Product / Service

Gauge provides the Banking industry with the data, insights, and strategic analysis they need to enhance profitability and efficiency. Through our proprietary benchmarking and analytics, we assess both the Front-Office and Infrastructure Functions, delivering fact-based solutions tailored to our client's unique needs allowing firms to compare their performance against industry peers.

Product / Service

Financial Institutions with General Ledger data

Financial institutions with Employee Headcount Data

Whether optimizing costs, improving workforce productivity, or refining compensation strategies, Gauge provides the insights that help investment banks stay competitive in an evolving landscape.

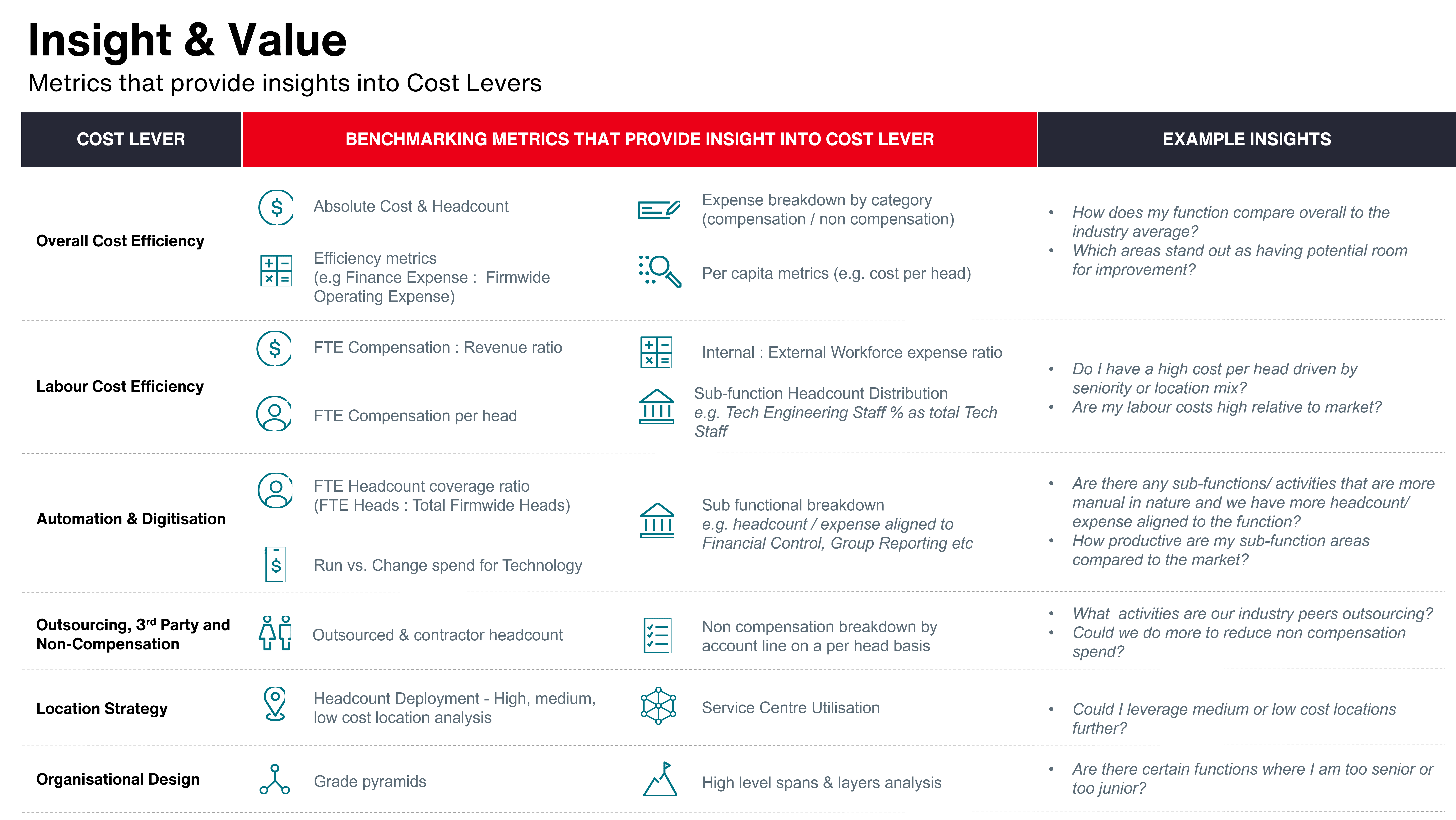

Our analysis is built on key insights, including:

Uncover the financial performance of your business/product lines and their capital productivity, including returns on capital deployed. Identify product exit/entry opportunities and pinpoint under resourced areas.

Improve workforce productivity by delving into Enterprise Functions and Front Office and sales team headcount, showing producer vs non-producer breakdowns, country analysis and location strategy, and corporate title and grade structure analysis.

Define key opportunities for cost management, assess compensation and non-compensation costs and identify your relative cost positioning with detailed Expense-line analysis.

Establish the link between compensation and revenue generation to inform talent strategies.

Aon job assessment and leveling methods are integrated to enable flexibility by regional requirements and business needs.

Our clients use our insights to optimize business models, refine resource allocation, and drive financial performance.