Taming the Tiger: Rising Health-Care Costs In Asia

Volume 1 Issue 2 - 2008

Anticipating the Slowdown in China | Rising Health-Care Costs in Asia | Leadership Risk Diagnostic

The rising cost of health care is not a problem that employers in Asia generally wish to accept or tackle. Many employers take a myopic view and wish the problem away by using some simplistic short-term solution applied behind the scenes. Accepting this as a reality in this region’s dynamic and fast-growing economy is the first step in tackling this complex issue.

Demands for Cost Curtailment

Consider the following scenario: An organization provides a health-care program to the workforce that is fully funded — there are no deductibles, co-payments or other employee cost-sharing programs to lower claims costs. The benefits coverage is above the market median, and dependents are covered on a self-declared basis. The loss ratio is 95 percent, and the company has switched carriers three times in five years. At the same time, the organization’s headcount has grown 64 percent — from 5,500 to 9,000 employees — in the past 12 months. Additionally, employee attrition rates are 25 percent to 30 percent.

Faced with health-plan premiums that have doubled since this organization’s previous renewal, the CEO would like to engage a consultant for the first time to help manage these significant health-care costs. Not only does the CEO want to renew the health-care plan at a lower rate, he would like to do this without cutting benefits or adding cost-containment measures.

Knowing the facts, it seems a Herculean task. The workforce is larger, attrition is high (leading to expensive employee entrance and exit costs), employees have no incentive to keep their claims down and the employer is an unreliable customer.

Maintaining the same costs with the same benefits with a workforce that has expanded by more than 60 percent is a near impossibility, but many actions could be taken to keep the rising costs under control.

Back to top

Health and Prevention

The fundamentals of ancient Chinese medicine provide valuable insight into the health-plan philosophy that should be followed by Asian organizations today. Ancient Chinese medicine focused on health and prevention of sickness, so much so that the village doctor was paid only if his constituents remained without disease. Today, Asia would have a better chance for success if organizations focused on managing the demand for health-care services; or, in other words, reduced the need for consumption of health-care services.

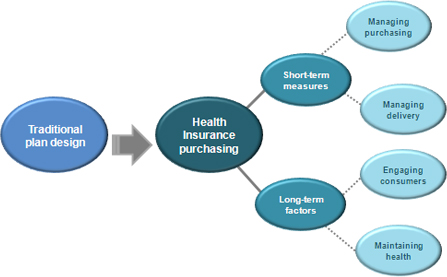

Figure 1: Transition from traditional plan design to health insurance

Most employers in Asia offer healthcare benefits that are designed to aid consumption. For example, benefits are triggered only at the occurrence of an adverse event, such as a hospitalization or sickness. It is generally understood that only a small segment of the employee population will use these benefits. But managing an event after its occurrence limits an employer’s ability to manage costs without impacting its quality.

Recognizing this paradigm has created tremendous interest in workplace wellness and integrated health management, such as on-site physicians and fitness centers, health screenings and health education discussions. It is early even for the more mature economies, but the results have been positive.

While Asia can leapfrog the learning hurdle and gain from the experience of its western counterparts, it is important to take a cautious approach, as this involves organizational commitment at all levels and a change in the culture and health-care philosophy.

Back to top

Employers Have To Renew Their Thinking

A nearsighted view of health-care coverage and of rising costs encourages the use of aggressive, short-term measures. If an employer squeezes the carriers or providers (hospitals and physicians) too hard, something will give, and the quality of care is most often the first casualty. Either the providers compromise on treatments or insurers stop paying claims.

Employers should reconsider their strategy on traditional plan design and health-insurance purchasing. This may mean encouraging employee participation from the start of this process of selection, purchase and consumption. (The participation may include which programs and benefits to buy; purchase, would include how much to pay for each benefit and consumption.) Thus, building a community around the health plan may increase employee engagement and result in a greater ownership of the plan by the employees. The plan would also need to support employees as they make their decisions while traversing through the health-care system.

One way to make this approach successful is by tracking and measuring outcomes regularly and consistently to keep the system dynamic, with the ability to improve and make changes when necessary.

Any progressive strategy designed to manage costs on a sustainable basis will need to address short-term needs, such as managing the purchase and delivery of health-care services. At the same time, however, the strategy cannot ignore long-term factors, such as consumer engagement and maintaining health.

Manage Purchasing

Most employers have achieved success through aggressive negotiations, benefits harmonization and portfolio management. Alternative funding options such as self-insurance, captives or some combination of insurance with self-funding may be explored. A big pitfall employers should avoid is the excessive reliance on this component to manage costs.

Manage Delivery

Problems of fragmented delivery, lack of data to make informed decisions, and variations in outcomes and pricing are also prevalent in Asian countries. Demanding provider accountability, measuring clinical outcomes, creating specialty networks, using decision-support systems and using disease-management programs to target chronic illnesses are some examples that would create positive impact for early adopters.

Engage Consumers

The saying “Nobody spends somebody else’s money as carefully as they spend their own” truly captures the philosophy of consumer engagement. A simple way to encourage consumer engagement is to introduce some level of financial responsibility to the employee. Providing

incentives for demonstrating healthy behavior helps increase employee participation, as well. It is important to stress that all levels of management must commit to inculcating a culture of accountability and ownership for benefits programs to be successful.

Maintaining Health

Lifestyle choices of employees contribute significantly to an organization’s health-care expenses. Behavior is the largest contributor to an individual’s health status. Modifiable risk factors include diet, alcohol consumption, smoking, exercise and stress. There are many elements of wellness, so when budgets are tight, the top choices should be health-education programs to provide the foundation for change and health-risk assessments (HRAs), as they are the first-step diagnostic for individuals to asses their risk status.

An Ideal End State

Focusing on the transactional cost of funding the employee health program is shortsighted and can only lead to significant increases in health-care costs in the long term. Asian employers will have to embrace other aspects of the continuum of care to lower costs. This can be accomplished through wellness and integrated health-management programs, such as health-risk assessments and chronic-disease management to reduce the overall health risk of the employee population. It is also important for employers to provide incentives to employees to participate in these wellness programs, as well as track results for further improvements. Overall, this approach will help reduce the demand for expensive tertiary care and high-cost medical claims.

Back to top

Contact

Rajeshree “Gina” Parekh, M.D., is the regional practice leader, Health & Benefits, Asia Pacific. She can be reached at [email protected].

*This article was featured in Workspan – The magazine of WorldatWork, November 2008

Back to top