Mitigation Measures for AI-Driven Upcoding

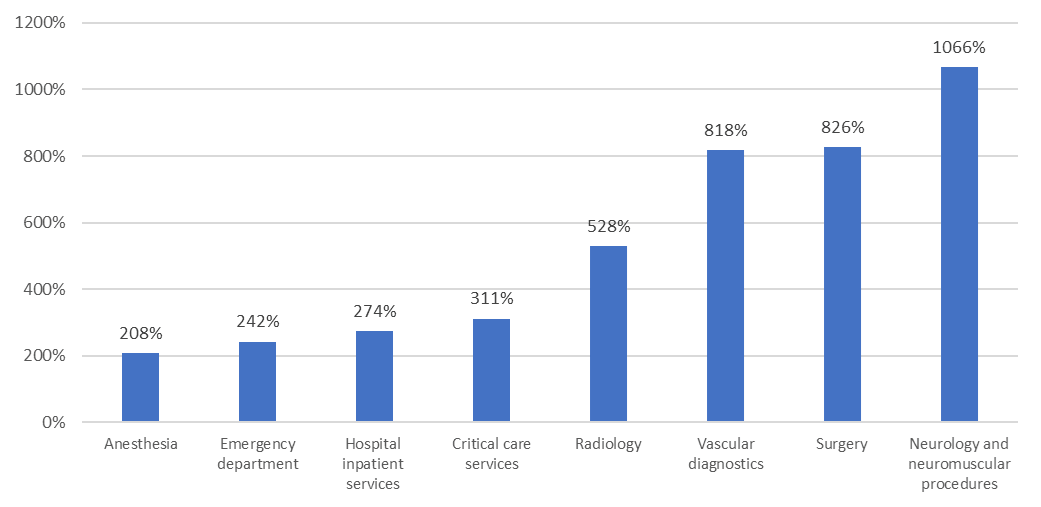

Whether intentional or not, provider use of AI tools is resulting in escalated service intensity in claim submissions. This can lead to higher costs for payers and employers.

Consider the following situation: A patient visits their physician for an annual exam. The provider uses an AI tool to record patient observation notes and that tool summarizes the conversation. When the physician mentions that in the future the patient may need surgery to address chronic back pain, the AI tool picks that up and makes it a central takeaway of the visit. Therefore, the visit is coded at a higher intensity level than the visit otherwise would have been, leading to a higher charge from the provider for the visit.

“Addressing this issue requires a combination of strong governance, technical transparency, regular monitoring, education and careful vendor management,” says Debbie Ashford, Aon Health Solutions Chief Actuary.

She recommends requesting the following actions from your carriers:

- Create an AI oversight committee

- Require algorithm documentation

- Routinely review claims

- Coding compliance workshops

- Third-party audits

- Anonymous reporting hotline

- Update policies as new rules or best practices are adopted