Aon | Professional Services Practice

How Professional Service Firms Can Use a Captive to Release Value from a UK Defined Benefit Pension Scheme

Release Date: October 2023 Companies running defined benefit (DB) pension schemes effectively self-insure their obligations to pay future pensions. As schemes mature and become better funded, a common aim is to discharge pensions risk by insuring. Typically this means buying out the scheme’s liabilities by purchasing a bulk annuity from an insurance company. While this enables the pension obligations to be passed to the insurance company, in many markets globally this is relatively expensive. An alternative approach, which avoids this external insurance cost and allows surplus pension assets to be paid back to the sponsoring employer, is to self-insure through the employer’s own captive.

Why Run Pensions Through a Captive?

Companies operating DB pension schemes make promises to pay pensions many years into the future. They accept the risks of funding these pensions, which can be viewed as a form of self-insurance.

There is regulatory pressure to fund UK DB pension schemes to an increasingly prudent level. At the same time, there are significant constraints on how and when excess funds can be recovered from a UK pension scheme.

As asset levels of schemes improve, many companies look to bulk annuities as a way of exiting DB pensions and passing the risk to an insurance company. But in the UK, and in many other countries, pensions can usually be run off at a lower expected cost than the corresponding bulk annuity premium.

Instead of using the traditional insurance market, significant savings can be made by self-insuring pensions through a captive. This enables excess funds from a well-funded pension scheme to be released to the employer as cash and is expected to provide a positive profit stream.

A pensions captive should therefore be considered by any employer that wants to extract value from its pension scheme and which is comfortable managing the risks as pensions are run off. There have been a small number of pensions captives established in the UK to date, but there is now significant market interest as funding levels improve and pension scheme sponsors understand the scale of the potential savings.

What’s the pay-off?

Pensions managed in a low-risk way through a captive can target a release of income of around 20% over the remaining life of a scheme, net of costs. This equates to a total income of £100M for pensions with a value of £500M.

This income comes from the release of excess reserves. This excess is due to a combination of modest target investment returns and the unwinding of margins as pensions liabilities mature.

How Does a Pensions Captive Work?

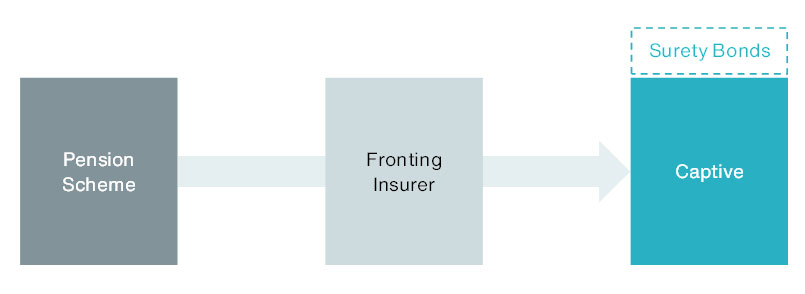

A pensions captive is structured as a fronted captive insurance. The pension scheme’s trustees enter into a bulk annuity transaction with a fronting insurer, which then reinsures the pension liabilities to the employer’s captive.

The pension scheme can then be wound up, just as with a traditional buy-out (unless the bulk annuities are structured as a “buy-in” and so are held by the pension scheme rather than being assigned to individual scheme members).

A new captive – or a new cell in an existing captive – is usually set up for pensions, which are longer term and utilize a larger asset pool than most other captive risks. Given the large amount of expected income release, it is often cost effective to establish a new captive or cell for pension purposes.

The fronting insurer passes on the bulk annuity premium, less the fronter’s own fees, to the captive. The employer needs to provide additional security to back the captive arrangement. A cost-effective way of providing this security, without tying up capital or reducing available banking credit, is through surety bonds, which pay out if the employer is no longer able to support the captive.

The pension scheme’s assets are paid, via the fronting insurer, to the captive, where additional security is provided by surety bonds.

The captive is likely to be domiciled outside of the UK and the EU, and to be governed by a combination of local reserving requirements and terms agreed with the fronting insurer. As pensions are run off through the captive, it is expected to build up excess reserves that can be distributed back to the employer as dividends. The income can be released over time as it emerges, or can be released earlier if appropriate security is provided.

The ongoing administration of the pensions within the captive, such as payment of benefits to members and calculation of reserving requirements, can be provided through the fronting insurer. The captive can also utilize external expertise on matters such as investment strategy.

Timeframe for Captive and Ultimate Exit

The pensions captive can be maintained for as long as it meets the employer’s requirements. One strategy is to run the captive until all scheme members are in receipt of a pension and the amount of income being released has fallen below a critical level. For example, the captive might run for 10 to 15 years after which there could be a “recapture” with the captive passing the remaining pensions liabilities back to the fronting insurer on commercial terms.

Why Not Run-Off Through the Existing Pension Scheme?

A UK pension scheme receives privileged tax treatment and is subject to flexible funding requirements making it an effective structure during the period when benefits are accruing and before the scheme reaches a position where it is well-funded enough to implement an “endgame.”

However, for well-funded, mature pension schemes, transferring to a captive arrangement offers some significant advantages:

- Early access to surplus

- Lower tax on payments to the employer

- Lower regulation

- Lower running costs

- Greater employer control

- More security for pension scheme members

What About a Traditional Insurance Company Buy-Out?

A traditional insurance company buy-out remains an effective option for those employers seeking a clean break from DB pensions and who want to pass all aspects of their pensions to a third party. In the UK, this is now complemented by “consolidators” which offer pensions settlement outside the insurance regime, although this is permitted only for those pension schemes where a traditional buy-out is out of reach.

A traditional buy-out or transfer to a consolidator requires the scheme to pay a one-off premium to meet not only the cost of paying members’ benefits but also the insurance company’s or consolidator’s cost of capital and profit margin. Furthermore, a third-party settlement often requires the employer to recognize a very large accounting cost through P&L. In comparison, transferring to a captive enables the employer to draw an income stream from its pensions and avoids the P&L hit of a third-party settlement.

Pensions Captives Outside of the UK

This article focusses on how captives can be used for UK pension schemes, but they can be considered for DB pensions in other countries.

Pensions captives are most attractive in countries where third party insurance is relatively expensive as pensions can be run-off at much lower cost through a captive. This is usually the case in the UK and Europe, but can apply in other countries, such as Brazil and Canada.

The structure of pensions in the US – for example, it is less common for pensions to attract annual increases – means that there is usually less scope to make savings by retaining pensions in a captive. Instead, transferring the pension scheme to a third party may look more attractive.

Glossary

Bulk annuity

An insurance company contract paying incomes for many individuals. Often used by pension schemes to secure their obligations covering current pensions and those not yet in payment.

Buy-in

Describes the situation where a pension scheme buys a bulk annuity to hold as an investment. The insurer usually makes the annuity payments to the scheme which, in turn, pays the members. The pension scheme retains the ultimate responsibility for interacting with members and making sure their pensions can be paid, while the insurer takes on the financial and demographic risks.

Buy-out

Under a buy-out, the pension scheme buys a bulk annuity and the insurer deals directly with the scheme members who then become policyholders. This means that the link between the pension scheme and the members is severed and the scheme can be wound up as its liabilities have been transferred to the insurer.

Consolidator (or superfund)

An alternative to bulk annuities in the UK, offering pensions settlement outside the insurance regime. A consolidator will take on a pension scheme’s liabilities in exchange for a premium. The consolidator is a pension scheme backed by additional third-party capital.

Surety bond

A surety bond is an insurance contract that can be used a means of providing security. In exchange for a premium the insurer will pay a specified sum if a trigger event occurs within the specified term. Surety bonds can be used as an alternative to letters of credit but with the advantage of not reducing a Company's available credit with its banks as it is issued by an insurer.

Contact

The Professional Services Practice at Aon values your feedback. To discuss any of the topics raised in this article, please contact Jennifer Millar and Paul Dooley.

Jennifer Millar

Managing Director

London

Paul Dooley

Associate Partner

Aon, UK