Rapid Response: Voluntary benefits – Total rewards are evolving

Many organizations provide their employees with typical health, dental, life and disability benefits. Offering a competitive benefits program is a proven method of attracting and maintaining an engaged workforce, but the pressure to enhance offerings grows as do budgetary constraints.

Adding value to a benefit program without adding cost is achievable through a voluntary benefits offering. The positive effects of addressing the diverse needs and interests of individual employees are increasingly recognized. Voluntary benefits that are fully employee-paid can both offset coverage gaps and acknowledge employee individuality. Organizations can maximize group buying power to provide a cost-effective array of benefits that satisfy the distinct needs of each employee.

The results of this survey show that while many employers offer a range of voluntary benefits, many more have actively taken the decision not to offer them over cost concerns or the impression that employees are not interested. A strategy that neglects voluntary benefits may be a lost opportunity to augment typical benefit programs and enhance the employee experience through what are in fact, inexpensive and relatively low maintenance channels.

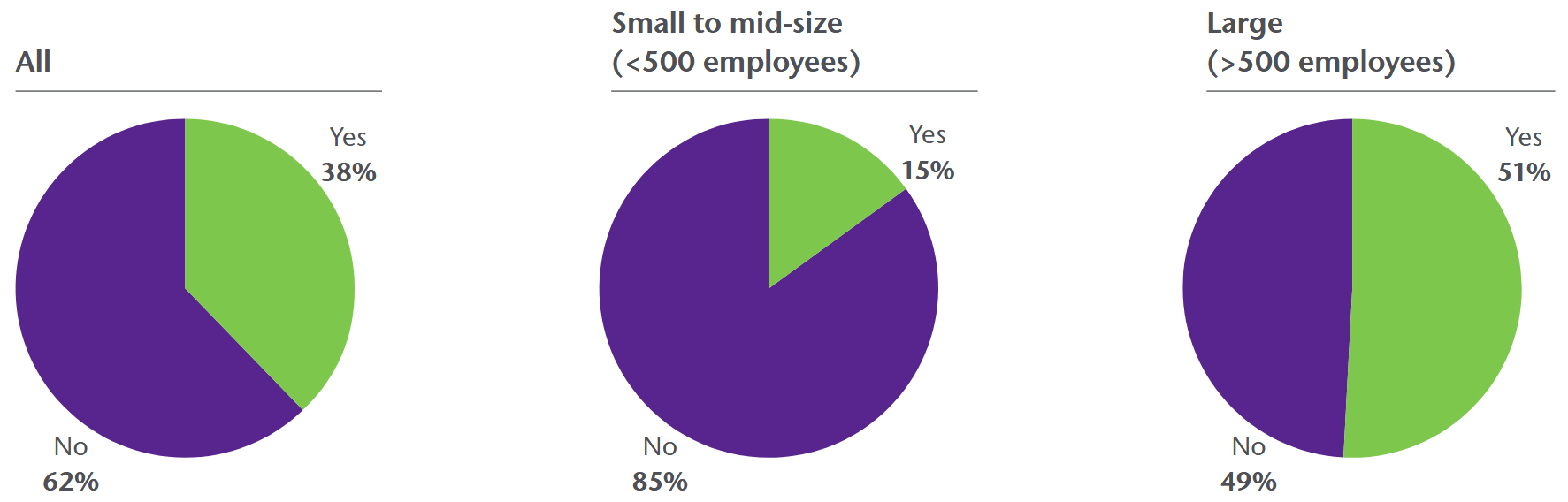

Are organizations providing voluntary benefits today?

Regardless of company size or the nature of the benefit offer, additional employee-paid options that compliment core benefits and cater to individual choice, are an advantage to employer and employee alike. Aon’s 2016 Workforce MindsetTM Study noted that employees who view their overall total rewards as meeting their needs are 6 times more engaged. Having an engaged and empowered workforce can lead to improved health and productivity and reduce turnover rates. Both factors enhance the work experience and provide competitive advantage in the talent market – goals that are important for any company.

Reasons for providing voluntary benefits

Survey respondents who provide voluntary benefits said that doing so helps them meet broad organizational goals by providing flexibility, increasing variety in the benefits offer, recognizing and addressing diversity, and responding directly to employee needs. Voluntary benefits also provide stable member pricing and better coverage than what would be available to employees outside of the group arrangement.

| Why offer? |

Top three reasons |

Why not? |

| Opportunity to differentiate programs from those of competitors |

1 |

No perceived employee demand |

| Perceived employee demand |

2 |

Concerns over administrative costs |

| Employee requests for an voluntary program |

3 |

Have simply never considered it |

Typical voluntary benefit choices

| Benefit |

Percentage of organizations offering benefit today |

| Risk |

| Home insurance |

32% |

| Auto insurance |

31% |

| Critical illness insurance |

20% |

| Travel insurance |

20% |

| Long-term care insurance |

6% |

| Pet insurance |

5% |

| Lifestyle |

| Employee discount programs |

28% |

| Childcare services– discounted/subsidized |

6% |

| Legal expense assistance |

5% |

| Concierge services |

5% |

Reasons for providing voluntary benefits

Top three challenges

- Communicating value

- Encouraging employee uptake

- Helping employees understand the total rewards link

Flexibility and choice are increasingly preferred and in some cases demanded, especially among millennials. According to a recent industry survey, 91 percent of employees expect to be able to choose benefits that best suit their needs. One-size-fits-all benefit solutions are becoming less common. Employers must search for new and innovative ways to create competitive advantage for talent.

Fewer than half of organizations surveyed provide voluntary benefits today and where they are offered, uptake varies and averages at about 40 percent. Communicating value and encouraging employee participation are critical to program success, but can’t happen if employees don’t know voluntary benefits exist or don’t recognize their worth. Long-service or older employees may be aware of available voluntary benefits, but may choose to forego participation as they may have established preferences elsewhere over the course of their lives. Shorter service employees or those who are new to the workforce and in receipt of benefits for the first time may not look instinctively to their employer for non-core insurance or lifestyle products. Well planned promotion of voluntary benefits helps to relay value to all employees. It should become part of standard communication and enrollment packages, and be incorporated into a comprehensive total rewards strategy.

Emerging technology solutions like Aon Choice feature online portals that facilitate direct interaction between employees and their employer-provided total rewards offerings. Interactive tools help to communicate the overall employer value proposition and bring voluntary benefits “front of mind” for employees.

Positive outcomes observed

There is growing demand for benefits plans to become more flexible and offer product choices that respect employees’ unique needs and lifestyles. Organizations have long been conscious of developing plans that consider core needs like health, dental, life and disability insurance. Voluntary benefits expand on this traditional approach by adding choices that address employees’ individual needs and lifestyle and are paid in full by the employee through payroll deductions or direct to insurer payment arrangements.

| Observed outcomes |

| Increased employee satisfaction with overall total benefits package |

50% |

| Increased employee recognition of total rewards |

35% |

| Positive effect on retention and recruitment |

19% |

| Increased employee engagement |

13% |

| Other |

4% |

Though challenges exist, employers are encouraged to take a look at voluntary benefits as a way to enhance your total rewards offering. The results of this survey illustrate that, where total rewards are concerned, respect for diversity and the advantage of choice is a satisfying combination for employers and employees alike.