A COVID-19 world is putting extra pressures on insurance claims teams by forcing them to work in a remote environment, but with the constant need to keep up with claims volume and quality to manage costs. New technology is allowing teams to shift from time-consuming methods such as closed file reviews and diary/task management to an evolution of monitoring claims handling quality through open claims analysis to improve outcomes. This will tackle insurers’ two big challenges for 2021: maintaining or improving quality by reducing leakage to control costs and maximizing the organization’s limited claims expertise to enhance claims performance.

TODAY:

Current State of Seeking to Improve Adjuster Performance

Most claims systems are great at capturing tasks that have been completed by adjusters, but they do not evaluate the quality of the tasks performed. Plus, insurance carriers perform labor-intensive processes, such as closed-file claims audits or periodically monitoring file activity, with after-the-fact feedback that does little to significantly control claims costs. This process challenge is coupled with a depleted labor pool as experienced claims managers retire, and insurers struggle to fill the void.

Controlling the costs of leakage through closed file reviews

Source: Aon Inpoint Claims Analysis

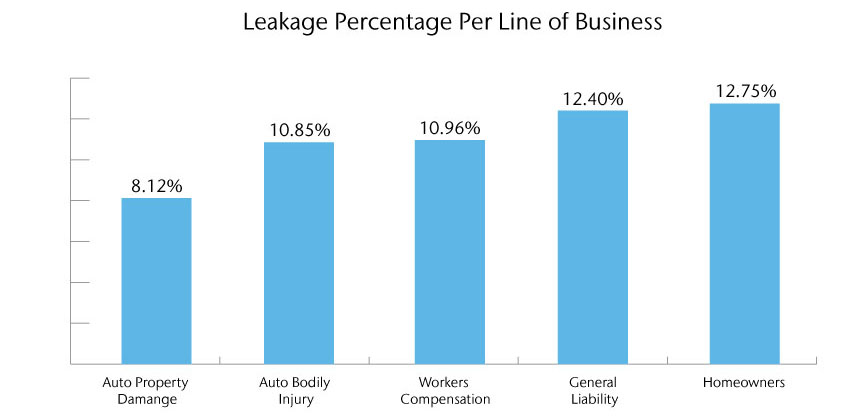

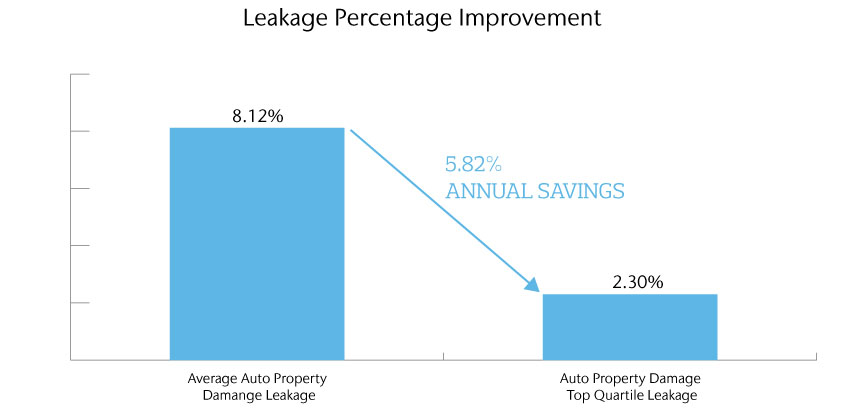

Leakage varies by line of business; but based on Aon studies, insurers still have between 3% to 4% of leakage present in their operations as it costs too much in resources or technology to totally eliminate. However, reducing leakage to these levels represents significant, sustained annual savings of 3% to over 8% in leakage to a carrier, depending on the line of business.

Insurance carrier with $100M in annual Auto Property Damage paid loss represents close to $6M in annual savings opportunity

Source: Aon Inpoint Claims Analysis

Most carriers have a quality assurance function that samples a group of closed claims over a period of time to monitor claims performance – some of which incorporates root cause analysis and includes the identification of leakage. While the closed claim file review is a very effective way of identifying areas where leakage occurs, the challenge in today’s environment is how to prevent it from occurring in order to realize this paid loss and expense savings.

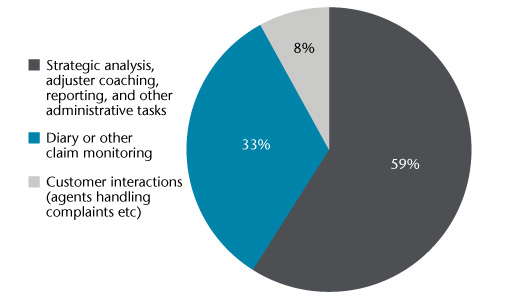

Using direct adjuster feedback and claims system diaries to prevent leakage

Based on Aon time studies, up to 33% (or 2.8 hours per day) is spent on diary or claims monitoring activities. However, many times this is when a claim is already down a path that can lead to a poor outcome. It can be extremely time-consuming for a supervisor to counsel the adjuster on how to course-correct the claim’s activity. In these cases, most supervisors are ‘putting out fires’ daily and reacting to existing claims issues, instead of finding and preventing missteps before they become problematic.

Aon Inpoint Claims Time Study Analysis

Over-reliance on skilled professionals

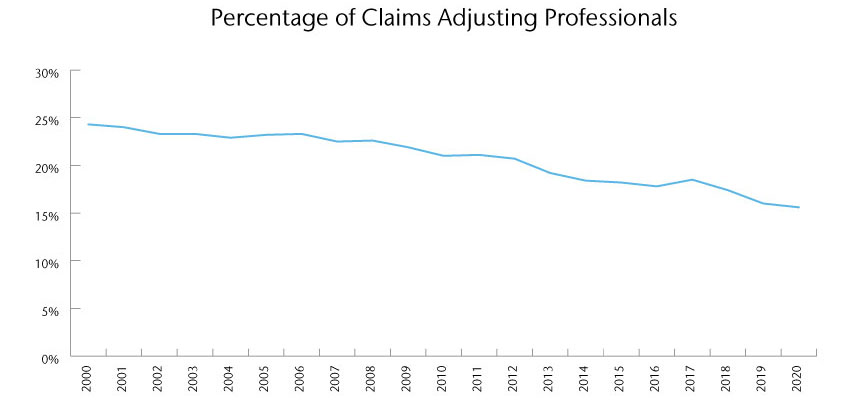

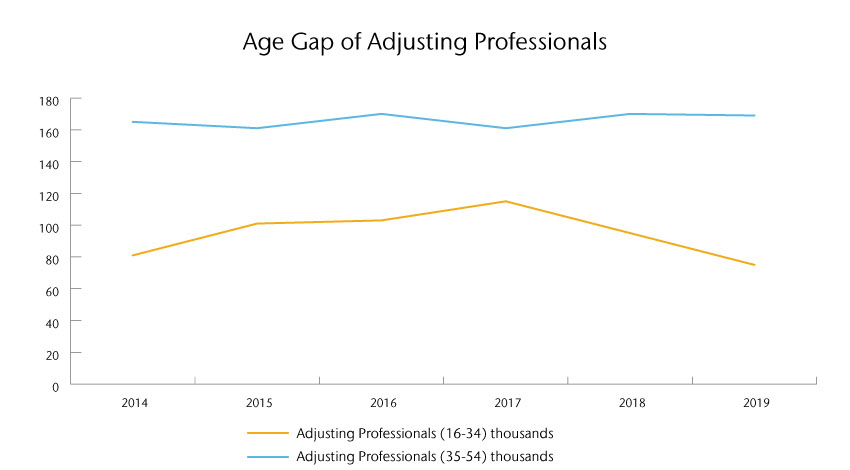

Another major factor in managing claims performance is the exodus of skilled claims professionals. The number of claims professionals has decreased by 8.7% in the last 20 years and there has been a 35% decrease in adjusting professionals aged 34 and younger since 2017.

Represents % of claims adjusting professionals as a % of overall insurance professionals

The number in thousands of claims professionals under and over the age of 34.

Source: Whitney Group Analysis & Bureau of Labor Statistics, U.S. Department of Labor

The challenge is how do you increase the efficiency of your most knowledgeable leaders and enable them to more effectively find and correct problematic claims? The future is to leverage technology to allow supervisors to be more efficient with their time and stop leakage before it happens. Additionally, technology can help train newer leaders by identifying those areas that need attention, especially those they may have overlooked due to a lack of experience.

TOMORROW:

Leveraging technology to constantly monitor the performance of open claims and enhance performance

Fortunately, new advances in technology, including Artificial Intelligence (AI), Natural Language Processing (NLP) and predictive analysis, enable insurers to constantly monitor the handling quality of open claims. When these new technologies are properly deployed, they serve as a ‘coach’ that automatically identifies issues and guides adjusters to take necessary actions that will improve outcomes – in real time. By better understanding the benefits of these advanced models for claims professionals and claims outcomes, carriers can determine whether their needs align with this new technology and begin exploring options to improve claims performance.

How technology can support claims professionals to enhance current claims performance:

- Prevent leakage through open claims audits – Automating the assessment of open claims by using NLP to analyze claims file notes and AI to apply best practice claims handling rules will help identify claims that need attention, avoid poor outcomes and reduce leakage.

- Create predictive models to better identify challenging claims – Utilizing feedback from closed file reviews and current claims, predictive models can help insurers leverage past outcomes to predict which claims will need more focus to drive down leakage.

- Proactively manage diaries around priority cases – Since technology can identify the files where supervisors should focus their time, the diary process can be greatly reduced (or eliminated altogether), allowing managers to focus on claims with pressing issues.

- Enhance workforce skills – Having an automated ‘coach’ to review all open files will allow supervisors to significantly decrease the time currently spent monitoring file activity and spend more time mentoring instead. Technology can also help train less-experienced claims resources on improving claims handling performance.

- Improve adjuster reviews – Instead of just measuring claims performance through a sample of closed file reviews, these tools can monitor all claims activity, increasing the accuracy of an adjuster’s performance across all claims files.

Summary

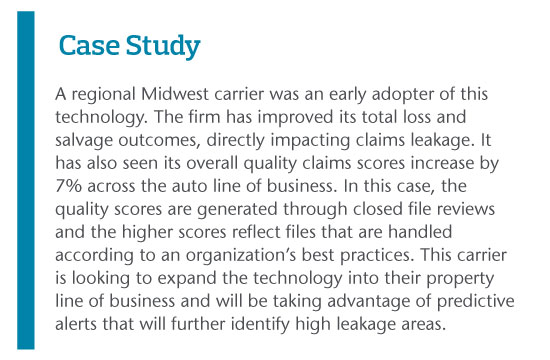

While traditional methods of controlling and monitoring claims performance have been successful in the past, for carriers to stay competitive, they will need to utilize technology to monitor the quality of activities on open claims in the future. Utilizing new technologies such as AI, NLP and predictive models will drive better outcomes for policyholders through more efficient claims management, while also improving adjuster performance and controlling costs by reducing leakage for more robust insurance firms.

About the Authors

Mike Cummings is a Principal with Aon Inpoint Claims practice. He has over 25 years of experience in the insurance industry working in auto physical damage (APD), property, casualty, workers' compensation, litigation management, claims quality improvement, operations management, technology research and claims system implementations. Most recently Mike has directed Aon Inpoint's research on InsurTech solutions for the P&C marketplace to enhance claims operations, customer service and communication. Mike leads the development of the Claims Signal Platform product for Aon Inpoint Claims.

Garnet Glover is the Senior Vice President of Sales at Athenium Analytics and has 30+ years of experience across the insurance industry, including roles as a regional QA/claims/operations manager, sales leader and insurance consultant. His expertise includes designing and implementing audit programs, automating business process improvements and leading training programs. As an executive at Athenium Analytics, Garnet collaborates with insurance carriers to develop superior audit and reporting solutions that optimize and transform existing QA processes.

Discover more

Through a collaboration between Aon and Athenium Analytics, carriers can harness the power of AI, NLP and predictive analytics to enhance their current claim lifecycle. Claims Signal enables carriers to assess all claims activity (loss run data and claims notes) and identify when best practices are not being followed. Alerts are generated automatically to direct the supervisor or adjuster to those areas where an adjuster needs to be ‘coached’ to perform best practices and avoid a leakage situation.