Aon | Professional Services Practice

Eat or be Eaten: The Urge to Merge for Professional Service Firms

Release Date: July 2023 The deal landscape for professional service firms is being shaped by factors new and old – as firms navigate this space, it is crucial to consider the relevant risk trends and requisite due diligence processes.

Professional service firms are no strangers to Mergers & Acquisitions (M&A). Many act as professional advisors and offer M&A advisory services to their clients. Mergers paved the way for the Big 4 accounting firms as well as the creation of leading international law firms. Beside the competition for market share, professional service firm M&A activity is being driven by technological disruption, private equity and a war for talent, among other factors.

It is useful for firms exploring the deal landscape to have an analysis of M&A trends to perform effective pre-transaction due diligence and to be generally informed of the risks involved.

The Pac-Man Process – Bigness

Beginning in the 1980s, the “Big 8” accounting firms, a term coined by Fortune magazine in the 1930s, begun a series of mergers that eventually led to the “Big 4” of today. What explains the motivation to merge for professional service firms? Why strive towards a bigger firm?

“The pressure is for bigness,” the editor of Accounting Today was quoted as saying in 1989, “the big, big companies are looking for their accounting firms to serve them on a worldwide basis.” So “bigness” is a key factor but so is the ability to service clients internationally.1

The importance of an international presence can be seen with the mega merger that led to the creation of DLA Piper in 2005, with a key partner describing the merger as being “designed to extend the global reach of our key practice areas so that we can serve the needs of clients wherever they choose to do business.” In a globalized world, the big players need to go big or go home.2

But “bigness” does not always lead to success. Consider Dewey & LeBoeuf LLP, a law firm created in 2007 following what was reported to be the largest law firm merger in history. With the onset of the 2008 financial crisis just around the corner, the timing was wrong for the creation of a mega-firm with too many “rainmakers” commanding big salaries. Unrealistic expectations and an unsustainable business model led to the collapse of Dewey & LeBoeuf in 2012, with the firm lasting only five years.3

Other considerations driving the urge to merge:

- Economies of scale: combining operations may lead to reduced costs.4

- Diversification: technical skills and expertise in a variety of practice areas to better meet client needs – difficult for smaller firms to achieve, often made possible via merger.5 For instance, in the Big 8 era, Deloitte and Price Waterhouse were reportedly seen to be weaker than their peers in many areas of management consulting, something which could be remedied via merger.6

- Mergers may also help to eliminate competition, increase efficiency, and attract talent.7

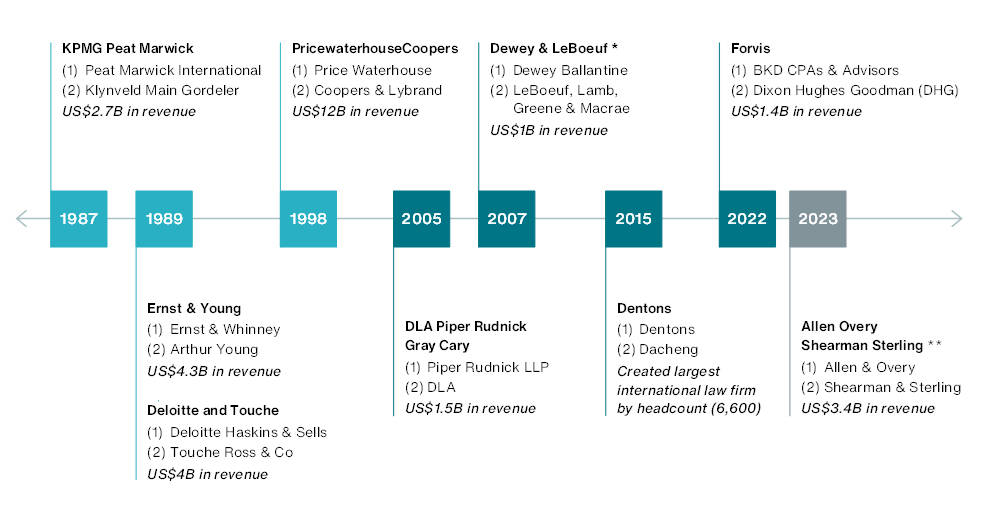

Timeline of Notable Mergers & Acquisitions | Professional Service Firms [1987-2022]

Please note that all the information has been reported in the press.

This document may not represent the most current information available.

* Filed for bankruptcy in 2012

** Proposed merger

Private Equity

Private equity (PE) firms have become more active in the professional service firm space in recent years, driving M&A activity. Managing some US$6.3 trillion in assets as of 2021 – a fourfold increase since the beginning of the 2007 financial crisis – PE firms are attractive to investors with a greater risk appetite, offering the possibility of greater returns.8 PE firms are also venturing off the beaten path to pursue new opportunities, with many of them investing in accounting firms.

Many accounting firms have restructured their operations, separating audit and attest operations, prior to moving forward with PE investment as preserving audit independence is a key requirement. The U.S. Securities Exchange Commission (SEC) has released guidance for accounting firms accepting funds from PE firms. Some industry players have, however, been reticent to enter such deals, not wanting to restructure or relinquish control over their firms.9

In August 2021, investment management firm TowerBrook Capital Partners L.P. announced that it had made an investment in top-20 accounting firm EisnerAmper, reported to be one of the first such private equity investments involving an accounting firm of that size.10

In October 2021, PE firm New Mountain Capital purchased a 60% stake in top-50 US accounting firm Citrin Cooperman, which spurred a series of M&A transactions, the largest coming in February 2023 when Citrin merged with Berdon, creating an accounting firm with roughly US$600 million in revenue.11

Towards the end of 2022 and going into the start of 2023 there were considerations among some professional services firms to split their operations. A carve-out, where the parent company sells a minority interest and facilitates a partial divestiture of a business unit, is often a complex deal to structure. PE firms can play an important role and be part of backing the new venture.12

Merger Momentum Growing?

Some 34 years later, it’s hard to argue with that assessment. If we compare KPMG’s 2022 revenue of US$34.6 billion (the smallest of the Big 4 firms) with BDO (US$12.8 billion) or RSM (US$8.1 billion), two of the top “challenger” firms, we see that there is still a very sizeable gap.13 The Big 4 control over 60% of the US market, a dominant position facilitated, as we have seen, by a series of big mergers.14

Nevertheless, major accounting firms are still actively jockeying for position with some influential players reportedly open to making moves. Some key motivating factors that may explain this urge to merge can be found in technological disruption, brought on by artificial intelligence, machine learning and, more recently, the adoption of tools like ChatGPT and the role played by private equity.15

A significant move among major accounting firms occurred in June 2022, with BKD and Dixon Hughes Goodman joining forces to create Forvis, a top-10 accounting firm with US$1.4 billion in revenue at the time of the merger.16

There is a lower level of consolidation in the legal industry perhaps partially due to the mixed results large law firm mergers have produced, the Dewey failure being one prominent example. Consolidation in the legal sector is on the rise however, at least in the US. The 5 largest US law firms generated approximately 14% of all US law firm revenue in 2021 – a notable increase from 8% in 2017.17

The pace of law firm mergers increased noticeably in 2023, with a number of deals in the works,18 including the proposed merger of Allen & Overy and Shearman & Sterling, announced in May 2023, which could potentially create a US$3.4 billion firm.19 In February 2023, London-based Clyde & Co announced a merger with a Boston-based firm, expanding its US base.20 A potential recession is one factor that is reportedly driving some of these merger talks.21

Moreover, recent developments in the global banking system have the potential to profoundly impact the M&A environment.

Buyers’ Market Drives Demand for Enhanced Due Diligence

M&A and other market transactions are complex, time-critical and highly specialized. M&A and finance professionals need partners who understand their goals and challenges and bring robust knowledge of the transaction processes. Aon’s M&A team have experienced an increased demand for enhanced due diligence services over recent years. Of relevance to professional service firms:

- People Transaction Advisory

- Cyber Diligence

- Risk and Insurance Diligence

- Representations & Warranties Risk

- Tax Risk

- Litigation Risk

- Intellectual Property Solutions

1 “Accounting Giants to Merge, 2 Others Talking,” San Francisco Chronicle, July 7, 1989.

2 “United States: Piper Rudnick And DLA Combine To Create A Global Legal Services Organization Merged Firm to Have 2,700 Lawyers in 49 Offices in 18 Countries.” Mondaq, December 6, 2004.

3 “Assigning Blame in Dewey’s Collapse.” New York Times, 14 May 2012.

4 “Biggest Merger is Said to be Set for Accounting,” New York Times, October 18, 1997.

5 “The past, present and future consolidation in public accounting,” Virginia Society of Certified Public Accountants, October 5, 2021.

6 “U.S. accounting firms may merge,” The Globe and Mail, August 30, 1984.

7 “Merger,” Encyclopedia Britannica, https://www.britannica.com/topic/merger, last accessed February 22, 2023.

8 “The New Financial Supermarkets.” The New York Times, 10 March 2022.

9 “Private equity firms expand their reach into accounting, with legal help,” Accounting Today, November 4, 2022.

10 “As M&A activity reshapes the tax & accounting profession, private equity takes a hand,” Reuters, September 1, 2021.

11 “Citrin Cooperman and Berdon unite in megamerger,” Accounting Today, February 1, 2023.

12 “PE and accounting: Alternative partners,” Accounting Today, March 27, 2023.

13 “Two More Accounting Firms Merge; Deloitte Haskins, Touche Ross to Join,” Washington Post, July 7, 1989.

14 “McKinsey’s 10 Principles for Successful Law Firm Mergers,” Law.com, February 23, 2023.

15 “RSM International boss says she is open to merger talks with rivals,” Financial Times, January 23, 2023.

16 “Two Leading Accounting Firms Join Forces to Create Top-10, Public Accounting Firm,” FORVIS, February 17, 2022.

17 “McKinsey’s 10 Principles for Successful Law Firm Mergers,” Law.com, February 23, 2023.

18 “For Growth’s Sake, That’s What Law Firm Mergers Are All About,” Bloomberg Law, January 26, 2023.

19 “Allen & Overy closes in on American dream with $3.4bn Shearman deal,” Financial Times, May 23, 2023.

20 “Law firm mergers continue, bringing U.K.’s Clyde & Co to Boston.” Reuters, February 2, 2023.

21 “This Biglaw Firm Has The Urge To Merge, But Can’t Find A Willing Partner.” Above the Law, February 6, 2023.

Aon is not a law firm or accounting firm and does not provide legal, financial or tax advice. Any commentary provided is based solely on Aon’s experience as insurance practitioners. We recommend that you consult with your own legal, financial and/or tax advisors on any commentary provided by Aon. The information contained on this article and the statements expressed are of a general nature and are not intended to address the circumstances of any particular individual or entity.

Contact

The Professional Services Practice and the Aon M&A and Transaction Solutions (AMATS) team will continue to monitor developments related to M&A and due diligence, particularly with relation to professional service firms, and related matters.

If you would like to discuss any of the issues raised in this article, please contact Jens Peters, Daniel Hacikyaner.

Jens Peters

Account Executive Manager

Montreal

Daniel Hacikyaner

Vice President and Director

Montreal