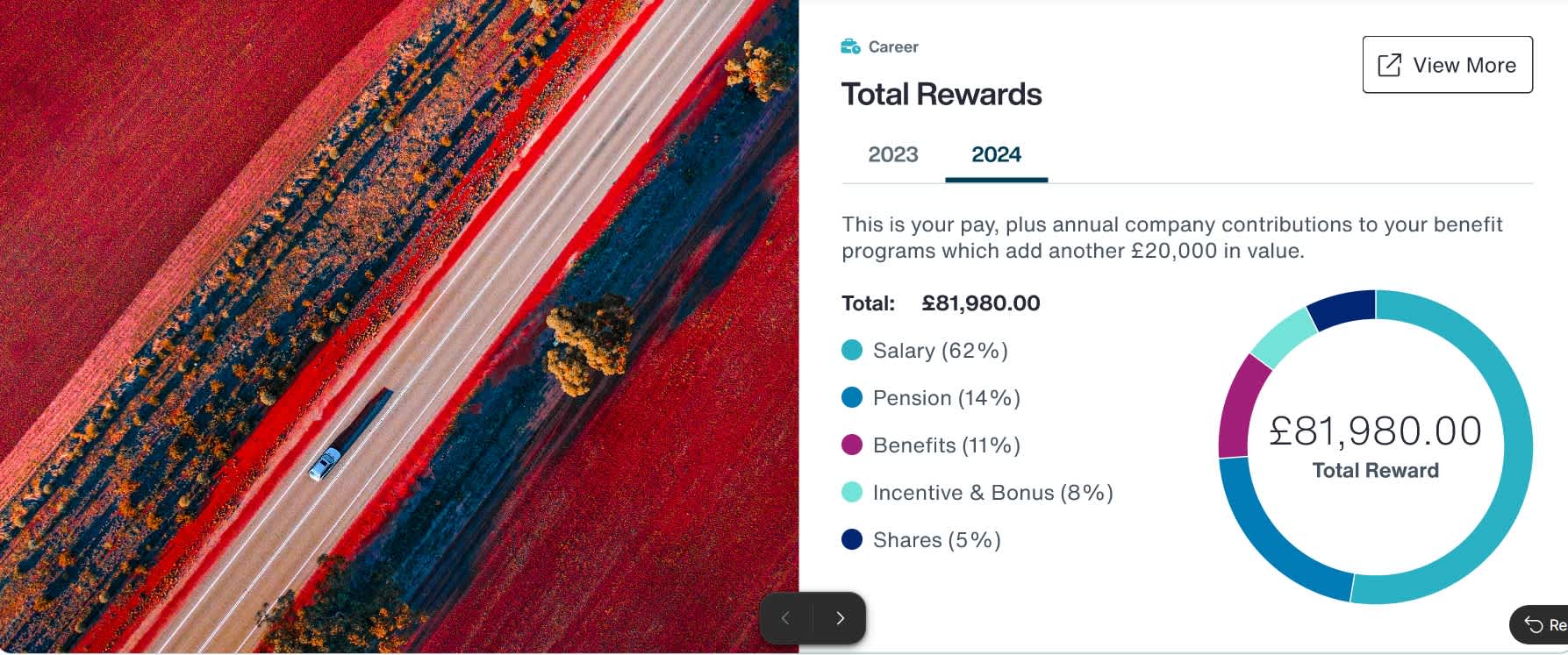

Despite significant investments in employee benefits, many organizations still face a disconnect: Employees are often unaware of, or indifferent to, the benefits available to them. This gap between perceived value and actual coverage erodes return on investment and can negatively impact employees’ health, wellbeing and performance if they aren’t getting the support they need. While technology is a powerful enabler, its true value lies in delivering tangible improvements in employee engagement, health and alignment with company culture.

Artificial Intelligence (AI) and advanced data analytics are transforming how employees engage with their benefits. The need for intelligent, targeted benefits communication has never been greater. As organizations grapple with cost containment and shifting employee expectations, the focus has shifted from simply offering benefits to ensuring employees understand and value them. More than seven out of 10 employees globally say benefit customization is important or extremely important to them.1 Employee needs can be incredibly diverse; personalization isn’t just a nice-to-have, but the key to building employee benefit programs that truly engage and deliver measurable value. With employees voicing a clear desire for choice and personalization, employers are increasingly able to deliver it in a more innovative and sustainable way with technology.

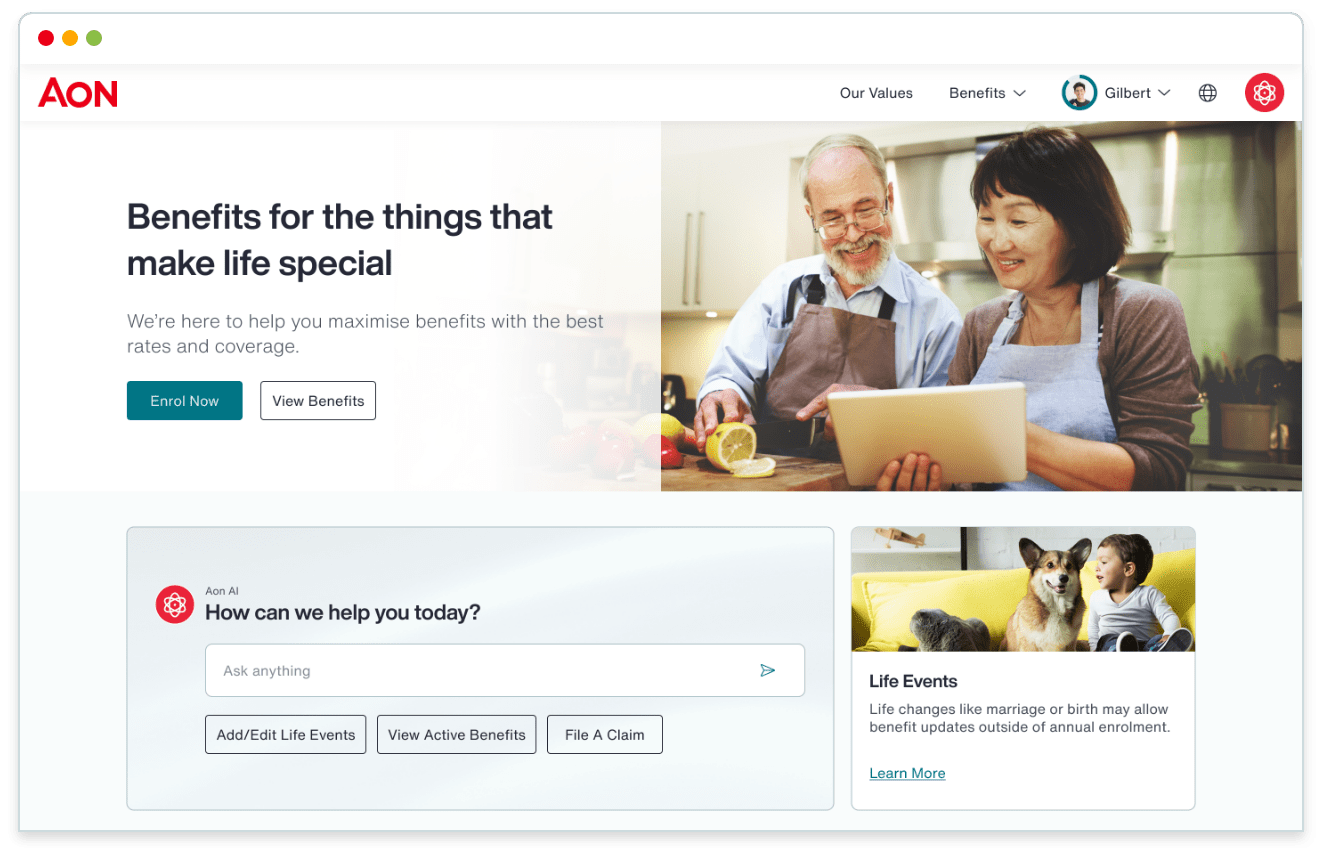

Online benefit platforms are the gateway for delivering tailored benefits. Technology can now streamline the process by eliminating tab-switching, third-party logins and manual approvals. Employees can manage benefits — enroll, update or claim — directly on the platform, ensuring greater engagement and control without leaving the system. Online benefit platforms offer global consistency with local impact. By tailoring campaigns and communications to the cultural nuances of each region, organizations can strengthen their employee value proposition in a consistent yet culturally sensitive way.