Breaking Down Health and Wellbeing Barriers

To address the workforce health challenges that can lead to poor on-the-job performance, employers are taking an

intentional approach to understanding key barriers to health and wellbeing. There are three targeted strategies that

can help improve affordability and health equity.

1. Aligning Employee Affordability

Employers are improving affordability by focusing on foundational care, including primary care, mental health and

prescription drugs. Nearly half (47 percent) of employers are offering or plan to offer low-cost primary care

services, such as plan design with low copays or waived deductibles. Sixty-two percent are focused on improving

prescription drug affordability, while 65 percent offer or are considering digital tools and self-guided resources

to support emotional wellbeing. Additionally, 35 percent have expanded or are evaluating benefits for employees with

disabilities, such as hearing aids and assistive devices.

These efforts reflect a broader commitment to more cost-effective healthcare benefits.

2. Removing Barriers to Health

Employers are taking meaningful steps to break down systemic barriers to individual health and wellbeing. These

challenges can come in the form of personal circumstances or plan design limitations that make it difficult for

employees and their families to take care of their health.

Employees with caregiving responsibilities often struggle to find time for their own

healthcare needs. Half of employers offer or are considering paid caregiver leave. What’s more, Aon research shows

that 23 percent of employees live in areas with high social determinants of health (SDoH), such as economic

instability, food insecurity and poor access to healthcare services. Nearly half (43 percent) of employers are

offering or considering benefits that address SDoH.

Plan design can also be a barrier to individuals receiving

the care they need. For example, out-of-pocket expenses for cancer diagnostic

services can prevent individuals from following up on cancer screenings that

reveal potential problems. Looking ahead, 40 percent of employers are offering

or considering full coverage for cancer diagnostic services, along with greater

access to screenings, personalized medicine and navigation support.

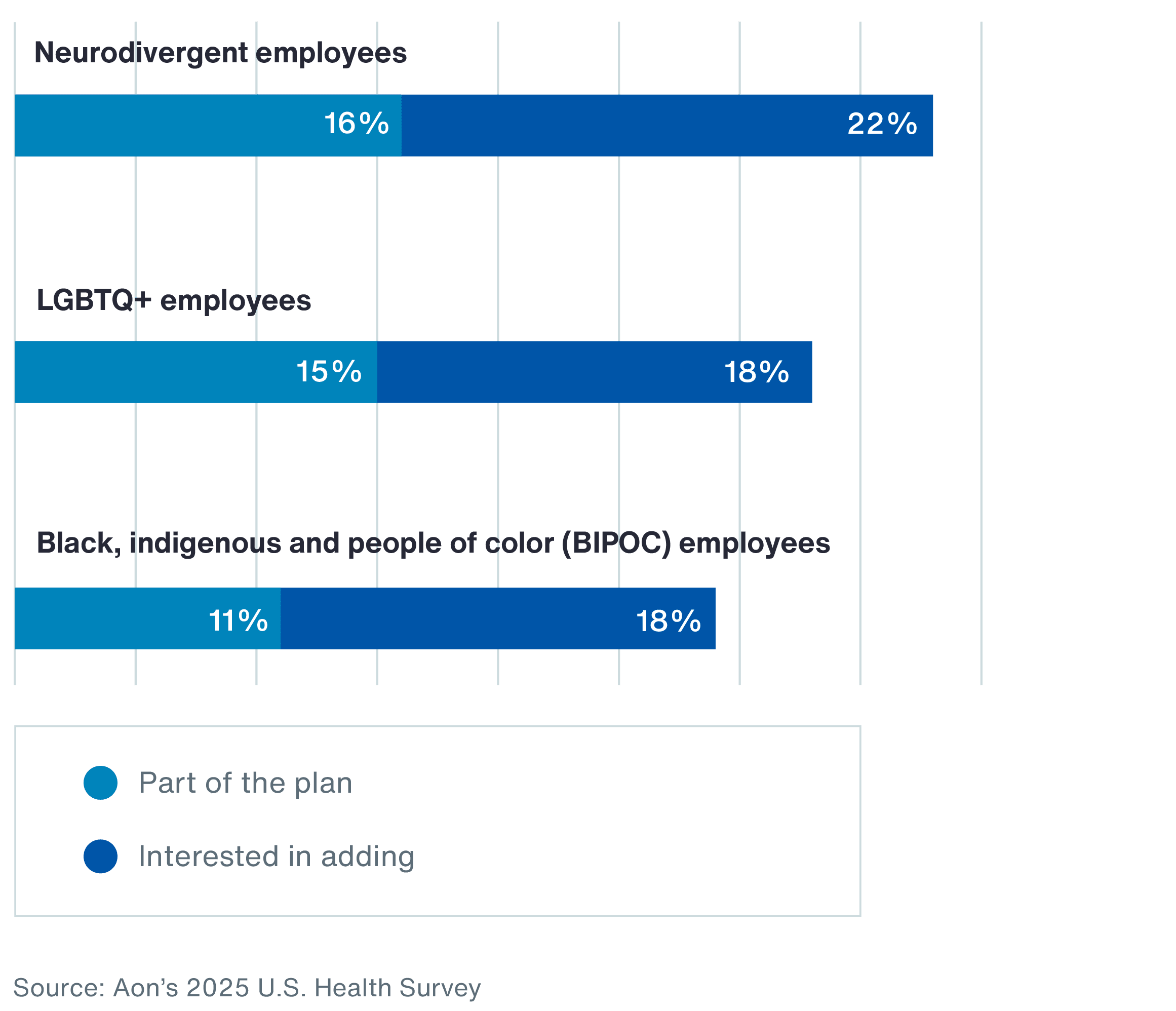

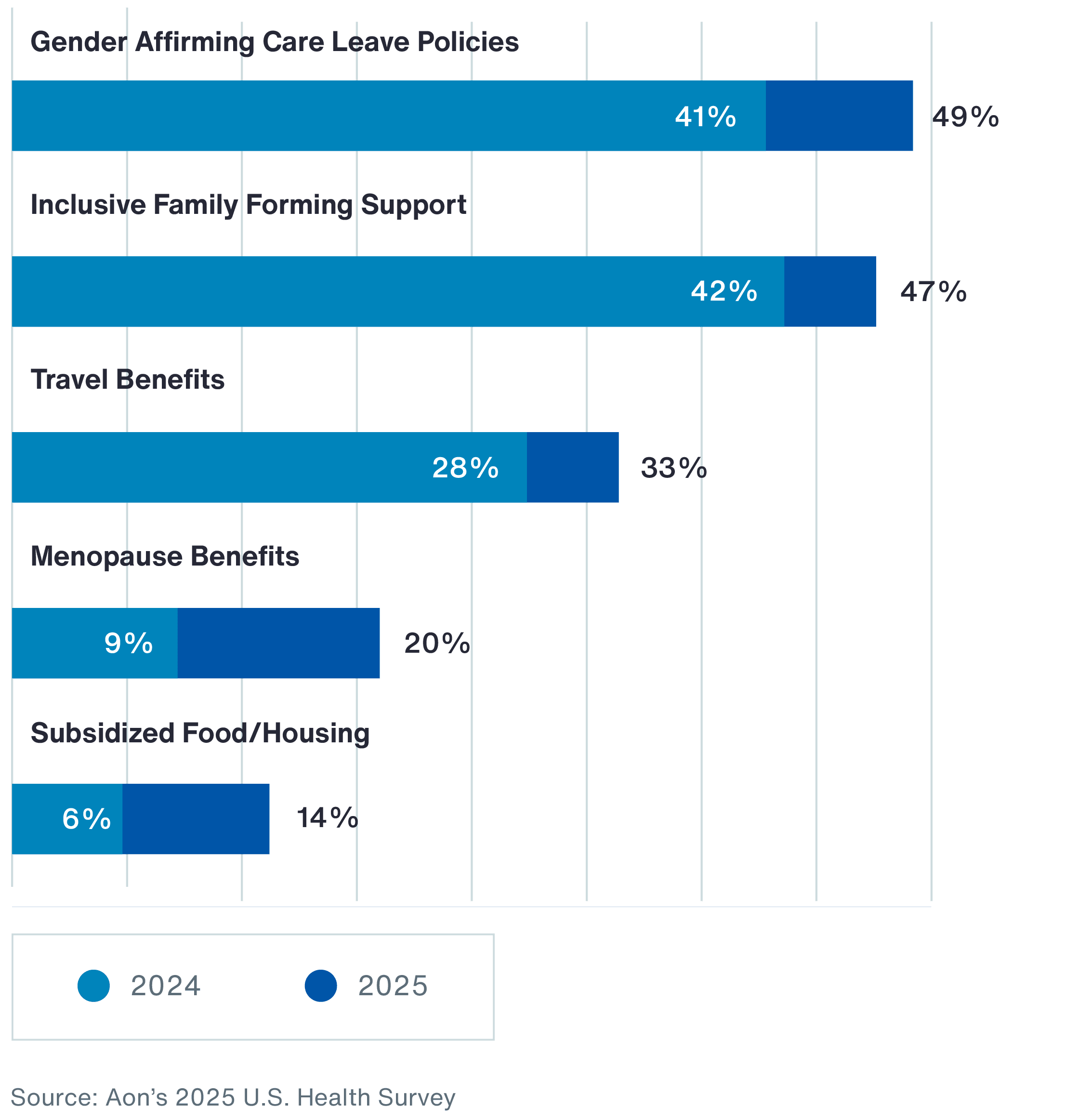

3. Scaling Specialized Care Access

Access to care can be a challenge for individuals with specialized healthcare needs. Many employers are taking action

by offering more inclusive and supportive care to different communities. For example, more employers are expanding

specialized care for neurodivergent, LGBTQ+, and black, indigenous and people of color (BIPOC) populations.

Chart 4: Employers Offering or Considering Specialized Care and Support for the Following Groups