Financial health of Canadian defined benefit pension plans surges to end 2019

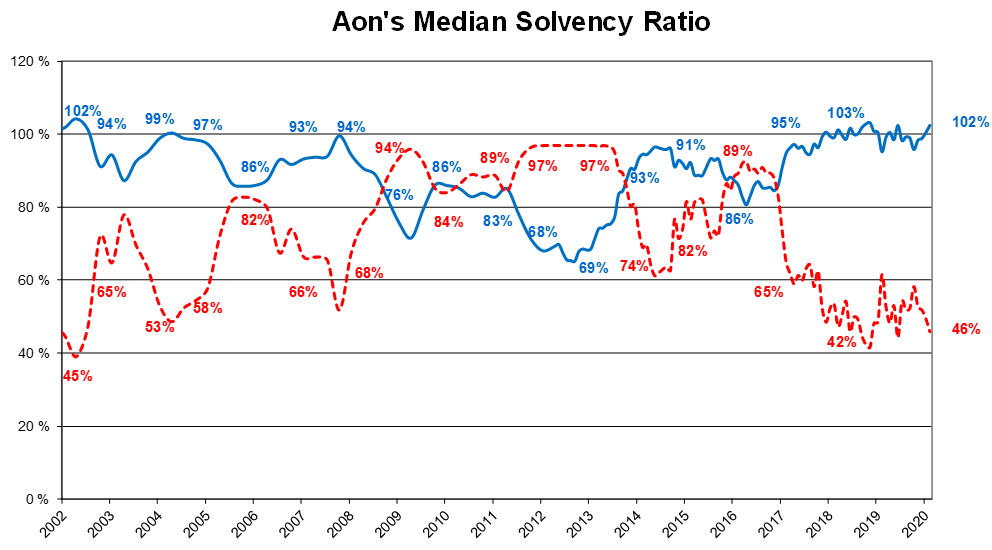

Aon’s Median Solvency Ratio at end of Q4 2019 stood at 102.5%

TORONTO (January 2, 2020) – Driven by rising bond yields and a late-year equity rally, the solvency positions of Canadian defined benefit pension plans increased sharply in the fourth quarter of 2019 to approach all-time highs, according to the latest Median Solvency Ratio survey by Aon, the leading global professional services firm providing a broad range of risk, retirement and health solutions. Through the year, Aon’s Median Solvency Ratio increased by 7.2 percentage points.

Quotes:

“Financial markets began 2019 still recovering from a rocky year, and equities climbed a wall of uncertainty throughout much of the year as a global growth slowdown and trade disputes clouded the outlook for investors,” said Erwan Pirou, Canada Chief Investment Officer, Aon. “Yet the sky did not fall, and a partial resolution of the U.S.-China trade war, the recent UK election and more accommodative monetary policy seemed to put global equity valuations on a surer footing, resulting in overall pension asset returns that easily bested last year’s performance. We are not so confident this sense of renewed optimism will survive 2020, however. Global growth remains a headwind to stock valuations, and the forces driving a reorientation of global trade and other economic relationships are still in play, suggesting more volatility ahead. Given the financial strength of Canadian pension plans, it makes sense for plan sponsors to further consider their risk mitigation strategies for the new year.”

“Plan sponsors need to separate recent events from long-term trends, and that’s nowhere more applicable than when it comes to bond yields,” said William da Silva, Senior Partner and Canadian Director, Retirement Solutions, Aon. “Despite a rise in yields through the fourth quarter, the long-term trend is still towards ‘lower for longer,’ given subdued inflation expectations and slowing global growth. As well, Canadian plan sponsors face changes in 2020 and beyond. British Columbia recently joined Quebec and Ontario in moving away from funding rules based on solvency – a move that reflects the fact that the regulatory landscape in Canada is evolving rapidly. Strong solvency positions give plan sponsors an opportunity to put all of their options for managing volatility and risk on the table, from diversification and outsourced investment solutions to full settlement of liabilities. We will see whether the respite from financial market volatility and falling yields lasts, but sponsors should not be lulled into complacency by what could turn out to be a short-term phenomenon.”

Key Facts:

- Aon’s Median Solvency Ratio increased sharply through the fourth quarter of 2019, to 102.5% as of Jan. 1, 2020. That is up 7.2 percentage points on the year, approaching the all-time quarterly high reached in Q3 2018.

- 54.2% of plans were fully funded as of Jan. 1, 2020, up 16 percentage points year-over-year and by nearly 7 percentage points on a quarterly basis.

- Canadian bond yields rose through the quarter, with Canada benchmark 10-year yields up 33 basis points and Canada benchmark long bond yields up 23 bps. Higher yields decrease plan liabilities, and positively impacted pension solvency over the quarter. Ten-year yields still ended the year 26 points lower than they were at the start of 2019; long bond yields ended 42 points lower.

- Pension assets rose by 1.9% in the fourth quarter, compared with 2.2% in Q3. The overall return on assets for the year was 15.9%.

- In Canadian dollar terms, all equity classes had positive returns in the quarter. The MSCI Emerging Markets index was the best performer, rising 9.5%, followed by the U.S. S&P 500 (+6.8%), the global MSCI World index (+6.3%), the international MSCI EAFE index (+5.9%) and the Canadian S&P/TSX composite (+3.2%).

- All equity classes provided a positive annual return in CAD terms, led by the U.S. S&P 500 (+24.8%). The Canadian S&P/TSX (+22.9%), the global MSCI World (+21.2%), the international MSCI EAFE (+15.9%) and the MSCI Emerging Markets (+12.4%) indices all had double-digit returns.

- As capital flowed into equities, alternative asset returns lagged through the quarter. Global infrastructure rose by 2.6% and global real estate fell by 0.4% in Q4 in CAD terms (+20.3% and +15.8% on the year, respectively).

- In fixed income, rising yields saw bond prices fall during the quarter. The FTSE Canada Long Term bond index fell by 1.9% in Q4, while the FTSE Canada Universe bond index declined by 0.9%. On an annual basis, however, both bond indices had positive returns in 2019, with Long Term bonds rising 12.7% and Universe bonds rising 6.9%, reflecting the decline in bond yields through the year.

About Aon’s median solvency ratio survey

Aon’s median solvency ratio measures the financial health of a defined benefit plan by comparing total assets to total pension liabilities on a solvency basis according to the different legislations. It is the most accurate and timely representation of the financial condition of Canadian DB plans because it draws on a large database and reflects each plan’s specific features, investment policy, contributions and solvency relief steps taken by the plan sponsor. The analysis of the plans in the database takes into account the index performance of various asset classes, as well as the applicable interest rates to value liabilities on a solvency basis.