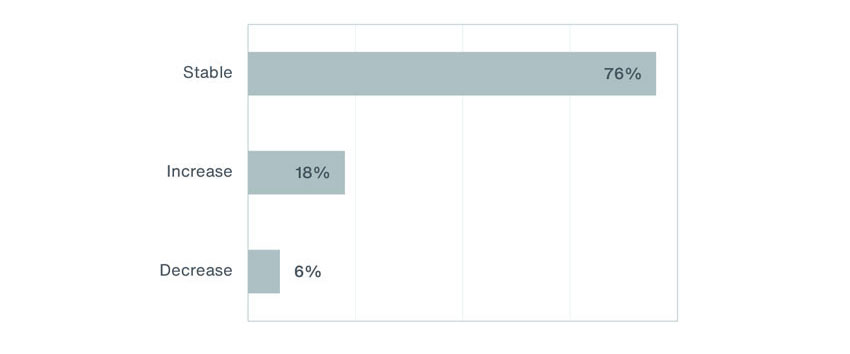

What do you expect overall D&O rates for public companies to do in 2024? Slightly over half of underwriters expect overall public company D&O rates to decrease between 0%-10%.

Based on the survey, D&O underwriters anticipate 0%-10% decreases in 2024, with fewer respondents anticipating stable rates and some noting they anticipate 0%-10% increases. We expect results will continue to be influenced by a company’s risk profile and exposures, such as historical pricing, claim history and financial health.

How will your appetite for newly public companies, i.e. – IPOs, special purpose acquisition companies (SPACs) or de-SPACs – change in 2024? Most underwriters expect appetite for newly public companies to remain stable.

The survey results suggest appetite for new public companies remains stable should the market open for more of these opportunities. That appetite, however, can be best described as cautious and expensive, with insurers offering smaller amounts of capacity (i.e. $5M in limits) for premiums per million that are more than most mature public companies experience.

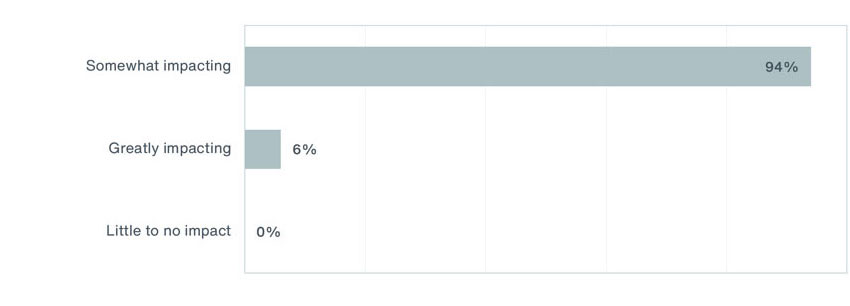

How are interest rates impacting your underwriting decisions? Almost all the underwriters say interest rates are somewhat impacting their underwriting decisions.

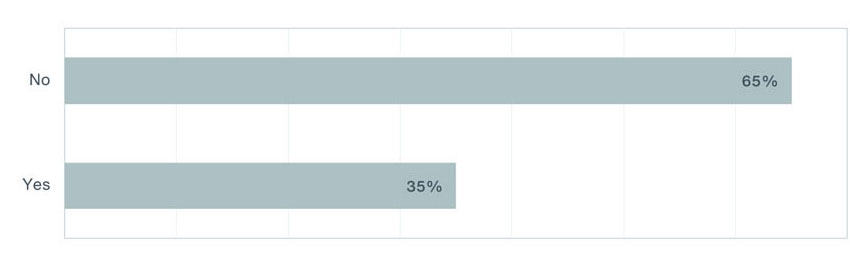

Have your underwriting models changed to include ESG-specific metrics or are you utilizing ESG raters in your models? About 2/3 of underwriters say their models have not changed to include ESG-specific metrics or ESG raters.

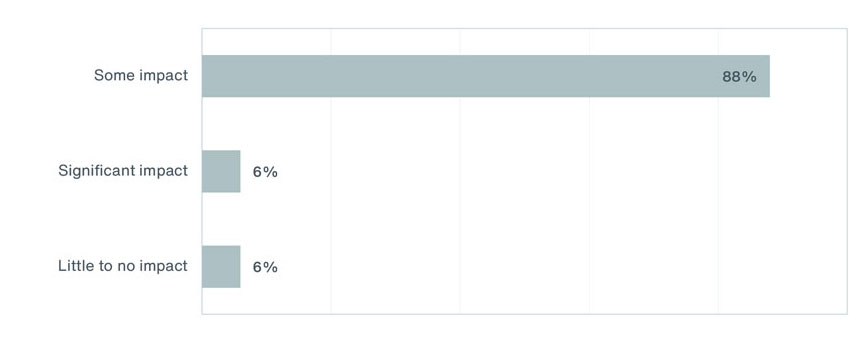

What kind of impact will reinsurance treaties have on the market in 2024? Most underwriters expect reinsurance treaties to have some impact on the D&O market in 2024.

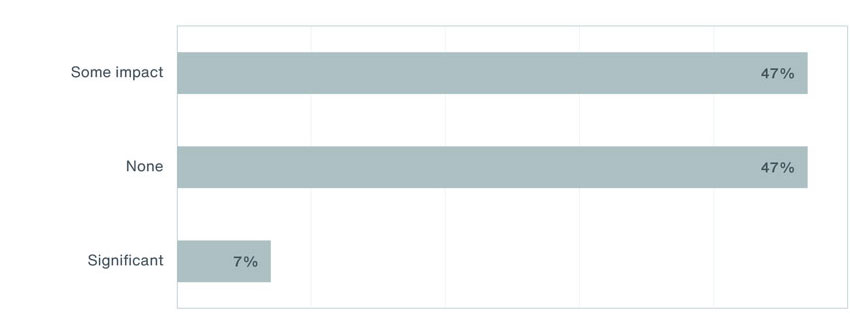

How much impact will the 2024 presidential election have on your underwriting metrics? Just under half of the underwriters expect the 2024 presidential election to either have some impact on their underwriting metrics or it will have no impact.

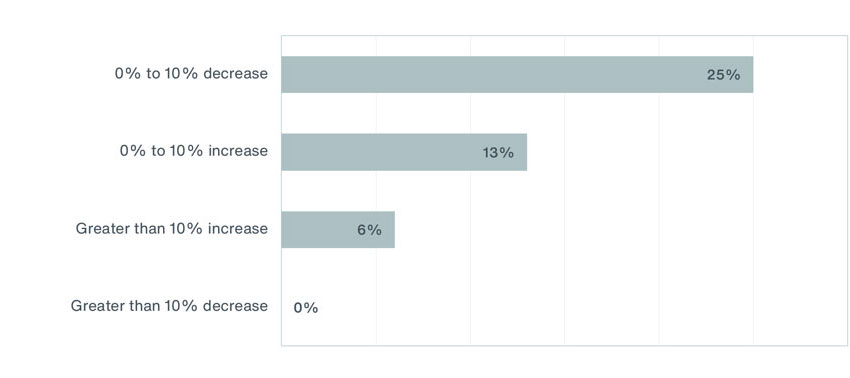

What do you expect overall Financial Institution D&O/E&O rates to do in 2024? 25% of underwriters expect overall Financial Institution D&O/E&O rates to decrease 0%-10%.

This document is not intended to address any specific situation or to provide legal, regulatory, financial, or other advice. While care has been taken in the production of this document, Aon does not warrant, represent or guarantee the accuracy, adequacy, completeness or fitness for any purpose of the document or any part of it and can accept no liability for any loss incurred in any way by any person who may rely on it. Any recipient shall be responsible for the use to which it puts this document. This document has been compiled using information available to us up to its date of publication and is subject to any qualifications made in the document.

Los Angeles

+1.212.441.2322

[email protected]

Bloomington

+1.952.807.0704

[email protected]

Denver

+1303.639.4172

[email protected]

New York

+1.212.441.1973

[email protected]