Aon | Professional Services Practice

The risk retention series:

How Do Actuaries Assist in Determining Captive Reserves?

Helping Professional Service Firms Make Appropriate Reserving Decisions for Their Captives

Release Date: February 2022

The Professional Services Practice at Aon share insights to help firms navigate the insurance market in the ninth article in a series exploring risk retention.

When considering the coverages that they provide, captives must determine appropriate insurance reserves to record as liabilities in their financial reporting. To assist with this and for the certification of reserves for regulatory compliance, a captive’s actuary is key in providing captive management with actuarial “incurred but not emerged” (“IBNE”, sometimes referred to as “IBNER” or “IBNR”) reserving estimates through actuarial risk analysis.

Unpaid Claims Liability on the Captive Balance Sheet

In the business of insurance, insurers issue policies and receive premium in exchange for a promise to pay future claims. The captive, as an insurer, is obligated to hold an appropriate liability on its balance sheet for the amount necessary to cover the estimated future costs of claims and related expenses.

Typically, for an annual policy, the premium is earned by the insurer over the course of the year on a pro-rata basis. The portion of the premium that has not yet been earned as at the date of the financial statements is recorded as a liability known as the unearned premium reserves.

Furthermore, with respect to the earned portion of the policy, the insurer will establish a liability known as “unpaid losses and loss adjustment expenses”, which is the sum of:

- Reported case-specific loss reserves (also known as “outstanding loss reserves”). These are provisions for specific claims set aside by the captive insurer and are not determined by the actuary.

- Bulk provisions for future development on claims, known as “Incurred but not emerged”, “Incurred but not evaluated” (IBNE), or “Incurred but not enough reported” (IBNER) reserves are estimated by the actuary in the aggregate for claims-made policies like professional indemnity. “Incurred but not reported” (IBNR) reserves is the term typically used for occurrence-based policies.

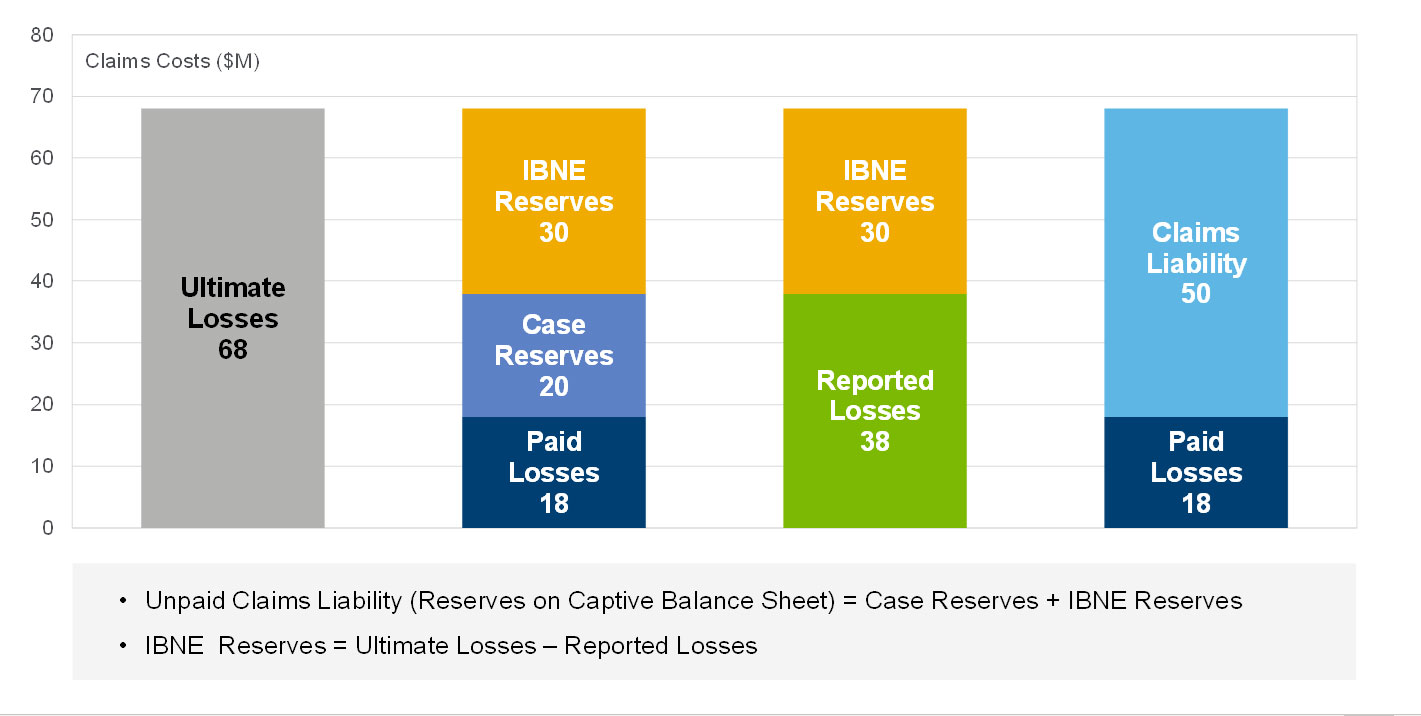

The following diagram illustrates some of the commonly used terminology with a hypothetical example breaking down claim estimates at a given evaluation into various components:

Hypothetical Example

Paid Losses = $18M, Case Reserves = $20M, IBNE Reserves = $30M, Ultimate Losses = $68M

For a given policy year, the case reserves set by the captive and IBNE reserves estimated by the actuary will generally decrease over time as claims are settled and paid out and the ultimate costs of claims for the insurer becomes known with increased certainty.

The interaction between changes in claim payments and case reserves set by the captive with the level of IBNE reserves estimated by the actuary may depend on the methodology being utilized and can be complicated. However, changes in reserve levels will impact the financial results of the captive as variations between actual and expected claims during the year will be recognized as a gain or loss in the captive’s income statement. This will subsequently impact its retained earnings.

Process Considerations

During the reserving process, there are several issues for the actuary and captive management to take into consideration:

- Actuarial IBNE methodologies: There are a variety of reasonable methodologies that the actuary uses in estimating unpaid claims reserves. Reserving methodologies typically involve the use of claims triangles, which depict the historical development of claim amounts as the policy ages. As well as being sensitive to the methodology used, IBNE results are also sensitive to the inputs and assumptions (such as loss development factor selections) used in the analysis. Valuable insights can be gained by testing the impact of alternate methodologies and assumptions on the IBNE estimates.

- Discounting and risk margins: Certain standards and regulations may require reserves to be discounted for the time value of money. They may also require a prudent risk margin for adverse deviation in claims development. Captive management needs to consider the applicable insurance accounting standards. For example, for captives reporting under the International Financial Reporting Standards (IFRS), there is a new standard “IFRS 17”, expected to be effective in 2023.

- Financial reporting process: The captive’s actuary provides a formal reserving report to the captive’s external auditor during the year-end audit process. Captive management may also request the actuary to conduct interim reserving studies throughout the year on, for example, a semi-annual, quarterly, or other basis depending on business needs.

- Certification of reserves to insurance regulator: The captive’s actuary typically issues an actuarial opinion at the fiscal year end certifying the reasonableness of the reserves to the regulator of the captive domicile. The process may differ for European-based captives, which follows Solvency II insurance regulations.

A key aspect of the captive actuarial function is to support captive management in determining appropriate IBNE reserves, which, in conjunction with the specific case reserves set by the captive, make up the unpaid claims reserve liability that is recorded on the captive’s balance sheet for financial reporting purposes and regulatory compliance. This support is essential to the successful operation of a captive.

Contact

The Professional Services Practice at Aon values your feedback. If you have any comments or questions, please contact Henry Lim.

Henry Lim

Managing Director

Montreal