Anticipating Slowdown, Companies in China Take Action

Volume 1 Issue 2 - 2008

Anticipating the Slowdown in China | Rising Health-Care Costs in Asia | Leadership Risk Diagnostic

About the Survey

The Aon Consulting Survey of the Global Financial Crisis’s Impact on HR Issues in China was conducted in late October and early November 2008. Valid responses were received from 71 companies.

Companies from high-tech / semiconductor, automotive and consumer goods industries represented the largest proportion of survey respondents.

Companies headquartered in Asia (China, Hong Kong and Japan) accounted for nine respondents with European firms comprising 29 of the total and North American making up 32 (31 US and 1 Canadian). The headquarters of one company could not be determined.

To find out more or to receive a free copy of the executive summary, contact Julia Cao at [email protected]

Pricing

Summary report:

Participant: Complimentary

Non-participant: RMB1,000

In-depth analysis report by categories:

Participant: RMB1,500

Non-participant: RMB2,500 |

Companies in China, particularly exporters, are taking pre-emptive measures to keep their business on an even keel in the face of expected strong head wind from the global financial crisis. The anticipatory pull back could lead to a “self-fulfilling prophecy” of a slowdown.

In a recent survey of 71 companies operating in China, Aon Consulting found that over half of the participants (and three-quarters of participants that are exporters) are planning to cut costs and 40% of respondents are planning a headcount freeze. High-tech companies are taking the strongest action with 80% of them planning to cut costs and 60% are expecting to freeze headcount. Almost two-thirds of respondents in the automotive and capital goods sector also expected to cut costs.

These across-the-board cutbacks contrast with recent projections of GDP growth for China of 9.9% in 2008 and up to 8.5% for 2009. China’s forecasted growth rate for 2009, while down from this year, is still expected to be among the world’s highest next year. While the prospects for Chinese exporters are dismal, the Chinese economy will still present significant opportunities next year for those focused on the domestic market.

Back to top

Budgeting for 2009

The timing of the crisis corresponds with budgeting for 2009; yet, the current emphasis on cost cutting has not led to a reduction of budget forecast. A majority of respondents in the Aon Consulting survey have decided to take no action or keep their budget unchanged. In fact, 8% have even revised their budget parameters upwards. Thus, it appears that companies are still hoping to sustain their sales levels while, at the same time, taking precautionary measures to limit the fall out if they come up short.

The early winter chill from the financial crisis has impacted compensation plans. Chinese and Hong Kong-based companies are the most likely to be considering a slow down in salary increases (44% of Asian-HQ participants) and more cost efficient benefits programs (67%). Interestingly, 67% of Asian-based respondents cited more aggressive sales plans as their most likely action in terms of compensation. Only 6% of American firms and 23% of European firms mentioned this option as a possibility.

| 11. As a direct impact of the financial crisis, what will be your next steps? |

| |

Asia

|

Europe

|

North America |

Total |

| Slow down salary increase |

44% |

13% |

41% |

31% |

| More selective in merit increase |

22% |

27% |

38% |

31% |

| Focus on cost-efficiency of benefit programs |

67% |

30% |

25% |

32% |

| More assessment on productivity |

0% |

7% |

22% |

13% |

| Stick to original increase budget |

0% |

10% |

19% |

13% |

| Freeze salary increase |

22% |

3% |

16% |

11% |

| Increase on bonus instead of base pay |

11% |

17% |

13% |

14% |

| Ensure HR programs cover HR risks |

44% |

13% |

13% |

17% |

| Introduce retention plans |

11% |

10% |

9% |

10% |

| More aggressive sales incentive plans |

67% |

23% |

6% |

21% |

| Defer incentive payments |

0% |

3% |

3% |

3% |

US firms are looking toward lower salary increases (41% of US-HQ participants) and more selective merit increases (31%). European firms are far more bullish with only 13% expecting to lower their salary increases and 27% saying they will be more selective with merit increases.

The Aon survey indicates that headquarters rather than local market conditions are more likely to drive the actions of US firms than their Europe. Since the Chinese market is likely to continue to grow at a much faster rate than the US and Europe, headquarters control could put US firms at a disadvantage as compared to their local and European competitors.

Back to top

Positive signs as well

On the positive side, few companies are yet to consider downsizing of their workforce. Downsizing is planned by 14% of respondents, with companies in the automotive industry most likely to consider it as an option. American companies are three times more likely than European firms to be planning a downsizing of their workforce (22% vs. 7%).

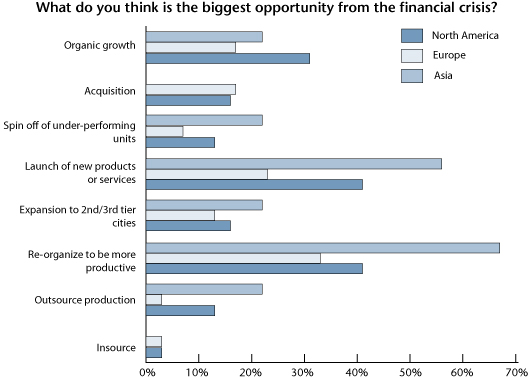

Many firms are taking advantage of the global financial crisis to capitalize on newly presented opportunities. Reorganizing to be more productive is the most commonly cited opportunity with 42% of participants citing this action as an opportunity. Asian-based companies are the most likely to be proactive in seizing opportunities coming out of the crisis. More than half of them expect to launch new products or services and reorganize their operations. European firms, on the other hand, seem to be less likely to be proactive with the most prominent opportunity (reorganization) being cited by only a third of European respondents.

Back to top

Conclusion

Pre-emptive action is necessary to avoid the negative impact that the global financial crisis undoubtedly will have on companies operating in China. Most companies have indeed responded with plans to cut costs and lower salary increases. The risk now is that companies will over-react, pull back too much and miss opportunities that are presented by new economic and financial conditions. These opportunities include reorganizing to increase efficiency, restructuring compensation to strengthen the link to productivity and performance and reviewing sales incentive plans to encourage more competitive behavior.

Back to top

Contact

For enquiries, please contact Julia Cao, Business Development Director, at [email protected].

Back to top