June 2019

- Aon data shows that up to 67% of employers have not considered the impact of lump sum death in service benefits on the Lifetime Allowance (LTA) of their employees

- Inaction – or incorrect action – may result in loss of HMRC protection or unexpected tax charges

Our recent research of over 1,000 clients shows that just a third of employers have taken actions to address the impact of lump sum death in service benefits on the Lifetime Allowance, by using Excepted Death in Service cover. Inaction on the issue can have tax implications for beneficiaries who receive lump sum death in service benefits, and a knowledge gap on whether employees have HMRC protection against the Lifetime Allowance could even cause such protection to be inadvertently invalidated – which could have a significant financial impact at retirement.

The wide-reaching impact of the Lifetime Allowance

Several converging factors mean that the Lifetime Allowance is no longer exclusively a concern for high earning individuals. Increasing pensions values, higher levels of lump sum life cover, and the current level of the Lifetime Allowance means more employees are now being impacted by the Lifetime Allowance threshold. At £1,055,000, the current level is one of the lowest levels since its introduction in 2006 – and will only increase modestly each April in line with the Consumer Prices Index.

The use of Excepted cover

Employers have a choice on how to provide lump sum death in service cover – either in a ‘registered’ or ‘excepted’ environment. Using the ‘excepted’ environment – outside the ‘registered’ pension framework – means that any claim benefit for lump sum life cover is not tested against the Lifetime Allowance, meaning beneficiaries are not exposed to the 55% tax charge above the LTA. However, for employers providing Death in Service benefits in an OpRA environment, the Government’s 2017 tax changes which impacted Excepted, but not Registered, life cover, are another complex aspect to consider. Optional Remuneration Arrangement (OpRA) is the new HMRC terminology which effectively replaces ‘Salary Sacrifice’ where benefits could be regarded as a benefit in kind.

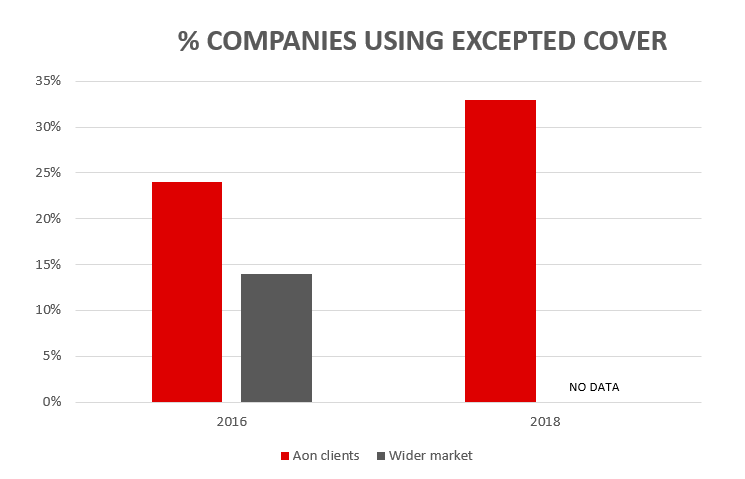

As part of our research, we compared the uptake of Excepted cover by Aon clients against the position in 2016 and also versus the wider market. Mark Witte, Principal at Aon, comments that “encouragingly, the overall percentage of Aon’s clients taking action and utilising Excepted cover has increased to 33%, up from 24% in 2016.” There has been higher utilisation ratios of Excepted cover across Aon’s portfolio compared with statistics from the market in general, with just over 14% utilising Excepted cover in 2016 according to Swiss Re’s 2018 Market Watch report.

Aon’s portfolio research also showed that the main increase in activity occurred in the small company sector – for companies with fewer than 100 employees – where 19% have now taken action (up from 4% in 2016). The percentage of large companies (defined as 100 or more employees) taking action remains stable at 45%.

Read more on how to help employees avoid Lifetime Allowance breaches >

The benefit of tailored advice

Due to the complex considerations for adopting an Excepted cover approach, there isn’t a single ‘best practice’ course of action for all businesses – hindered further by HMRC’s lack of clarity on the ‘acceptable’ use of this cover type. Our technical expertise, insights into the wide range of employer attitudes, and proactive approach to client discussions has helped to support their decision-making when it comes to lump sum cover options – alongside the appropriate legal and tax advice – to find the option that works best for their business and employees.

Recommended action plan for employers:

For those providing life cover on an ‘excepted’ basis:

- Revisit the eligibility criteria you apply for this cover to ensure it remains appropriate

- Ensure you’re aware of the April 2017 tax changes (which affect some benefits provided in an OpRA environment) and the impact these tax changes have on ‘excepted’ life cover

For those not providing life cover on an ‘excepted’ basis

- Review cover to ensure it’s still the best option for your requirements and goalsthis

- Ensure you’re aware of the April 2017 tax changes (which affect some benefits provided in an OpRA environment) and the impact these tax changes have on ‘excepted’ life cover/li>

For all employers:

- Consider the impact of lump sum life cover on the Lifetime Allowance of your employees

- Identify which staff have a form of ‘HMRC Protection’ against the Lifetime Allowance, and implement a ‘HMRC Protection status’ check as part of the new joiner process

- Engage with your employees on overall financial well-being, including ensuring they are aware of the impact of lump sum life cover on their Lifetime Allowance

For more information or to discuss any of the issues outlined in this article, please get in touch by emailing us at [email protected] or call us on 0344 573 0033.

Aon UK Limited is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales. Registered number: 00210725. Registered Office: The Aon Centre, The Leadenhall Building, 122 Leadenhall Street, London EC3V 4AN.