ASATS Case Study: Buyer Uses R&W Insurance Policy to Reduce Purchase Price

Client situation

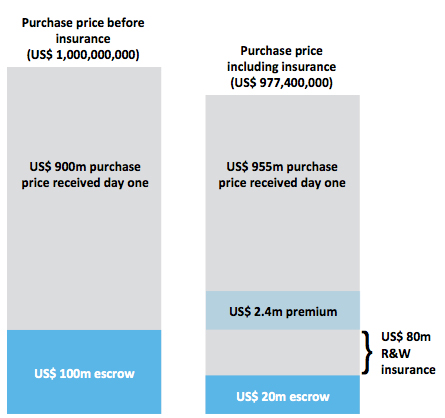

A US private equity fund was purchasing a manufacturer for approximately US $1bn +/- Aon approached the fund about replacing a portion of the escrow with a buyer-side R&W insurance policy, hoping that the fund would negotiate to reduce the escrow in exchange for a purchase price adjustment in the fund's favor.

Aon solution

Within the deal timeframe, Aon negotiated and placed buyer-side R&W policy for US$ 80m excess of a US$ 20m retention/deductible that provided coverage broader than the seller indemnity. In addition, the policy period extended for a full 6 years for all R&W, the retention/deductible was reduced to US$ 4m after 18 months, in tandem with the release of the escrow to seller. The fund negotiated a purchase price reduction that far exceeded the cost of the insurance.

Notes:

Policy cost US$ 3m

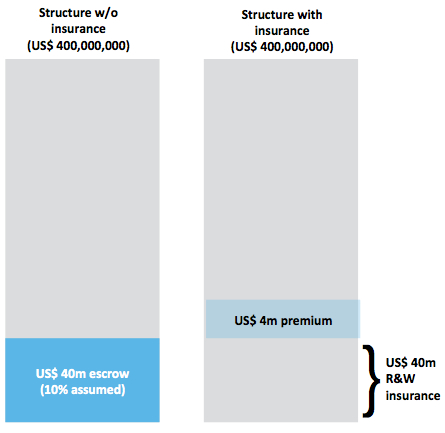

Aon negotiated the retention to decline to US$ 4m when the escrow burned off in 18 months

Note:

The winning bid had the option to keep the US$ 4m premium and go "bare" on the indemnity or to purchase the insurance package.