Podcast 23 mins

Better Being Series: Understanding Burnout in the WorkplaceOur Better Being podcast series, hosted by Aon Chief Wellbeing Officer Rachel Fellowes, explores wellbeing strategies and resilience. This season we cover human sustainability, kindness in the workplace, how to measure wellbeing, managing grief and more.

Podcast 23 mins

Better Being Series: Understanding Burnout in the Workplace

Podcast 14 mins

Better Being Series: Why Nutrition Matters

Podcast 10 mins

Better Being Series: Discover the ‘Blue Zones’ Where People Live Longer

Podcast 20 mins

Better Being Series: Improving Your Financial Wellbeing

Podcast 17 mins

Better Being Series: Are You Taking Care of Your Digital Wellbeing?

Podcast 19 mins

On Aon Podcast: Better Being Series Dives into Women’s Health

Podcast 25 mins

On Aon’s Better Being Series: Managing Loss and GriefExpert Views on Today's Risk Capital and Human Capital Issues

Article 8 mins

Thriving in an Interconnected World: How the C-Suite Embraces Uncertainty

Article 6 mins

Powering Progress: Collaborating to Build a Sustainable Future in Emerging Markets

Article 5 mins

Building Business Resilience: Key Steps to Effectively Integrate Risk Management Across Your Organisation

Article 7 mins

Why Humans Are the Essential Factor in the Success of Artificial Intelligence (AI)

Article 5 mins

Leveraging Research and Expertise to Strengthen Your HR Strategy for 2025 and Beyond

Article 5 mins

Managing Risk on the Energy Transition Journey

Article 7 mins

The Role of Risk Management in the Age of Generative Artificial Intelligence

Article 7 mins

Finding A Way In Asia Pacific's New Economic Reality

Article 4 mins

Three Ways to Boost Value from Benefits: APAC Insights from LinkedInExpert Views on Today's Risk Capital and Human Capital Issues

Article 3 mins

Article Template to DuplicateExpert Views on Today's Risk Capital and Human Capital Issues

Article 2 mins

Introduction: Clarity and Confidence to Act Now

Article 11 mins

Navigating a New Age of Macroeconomic Uncertainty

Article 3 mins

Making Better Decisions — A C-Suite Perspective

Article 3 mins

Understanding the Dynamics of Today’s Workforce — Reward, Retain, Evolve

Article 3 mins

Artificial Intelligence — Managing the Risk and Potential

Article 10 mins

Unlocking Balance Sheet Value to Empower Your Business Strategy

Article 3 mins

Navigating the Unpredictable: Aon’s Suite of Actionable Analytics

Article 4 mins

Redefining Risk Capital as a Business Enabler: Veolia's Innovative Approach

Article 9 mins

A Data-Driven Approach to Better Workforce Decisions

Article 5 mins

The Importance of Pay Transparency

Article 6 mins

How Human Capital Data Enhances Risk Management for Financial Institutions

Article 4 mins

The Battle for Top Talent in the Professional Services Sector

Article 5 mins

Insights on a Volatile World — Risk Factors That Businesses Need to be MonitoringBetter Decisions Across Interconnected Risk and People Issues.

Article 3 mins

Acknowledging Our Complex Reality

Article 10 mins

Trade in a Technology-Driven Future

Article 9 mins

How AI and Workforce will Intersect: Navigating Risks and Opportunities

Article 8 mins

Weather and Workforce: Employers Must Quantify the Risk

Article 9 mins

Steering Trade and Supply Chains Amid Weather Challenges

Report 13 mins

Trade Issues Confront Global Businesses on Multiple Fronts

Report 19 mins

Technology is Driving Firms to Harness Opportunities and Defend Against Threats

Report 19 mins

Climate Analytics Unlock Capital to Protect People and Property

Report 14 mins

A Workforce in Transition Prepares to Meet a Host of ChallengesThe construction industry is under pressure from interconnected risks and notable macroeconomic developments. Learn how your organization can benefit from construction insurance and risk management.

Article 8 mins

How North American Construction Contractors Can Mitigate Emerging Risks

Article 7 mins

Managing Construction Risks: 7 Risk Advisory Steps

Article 7 mins

Unlocking Capacity and Capital in a Challenging Construction Risk Market

Article 7 mins

Protecting North American Contractors from Extreme Heat Risks with Parametric

Article 5 mins

How Climate Modeling Can Mitigate Risks and Improve Resilience in the Construction Industry

Report 1 mins

Construction Risk Management Europe Report 2023

Article 8 mins

Parametric Can Help Mitigate Extreme Heat Risks for Contractors in EMEAOur Cyber Resilience collection gives you access to Aon’s latest insights on the evolving landscape of cyber threats and risk mitigation measures. Reach out to our experts to discuss how to make the right decisions to strengthen your organization’s cyber resilience.

Article 8 mins

Cyber and E&O Market Conditions Remain Favorable Amid Emerging Global Risks

Article 7 mins

How to Navigate AI-Driven Cyber Risks

Article 9 mins

Building Resilience in a Buyer-Friendly Cyber and E&O Market

Article 11 mins

A Middle Market Roadmap for Cyber Resilience

Article 7 mins

Lessons Learned from the CrowdStrike Outage: 5 Strategies to Build Cyber Resilience

Article 8 mins

Responding to Cyber Attacks: How Directors and Officers and Cyber Policies Differ

Article 6 mins

Why Now is the Right Time to Customize Cyber and E&O ContractsOur Employee Wellbeing collection gives you access to the latest insights from Aon's human capital team. You can also reach out to the team at any time for assistance with your employee wellbeing needs.

Article 8 mins

Employer Strategies for Cancer Prevention and Treatment

Article 6 mins

The Long-Term Care Conundrum in the United States

Article 9 mins

Developing a Paid Leave Strategy That Supports Workers and Their Families

Article 9 mins

4 Ways to Foster a Thriving Workforce Amid Rising Health Costs

Article 9 mins

The Next Evolution of Wellbeing is About Performance

Article 6 mins

Three Ways Collective Retirement Plans Support HR Priorities

Article 9 mins

How the Right Employee Wellbeing Strategy Impacts Microstress and Burnout at Work

Podcast 13 mins

On Aon Podcast: The Future of Healthcare: Key Factors Impacting Medical Trend Rates

Article 7 mins

Making Wellbeing Part of a Company’s DNA

Article 7 mins

A Comprehensive Approach to Financial WellbeingExplore Aon's latest environmental social and governance (ESG) insights.

Our Global Insurance Market Insights highlight insurance market trends across pricing, capacity, underwriting, limits, deductibles and coverages.

Article 12 mins

Q4 2023: Global Insurance Market Overview

Article 13 mins

Top Risk Trends to Watch in 2024Better Decisions Across Interconnected Risk and People Issues.

Report 28 mins

A New Era of Converging Risks and Accelerating Disruption

Article 1 mins

Top 10 Global Risks

Article 1 mins

Industry Insights

Article 1 mins

Regional Results

Article 41 mins

Country-Level Findings

Report 5 mins

Methodology and Respondent DemographicsHow do the top risks on business leaders’ minds differ by region and how can these risks be mitigated? Explore the regional results to learn more.

Article 12 mins

Rethinking Resilience: Addressing Asia Pacific’s Top Risks

Article 10 mins

Turning Uncertainty into Opportunity: Managing Risk in the EMEA Region

Article 10 mins

Latin America’s Risk Landscape: Turning Complexity into Competitive Advantage

Article 10 mins

Rethinking Resilience: Navigating North America’s Evolving Risk LandscapeTrade, technology, weather and workforce stability are the central forces in today’s risk landscape.

Article 6 mins

Cyber Risk: Turning Uncertainty into Opportunity

Article 7 mins

Business Interruption: Managing Risk in an Interconnected World

Article 6 mins

Why Economic Slowdown is an Ongoing Risk for Organizations

Article 8 mins

Navigating Regulatory and Legislative Change

Article 5 mins

Increasing Competition Is Intensifying Risk for Organizations

Article 7 mins

Commodity Price Risk and Material Scarcity: An Escalating and Complex Risk

Article 9 mins

Supply Chain or Distribution Failure: Navigating the New Normal

Article 5 mins

Damage to Reputation or Brand: A Critical Risk

Article 6 mins

Geopolitical Volatility: Preparing for the Unpredictable

Article 6 mins

Cash Flow and Liquidity Risk: A Rising ChallengeThese industry-specific articles explore the top risks, their underlying drivers and the actions leaders are taking to build resilience.

Article 9 mins

Building Resilience to Support Growth in Construction and Real Estate

Article 10 mins

Managing Risk and Unlocking Opportunity in the Food, Agribusiness and Beverage Industry

Article 8 mins

Adapting to Disruption: How Financial Institutions are Reframing Risk

Article 10 mins

Turning Risk into Resilience in the Industrials and Manufacturing Industry

Article 11 mins

Navigating Risk in Insurance: Turning Complexity into Competitive Advantage

Article 10 mins

Navigating Risk in Life Sciences: Building Resilience to Support Growth

Article 11 mins

Navigating Volatility in Natural Resources: Risk Management as a Value Driver

Article 10 mins

Navigating Risk in Transportation and Logistics: Gearing Up for Big Transitions

Article 9 mins

Technology, Media and Communications: Rethinking Risk in a Shifting LandscapeOur Human Capital Analytics collection gives you access to the latest insights from Aon's human capital team. Contact us to learn how Aon’s analytics capabilities helps organizations make better workforce decisions.

Article 35 mins

5 Human Resources Trends to Watch in 2025

Article 13 mins

Medical Rate Trends and Mitigation Strategies Across the Globe

Article 9 mins

3 Strategies to Help Avoid Workers Compensation Claims Litigation

Podcast 15 mins

On Aon Podcast: Using Data and Analytics to Improve Health Outcomes

Article 14 mins

How Technology Will Transform Employee Benefits in the Next Five Years

Podcast 18 mins

On Aon Podcast: Technology Impacting the Future of Health and Benefits

Article 11 mins

Designing Tomorrow: Personalizing EVP, Benefits and Total RewardsRead our collection of human capital articles that explore in depth hot topics for HR and risk professionals, including using data and analytics to measure total rewards programs, how HR and finance can better partner and the impact AI will have on the workforce.

Article 12 mins

Total Rewards Strategies That Drive Business Outcomes

Article 35 mins

5 Human Resources Trends to Watch in 2025

Article 20 mins

5 Ways HR Can Partner with Finance to Drive Growth

Article 15 mins

How Artificial Intelligence is Transforming Human Resources and the Workforce

Article 15 mins

Five Big Human Resources Trends to Watch in 2024

Article 11 mins

Designing Tomorrow: Personalizing EVP, Benefits and Total Rewards

Article 10 mins

How Data and Analytics Can Optimize HR Programs

Article 15 mins

Get Ready for the Top 5 HR Trends in 2023Explore our hand-picked insights for human resources professionals.

Article 7 mins

COVID-19 has Permanently Changed the Way We Think About Wellbeing

Article 10 mins

How Data and Analytics Can Optimize HR Programs

Article 7 mins

Case Study: The LPGA Unlocks Talent Potential with Data

Article 10 mins

Navigating the New EU Directive on Pay Transparency

Article 7 mins

Rethinking Your Total Rewards Programs During Mergers and AcquisitionsOur Workforce Collection provides access to the latest insights from Aon’s Human Capital team on topics ranging from health and benefits, retirement and talent practices. You can reach out to our team at any time to learn how we can help address emerging workforce challenges.

Article 8 mins

Weather and Workforce: Employers Must Quantify the Risk

Article 12 mins

Total Rewards Strategies That Drive Business Outcomes

Article 8 mins

AI and Workforce Skills: Who Should Act and Why Now?

Article 19 mins

3 Strategies to Promote an Inclusive Environment and Bridge the Gender Gap

Article 8 mins

2025 Salary Increase Planning Tips

Article 12 mins

People Risks Are Rising: Here’s How U.S. Benefits Are Stepping Up

Article 8 mins

Employer Strategies for Cancer Prevention and Treatment

Article 6 mins

Taking a Data-Led Approach to Job Architecture to Accelerate Pay Transparency

Podcast 12 mins

Better Being Series: Building Sustainable Performance in a Multi-Generational Workforce

Article 7 mins

Key Trends in U.S. Benefits for 2025 and Beyond

Article 7 mins

Why Pay Transparency Demands a Total Rewards Lens

Article 9 mins

4 Ways to Foster a Thriving Workforce Amid Rising Health CostsOur Mergers and Acquisitions (M&A) collection gives you access to the latest insights from Aon's thought leaders to help dealmakers make better decisions. Explore our latest insights and reach out to the team at any time for assistance with transaction challenges and opportunities.

Article 8 mins

3 Ways to Unlock M&A Value in a Challenging Credit Environment

Article 7 mins

Rethinking Your Total Rewards Programs During Mergers and Acquisitions

Article 9 mins

Organizational Design and Talent Planning are Key to M&A Success

Article 5 mins

Project Management for HR: The Secret Behind a Successful M&A Deal

Article 8 mins

Cultural Alignment Planning Drives M&A Success

Report 1 mins

A Guide to Maximizing Value in Post-Merger Integrations

Report 2 mins

The ABC's of Private Equity M&A: Deal Flow Impacts of Al, Big Tech and Climate Change

Article 11 mins

The Silver Lining on M&A Deal Clouds: M&A Insurance Insights from 2023The challenges in adopting renewable energy are changing with technological advancements, increasing market competition and numerous financial support mechanisms. Learn how your organization can benefit from our renewables solutions.

Article 4 mins

5 Steps for Successful Carbon Accounting Verification

Article 6 mins

AI Innovations in Renewable Energy: Transforming the Sector

Article 11 mins

Securing Human Capital in Natural Resources

Article 6 mins

Decarbonizing Construction for a Low-Emission FutureHow do businesses navigate their way through new forms of volatility and make decisions that protect and grow their organizations?

Our Parametric Insurance Collection provides ways your organization can benefit from this simple, straightforward and fast-paying risk transfer solution. Reach out to learn how we can help you make better decisions to manage your catastrophe exposures and near-term volatility.

Article 10 mins

How Public Entities and Businesses Can Use Parametric for Emergency Funding

Article 6 mins

Parametric Insurance: A Complement to Traditional Property Coverage

Article 8 mins

Using Parametric Insurance to Match Capital to Climate Risk

Article 6 mins

Using Parametric Insurance to Close the Earthquake Protection Gap

Article 5 mins

How Technology Enhancements are Boosting ParametricOur Pay Transparency and Equity collection gives you access to the latest insights from Aon's human capital team on topics ranging from pay equity to diversity, equity and inclusion. Contact us to learn how we can help your organization address these issues.

Article 6 mins

Taking a Data-Led Approach to Job Architecture to Accelerate Pay Transparency

Article 19 mins

3 Strategies to Promote an Inclusive Environment and Bridge the Gender Gap

Report 1 mins

The 2024 North America Pay Transparency Readiness Study

Article 10 mins

How Financial Institutions can Prepare for Pay Transparency Legislation

Article 8 mins

Pay Transparency Can Lead to Better Equity Across Benefits

Article 12 mins

Understanding and Preparing for the Rise in Pay Transparency

Podcast 14 mins

On Aon Podcast: Understanding Pay Transparency Regulations

Article 10 mins

Navigating the New EU Directive on Pay Transparency

Article 6 mins

To Disclose Pay or Not? How Companies are Approaching the Pay Transparency Movement

Podcast 19 mins

On Aon Podcast: Better Being Series Dives into Women’s Health

Article 11 mins

Advancing Women’s Health and Equity Through Benefits and SupportForecasters are predicting an extremely active 2024 Atlantic hurricane season. Take measures to build resilience to mitigate risk for hurricane-prone properties.

Article 8 mins

Florida Hurricanes Not Expected to Adversely Affect Property Market

Article 10 mins

Build Resilience for an Extremely Active Atlantic Hurricane Season

Article 4 mins

Four Steps to Develop Strong Property Risk Coverage in a Hardening Market

Podcast 16 mins

On Aon Podcast: Navigating and Preparing for Catastrophes

Article 6 mins

Parametric Insurance: A Complement to Traditional Property Coverage

Article 4 mins

Navigating Climate Risk Using Multiple Models and Data Sets

Article 5 mins

Rising Losses From Severe Convection Storms Mostly Explained by Exposure Growth

Article 6 mins

Using Parametric Insurance to Close the Earthquake Protection GapOur Technology Collection provides access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities of technology. Reach out to the team to learn how we can help you use technology to make better decisions for the future.

Article 9 mins

How AI and Workforce will Intersect: Navigating Risks and Opportunities

Article 23 mins

The AI Data Center Boom: Strategies for Sustainable Growth and Risk Management

Article 8 mins

AI and Workforce Skills: Who Should Act and Why Now?

Article 7 mins

How Technology is Transforming Open Enrollment in the U.S.

Article 15 mins

Navigating Cyber Risks in EMEA: Key Insights for 2025

Article 7 mins

How to Navigate AI-Driven Cyber Risks

Article 15 mins

How Artificial Intelligence is Transforming Human Resources and the Workforce

Podcast 9 mins

On Aon Podcast: How has CrowdStrike Changed the Cyber Market?

Article 12 mins

5 Ways Artificial Intelligence can Boost Claims Management

Article 12 mins

Navigating AI-Related Risks: A Guide for Directors and Officers

Article 5 mins

How Technology Enhancements are Boosting Parametric

Article 7 mins

How to Futureproof Data and Analytics Capabilities for ReinsurersOur Trade Collection gives you access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities for international business. Reach out to our team to understand how to make better decisions around macro trends and why they matter to businesses.

Article 10 mins

Trade in a Technology-Driven Future

Podcast 9 mins

Special Edition: Global Trade and its Impact on Supply Chain

Article 8 mins

The Evolving Threat of Cargo Theft: 5 Key Mitigation Strategies

Report 1 mins

Findings from Aon's Global Risk Management Survey | Tenth Edition

Article 4 mins

Four Steps to Develop Strong Property Risk Coverage in a Hardening Market

Article 14 mins

Cutting Supply Chains: How to Achieve More Reward with Less Risk

Article 9 mins

Driving Private Equity Value Creation Through Credit Solutions

Article 7 mins

4 Steps to Help Take Advantage of a Buyer-Friendly Directors' & Officers' Market

Article 9 mins

Managing Reputational Risks in Global Supply Chains

Article 8 mins

How an Outsourced Chief Investment Officer Can Help Improve Governance and Manage Complexity

Article 8 mins

Decarbonizing Your Business: Finding the Right Insurance and Strategy

Article 8 mins

Reputation Analytics as a Leading Indicator of ESG RiskBetter Decisions Across Interconnected Risk and People Issues.

Report 5 mins

Chapter 1: Author’s Note & Executive Summary

Report 8 mins

Chapter 2: North America: Highlights, Claims Severity and Frequency

Report 3 mins

Chapter 3: North America: Breach Type and Notification

Report 24 mins

Chapter 4: North America: Industry Sectors and Trends

Report 5 mins

Chapter 5: North America: Tax Insurance Claims

Report 5 mins

Chapter 6: EMEA: Highlights and Introduction

Report 9 mins

Chapter 7: EMEA: Claim Frequency and Metrics

Report 7 mins

Chapter 8: EMEA: Notifications by Target Location and Claims Severity and Payment Trends

Report 10 mins

Chapter 9: EMEA: Breach Types and Trends

Report 7 mins

Chapter 10: EMEA: Case Law, Insurer Survey, Claims Handling and Tax

Report 6 mins

Chapter 11: APAC: Asia

Report 9 mins

Chapter 12: APAC: PacificWith a changing climate, organizations in all sectors will need to protect their people and physical assets, reduce their carbon footprint, and invest in new solutions to thrive. Our Weather Collection provides you with critical insights to be prepared.

Article 9 mins

Steering Trade and Supply Chains Amid Weather Challenges

Podcast 9 mins

On Aon Podcast: Climate Impact on the Property and Casualty Market

Alert 14 mins

L.A. Wildfires Highlight Urgent Need for Employee Support and Business Resilience

Report 3 mins

2026 Climate and Catastrophe Insight

Article 10 mins

How Public Entities and Businesses Can Use Parametric for Emergency Funding

Podcast 12 mins

On Aon Podcast: Tackling Climate Risk to Build Economic Resilience

Article 8 mins

Understanding Freeze Risk in a Changing Climate

Podcast 9 mins

On Aon Podcast: Climate Science Through Academic Collaboration

Article 6 mins

How Companies Are Using Climate Modeling to Improve Risk Decisions

Article 8 mins

Using Parametric Insurance to Match Capital to Climate Risk

Article 9 mins

Record Heatwaves: Protecting Employee Health and SafetyOur Workforce Resilience collection gives you access to the latest insights from Aon's Human Capital team. You can reach out to the team at any time for questions about how we can assess gaps and help build a more resilience workforce.

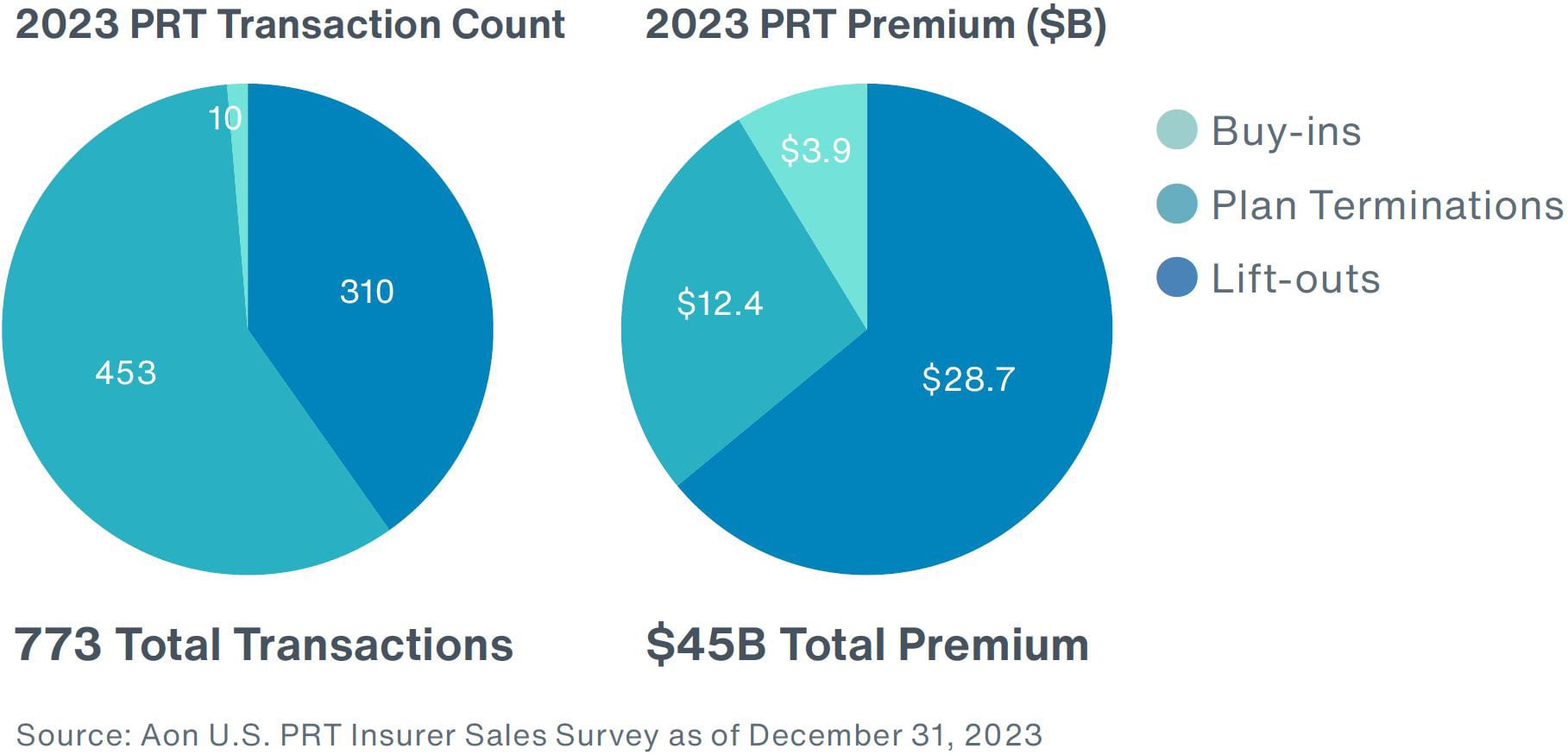

According to Aon’s U.S. Pension Risk Transfer (PRT) report, after setting record highs for total premium in 2021 and 2022, the market set a new high-water mark for the total number of transactions in 2023 with 773 deals closing during the calendar year. These transactions resulted in $45 billion of premium transferred. Since 2012, $318 billion of pension obligations have transferred from plan sponsors to insurance companies.

In 2023, there were 773 PRT transactions totaling $45 billion in premium - this includes buy-outs, either as a lift-out or plan termination, and buy-ins. Plan terminations led the transaction count with 453, but it was a record year for all deal types. From a premium perspective, lift-outs drove the total premium with $28.7B, which is consistent with past years.

Capability Overview

Pension Risk Transfer

Capability Overview

Pensions and Retirement

Capability Overview

Risk Transfer

Aon’s position as a leader in PRT — working with plan sponsors, independent fiduciaries, and insurers — provides us with deep insight into the market. We are delighted to share our expertise with you.

Ready to Explore Further?

Sign up to receive updates on the latest events, insights, news and more from our team.

You will soon receive an email to verify your email address. Please click on the link included in this note to complete the subscription process, which also includes providing consent in applicable locations and an opportunity to manage your email preferences.

Article

Article

Your request is being reviewed so we can align you to the best resources on our team. In the meantime, we invite you to explore some of our latest insights below.

Article

Article

If you encounter an issue, use the link below to start a new download.

Access Content