01

Risk Appetite:

Clarity of risk tolerance that aligns with portfolio design and strategies that adapt to market shocks and new opportunities.

In the insurance industry, resilience isn’t about surviving one phase of the cycle — it’s about outperforming through them all. As global risks evolve and structural shifts accelerate, expectations from capital providers and clients continue to rise. Insurers must deliver profitable growth and strategic relevance whether the market is softening or hardening. Those who embed relevance into every decision are best positioned to lead through uncertainty and unlock opportunity at every stage.

The forces reshaping insurance in 2025 are intensifying. Capital is abundant, with global reinsurance capacity estimated at a record $720 billion1 and 1H seeing an all-time high of $17 billion2 in catastrophe bond issuance. This signals growing investor demand for non-correlated returns, but it also sharpens competition, squeezes pricing power and raises the stakes for differentiation.

Meanwhile, geopolitical pressures — from protectionism and civil unrest to persistent inflation — are complicating underwriting assumptions and dragging volatility into claims environments. Interest rates remain flat across major markets, leaving little room for investment yield strategies to paper over underwriting shortfalls.

The market may be softening, but risk is growing.

Commercial insurance buyers are increasingly demanding multi-year, multi-line solutions that integrate risk financing, reduce volatility and generate enterprise value. To effectively respond while driving profit and delivering consistent returns to shareholders, insurers themselves — as reinsurance buyers — are evolving. They are seeking structures that are agile, transparent and strategically aligned to their own customers’ objectives. Insurers must pivot from product suppliers to performance partners. That means being proactive, insightful and deeply attuned to client needs across geographies and sectors.

However, legacy operating models, rigid capital structures and siloed distribution strategies are holding some insurers back. Those who evolve now, aligning relevance with agility, will be best positioned to extract value through the market cycle.

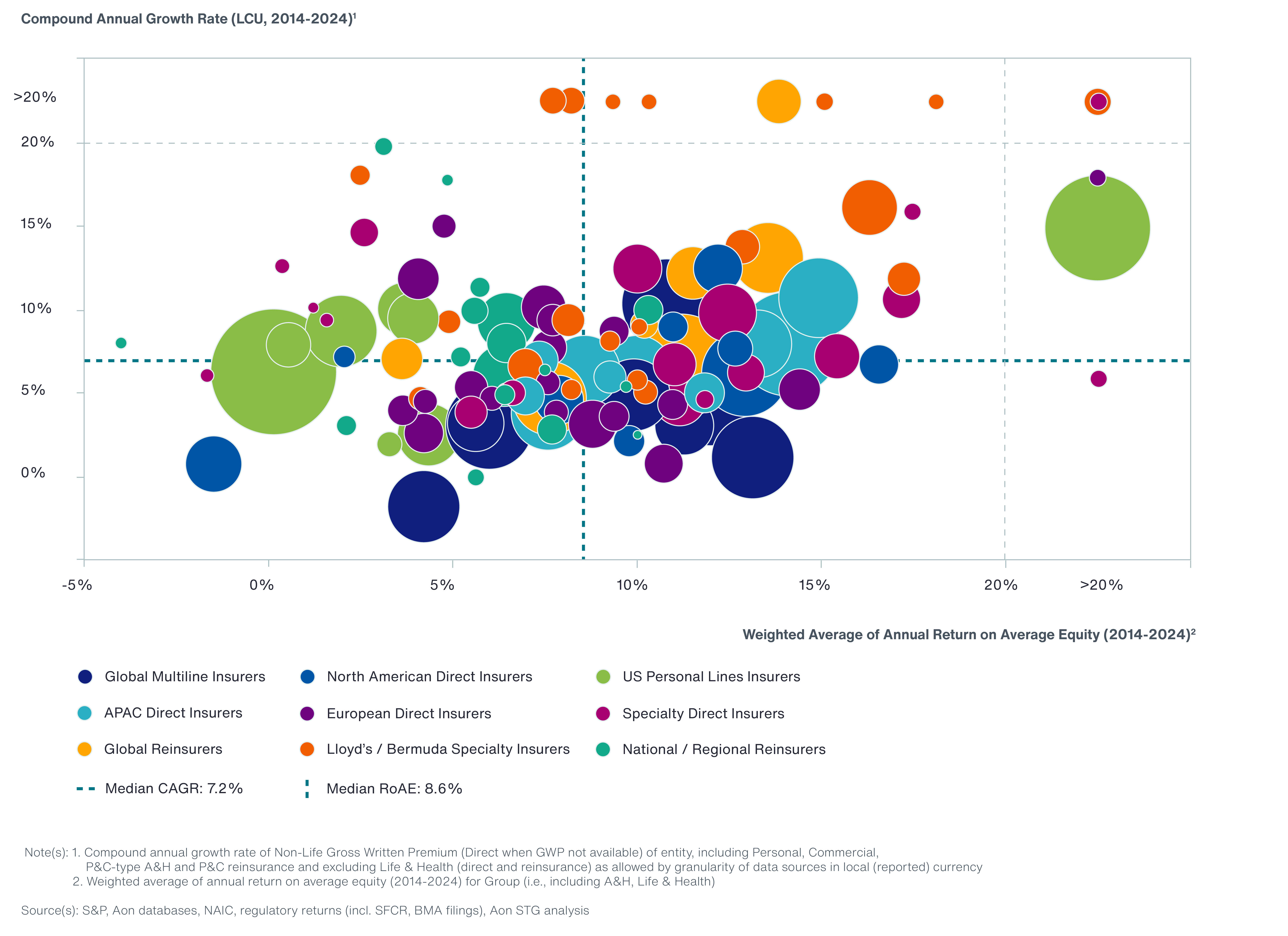

Aon’s global analysis of 120 insurers from 2013 to 2024 confirms a clear pattern: Strategic focus and relevance consistently drive stronger financial outcomes — regardless of market conditions. Our research shows that:

We reflect on how these figures have evolved since our FY 2023 analysis, noting how approximately 15% of insurers moved above or below the median, including eight carriers that have adopted strategies to significantly improve their positioning in either returns or growth.

What sets top performing insurers apart? Aon has identified seven traits that consistently characterize insurers who outperform in complex, cyclical markets:

01

Clarity of risk tolerance that aligns with portfolio design and strategies that adapt to market shocks and new opportunities.

02

Fast to respond to emerging market trends, enter and expand in new risk categories and capitalize on favorable conditions.

03

Investment in advanced analytics to improve decision making throughout the value chain.

04

Innovation and alternative techniques to improve risk selection, reduce acquisition costs and make efficiency gains.

05

Attract and develop the best underwriting, claims and actuarial talent with shared vision and goals.

06

Build relevance through carefully considered propositions for key channels to market.

07

Analytics-driven approach to optimizing the capital stack for efficiency, flexibility and returns.

Strategic relevance isn’t just a differentiator — it’s a performance driver. Insurers who embed it across the value chain consistently outperform, even in softening markets. Building on research into top-performing carriers, here are five actionable strategies that offer a blueprint for sustaining that edge.

Many boardrooms call for increased revenue — but achieving it means identifying the right opportunities and executing with precision. Insurers must move beyond market generalities and be forensic about rate adequacy, insurability and loss cost trends.

A global reinsurer made a targeted expansion into select Continental European direct insurance markets — driven by deep analysis, not broad ambition. The team examined client demographics, buying behaviors, historical loss ratios by segment, broker dynamics, commission structures and incumbent carrier profiles. Market concentration and churn rates were also mapped to identify alignment with appetite.

These insights enabled the reinsurer to define a differentiated proposition, select a target client set and build a business plan with clear metrics to track progress and performance.

Finding the right balance between risk and capital requires careful planning and strategic decision making. Insurers must reassess whether their capital structures align with where and how they go to market. Disconnected internal structures, rigid legal entities and under-utilized capital all contribute to inefficiency and missed opportunities.

A global reinsurer has leveraged approximately $8 billion in third-party investments through its capital partners insurance-linked securities business and joint ventures — supplementing its balance sheet by 75%. This capital structure enables the reinsurer to write larger lines, support clients consistently through the cycle and expand its property catastrophe reinsurance portfolio. In Q2 2025 alone, the strategy generated nearly $100 million in fee income.

AI and analytics are transforming how insurers detect fraud, engage clients and model loss cost. But many insurers still struggle to connect data insights with core business decisions — especially in day-to-day underwriting. Forty percent of insurance employees report a need for better technological resources, compared to 30% in other industries, according to Aon’s Employee Sentiment Study.

A UK motor underwriter, consistently delivers a COR 30 points below the market average by focusing on non-standard, high-margin risks. Its edge lies in disciplined data strategy: proprietary inflation trend detection, a 20-year pricing and claims dataset and in-house analytics designed to extract actionable insights. Technical expertise and data consistency underpin every underwriting decision — turning complexity into competitive advantage.

Your clients and brokers are not static — your engagement strategy should not be either. Insurers must dive deeper into segmentation by sector, complexity and buying behavior to deliver value that resonates.

A large independent UK MGA has streamlined distribution by enabling automated underwriting via low-friction broker platforms. Its product set is tailored for digital delivery — reducing operational drag and enhancing broker engagement. In 2024, the MGA deepened its sector relevance by entering the carbon insurance market and launching an M&A team focused on representations and warranties for the renewable energy industry — aligning product innovation with emerging client needs.

Your future operating model will require different talent. Whether it’s embedded analytics, client co-creation or agile response teams, your workforce needs a radical rethink. With 60% of employees in the insurance industry considering or planning to leave their current role within 12 months3, how do you attract and retain talent?

A fast-growing startup in Lloyd’s is treating talent as a strategic asset. Its approach combines a strong employer brand — positioning them as a tech-led insurer — with department-level learning budgets that empower teams to upskill and stay competitive. Cross-functional squads of actuaries, data scientists, underwriters and strategists foster a nimble, fail-fast culture, enabling rapid adaptation and innovation at scale.

Success in today’s market can be distilled to two strategic models:

Both paths require discipline, actionable insight — and relevance.

Relevance is a mindset. It’s how you stay connected to clients, channels and capital partners. It’s also how you profitably grow through the market cycle. The insurers who win in this market embed relevance into everything they do — from capital deployment and talent strategy to distribution focus and underwriting innovation.

1 Source: Aon’s Reinsurance Market Dynamics report

2 Source: The Aon Securities Proprietary 144A Catastrophe Bond Database

3 Source: Aon Employee Sentiment Study

General Disclaimer

This document is not intended to address any specific situation or to provide legal, regulatory, financial, or other advice. While care has been taken in the production of this document, Aon does not warrant, represent or guarantee the accuracy, adequacy, completeness or fitness for any purpose of the document or any part of it and can accept no liability for any loss incurred in any way by any person who may rely on it. Any recipient shall be responsible for the use to which it puts this document. This document has been compiled using information available to us up to its date of publication and is subject to any qualifications made in the document.

Terms of Use

The contents herein may not be reproduced, reused, reprinted or redistributed without the expressed written consent of Aon, unless otherwise authorized by Aon. To use information contained herein, please write to our team.

Our Better Being podcast series, hosted by Aon Chief Wellbeing Officer Rachel Fellowes, explores wellbeing strategies and resilience. This season we cover human sustainability, kindness in the workplace, how to measure wellbeing, managing grief and more.

Expert Views on Today's Risk Capital and Human Capital Issues

Expert Views on Today's Risk Capital and Human Capital Issues

Expert Views on Today's Risk Capital and Human Capital Issues

Better Decisions Across Interconnected Risk and People Issues.

The construction industry is under pressure from interconnected risks and notable macroeconomic developments. Learn how your organization can benefit from construction insurance and risk management.

Our Cyber Resilience collection gives you access to Aon’s latest insights on the evolving landscape of cyber threats and risk mitigation measures. Reach out to our experts to discuss how to make the right decisions to strengthen your organization’s cyber resilience.

Our Employee Wellbeing collection gives you access to the latest insights from Aon's human capital team. You can also reach out to the team at any time for assistance with your employee wellbeing needs.

Explore Aon's latest environmental social and governance (ESG) insights.

Our Global Insurance Market Insights highlight insurance market trends across pricing, capacity, underwriting, limits, deductibles and coverages.

Better Decisions Across Interconnected Risk and People Issues.

How do the top risks on business leaders’ minds differ by region and how can these risks be mitigated? Explore the regional results to learn more.

Trade, technology, weather and workforce stability are the central forces in today’s risk landscape.

These industry-specific articles explore the top risks, their underlying drivers and the actions leaders are taking to build resilience.

Our Human Capital Analytics collection gives you access to the latest insights from Aon's human capital team. Contact us to learn how Aon’s analytics capabilities helps organizations make better workforce decisions.

Read our collection of human capital articles that explore in depth hot topics for HR and risk professionals, including using data and analytics to measure total rewards programs, how HR and finance can better partner and the impact AI will have on the workforce.

Explore our hand-picked insights for human resources professionals.

Our Workforce Collection provides access to the latest insights from Aon’s Human Capital team on topics ranging from health and benefits, retirement and talent practices. You can reach out to our team at any time to learn how we can help address emerging workforce challenges.

Our Mergers and Acquisitions (M&A) collection gives you access to the latest insights from Aon's thought leaders to help dealmakers make better decisions. Explore our latest insights and reach out to the team at any time for assistance with transaction challenges and opportunities.

The challenges in adopting renewable energy are changing with technological advancements, increasing market competition and numerous financial support mechanisms. Learn how your organization can benefit from our renewables solutions.

How do businesses navigate their way through new forms of volatility and make decisions that protect and grow their organizations?

Our Parametric Insurance Collection provides ways your organization can benefit from this simple, straightforward and fast-paying risk transfer solution. Reach out to learn how we can help you make better decisions to manage your catastrophe exposures and near-term volatility.

Our Pay Transparency and Equity collection gives you access to the latest insights from Aon's human capital team on topics ranging from pay equity to diversity, equity and inclusion. Contact us to learn how we can help your organization address these issues.

Forecasters are predicting an extremely active 2024 Atlantic hurricane season. Take measures to build resilience to mitigate risk for hurricane-prone properties.

Our Technology Collection provides access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities of technology. Reach out to the team to learn how we can help you use technology to make better decisions for the future.

Our Trade Collection gives you access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities for international business. Reach out to our team to understand how to make better decisions around macro trends and why they matter to businesses.

Better Decisions Across Interconnected Risk and People Issues.

With a changing climate, organizations in all sectors will need to protect their people and physical assets, reduce their carbon footprint, and invest in new solutions to thrive. Our Weather Collection provides you with critical insights to be prepared.

Our Workforce Resilience collection gives you access to the latest insights from Aon's Human Capital team. You can reach out to the team at any time for questions about how we can assess gaps and help build a more resilience workforce.

Article 6 mins

Addressing the retirement pay gap issue between men and women starts with first acknowledging it exists. Then companies can conduct further analysis and adjust their benefit plans accordingly.

Article 8 mins

AI acceleration, rising healthcare costs and changes to workforce skills are transforming organizations. Our analysis of financial services, life sciences and technology companies provides insights on how to redesign roles, reskill at scale and reimagine talent strategies to stay competitive.

Article 10 mins

Workforce-related risks — spanning health, benefits, safety systems, and data and analytics — are not just operational concerns but strategic drivers. When activated, they positively shape the total cost of risk and long-term resilience for industrials and manufacturing organizations.