BOX-OUT

Our energy future: by the numbers

2/3 of energy demand will come from Asia by 2035

20% world without access to electricity

Global economy will double by 2050

359 million tonnes of plastic entered economy in 2019

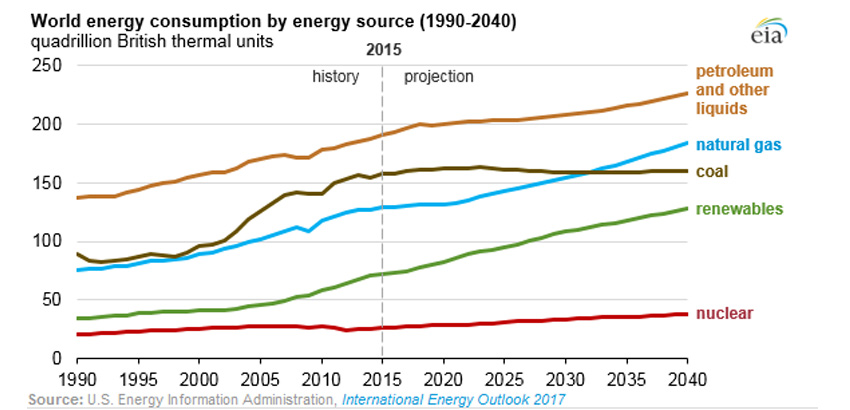

China and India will be the most significant sources of demand in the coming decades, while US demand for energy will remain buoyant. Asian oil imports are expected to surpass 31 million barrels a day by 2025, with every major Asian economy dependent on energy imports.

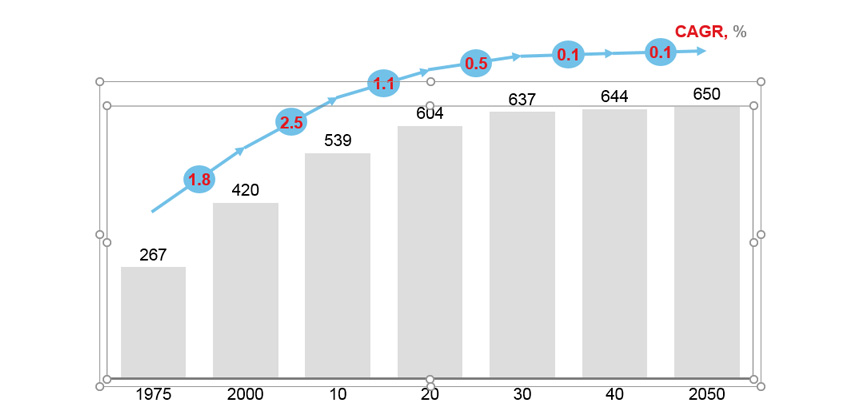

Before COVID-19, economists were predicting that the global economy would double in size by 2050 buoyed by technology-driven productivity improvements. While the pandemic may have knocked this heading off-course, it provides some indication of the likely energy needs to help fuel this development.

And with around 20% of the world’s population without access to electricity, and others seeking to accelerate economic development and improve living standards, it is apparent that energy has a positive role to play – particularly when you consider that 87% of fossil fuels is used for transport, electricity and heating.

Global primary energy demand

Million terajoules (TJ)

Source: McKinsey

Demand for oil is forecast to grow at an average annual rate of just below 1 million barrels a day. Within that, demand for petrochemical products will remain significant, despite a move away from motor fuel and products such as naphtha, with liquefied petroleum gas (LPG) and ethane accounting for about half of all growth.

As a result, we anticipate firms shifting their production to petrochemicals as global demand for plastic and other petroleum products increases. With few viable alternatives, it is anticipated that global demand for plastics will triple by 2050, particularly as consumers become more comfortable with recycling. Last year 359 million tonnes of plastic entered markets around the world and that figure looks set to rise significantly.

The threat from electric vehicles has also been largely overplayed. By 2035 electric vehicles will account for only 100 million of a global fleet of 1.8 billion. If one looks at the US alone and if all new cars sold were electric, it would take 20-25 years to replace the entire US vehicle fleet.

Firms can therefore count on economic development and the limited scope of alternatives to continue to drive increasing demand for petroleum products in the coming two decades.

BOX OUT

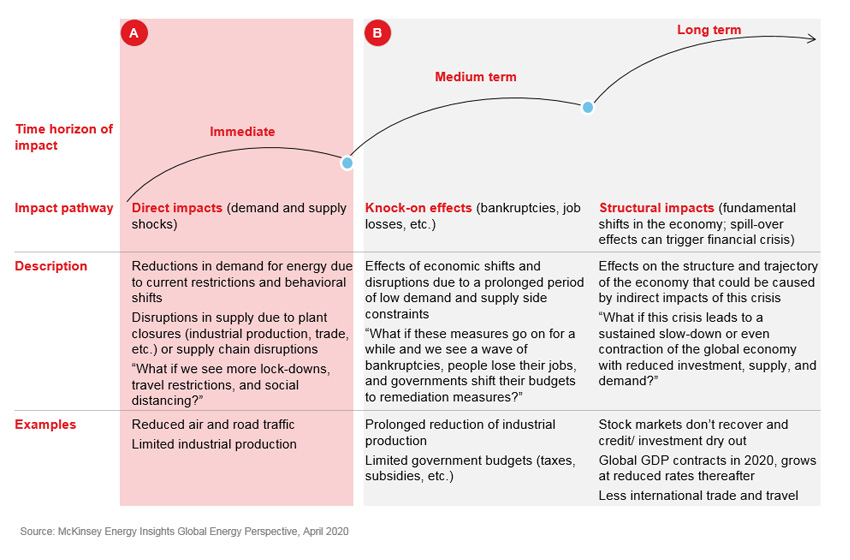

COVID 19 and global energy demand

The impact of COVID-19 on global energy systems is still highly uncertain.

What seems clear is that the virus has led to severe direct impacts on supply and demand balances within energy markets and will likely lead to knock-on effects in most economies.

Source: McKinsey

Renewables: an increasingly significant addition

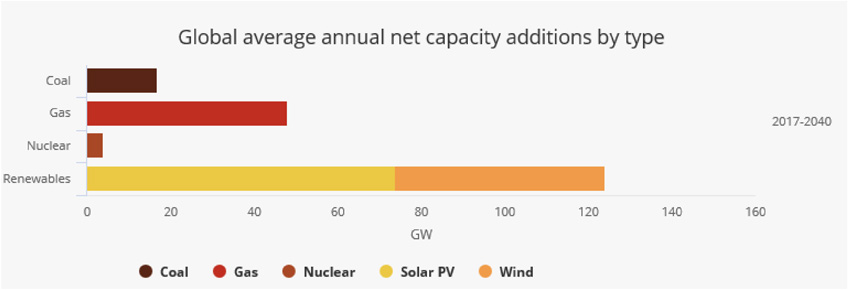

That is not to say that the energy sector is not facing potential change. According to data from the International Energy Agency, the sector will need to adapt to increasingly green dynamics when it comes to power generation. The IEA estimates that two-thirds of net new power generation will come from renewables – a significant shift from a traditional emphasis on coal, gas and nuclear. And BP has made similar projections, estimating that renewable generation will increase five-fold by 2040, to account for around 14% of global energy production.

Source: International Energy Agency

For firms considering diversifying into power – through development or acquisition – future sources will inevitably affect their energy mix strategy and attitudes toward renewables. Adaption and appetite varies considerably. Of the eight oil majors (BP, Chevron, Eni, Equinor, ExxonMobil, Petrobras, Shell and Total), five are actively involved in renewables, while Shell has recently positioned itself as an energy transition company.

European firms have led the charge, but they are also those with the least reserves, making a transition to alternative sources of energy more of an imperative. In the Americas, strong proven reserves and a more ambivalent attitude towards the need to transition has seen those firms take a slower approach to adapting their energy mix.

How the majors move forward will provide some indication of the likely heading for the wider industry, although their size and capital base puts them in a unique position to shape and dictate their future heading. Others are likely to take a more measured approach and will depend where they sit in the value chain and whether a transition to alternatives is even possible.

What is apparent is that renewables will continue to gain ground in both the power and energy sector, and pressures from issues such as divestment, shareholder activism and government regulation may push firms to change the make-up of their energy mix more quickly.

CONTENT TO COME

5 years

10 years

20 years

VIDEO

Natalie Payne

How are energy and power companies pursuing synergies and what factors are driving this?