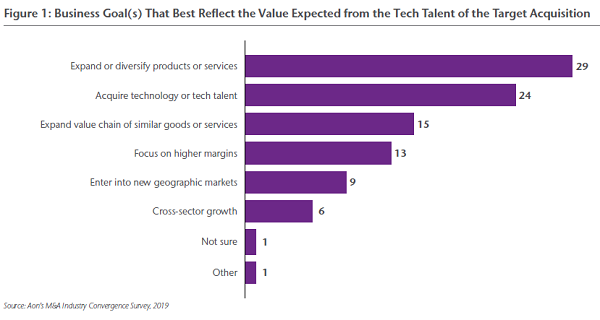

With tech talent playing an increasing role in business strategy, we wanted to learn more about the integration of this talent and its impact on the business. We created a survey earlier this year to explore how successful companies outside the technology industry acquired tech talent and what challenges they faced along the way. We received 92 responses from M&A leaders at companies across the globe whose organizations had recently acquired a technology-related company or were in the process of going through such a transaction. Our findings illustrate that acquiring tech talent is not just a side benefit; it is a key driver of acquisition strategy and product/services growth. Acquiring the underlying technology as well as human capital to support the technology is the second most common business goal of technology-related transactions, as shown in Figure 1.

Source: Aon’s M&A Industry Convergence Survey, 2019

Our survey results also show that companies are encountering numerous challenges in bridging industry differences when acquiring new tech talent. These challenges include:

Companies are struggling to succeed

Only 38% of respondents indicated they were successful in their acquisition strategy.

Significant transaction hurdles

Cultural challenges, budgetary considerations, and execution challenges were reported as the top three issues across all organizations.

Lack of commonality

Companies’ job architecture and total rewards frameworks often do not match that of the acquired company and can pose challenges to integrating new tech talent to the organization.

The change management challenge

M&A transactions typically generate anxiety among employees about how the change will impact them personally and professionally. That is why many companies chiefly rely on a change management strategy and communication efforts to effectively retain and engage talent after the transaction closes.

Let's dive into each of these challenges and how companies can address them.

Challenge 1 – Deal Success is Somewhat Elusive

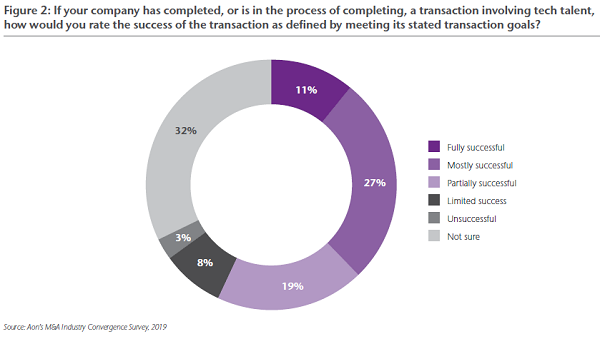

In the past decade, we have seen increased transaction activity, yet survey respondents reported a relatively low success rate in achieving their strategic goals. Only 38% of respondents are mostly or fully successful in meeting their stated transaction goals, with the greatest number reporting partial success.

Source: Aon’s M&A Industry Convergence Survey, 2019

So why are companies struggling with transaction success? “Digital acquisitions are uncharted waters for many organizations,” explains Jim Muetzel, director of Aon’s Strategic Advisory M&A Solutions. “Anxious to compete, many companies are acquiring tech assets they are ill-prepared to manage,” he says. That’s because the culture, skills, and business models can be vastly different between the two companies. The result: Organizations are left scratching their heads as deal objectives are not met, integration targets are delayed, costs balloon, and employee retention and engagement drop.

Challenge 2 – Cultural Compatibility and Budgetary Constraints

Tech talent is classified as individuals who are typically responsible for developing, modifying, designing and testing products, software, systems or processes based on knowledge gained through experience or a course of study using established scientific knowledge. These employees typically create products or systems with the intent of selling to external customers to further the growth of the company as a technology leader or to diversify the company’s business model. These employees typically require a formal engineering, data science or design degree.

“When acquiring tech talent, it is important to address cultural due diligence upfront and early,” according to Dawn Conrad, Executive Vice President of Strategic Advisory M&A Solutions at Aon. “This will help identify potential barriers to deal success and ensure value is not destroyed by overlooking cultural elements that are imperative to the transaction’s success.”

Our survey indicated that budgetary constraints were consistently the second biggest challenge facing companies in acquiring tech talent. We find that successful companies often set aside specific budgets in advance to explicitly address differences in total rewards programs to ensure talent is retained. Companies often consider the following when prioritizing reward elements in an acquisition:

Cash Compensation

This may include an increase to base salary, a spot bonus or a retention bonus. Companies may need a variety of cash compensation components to facilitate retention.

Equity Compensation

In addition to the conversion of equity, organizations may need to use additional equity with vesting schedules designed to encourage performance and prevent key talent from leaving the new organization. We find that equity grants are often delivered more broadly and at higher values for tech talent.

Benefits Differences

Even in instances where the acquiring company’s benefits may be of greater value, it still may be beneficial to preserve selected elements of the tech talent’s benefits that are core to their value proposition. This may include tuition reimbursement or development programs.

Paying the right price and establishing effective budgets for moving forward means understanding the transaction strategy and finding the human capital related “landmines” in the pre-due diligence phase (i.e., prior to determining price/signing the purchase agreement). These so-called landmines include identifying and quantifying liabilities that can affect the long- term success of transactions, assessing the general level of legal compliance, identifying and quantifying potential integration issues, and developing potential mitigation strategies.

Challenge 3 – Job Architecture and Disparate Rewards

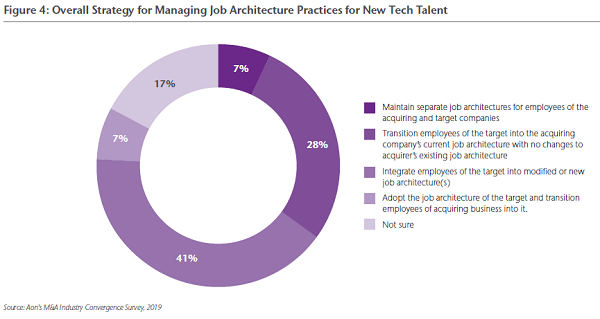

About half of respondents indicated that their job architecture systems had limited or no similarity to those of the target company. But how companies approached this challenge varies. The leading response was to integrate employees into modified or new job architectures as shown in Figure 4.

Source: Aon’s M&A Industry Convergence Survey, 2019

Job architecture is the foundation of virtually all HR processes. More importantly, though, it is the means the business uses to communicate career expectations, growth, and opportunity to employees. “As companies are going through digital transformation and M&A related to those efforts, companies that are most successful are going back to the basics by asking themselves what their business needs are currently and into the future,” says Dan Weber, director of the Rewards Solutions practice at Aon. “Companies can then build a job architecture that aligns with those needs and provides employees and managers clear guidance and communications on job roles, performance criteria, and career paths.”

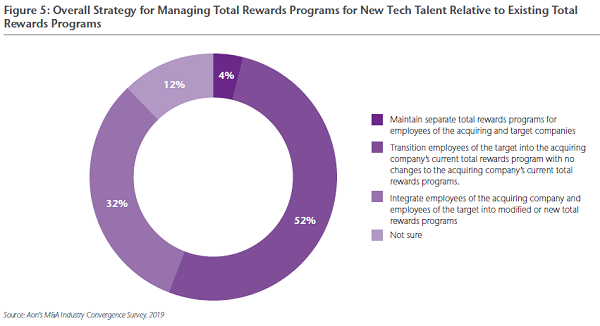

Nearly every acquiring company found differences in their rewards programs when comparing to those provided to tech talent. Given that only 38% of respondents were successful in their acquisitions and more than half of the respondents are simply bringing the tech talent into their existing programs suggests that companies may want to differentiate rewards for tech talent.

For those companies willing to make a strategic decision to differentiate rewards programs, their focus tends to be toward differentiating short-term incentives and providing greater work-life balance by allowing remote working and flexible work hours. While differentiating rewards for different talent segments often raises questions, most companies already do this (e.g., separate incentives for sales personnel, shift differentials for nurses, long-term incentives for leaders).

Source: Aon’s M&A Industry Convergence Survey, 2019

Challenge 4 – Transaction Execution & Retention of Tech Talent

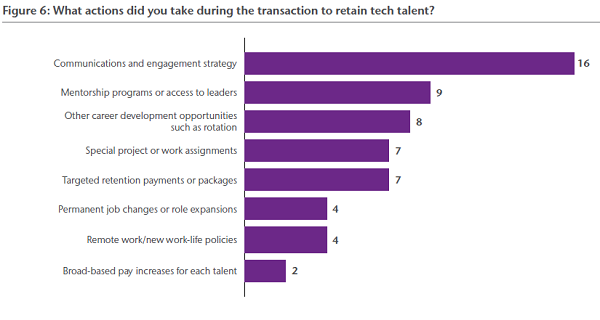

As organizations prepare their workforces for the digital age, the attraction and retention of technology talent is the number one talent priority. Given the shifting talent strategies in the digital world, there is a compelling reason to identify key talent early in the M&A process. Many companies find that using people analytics to improve decision making often leads to more efficient results. Driving cost savings and a holistic, agile approach to total rewards integration helps decrease turnover of tech talent. Our survey results found that a small investment in change management can pay multiple dividends in retaining key talent who feel vulnerable due to changes triggered by a transaction. Companies taking at least one retentive action during a transaction (e.g., retention bonuses) reported that they were able to retain necessary tech talent and were more successful in achieving their stated transaction goals.

Clear and effective communications is one of the best ways to align employees to the mission, vision, and values of the acquiring organization, as evidenced by being the most prevalent method of retaining tech talent. And there is more than one tool in the toolkit. All but one of the companies taking retentive action utilize more than one strategy to retain key tech talent.

How to Overcome These Challenges

The purpose of our survey was to explore the question: Are companies adopting different talent and rewards plans for acquired tech talent and is that approach correlated with meeting the stated objectives of the deal? Our research found that companies are beginning to look at differentiating programs for acquired talent and there is work to be done. Companies that wish to maximize retention and boost engagement must at least go through the process of evaluating whether taking a different approach to culture, rewards, job architecture, and more is warranted. M&A success will come through the alignment of transaction strategies with people strategies.

The following tips may help your organization overcome the challenges to integrating tech talent highlighted in this paper.

Be intentional about your culture.

Seek to better understand cultural challenges (e.g., differences in pay programs, work environment, flexible work schedules, etc.) as well as funding required to address cultural differences. Adopting a new approach can take many forms, including clear acknowledgment and acceptance of cultural differences where feasible, enhanced communication and onboarding support, and differentiated job architectures and/or rewards programs. Our research on talent programs at technology companies has found the most effective vehicles in driving culture are CEO/ leadership communication, people manager interaction and communication, and employeedriven efforts.

Design job architecture around what makes sense for your business.

Instead of looking to copy “what tech companies do,” look for the reasons why they do it. For example, technology companies often design their job architecture for dual tracks so that individuals who don’t want to manage people can continue to advance without having to become people managers. These companies have the need and ability to support having thought leadership and people leadership in separate roles. We recognize a dual track for all jobs would not make good business sense for certain organizations so determine where it could make sense as you build a workforce around people in technology-related jobs.

Build a robust retention strategy.

The retention of key talent is the cornerstone of many of these technology-related transactions. Therefore, early identification of key talent is critical. Talent differs from deal to deal and can come from any function and level in the organization.

It’s not just about the money.

Effective placement of key talent is a major focus for technology companies so that employees remain engaged and are given opportunities to grow and gain new knowledge and skills.

At the same time, money does matter.

Spend wisely and don’t throw your money around. Be adaptable with your rewards budget. Our research finds employees who view their overall total rewards as meeting their needs are six times more engaged.

Focus on seamless execution.

With the range of distractions in a transaction (e.g., job security, changes in reporting relationships, performance metrics, etc.), it is not surprising that maintaining productivity becomes challenging while trying to execute on a complex transaction. Consider implementing fully dedicated resources —rather than having two individuals each 50% focused on integration, consider having one focused fully on integration while the other maintains a focus on ongoing productivity. You may also want to add supplemental resources on a temporary basis, such as outside consultants or short-term staffing to support the additional workload created by integration activities.

If you’d like to learn more about how we help companies reimagine their rewards for the digital age, or how we help companies going through M&A, please reach out to our authors or write to [email protected].