Information Bulletin: Funding of Quebec Pension Plans – New scale proposed for establishing the target level of the stabilization provision

On July 28, 2016, the scale for establishing the target level of the stabilization provision, which applies to private-sector pension plans, was adopted on a temporary basis. The revision of this scale, which applies to private-sector pension plans, is the main purpose of the draft regulation published on July 3 in the Gazette officielle du Québec. Interested parties have 45 days to submit comments on the draft regulation.

Scale for determining the stabilization provision

Since 2016, solvency deficits of private-sector pension plans no longer need to be funded. However, the going concern approach must include a stabilization provision that is based on a scale dependent on the investment policy.

The proposed scale would apply to actuarial valuations as of December 31, 2019 or later

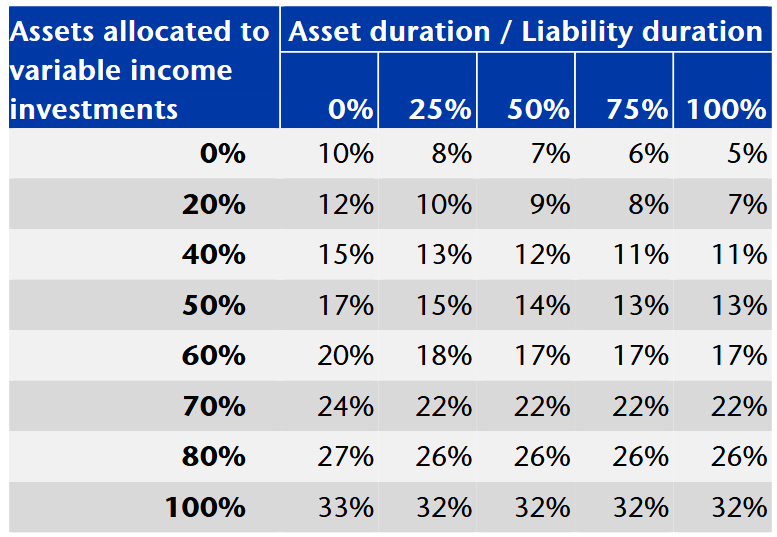

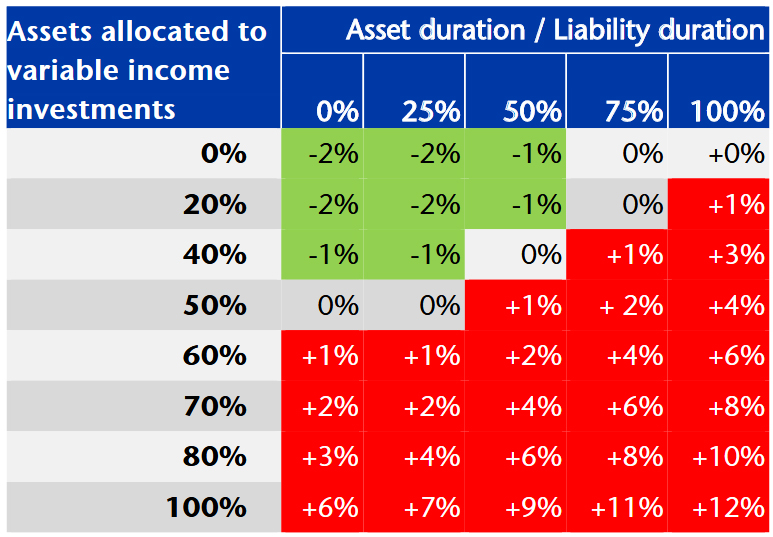

As a general rule, the proposed scale determines target levels of the stabilization provision that are greater than those determined by the current scale. Here are some observations:

- For a typical plan where the assets allocated to variable-income investments are between 50% and 60% and the ratio of the asset duration to the liability duration is between 25% and 50%, the target level of the stabilization provision will be increased by 1% to 2%.

- For plans with a stabilization deficit (plans that either are in deficit or have a surplus below the target level less 5% on a going concern basis), the increase may constitute a significant financial burden, in particular for mature plans for which an increase of 1% to 2% of the provision to be funded represents a significant proportion of the payroll.

- Plans for which the proposed scale includes the greatest increases are those where the asset duration/liability duration ratio is greater than 50% and the variable-income proportion is equal to or greater than 60%. For instance, the stabilization provision target level for a plan with an asset duration/liability duration ratio of 75% and with 60% variable-income investments would be increased by 4% (from 13% to 17%). As such, the proposed scale will:

- Require a greater provision for plans with relatively aggressive investment policies;

- Be less favourable than the current scale to plans that favour tighter management of the interest rate risk with a long duration of their bond portfolio.

Proposed scale

Differences between proposed scale and current scale

Unquoted private debt as fixed income security

A positive change proposed by the draft regulation is recognition, when certain conditions are met, of unquoted private debt as fixed-income security, up to 10% of the plan’s assets. This type of investment is already garnering interest among pension committees, and the proposed change should increase their interest. In fact, by being a “fixed-income security,” the asset proportion allocated to variable-income securities is reduced, thus allowing the target level of the stabilization provision to be decreased and to take full advantage of the features of such an investment as opposed to the current scale.

Other changes

Additional technical changes are also proposed in the draft regulation (the first two apply to all sectors, while the last one only applies to the private sector):

- Increase in the cap for the fees payable when registering a pension plan, filing the annual information return, or transmitting the termination report from $100,000 to $150,000. The new ceiling will apply starting on December 31, 2019 and will be indexed starting in January 1, 2020. This concerns only a limited number of plans.

- Elimination of additional fees for the notice of solvency required under section 119.1 of the Supplemental Pension Plans Act or for a report related to an actuarial valuation in cases where such a report has been filed on the date when the notice of solvency or actual valuation was required or on an earlier date.

- Changes to the information required in the report related to a partial actuarial valuation in the event such a valuation is done to take into account plan amendments with an impact on the funding of the plan or following an agreement with an insurer to settle benefits in accordance with the plan’s annuity purchase policy.

To conclude, we applaud the fact that the changes related to the stabilization provision are to come into force on December 31, 2019. Insofar as the final version of the regulation is adopted quickly, the regulation would give interested parties enough time to adequately manage the transition of the current scale to the proposed scale.

Contact Information

Should you wish additional information on this topic, please contact your local Aon consultant, or send an email to [email protected].

Aon publishes Information Bulletin for the purposes of providing general information. The information in Information Bulletin does not constitute financial, legal, or any specific advice and should not be used as a basis for formulating business decisions. For information tailored to your organization’s specific needs, please contact your consultant at Aon. This issue of Information Bulletin contains information that is proprietary to Aon and may not be distributed, reproduced, copied or amended without Aon’s prior written consent.