More Like This

-

Capability Overview

Health and Benefits

-

Article

Key Trends in U.S. Benefits for 2025 and Beyond

A thriving organization relies on thriving employees. It’s more important than ever to craft benefits strategies that focus on reducing the people risks that impact employee performance, market reputation, financial sustainability and legal liabilities.

Here are key findings from Aon’s 2025 U.S. Health Survey on how employers are responding to people risks in their benefit strategies.

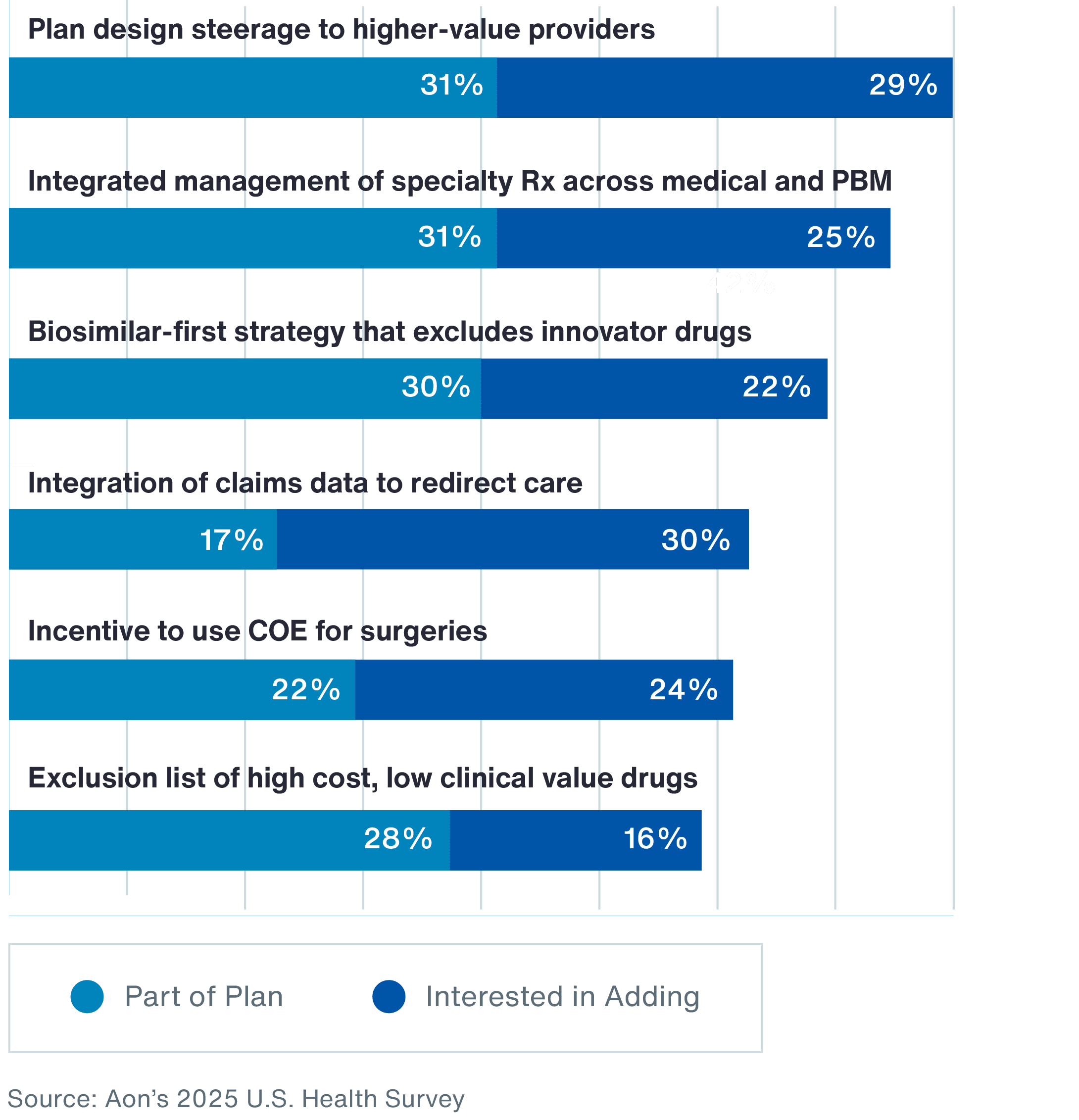

Amid cost volatility and skepticism about new strategies, employers are staying focused on results. They are improving care quality, addressing key cost drivers, and demanding fair pricing and transparency from vendors to ensure long-term value. Employers are using the following strategies:

Leading-edge employers are intentionally and methodically removing low-value care pathways and making it easier to choose higher quality and more cost-effective care. Nearly a third (31 percent) are steering employees toward better, lower-cost providers through plan design, with another 29 percent considering it. This approach helps employees make smarter healthcare choices while reducing costs.

Capability Overview

Health and Benefits

Article

Key Trends in U.S. Benefits for 2025 and Beyond

Many are also incentivizing centers of excellence and surgery networks to drive better outcomes at lower costs. Currently, 22 percent of employers are encouraging their employees to use these networks for surgeries, with 24 percent more considering this approach. Surgery networks can significantly lower costs and improve the quality of care, making them a win-win for both employers and employees.

Chart 1: Strategies Employers are Adopting for Higher Quality, Cost-Effective Care

of employers are either already steering employees toward better, lower cost providers through plan design or considering it.

Source: Aon’s 2025 U.S. Health Survey

Employers are pursuing a variety of strategies to address the future cost drivers that contribute to a projected 45 percent increase in healthcare costs by 2030.

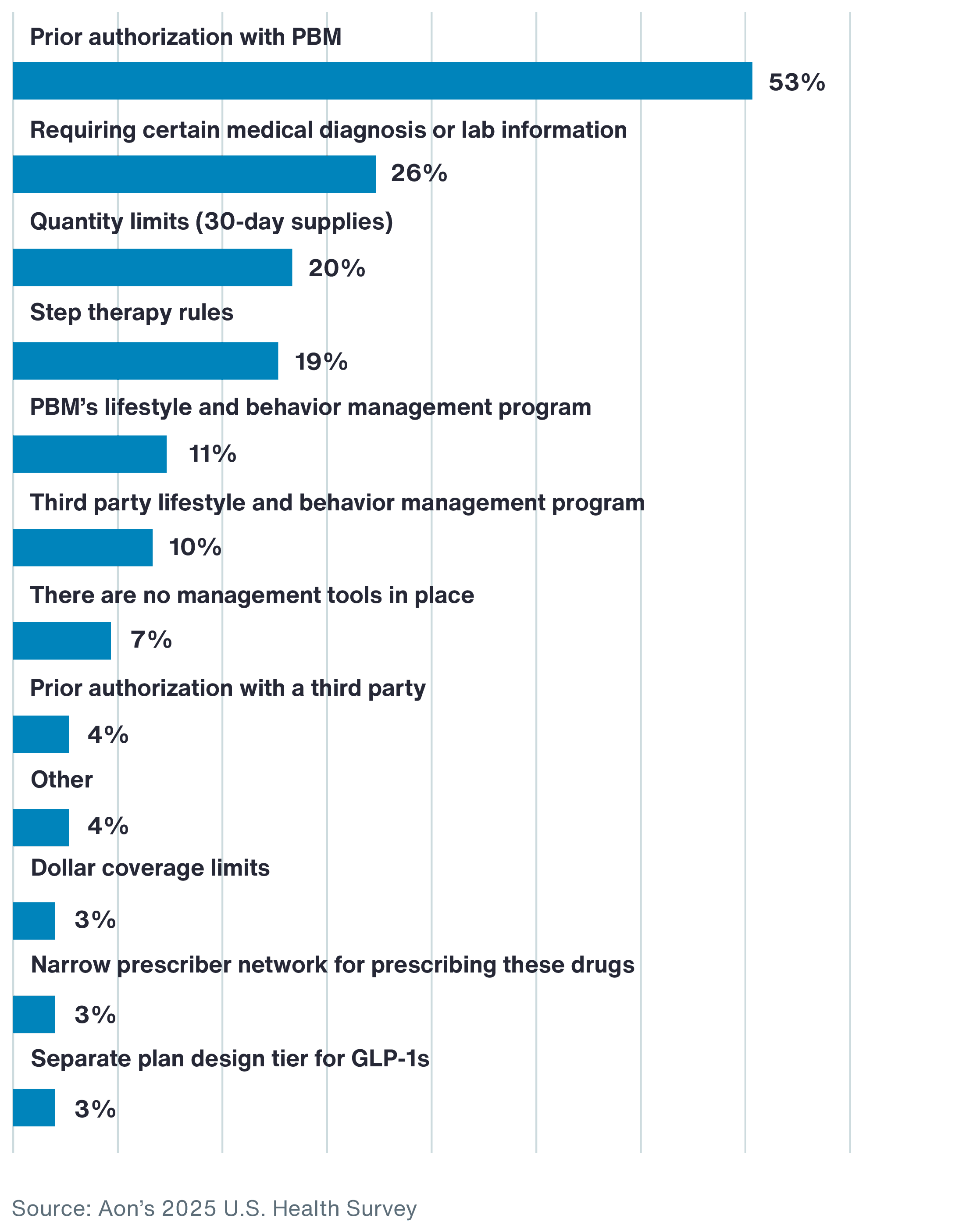

The popularity of diabetes and weight management medications known as GLP-1s is directly affecting employer health plan strategies. After increasing employee payroll contributions, the second most common specific action being taken to control rising costs is tighter management of GLP-1s. These medications drive an increasing share of pharmacy expenses, with 49 percent of employers covering GLP-1s for weight loss.

About half (53 percent) of employers require prior authorization for GLP-1s. Only 26 percent mandate a specific diagnosis or lab results for coverage, which can help to ensure appropriate use.

Chart 2: Strategies Companies Have Implemented or Planned for 2025 Given Current GLP-1 Coverage Approach

High-cost claimants are another key cost driver. A majority of employers (65 percent) rely on carrier clinical programs to manage these individuals, but today’s complex claims environment demands a more strategic approach. Some employers are turning to predictive modeling — such as Aon’s Health Risk Analyzer — to identify emerging risks, with 26 percent already using predictive analytics and another 28 percent considering it. Other emerging strategies include hospital bill audits (with 11 percent already doing this and 20 percent considering it) and implementing fully insured carve-out programs for high-cost services like gene and cell therapy (4 percent have it in place and 18 percent are considering).

Rising costs driven by the growing prevalence and severity of chronic conditions add further pressure. Yet only 8 percent of employers currently offer plan design incentives to support adherence to chronic care guidelines. However, that number is set to grow with 26 percent exploring incentives to improve health outcomes for high-risk populations.

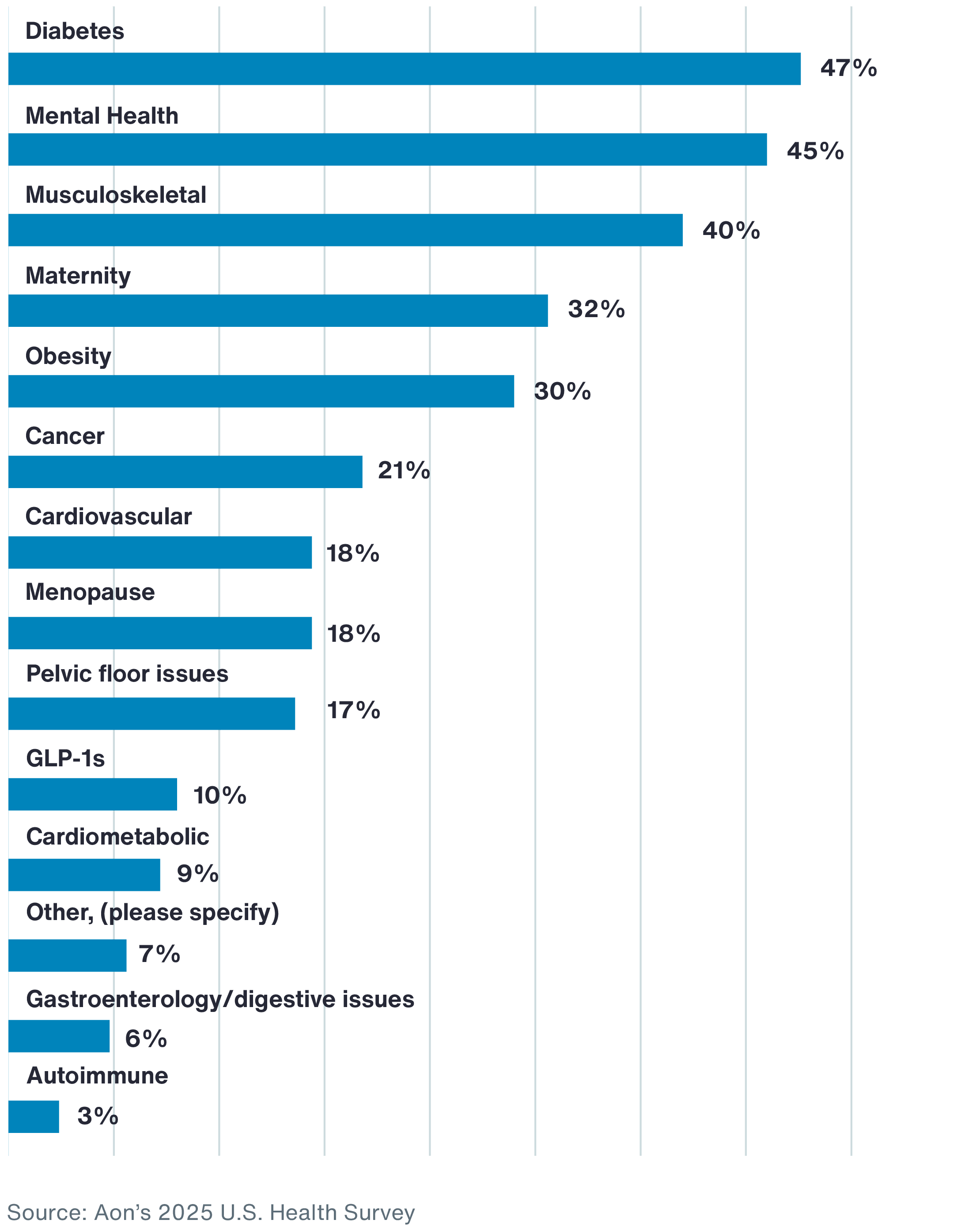

Many employers are relying on digital health solutions to help individuals manage their chronic conditions, with diabetes and mental health topping the list.

Chart 3: Companies Using Digital Health Apps or Other Specialized Solutions to Address the Following Health Conditions

So far, only a small number of employers have taken action to drive transparency and appropriate limits on vendor partner pricing models, but interest is growing.

Transparent pharmacy pricing is gaining traction as a tactic for controlling costs. The rising costs of prescriptions, breakthrough drugs and regulatory pressures are accelerating the shift. Twenty-nine percent of employers have already adopted a transparent pharmacy benefit manager (PBM) pricing model, and another 28 percent are considering it. This approach helps promote fair and accurate medication pricing while keeping expenses in check. An emerging trend is using alternative models to traditional PBMs, such as disintermediated pharmacy benefit administrators. While only 4 percent are doing that today, 18 percent are considering it.

Employers are also shifting away from fee-for-service in their medical plans. Instead, they are exploring value-based and alternative payment models that focus on appropriate cost and utilization and improving health outcomes. While adoption of value-based contracts is still low — just 5 percent have made the switch — momentum is building, with another 14 percent considering a transition in the next one to three years. Outcome-based contracts for gene and cell therapy show a similar trend: Only 1 percent have one in place today and an additional 18 percent are considering.

To address the workforce health challenges that can lead to poor on-the-job performance, employers are taking an intentional approach to understanding key barriers to health and wellbeing. There are three targeted strategies that can help improve affordability and fair access to healthcare.

Employers are improving affordability by focusing on foundational care, including primary care, mental health and prescription drugs. Nearly half (47 percent) of employers are offering or plan to offer low-cost primary care services, such as plan design with low copays or waived deductibles. Sixty-two percent are focused on improving prescription drug affordability, while 65 percent offer or are considering digital tools and self-guided resources to support emotional wellbeing. Additionally, 35 percent have expanded or are evaluating benefits for employees with disabilities, such as hearing aids and assistive devices.

These efforts reflect a broader commitment to accessible and more affordable healthcare benefits.

Employers are taking meaningful steps to break down systemic barriers to individual health and wellbeing. These challenges can come in the form of personal circumstances or plan design limitations that make it difficult for employees and their families to take care of their health.

Employees with caregiving responsibilities often struggle to find time for their own healthcare needs. Half of employers offer or are considering paid caregiver leave. What’s more, Aon research shows that 23 percent of employees live in areas with high social determinants of health (SDoH), such as economic instability, food insecurity and poor access to healthcare services. Nearly half (43 percent) of employers are offering or considering benefits that address SDoH.

Plan design can also be a barrier to individuals receiving the care they need. For example, out-of-pocket expenses for cancer diagnostic services can prevent individuals from following up on cancer screenings that reveal potential problems. Looking ahead, 40 percent of employers are offering or considering full coverage for cancer diagnostic services, along with greater access to screenings, personalized medicine and navigation support.

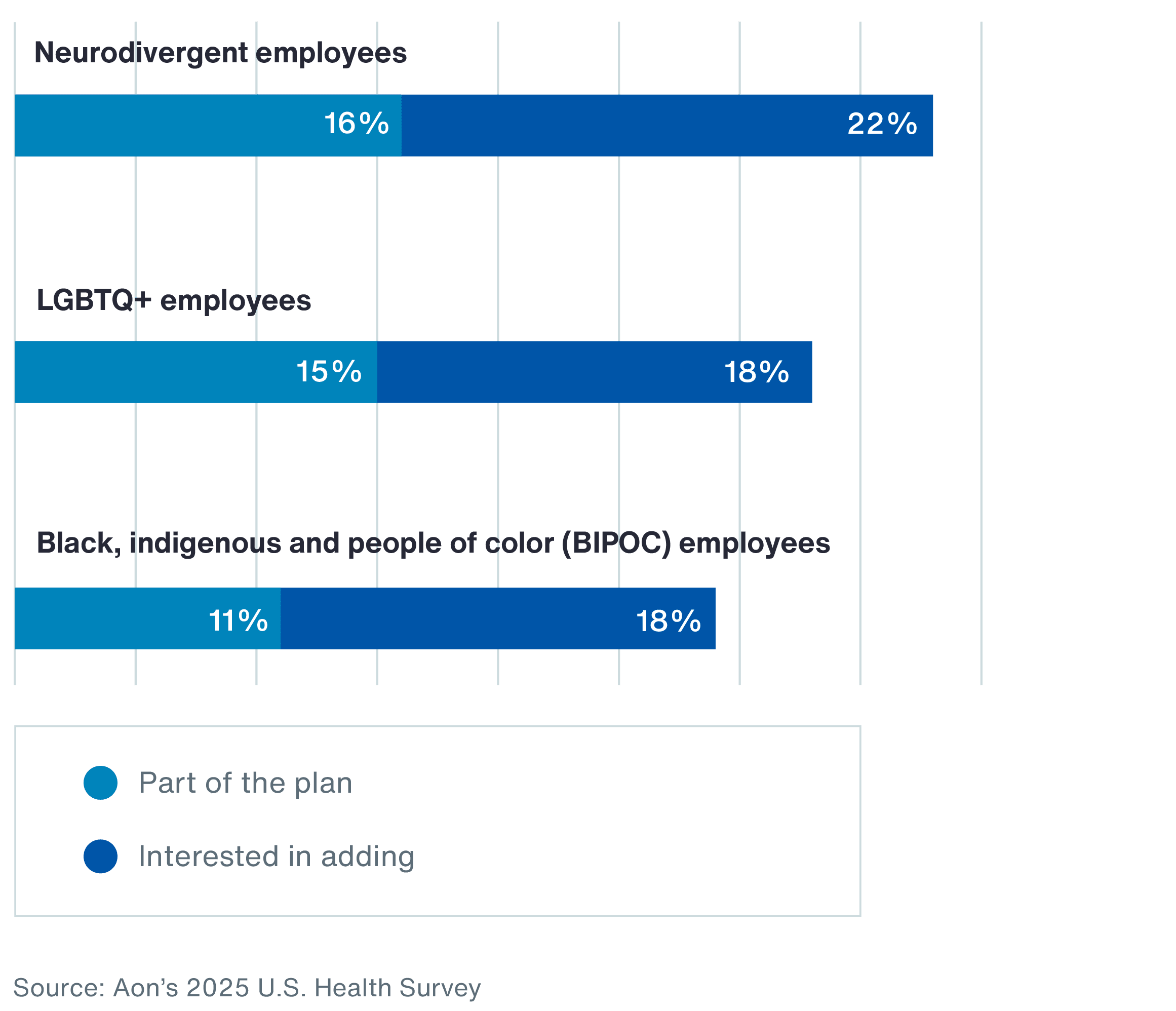

Access to care can be a challenge for individuals with specialized healthcare needs. Many employers are taking action by offering more accessible and supportive care to different communities. For example, more employers are expanding specialized care for neurodivergent, LGBTQ+, and black, indigenous and people of color (BIPOC) populations.

Chart 4: Employers Offering or Considering Specialized Care and Support for the Following Groups

of employers offer or are considering digital tools and self-guided resources to support emotional wellbeing.

Source: Aon’s 2025 U.S. Health Survey

Seventy-one percent have already implemented accessible benefits and policies and 42 percent are addressing disparities in care.

Rising regulatory pressures and recent lawsuits over PBM contracts and drug pricing have put fiduciary responsibility front and center. In response, employers are tightening vendor oversight, enhancing governance and closely monitoring programs to stay ahead of risk.

As healthcare costs rise, employers are taking a more strategic approach to vendor management. Legal risks are also driving change, underscoring the need for robust oversight of vendor contracts and pricing for prescription drugs and healthcare providers. To reduce litigation risk, plan sponsors should assess vendor selection and due diligence to ensure plan-appropriate outcomes and thorough documentation.

Forty-two percent of employers are reassessing their vendor strategy to address healthcare costs, with 79 percent conducting regular contract reviews and 78 percent performing market checks to maintain cost competitiveness. The majority (61 percent) of employers have begun evaluating stop loss coverage annually. These practices help employers secure high-quality, cost-effective solutions while promoting better governance.

Plan sponsors must carefully select and monitor their service providers to meet fiduciary obligations and minimize liability risk. As scrutiny increases, employers are leveraging more tools — such as audits and HIPAA risk assessments — to ensure compliance and strengthen their health plan oversight.

Progress is being made, with 74 percent of employers reviewing their welfare plan governance in the past year. However, there’s still room for improvement. Establishing a welfare plan fiduciary committee can enhance oversight and reduce risk, yet only one in three employers have one in place.

More employers recognize that regular vendor assessments are key to maintaining a well-performing health plan. Fifty-three percent conduct routine claims audits to ensure accuracy and accountability, while 28 percent hold monthly or quarterly “grand rounds” reviews with their medical management vendor to track high-cost claimants and improve care coordination. These proactive strategies help control costs and drive better plan outcomes.

of employers are offering or considering benefits that address social determinants of health.

Source: Aon’s 2025 U.S. Health Survey

Nearly half (47 percent) of employees surveyed for Aon’s 2025 Employee Sentiment Study say competitive pay and meaningful benefits are their top priorities when evaluating employers. Aon’s 2025 U.S. Health Survey reinforces this: 81 percent of employers say benefits are important or extremely important to attracting and retaining talent.

Many employees have come to expect retirement savings and general health coverage as table stakes. Employers who go beyond the standard with tailored, high-impact benefits gain a clear advantage in attracting and retaining top talent.

Employers are starting to embrace newer technologies to better educate and communicate with employees.

Notably, more employers are turning to artificial intelligence (AI) and data-driven strategies to enhance care quality and manage costs. Half of employers now use AI in some form to educate employees and support better health decisions — leading to more informed choices and potential cost savings.

Employers are steadily growing more comfortable with AI in benefits, particularly in its ability to enhance personalization through education, communications and proactive nudges: Seven in 10 employers are at least somewhat comfortable with AI answering generalized benefits questions.

There is also rising interest in using AI to deliver more tailored messaging. Employers are increasingly focused on leveraging data in an integrated way across modern communication channels. In fact, interest in using claim data and preference information to personalize messaging has increased by 26 percent.

of employers are at least somewhat comfortable with AI answering generalized benefits questions.

Source: Aon’s 2025 U.S. Health Survey

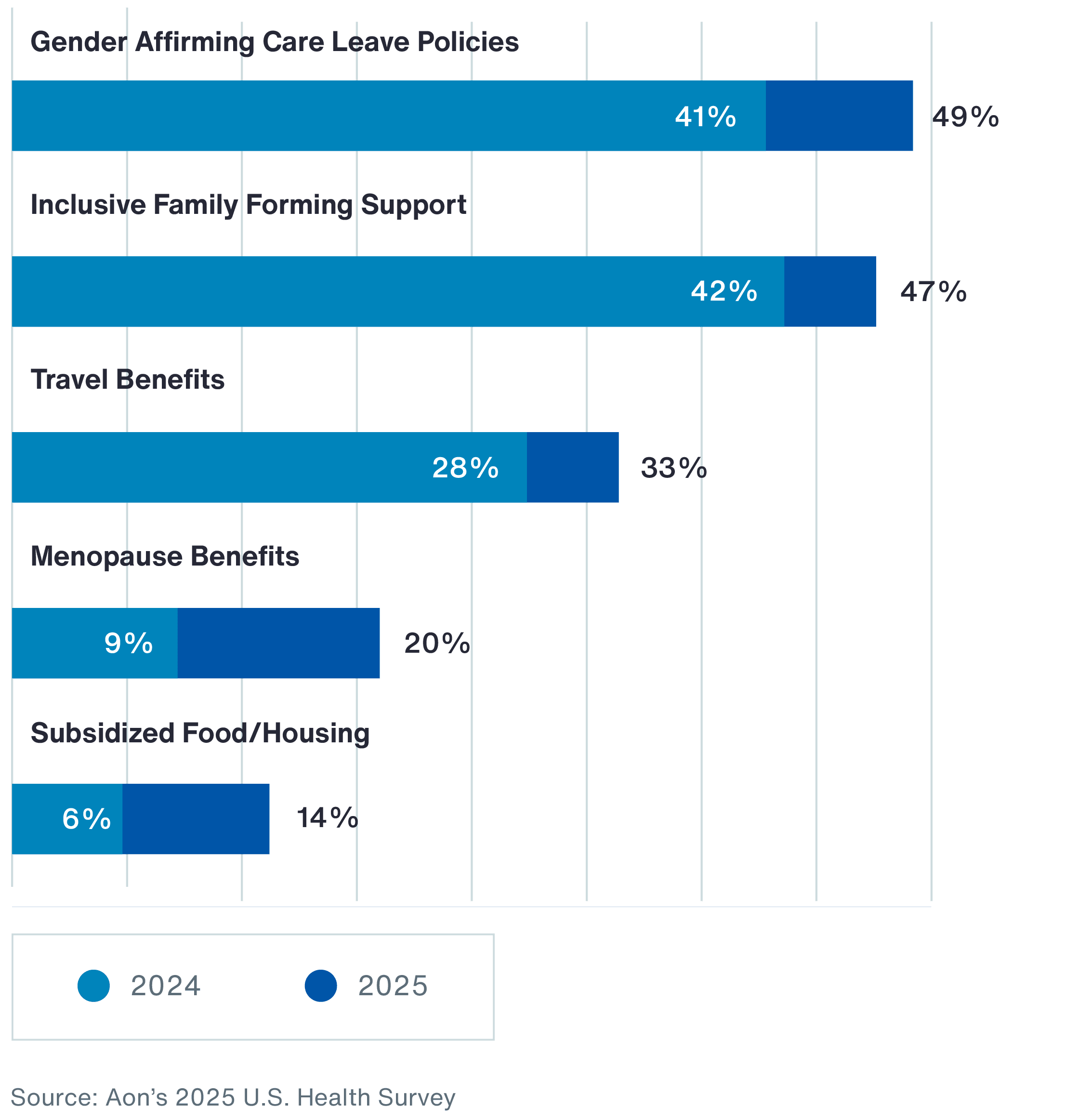

Employers are prioritizing benefits that support life stages and strengthen workplace culture — and they’ve made significant progress toward accessible coverage and policies.

Chart 5: Inclusive Benefits Currently Offered

of companies are using benefits to advance more customized people strategies to meet different needs of employees.

Source: Aon’s 2025 U.S. Health Survey

Voluntary benefits are now a strategic advantage, providing employees with greater financial security and personalized healthcare solutions. For employers, these benefits drive higher engagement, loyalty and overall workforce wellbeing. Seventy-six percent offer voluntary or supplemental benefits to meet individual employee needs.

Accident, critical illness and hospital indemnity insurance continue to add value by filling gaps in traditional health coverage. More employers are also offering identity theft protection to address the growing threat of cybercrime.

Employers are expanding their focus beyond traditional healthcare benefits to better support overall employee wellbeing. Eighty-two percent believe they play a significant role in supporting physical, emotional, social and financial wellbeing. Meanwhile, 72 percent offer wellbeing incentives. Among those investing in incentives, most provide $500 or more.

Despite this commitment, few employers see their wellbeing strategies as highly effective, highlighting the need for stronger evaluation methods. Only 12 percent rate their current approach as highly effective. To address this gap, seven in 10 employers are exploring benefits that help employees navigate financial challenges, including financial wellbeing tools, discount platforms and emergency savings programs.

The future of employer-sponsored benefits is not just focused on managing cost. It’s about reducing people risk across every dimension. By aligning benefit strategies to address performance, reputation, financial sustainability and legal exposure, employers are actively strengthening workforce and organizational resilience.

For companies offering wellbeing incentives, most are valued at $500 or more.

Source: Aon’s 2025 U.S. Health Survey

General Disclaimer

This document is not intended to address any specific situation or to provide legal, regulatory, financial, or other advice. While care has been taken in the production of this document, Aon does not warrant, represent or guarantee the accuracy, adequacy, completeness or fitness for any purpose of the document or any part of it and can accept no liability for any loss incurred in any way by any person who may rely on it. Any recipient shall be responsible for the use to which it puts this document. This document has been compiled using information available to us up to its date of publication and is subject to any qualifications made in the document.

Terms of Use

The contents herein may not be reproduced, reused, reprinted or redistributed without the expressed written consent of Aon, unless otherwise authorized by Aon. To use information contained herein, please write to our team.

Our Better Being podcast series, hosted by Aon Chief Wellbeing Officer Rachel Fellowes, explores wellbeing strategies and resilience. This season we cover human sustainability, kindness in the workplace, how to measure wellbeing, managing grief and more.

Expert Views on Today's Risk Capital and Human Capital Issues

Expert Views on Today's Risk Capital and Human Capital Issues

Expert Views on Today's Risk Capital and Human Capital Issues

Better Decisions Across Interconnected Risk and People Issues.

The construction industry is under pressure from interconnected risks and notable macroeconomic developments. Learn how your organization can benefit from construction insurance and risk management.

Our Cyber Resilience collection gives you access to Aon’s latest insights on the evolving landscape of cyber threats and risk mitigation measures. Reach out to our experts to discuss how to make the right decisions to strengthen your organization’s cyber resilience.

Our Employee Wellbeing collection gives you access to the latest insights from Aon's human capital team. You can also reach out to the team at any time for assistance with your employee wellbeing needs.

Explore Aon's latest environmental social and governance (ESG) insights.

Our Global Insurance Market Insights highlight insurance market trends across pricing, capacity, underwriting, limits, deductibles and coverages.

Better Decisions Across Interconnected Risk and People Issues.

How do the top risks on business leaders’ minds differ by region and how can these risks be mitigated? Explore the regional results to learn more.

Trade, technology, weather and workforce stability are the central forces in today’s risk landscape.

These industry-specific articles explore the top risks, their underlying drivers and the actions leaders are taking to build resilience.

Our Human Capital Analytics collection gives you access to the latest insights from Aon's human capital team. Contact us to learn how Aon’s analytics capabilities helps organizations make better workforce decisions.

Read our collection of human capital articles that explore in depth hot topics for HR and risk professionals, including using data and analytics to measure total rewards programs, how HR and finance can better partner and the impact AI will have on the workforce.

Explore our hand-picked insights for human resources professionals.

Our Workforce Collection provides access to the latest insights from Aon’s Human Capital team on topics ranging from health and benefits, retirement and talent practices. You can reach out to our team at any time to learn how we can help address emerging workforce challenges.

Our Mergers and Acquisitions (M&A) collection gives you access to the latest insights from Aon's thought leaders to help dealmakers make better decisions. Explore our latest insights and reach out to the team at any time for assistance with transaction challenges and opportunities.

The challenges in adopting renewable energy are changing with technological advancements, increasing market competition and numerous financial support mechanisms. Learn how your organization can benefit from our renewables solutions.

How do businesses navigate their way through new forms of volatility and make decisions that protect and grow their organizations?

Our Parametric Insurance Collection provides ways your organization can benefit from this simple, straightforward and fast-paying risk transfer solution. Reach out to learn how we can help you make better decisions to manage your catastrophe exposures and near-term volatility.

Our Pay Transparency and Equity collection gives you access to the latest insights from Aon's human capital team on topics ranging from pay equity to diversity, equity and inclusion. Contact us to learn how we can help your organization address these issues.

Forecasters are predicting an extremely active 2024 Atlantic hurricane season. Take measures to build resilience to mitigate risk for hurricane-prone properties.

Our Technology Collection provides access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities of technology. Reach out to the team to learn how we can help you use technology to make better decisions for the future.

Our Trade Collection gives you access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities for international business. Reach out to our team to understand how to make better decisions around macro trends and why they matter to businesses.

Better Decisions Across Interconnected Risk and People Issues.

With a changing climate, organizations in all sectors will need to protect their people and physical assets, reduce their carbon footprint, and invest in new solutions to thrive. Our Weather Collection provides you with critical insights to be prepared.

Our Workforce Resilience collection gives you access to the latest insights from Aon's Human Capital team. You can reach out to the team at any time for questions about how we can assess gaps and help build a more resilience workforce.

Article 6 mins

Addressing the retirement pay gap issue between men and women starts with first acknowledging it exists. Then companies can conduct further analysis and adjust their benefit plans accordingly.

Article 8 mins

AI acceleration, rising healthcare costs and changes to workforce skills are transforming organizations. Our analysis of financial services, life sciences and technology companies provides insights on how to redesign roles, reskill at scale and reimagine talent strategies to stay competitive.

Article 10 mins

Workforce-related risks — spanning health, benefits, safety systems, and data and analytics — are not just operational concerns but strategic drivers. When activated, they positively shape the total cost of risk and long-term resilience for industrials and manufacturing organizations.