Cost Crisis or Business as Usual? Employer Responses to Soaring Healthcare Costs

Aon's Annual Health Survey reveals a critical trend: with healthcare costs accelerating at the fastest pace in a decade, more organizations are making bold benefits decisions to maintain affordability and sustainability.

Key Takeaways

-

Healthcare cost pressures are intensifying and expected to continue: Employers can no longer rely on incremental changes alone. The pace of cost increases is forcing a re-examination of traditional strategies.

-

Employers are divided in their readiness to take bold action: while nearly one-third of survey respondents are already making significant changes, the remaining two-thirds are waiting for a higher cost threshold or remain uncertain about when to act.

-

Be ready for bold moves: Some employers are already taking aggressive steps. Those who wait may find themselves playing catch-up.

Consistent Priorities, New Pressures: The 2026 Benefits Agenda

Despite the shifting environment, the top five benefits priorities for employers have stayed consistent from 2024 to 2026. Here’s what’s driving decisions this year:

Top 5 Benefits Priorities for 2026

Based on % of employers ranking as a top 3 priority

- Manage healthcare cost and trend

- Invest in supporting employee health and wellbeing

- Enhance benefits to improve employee attraction and retention

- Improve access and affordability of healthcare for employees

- Measure impact of benefits and programs to show return and/or value on investment

Managing cost is the #1 priority for 62% of employers and a top 3 priority for 84%. This is a significant increase from 2024, when 38% of employers ranked managing cost as their #1 priority, and reflects the growing concern around healthcare cost increases.

Employers are Divided on What to Do as Costs Rise

As healthcare costs climb to their highest levels in a decade, many employers are grappling with where the tipping point lies: the moment when incremental adjustments are no longer enough and bold action is necessary. As a result of these mounting cost pressures, benefits are drawing increased scrutiny from CFOs and CEOs, making them an even greater business imperative in today’s environment.

When asked what level of cost increase would compel them to move beyond standard measures –like plan design, contribution changes , vendor bidding and negotiations – employers fell into three distinct groups:

- The Early Movers: These organizations aren’t waiting for costs to climb higher. 28% say they have already reached the cost trigger to take significant steps to control spending, including some coverage restrictions, narrow networks and pharmacy benefit manager (PBM) restrictions. Among the Early Movers, large employers lead the way at 37%.

- The Threshold Watchers: 35% of employers are keeping a close eye on cost trends and won’t make major changes until the increase surpasses a point that is higher than the 9.5% projected for 2026. 19% believe that threshold is 12% or higher.

- The Uncertain Majority: 30% aren’t sure what would trigger bold action, reflecting the complexity and unpredictability of today’s benefits landscape. Small employers are especially likely to fall into this category, with 36% unsure.

The fact that 30% of employers are uncertain about when to take bolder action as costs rise is a concern. For a company with 1,000 employees, each 1% increase in healthcare costs can mean more than $100,000 in yearly expenses. Relying on trade-offs elsewhere isn’t a lasting solution, and ignoring these rising costs may lead to an even bigger financial impact over time . Alignment with organizational leadership, including the CEO and CFO, is crucial to ensure that any bold decisions made around benefits and cost management are strategically supported and effectively implemented across the organization.

Employers Favor Proven Cost-Control Strategies – For Now

For 2026, survey respondents are prioritizing familiar approaches:48% rank adjusting employee cost sharing, such as changing payroll contributions, deductibles, and out-of-pocket costs, as one of their top three strategies to reduce costs in 2026.

- 37% rank vendor optimization, focusing on better value and service by changing vendors, renegotiating terms, or consolidating vendors, as a top three approach to reducing costs in 2026.

- 35% rank pharmacy spend management, including changing PBMs and implementing tighter controls like prior authorization, step therapy, and quality limits, as one of their top three cost-reduction strategies.

- 34% rank adding or changing wellbeing strategies and programs, or implementing healthcare navigation solutions, as one of their top three strategies to reduce costs.

These strategies reflect a cautious approach. Employers are leaning on proven methods rather than disruptive changes. However, as cost pressures intensify, incremental steps may not be enough, and more innovative solutions could gain traction.

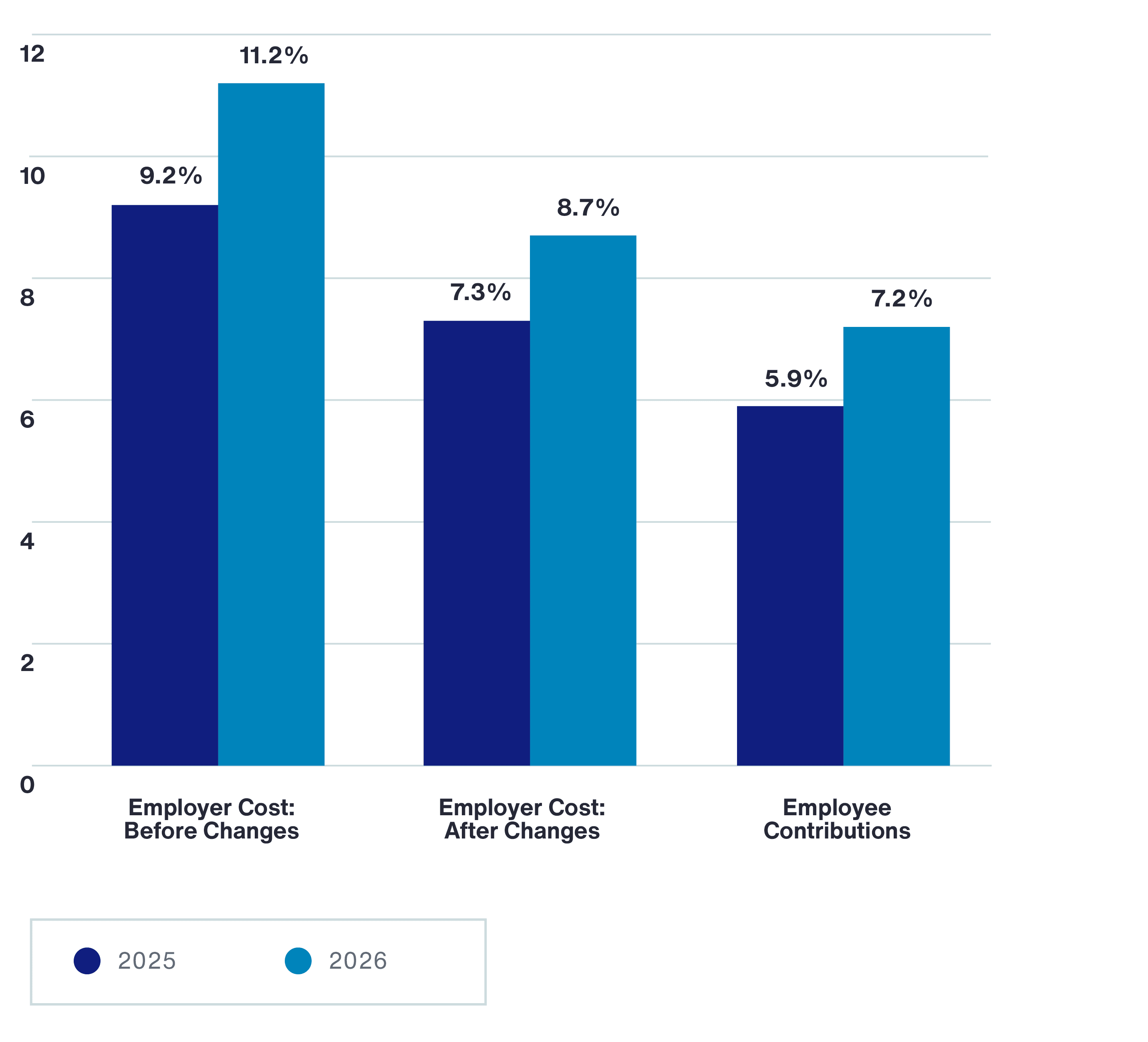

Employer and Employee Cost Increases

Pulling the Big Levers: What Employers Will Do When Costs Demand Bold Action

If required to make more significant changes to reduce healthcare costs employers are most likely to turn to strategies to more aggressively manage pharmacy spend and to steer plan participants to higher quality more cost-effective care.

Pharmacy strategies include:

- Reducing or restricting access to coverage for GLP-1s (39% planned for 2026, 19% strongly consider)

- Limiting or restricting access to newer high-cost pharmaceutical therapies (13% in place for 2026, 24% strongly consider)

- Implementing a transparent PBM program or non-traditional PBM (15% in place for 2026, 22% strongly consider)

Strategies to steer to higher quality more cost-effective care such as significant plan design differentials or narrow networks rank second in consideration, after GLP-1 strategies.

- 24% using these strategies today and 29% who would strongly consider

- Requiring use of Centers of Excellence is a strategy used by 13% of employers, while 19% would strongly consider it if required to significantly reduce cost.

Many of these strategies, such as adopting new PBM approaches, GLP-1 coverage management, and care steerage, allow employers to take incremental steps now. By implementing these approaches, organizations position themselves for greater flexibility in the future, making it easier to take more significant actions later if needed.

Early Movers Are More Likely to Pursue Bold Healthcare Strategies Compared to Their Peers

| Early Movers | Everyone Else | |

| Reduce coverage or restrict access to coverage for GLP-1s | 48.0% | 35.8% |

| Strong steerage to high-quality, cost-effective care through significant plan design differentials or narrow networks | 39.7% | 17.8% |

| Implement a transparent PBM program or non-traditional PBM | 22.9% | 11.6% |

| Limit or restrict access to newer high-cost pharmaceutical therapies | 19.6% | 10.5% |

| Require use of Centers of Excellence | 16.8% | 11.9% |

| Implement an alternative health plan model (e.g. Surest, Coupe, Centivo, etc.) | 16.2% | 5.9% |

| An ACA-compliant Minimum Essential Coverage (MEC) plan | 11.7% | 6.8% |

| Require use of navigator for care access | 10.6% | 5.1% |

| Require use of primary care physician to coordinate care and provide referrals to specialists and other services | 10.1% | 6.2% |

Most employers would consider more disruptive strategies only as a last resort:

| % as last resort | |

| Terminate existing healthcare plans and replace with fixed employer contribution toward individual market coverage | 89% |

| Reference-based pricing plan as a full replacement to traditional health plans | 75% |

| An ACA-compliant Minimum Essential Coverage (MEC) plan | 69% |

| Reference-based pricing plan as a separate plan option | 63% |

| Implement an alternative health plan model (e.g. Surest, Coupe, Centivo, etc.) | 49% |

What’s Next?

The 2026 employer benefits landscape is defined by urgency, innovation and the need for strategic clarity. As cost pressures mount, benefits leaders must balance immediate financial realities with long-term workforce wellbeing and attraction and retention goals. The most successful organizations will be those that act decisively, measure what matters and remain agile in the face of ongoing change.

General Disclaimer

This document is not intended to address any specific situation or to provide legal, regulatory, financial, or other advice. While care has been taken in the production of this document, Aon does not warrant, represent or guarantee the accuracy, adequacy, completeness or fitness for any purpose of the document or any part of it and can accept no liability for any loss incurred in any way by any person who may rely on it. Any recipient shall be responsible for the use to which it puts this document. This document has been compiled using information available to us up to its date of publication and is subject to any qualifications made in the document.

Terms of Use

The contents herein may not be reproduced, reused, reprinted or redistributed without the expressed written consent of Aon, unless otherwise authorized by Aon. To use information contained herein, please write to our team.

Aon's Better Being Podcast

Our Better Being podcast series, hosted by Aon Chief Wellbeing Officer Rachel Fellowes, explores wellbeing strategies and resilience. This season we cover human sustainability, kindness in the workplace, how to measure wellbeing, managing grief and more.

Aon Insights Series Asia

Expert Views on Today's Risk Capital and Human Capital Issues

Aon Insights Series Pacific

Expert Views on Today's Risk Capital and Human Capital Issues

Aon Insights Series UK

Expert Views on Today's Risk Capital and Human Capital Issues

Client Trends 2025

Better Decisions Across Interconnected Risk and People Issues.

Construction and Infrastructure

The construction industry is under pressure from interconnected risks and notable macroeconomic developments. Learn how your organization can benefit from construction insurance and risk management.

Cyber Resilience

Our Cyber Resilience collection gives you access to Aon’s latest insights on the evolving landscape of cyber threats and risk mitigation measures. Reach out to our experts to discuss how to make the right decisions to strengthen your organization’s cyber resilience.

Employee Wellbeing

Our Employee Wellbeing collection gives you access to the latest insights from Aon's human capital team. You can also reach out to the team at any time for assistance with your employee wellbeing needs.

Environmental, Social and Governance Insights

Explore Aon's latest environmental social and governance (ESG) insights.

Q4 2023 Global Insurance Market Insights

Our Global Insurance Market Insights highlight insurance market trends across pricing, capacity, underwriting, limits, deductibles and coverages.

Global Risk Management Survey

Better Decisions Across Interconnected Risk and People Issues.

Regional Results

How do the top risks on business leaders’ minds differ by region and how can these risks be mitigated? Explore the regional results to learn more.

Top 10 Global Risks

Trade, technology, weather and workforce stability are the central forces in today’s risk landscape.

Industry Insights

These industry-specific articles explore the top risks, their underlying drivers and the actions leaders are taking to build resilience.

Human Capital Analytics

Our Human Capital Analytics collection gives you access to the latest insights from Aon's human capital team. Contact us to learn how Aon’s analytics capabilities helps organizations make better workforce decisions.

Human Capital Quarterly Insights Briefs

Read our collection of human capital articles that explore in depth hot topics for HR and risk professionals, including using data and analytics to measure total rewards programs, how HR and finance can better partner and the impact AI will have on the workforce.

Insights for HR

Explore our hand-picked insights for human resources professionals.

Workforce

Our Workforce Collection provides access to the latest insights from Aon’s Human Capital team on topics ranging from health and benefits, retirement and talent practices. You can reach out to our team at any time to learn how we can help address emerging workforce challenges.

Mergers and Acquisitions

Our Mergers and Acquisitions (M&A) collection gives you access to the latest insights from Aon's thought leaders to help dealmakers make better decisions. Explore our latest insights and reach out to the team at any time for assistance with transaction challenges and opportunities.

Natural Resources and Energy Transition

The challenges in adopting renewable energy are changing with technological advancements, increasing market competition and numerous financial support mechanisms. Learn how your organization can benefit from our renewables solutions.

Navigating Volatility

How do businesses navigate their way through new forms of volatility and make decisions that protect and grow their organizations?

Parametric Insurance

Our Parametric Insurance Collection provides ways your organization can benefit from this simple, straightforward and fast-paying risk transfer solution. Reach out to learn how we can help you make better decisions to manage your catastrophe exposures and near-term volatility.

Pay Transparency and Equity

Our Pay Transparency and Equity collection gives you access to the latest insights from Aon's human capital team on topics ranging from pay equity to diversity, equity and inclusion. Contact us to learn how we can help your organization address these issues.

Property Risk Management

Forecasters are predicting an extremely active 2024 Atlantic hurricane season. Take measures to build resilience to mitigate risk for hurricane-prone properties.

Technology

Our Technology Collection provides access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities of technology. Reach out to the team to learn how we can help you use technology to make better decisions for the future.

Trade

Our Trade Collection gives you access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities for international business. Reach out to our team to understand how to make better decisions around macro trends and why they matter to businesses.

Transaction Solutions Global Claims Study

Better Decisions Across Interconnected Risk and People Issues.

Weather

With a changing climate, organizations in all sectors will need to protect their people and physical assets, reduce their carbon footprint, and invest in new solutions to thrive. Our Weather Collection provides you with critical insights to be prepared.

Workforce Resilience

Our Workforce Resilience collection gives you access to the latest insights from Aon's Human Capital team. You can reach out to the team at any time for questions about how we can assess gaps and help build a more resilience workforce.

More Like This

-

Article 6 mins

Strategies for Closing the Gender Retirement Pay Gap

Addressing the retirement pay gap issue between men and women starts with first acknowledging it exists. Then companies can conduct further analysis and adjust their benefit plans accordingly.

-

Article 8 mins

How AI, Cost Pressures and Reskilling are Transforming Talent Strategies

AI acceleration, rising healthcare costs and changes to workforce skills are transforming organizations. Our analysis of financial services, life sciences and technology companies provides insights on how to redesign roles, reskill at scale and reimagine talent strategies to stay competitive.

-

Article 10 mins

Industrials and Manufacturing: A Risk Management Approach to Transform Workforce Risk into Workforce Resilience

Workforce-related risks — spanning health, benefits, safety systems, and data and analytics — are not just operational concerns but strategic drivers. When activated, they positively shape the total cost of risk and long-term resilience for industrials and manufacturing organizations.