Cyber Insurance

What is Cyber Insurance?

As a company’s digital presence expands — and as cyber criminals become more advanced — the cyber risks a business faces grow and become more sophisticated. Cyber insurance is critical to an organization’s overall cyber risk management strategy. It is intended to provide organizations with better protection against the financial risk posed by cyber security threats such as ransomware and data breaches.

Cyber Insurance: The Why and When

Explore the research and data points below to learn more about why cyber insurance is an important and necessary value-add for organizations at a time of rising cyber security risk.

-

13.8T

The global cost of cyber crime is expected to increase to $13.82 trillion by 2028, up from $9.22 trillion in 2024. (1)

-

4.4M

The global average cost of a data breach, in USD, a 9% decrease over 2024. (2)

-

211%

The number of data breach notices issued in 2024 increased 211% from 2023. (3)

For the past decade, digital transformation initiatives have revolutionized how business is done. That process has accelerated as organizations adapt to rapidly evolving customer preferences and lead to benefits such as deeper customer engagement and significant efficiency gains.

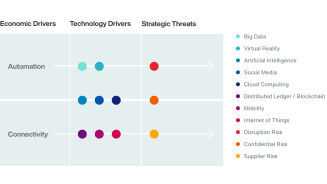

However, these trends may have also expanded an organization’s vulnerability to cyber attacks. New applications, cloud-based infrastructure, the deployment of Internet-of-Things devices at the network edge and software-defined networking using the public internet are just some of the new surface areas for potential exploitation. As the universe of possible attack vectors grows, the likelihood is that someone will find a way to penetrate one or more of these system components.

The need for cyber insurance solutions has never been greater than it is today, and the factors for an organization to consider are a blend of economic, technological and strategic.

How Aon Can Help

To understand potential threats, we help identify and quantify probable cyber losses. With this knowledge, organizations can make better decisions on risk appetite and appropriate levels of risk transfer using cyber insurance. Our holistic cyber risk management includes a multiphase solution for identifying, prioritizing and mitigating cyber exposure.

-

Assess Cyber Risk

Evaluating your risk posture and understanding how it compares to peers allows for informed decisions. Aon supports this by offering assessments that provide insights into security controls, helping clients understand vulnerabilities and prioritize investments.

-

Analyze Cyber Risks

Aon’s cyber analytics provide quantitative insights necessary to understand and mitigate cyber risks, enabling organizations to make informed, data-driven decisions that protect their assets and ensure operational resilience.

-

Mitigate Cyber Risk

Aon has forged relationships with Preferred Providers* who help clients prioritize and implement tools and resources to improve risk profiles, specifically in the eyes of underwriters. -

Transfer Cyber Risk

Cyber risk is a growing part of the larger risk portfolio. Aon’s approach helps quantify probable cyber losses so businesses can make decisions to transfer the risk via cyber insurance. -

Recover From Cyber Events

Having a trusted incident response plan is critical to operating with confidence after a cyber event. Aon provides strategic support for claim recovery, insurer coordination, and can enable client access to preferred providers* to help maximize the value of risk transfer. We also offer specialized guidance and deep knowledge in assessing impact and navigating the recovery process.

Product / Service

Cyber Risk Analyzer

Don’t Just Take Our Word for it — We’ve got Numbers to Back it up:

-

~ $2.28B

in total premium placed in 2024

-

5,000+

E&O/Cyber claims managed by Aon

-

$200 million

closed claims since 2023

(1) Cybercrime Expected To Skyrocket in Coming Years

(2) Cost of a Data Breach Report 2025

Insurance products and services are offered by Aon Risk Insurance Services West, Inc., Aon Risk Services Central, Inc., Aon Risk Services Northeast, Inc., Aon Risk Services Southwest, Inc., and Aon Risk Services, Inc. of Florida, and their licensed affiliates.

The information contained herein and the statements expressed are of a general nature, not intended to address the circumstances of any particular individual or entity and provided for informational purposes only. The information does not replace the advice of legal counsel or a cyber insurance professional and should not be relied upon for any such purpose. Although we endeavor to provide accurate and timely information and use sources we consider reliable, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future.

*Aon does not provide this service but can facilitate client introductions to its network of preferred third-party providers for these and other products and solutions. The decision to use a third-party vendor's product or service is made solely by customers that purchase and/or use the product or service. Aon shall not be a party to or be subject to any obligations or liabilities set forth in, any agreement entered between any third-party vendor and its customer. Third-party cybersecurity vendors are not agents of Aon. Aon makes no warranties or guarantees of any kind, express or implied, and assume no liability arising out of or relating to any service or product rendered or provided by any third-party vendor/entity denoted as a preferred provider to its customer.