Navigating Regulatory Complexity with Confidence

While captive insurance offers numerous advantages, it can likewise present challenges in the form of regulatory and compliance issues. Companies must navigate complex legal frameworks to establish and maintain captives, ensuring adherence to local and international regulations. This requires a thorough understanding of the legal landscape and the ability to manage compliance effectively.

Jurisdictions like Bermuda, Singapore or Ireland that have established, captive-friendly environments offer favorable regulatory conditions. France has also led the way for new captive formations in Europe, along with Italy.1 Meanwhile, in the United Kingdom, Chancellor of the Exchequer Rachel Reeves announced a consultation on the regulatory regime for UK-domiciled captives in 2024, intending to receive market feedback on the principles which will underpin the overhauled regulation.2 New captive regulations were also introduced in Gibraltar that year to attract new captive business.3

The regulatory process requires demonstrating financial stability by maintaining minimum capital reserves, proving risk-bearing capacity and meeting stringent solvency standards. Fulfilling reporting obligations is critical, as regulators mandate the maintenance of detailed financial statements, annual audits and documentation of risk transfer mechanisms. Regulators also expect well-structured boards, independent oversight and clear frameworks that separate the captive from the parent organization. Tax considerations require companies to navigate related tax regulations and a proper treatment of premiums and claims.

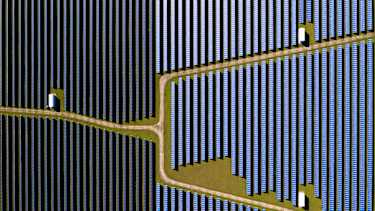

Ongoing compliance demands an awareness of and adaptation to evolving regulatory landscapes, particularly in growing sectors like renewable energy. “Captive managers can help with this process, allowing companies to leverage the strategic benefits of captive insurance while meeting regulatory requirements,” says Ciaran Healy, Aon’s global head of captives for Commercial Risk Solutions.