M&A:

significant opportunities

Our Experts

Charlie Garrood

Head of EMEA Infrastructure M&A

EMEA

+44.207.086.1155

Charlie Pearson

Project Manager, UK M&A

UK

+44.207.086.1693

Alexandra Taylor

Executive Director UK M&A

UK

+44.207.086.4833

COVID-19, the low oil price environment and an

increasing focus on decarbonisation, are creating

unique challenges for energy. Many are turning to

M&A to add green assets, strengthen their balance

sheets and redeploy capital.

There is significant M&A activity in the energy sector and

it seems likely this trend will continue, as the sector faces a

number of headwinds that are concentrating minds when it

comes to strategic acquisitions and divestitures.

Low commodity prices, the impairment of assets and high

operational costs in areas such as upstream energy, are

encouraging firms to sell-off non-core assets and focus on

areas with higher returns. The pandemic has added further

impetus, as energy demand has fallen.

Conditions have created buoyant levels of M&A demand

and supply. On the demand-side, there is a wall of

capital raised by infrastructure, pension and sovereign

wealth funds that is looking for diversified and attractive

returns. Many are considering energy, even in the face

of divestment pressures that are looking to ‘green’ the

financial system. Stressed energy balance sheets in the face

of the low oil price environment and COVID-19 are helping

to drive up supply.

Energy is looking a particularly attractive prospect for

institutional investors due to the cost of capital differential

most financial firms enjoy. Acquirers are employing this

differential to pursue energy opportunities underpinned

by long-term contracts and strong counter-party credit.

Midstream acquisitions such as pipeline networks are

helping to pep-up and lock-in returns for the long-term;

while allowing energy firms to concentrate operationally

and financially on their core specialism/s.

“Firms need to

see M&A as an

opportunity to

strengthen their

balance sheet and

reposition for the

energy transition.”

These factors have been further

reinforced by moves to decarbonise.

In this area M&A activity forms the

twin arms of a pincer – with one arm

the divestment of carbon-intensive

segments of the portfolio and the other

the acquisition of – and investment

in – renewables. Where these are

acquisitions, they are less about pure

synergies and more about facilitating

a strategic change towards a lower

carbon footing.

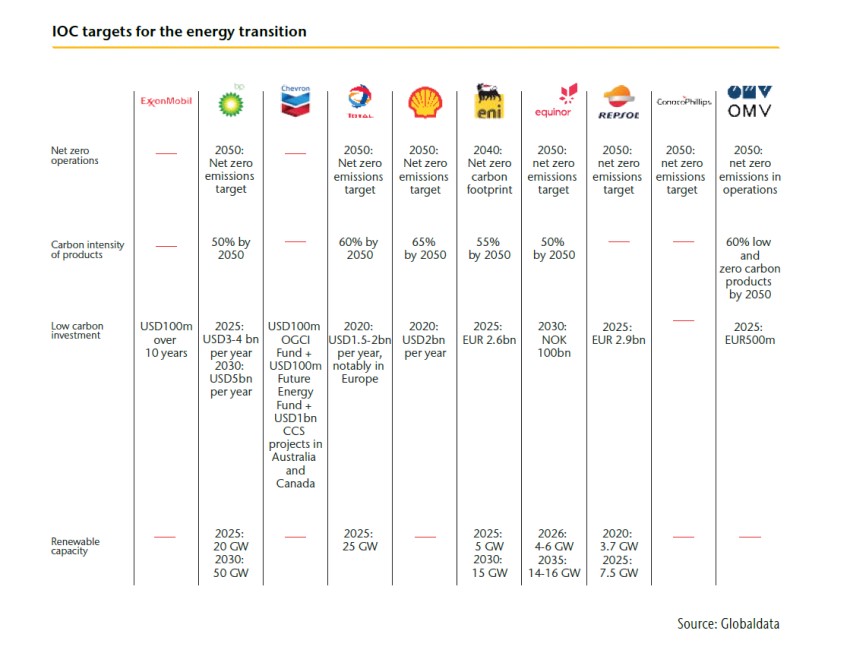

The transition and a strategic driver

What is apparent is that there will be

significant M&A activity linked to the

energy transition. Firms need to see

M&A as an opportunity to strengthen

their balance sheet and reposition for

the energy transition. The likes of BP

and Shell are already pursuing such

opportunities as they evolve their

strategy.

When it comes to synergies with areas

such as power and renewables, firms

need to consider how these will create

value. Scale will inevitably be important,

but if you are simply buying scale,

without considering the underlying

capability needed in these combined

companies, acquisitions may prove

a challenge to integrate. M&A can

prove game-changing, but the more

successful transactions will be those that

marry external capability with that built

in-house.

This involves retooling staff and

refocusing efforts on areas of the

business that can support the energy

transition. BP, for example, have done

exactly that by developing in-house

renewables capabilities and then

acquiring Light Source, a developer

and operator of solar projects. This

has enabled BP - through its financial

and operational strength and access

to capital – to throw its weight behind

Light Source’s renewables ventures,

fast-tracking the deployment of solar

capabilities.

This strategic pivot to decarbonise

through the pursuit of energy-power

combinations, is also helping firms

to stave-off divestment pressure and

negative PR linked to more carbon

intensive operations. This is particularly

true for listed companies which face the

more acute pressure to transition and

champion their green credentials.

Increasing Synergies

“We anticipate a deepening of core trends,

with transactions linked to, and augmenting,

energy companies push to decarbonise.

Hydrogen appears particularly promising,

with advancements in technology and

storage opening up significant possibilities.”

5 Years

Much will depend on the recovery in the oil price. If we don’t see oil heading

north of USD 60 a barrel, we anticipate greater consolidation, particularly

among the smaller players, and the sale of non-core assets in places like

South America and Africa.

If we see an uptick to USD 70-100 a barrel, we will likely see consolidation

within the fracking sector, with distressed companies in the US and

elsewhere being acquired.

Firms looking to bridge into the green sector will also drive a significant level

of M&A, which will be a facilitator of a broader corporate strategy.

10 Years

We anticipate a deepening of core trends, with transactions linked to, and

augmenting, energy companies push to decarbonise. Hydrogen appears

particularly promising, with advancements in technology and storage openingup

significant possibilities. With obvious synergies with oil and gas storage and a

bridge to renewables, we anticipate interest among energy firms.

More broadly, energy M&A will continue to be linked to commodity pricing and

the long-term profitability of operations.

When it comes to trends in the wider M&A space, we anticipate the breadth of

involvement and the use of data and analytics to deliver far greater rigour and

granularity around transactions. Engagement will be not simply around the deal,

but will address underlying capabilities and liabilities, including issues such as

talent, cyber, intellectual property and supply chain.

Please click here to download the report.