Aon | Professional Services Practice

The risk retention series:

How Is the Adequacy of a Captive’s Capital Assessed?

Helping Professional Service Firms Stress Test and Model Capital Adequacy for Their Captives

Release Date: February 2022

The Professional Services Practice at Aon share insights to help firms navigate the insurance market in the tenth article in a series exploring risk retention.

The long-term successful operation of a captive is dependent on the captive’s management continually monitoring and assessing the adequacy of their capital position and the captive’s ability to withstand unexpected losses. To assist with this assessment, actuarial risk analysis is key in providing stress testing and financial modelling.

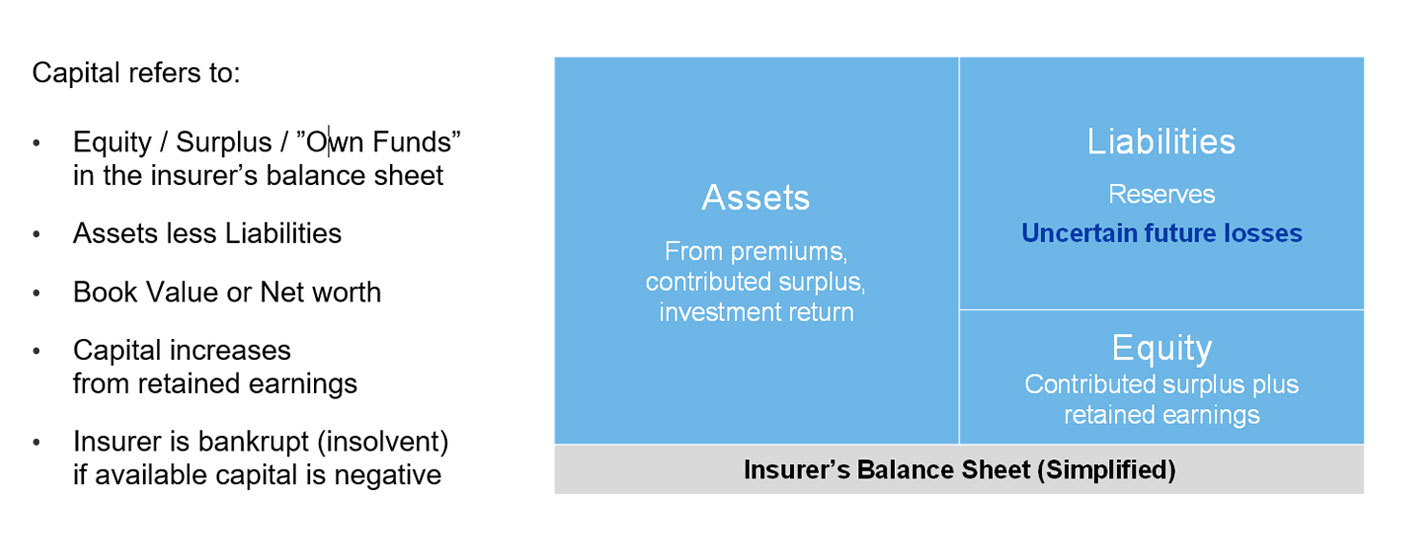

Capital in the Captive’s Balance Sheet

In the business of insurance, insurers issue policies and receive premium in exchange for a promise to pay claims arising from the policies. However, future claim payments are uncertain, random events. The insurer is taking on the downside risk that the premium collected may not be sufficient if adverse losses occur.

A simplified example

A captive underwrites an insurance policy with $10 million of limit for $500,000 in premium. Should there be a full $10 million claim suffered in the future, the captive would realize an underwriting loss of $9.5 million. For the captive to pay the full claim, the captive’s capital level (which is the captive’s equity, or excess of assets over liabilities) must be able to absorb the $9.5 million underwriting loss. Otherwise, the captive would face insolvency.

As an insurer, the captive must maintain a sufficient level of capital on its balance sheet to cover unexpected adverse losses to avoid bankruptcy.

In addition to the underwriting risk posed by inadequate premium and reserve levels, the captive’s capital level must also be sufficient to absorb market or asset risk (for example, investment losses from changes in bond or equity values), counterparty default risk (such as credit risk of a reinsurer’s insolvency, if the captive purchases reinsurance), and other operational risks.

Considerations in Capital Adequacy

There are a variety of issues that captive management must take into consideration in assessing capital adequacy:

- Build-up of capital: The captive’s capital levels (after initial paid-in capital from the captive parent) are built up through retained earnings from underwriting income and investment income. Therefore, for immature captives or captives which have recently suffered a loss, captive management may wish to help grow their capital position by increasing the level of premium funding.

- Volatility of risks insured and diversification: Captive management’s view of internally targeted capital levels could be aligned to the riskiness of the insurance lines being underwritten. The level of capital needed by a captive for short-tailed low-risk lines of insurance would be less than a long-tailed volatile line of insurance, for example. If a captive underwrites multiple lines of diversified, uncorrelated risks, however, the captive would benefit from a risk pooling effect reducing the volatility of the aggregated portfolio of risks.

- Use of reinsurance: Reinsurance purchases could be strategically utilized by the captive to transfer the more volatile portions of their risks to third-party reinsurers, reducing the level of capital needed by reducing the captive’s insurance risk on a net of reinsurance basis.

- Stress testing of large loss events: The captive’s actuary could assist the captive management in modelling the impact of large loss events on the captive’s financial statements over, for example, a five-year period. The analysis would inform captive management on how their capital position could absorb stressed scenarios under its business plan and whether management remedial action (such as premium increases or additional capital injections from the parent) is necessitated.

- Regulatory minimum capital: Captives must also comply with minimum capital levels prescribed by the regulator. For example, captives domiciled in Europe are subject to Solvency II, which mandates that insurers hold sufficient capital to withstand a 99.5th percentile (or a 1-in-200-year event) adverse outcome over a 12-month horizon. Other domiciles may monitor certain financial metrics, such as premiums to surplus and reserves to surplus ratios, or simply require a minimum capital level depending on size of the captive.

Uses of Excess Capital

Should a captive successfully accumulate capital levels in excess of management’s internal targets, this excess could potentially be deployed such as:

- Issue policyholder dividends back to the parent (while considering tax implications)

- Reduce premium levels to reflect favorable claims performance

- Underwrite additional coverage for the parent

- Issue intercompany loans back to the parent firm to finance other business activities

- Consider more aggressive investment policies by the captive

A key aspect in the successful operation of a captive is to assess and monitor the ability of its capital levels to absorb volatility from unexpected adverse events. A captive’s actuary could assist captive management in considering issues such as the build-up of capital, the inherent volatility in the risks underwritten, use of reinsurance, ability to absorb shock events, regulatory requirements, and the deployment of excess of capital.

Contact

The Professional Services Practice at Aon values your feedback. If you have any comments or questions, please contact Henry Lim.

Henry Lim

Managing Director

Montreal