How Insurers are Turning Risk Exposure into Resilience Advantage

As climate volatility escalates, insurers face a critical inflection point. Traditional responses like hiking premiums and cutting coverage are no longer enough. A new resilience strategy is emerging to drive growth, restore trust and strengthen client partnerships.

Key Takeaways

-

Insurers must shift from a reactive, post-loss mindset to a proactive one — by applying forward-looking climate data, analytics, loss mitigation and product innovation into strategic underwriting and operational decision-making.

-

Investing in resilience enables insurers to reduce volatility, strengthen customer relationships and capture new market opportunities.

-

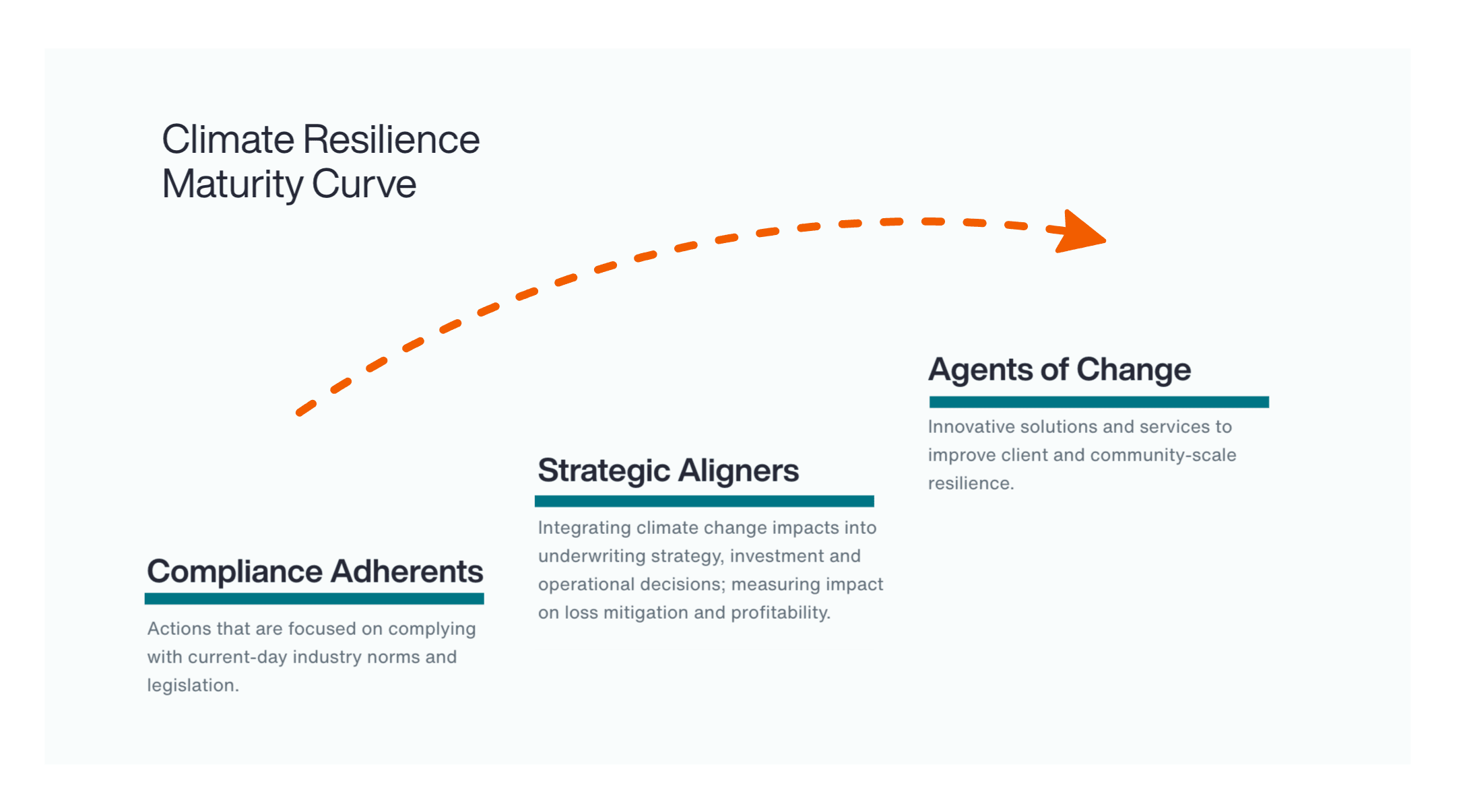

The Climate Resilience Maturity Curve helps insurers assess their current capabilities and identify targeted actions to improve resilience and drive profitable growth.

For insurers, the cost of inaction is no longer theoretical — it’s a direct threat to portfolios, profitability and long-term relevance.

Traditional responses like raising premiums or withdrawing from high-risk areas are no longer sustainable. Insurers must take a more proactive role — developing innovative products, sharing data, and using risk capital to unlock investment in pre-loss mitigation. This shift is not just about protecting balance sheets; it’s about enabling clients and communities to withstand future shocks and avoid escalating losses as environmental pressures intensify.

The consequences of inaction extend beyond the insurance sector. Falling property values, reduced access to financing, population displacement and weakened municipal creditworthiness all contribute to broader economic instability. But who pays for resilience? As governments scale back their financial support for disaster recovery, the private sector — and insurers in particular — are being called on to step in and help fund resilience.

Insurers have an opportunity to lead. By enabling upfront mitigation through data, capital and product innovation, they can restore trust, strengthen long-term relationships and redefine how resilience is built and financed. Those who act early will not only protect portfolios — they’ll shape the future of insurability.

Beyond the Weather: What’s Really Driving Rising Losses

Natural catastrophe losses are well documented and continue to climb — and insurers are absorbing more of the strain. In the first half of 2025 alone, global events pushed economic and insured losses well above historical averages. But climate volatility isn’t the only driver. External and industry-specific challenges are compounding exposures and intensifying pressure across portfolios.

External Pressures Intensifying Portfolio Risk

-

Inflationary Strain

Rising costs for materials, labour and logistics are increasing claims severity and challenging pricing adequacy.

-

Urban Density Risk

Population growth and urbanization are concentrating exposures — amplifying loss potential from extreme weather events.

-

Infrastructure Lag

Ageing systems are failing under climate stress, compounding losses and disrupting recovery.

-

Erosion of Natural Buffers

Development on floodplains and coastal zones is removing natural defences, increasing vulnerability.

-

Outdated Resilience Standards

Building codes and voluntary guidelines lag behind climate realities — despite resilient construction for new assets often costing the same.

Industry-Specific Challenges for Insurers

-

Claims Escalation and Financial Pressure

Surging claims are testing capital reserves and long-term solvency strategies.

-

Underwriting Gaps

Legacy models fall short in assessing future climate risk. Forward-looking analytics are needed to identify exposures and reward mitigation.

-

Capacity Retraction Risks

Withdrawing from high-risk areas may protect short-term margins but risks market share, reputation and long-term relevance.

-

Innovation Imperative

Insurers must evolve products to incentivize loss mitigation and support recovery.

-

Trust Deficit

Coverage withdrawals and claims disputes are eroding public confidence. Legislative pressure is mounting for broader coverage and proactive loss prevention.

Plotting A Path to Resilience

Building resilience is a shared responsibility. Local and national governments must future-proof building codes, planning and approval processes to reflect climate realties. Meanwhile, businesses should start to assess current and future exposures — and embed mitigation into operations. Homeowners have a role to play too, by maintaining properties and investing in protective upgrades – for example strengthening roofs to withstand severe convective storms.

For insurers, the opportunity is to move from strategic intent to operational impact.

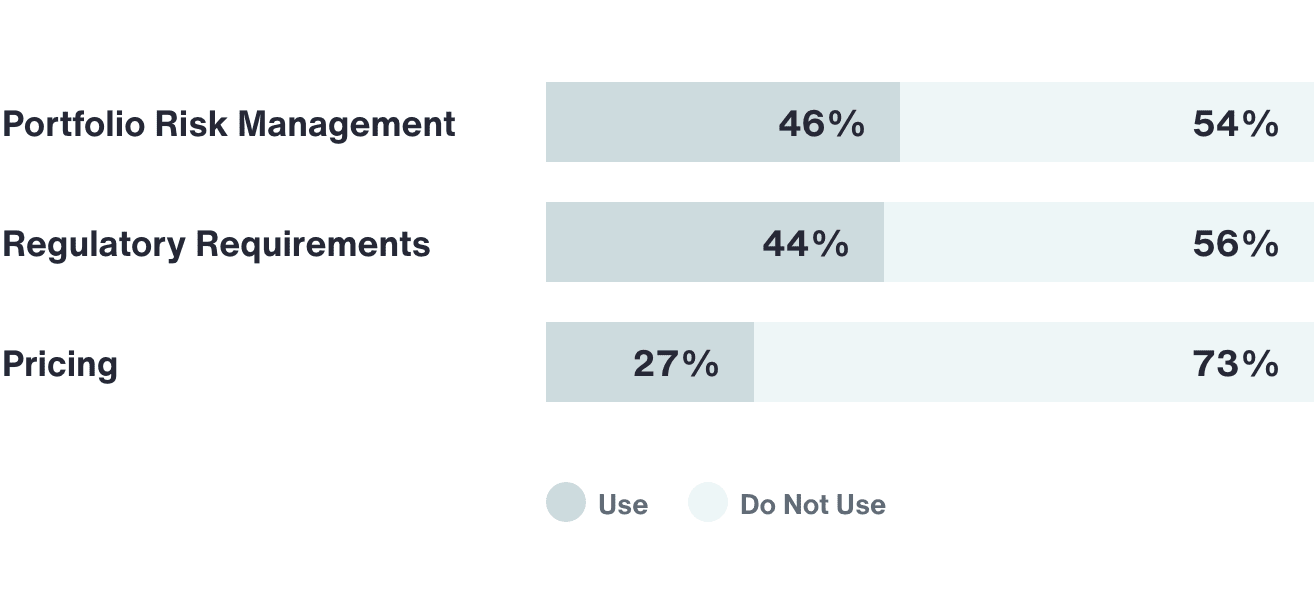

According to Aon’s 2025 Catastrophe Risk Management Survey, 68 percent of insurers are seeking improved methods to integrate climate change impacts in their view of risk for internal capital management. Portfolio risk management and regulatory requirements are the motivation for most respondents to reflect climate change in their view of risk, with fewer applying it in their pricing.

Where Climate Change is Considered in Catastrophe Models

Climate volatility is accelerating and the financial toll is mounting. Without adaptation to worsening extreme weather, large corporations alone face projected losses of $1.2 trillion annually by the 2050s.

By enabling pre-loss mitigation, partnering with clients on resilience strategies and embedding climate analytics into underwriting, insurers can reduce volatility, restore trust and unlock new growth. But the journey isn’t uniform. Each organization faces distinct challenges — and must begin by understanding its current level of readiness.

Where Do You Sit on the Climate Resilience Maturity Curve?

The Climate Resilience Maturity Curve helps insurers assess their current level of commitment to climate resilience — and identify the next steps to evolve their strategy. It categorizes insurers into three distinct profiles:

-

Compliance Adherents

These insurers focus on meeting minimum regulatory requirements and industry norms. Their actions are often reactive — aimed at avoiding penalties rather than actively managing climate risk.

Example in Practice: In Colorado, HB25-1182 requires insurers using risk models to price wildfire and catastrophe risk to disclose how those models affect individual policies. It also mandates recognition of policyholder mitigation efforts, transparent discount programs, and a formal appeals process for risk classification.

-

Strategic Aligners

These insurers embed resilience into existing services and begin to measure its impact. They integrate forward-looking climate risk assessments into underwriting and develop mitigation strategies that enhance their value proposition.

What Sets Them Apart: Strategic Aligners move beyond compliance to align resilience with business goals — improving client outcomes and operational performance.

-

Agents of Change

These are market leaders driving resilience innovation. They invest in advanced analytics, technology and partnerships to reduce losses, deepen client engagement and grow market share.

Market Influence: Agents of Change often shape industry standards — setting benchmarks and accelerating the shift toward proactive climate risk management.

From Reflection to Action: Navigating the Maturity Curve

To move along the Climate Resilience Maturity Curve, insurers must first understand where they stand — and where they want to go. The following framework helps organizations assess their current approach and identify opportunities to evolve.

- Strategic Intent

What are we aiming to achieve?

Are we meeting regulatory requirements, aligning with business objectives or leading the market?

What is our long-term vision for climate loss mitigation?

How can our existing offerings better support that vision? - Organizational Ownership

Who in the organization is driving our climate resilience strategy?

Is it embedded across teams or siloed within compliance?

Do we treat resilience as a compliance task — or a driver of profitability and innovation? - Operational Integration

How aligned are our resilience measures with our overall business strategy?

Are we integrating climate analytics into underwriting, pricing and product development?

What solutions are we currently deploying to mitigate climate-related losses? - Measurement and Impact

What does success look like?

Is it basic compliance, improved service and risk management, or market leadership?

What KPIs do we use to measure effectiveness?

Are we tracking outcomes that matter to clients, regulators and shareholders? - Innovation Appetite

Is there appetite for new product innovation to boost client resilience?

Are we exploring parametric solutions, multi-year policies or build-back-better endorsements?

Turning Insight into Action: Prioritizing and Embedding Resilience

Once they have plotted their place — and path — on the Climate Resilience Maturity Curve, insurers will need to prioritize their resilience measures and balance the investment needed with potential impact.

The most effective approaches strike a balance between pre- and post-loss mitigation. They strengthen resilience, reduce volatility, enhance financial performance and deepen client relationships — all while supporting the broader communities that insurers serve.

To do this well, insurers must move beyond reactive measures and embed forward-looking climate data and analytics into their core operations. The wealth of hazard risk data already collected — when paired with AI-driven forecasting models — can help insurers and their clients better understand, price and manage vulnerabilities to extreme weather.

The business case is clear:

- Transforming Insight into Impact: By identifying effective mitigation strategies, enabling cost-effective risk transfer, and supporting accurate pricing, insurers turn resilience from a strategic ambition into a competitive advantage.

- Driving Customer Loyalty and Stability: Improving insurability and helping clients manage risk builds trust, reduces churn, and improves financial performance.

- Unlocking Growth and Market Leadership: Innovative climate-focused products and underwriting practices open new market segments, boost reputation, and position insurers as forward-thinking leaders in the society.

Resilience as a Strategic Advantage

The insurance industry is at a turning point. As climate volatility intensifies, resilience is emerging as a core differentiator for insurers — shaping how risk is managed, relationships are built and growth is achieved.

But the opportunity extends beyond individual success. By collaborating across the sector — sharing data, aligning on standards and enabling proactive risk management — insurers can help close the protection gap and build a more insurable future.

Resilience is not just about reducing losses. It’s about driving relevance, restoring trust and shaping the next era of insurance. Those who embed resilience into their core strategy will not only navigate disruption — they’ll lead the transformation.

General Disclaimer

This document is not intended to address any specific situation or to provide legal, regulatory, financial, or other advice. While care has been taken in the production of this document, Aon does not warrant, represent or guarantee the accuracy, adequacy, completeness or fitness for any purpose of the document or any part of it and can accept no liability for any loss incurred in any way by any person who may rely on it. Any recipient shall be responsible for the use to which it puts this document. This document has been compiled using information available to us up to its date of publication and is subject to any qualifications made in the document.

Terms of Use

The contents herein may not be reproduced, reused, reprinted or redistributed without the expressed written consent of Aon, unless otherwise authorized by Aon. To use information contained herein, please write to our team.

Aon's Better Being Podcast

Our Better Being podcast series, hosted by Aon Chief Wellbeing Officer Rachel Fellowes, explores wellbeing strategies and resilience. This season we cover human sustainability, kindness in the workplace, how to measure wellbeing, managing grief and more.

Aon Insights Series Asia

Expert Views on Today's Risk Capital and Human Capital Issues

Aon Insights Series Pacific

Expert Views on Today's Risk Capital and Human Capital Issues

Aon Insights Series UK

Expert Views on Today's Risk Capital and Human Capital Issues

Client Trends 2025

Better Decisions Across Interconnected Risk and People Issues.

Construction and Infrastructure

The construction industry is under pressure from interconnected risks and notable macroeconomic developments. Learn how your organization can benefit from construction insurance and risk management.

Cyber Resilience

Our Cyber Resilience collection gives you access to Aon’s latest insights on the evolving landscape of cyber threats and risk mitigation measures. Reach out to our experts to discuss how to make the right decisions to strengthen your organization’s cyber resilience.

Employee Wellbeing

Our Employee Wellbeing collection gives you access to the latest insights from Aon's human capital team. You can also reach out to the team at any time for assistance with your employee wellbeing needs.

Environmental, Social and Governance Insights

Explore Aon's latest environmental social and governance (ESG) insights.

Q4 2023 Global Insurance Market Insights

Our Global Insurance Market Insights highlight insurance market trends across pricing, capacity, underwriting, limits, deductibles and coverages.

Global Risk Management Survey

Better Decisions Across Interconnected Risk and People Issues.

Regional Results

How do the top risks on business leaders’ minds differ by region and how can these risks be mitigated? Explore the regional results to learn more.

Top 10 Global Risks

Trade, technology, weather and workforce stability are the central forces in today’s risk landscape.

Industry Insights

These industry-specific articles explore the top risks, their underlying drivers and the actions leaders are taking to build resilience.

Human Capital Analytics

Our Human Capital Analytics collection gives you access to the latest insights from Aon's human capital team. Contact us to learn how Aon’s analytics capabilities helps organizations make better workforce decisions.

Human Capital Quarterly Insights Briefs

Read our collection of human capital articles that explore in depth hot topics for HR and risk professionals, including using data and analytics to measure total rewards programs, how HR and finance can better partner and the impact AI will have on the workforce.

Insights for HR

Explore our hand-picked insights for human resources professionals.

Workforce

Our Workforce Collection provides access to the latest insights from Aon’s Human Capital team on topics ranging from health and benefits, retirement and talent practices. You can reach out to our team at any time to learn how we can help address emerging workforce challenges.

Mergers and Acquisitions

Our Mergers and Acquisitions (M&A) collection gives you access to the latest insights from Aon's thought leaders to help dealmakers make better decisions. Explore our latest insights and reach out to the team at any time for assistance with transaction challenges and opportunities.

Natural Resources and Energy Transition

The challenges in adopting renewable energy are changing with technological advancements, increasing market competition and numerous financial support mechanisms. Learn how your organization can benefit from our renewables solutions.

Navigating Volatility

How do businesses navigate their way through new forms of volatility and make decisions that protect and grow their organizations?

Parametric Insurance

Our Parametric Insurance Collection provides ways your organization can benefit from this simple, straightforward and fast-paying risk transfer solution. Reach out to learn how we can help you make better decisions to manage your catastrophe exposures and near-term volatility.

Pay Transparency and Equity

Our Pay Transparency and Equity collection gives you access to the latest insights from Aon's human capital team on topics ranging from pay equity to diversity, equity and inclusion. Contact us to learn how we can help your organization address these issues.

Property Risk Management

Forecasters are predicting an extremely active 2024 Atlantic hurricane season. Take measures to build resilience to mitigate risk for hurricane-prone properties.

Technology

Our Technology Collection provides access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities of technology. Reach out to the team to learn how we can help you use technology to make better decisions for the future.

Trade

Our Trade Collection gives you access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities for international business. Reach out to our team to understand how to make better decisions around macro trends and why they matter to businesses.

Transaction Solutions Global Claims Study

Better Decisions Across Interconnected Risk and People Issues.

Weather

With a changing climate, organizations in all sectors will need to protect their people and physical assets, reduce their carbon footprint, and invest in new solutions to thrive. Our Weather Collection provides you with critical insights to be prepared.

Workforce Resilience

Our Workforce Resilience collection gives you access to the latest insights from Aon's Human Capital team. You can reach out to the team at any time for questions about how we can assess gaps and help build a more resilience workforce.

More Like This

-

Article 6 mins

Strategies for Closing the Gender Retirement Pay Gap

Addressing the retirement pay gap issue between men and women starts with first acknowledging it exists. Then companies can conduct further analysis and adjust their benefit plans accordingly.

-

Article 8 mins

How AI, Cost Pressures and Reskilling are Transforming Talent Strategies

AI acceleration, rising healthcare costs and changes to workforce skills are transforming organizations. Our analysis of financial services, life sciences and technology companies provides insights on how to redesign roles, reskill at scale and reimagine talent strategies to stay competitive.

-

Article 10 mins

Industrials and Manufacturing: A Risk Management Approach to Transform Workforce Risk into Workforce Resilience

Workforce-related risks — spanning health, benefits, safety systems, and data and analytics — are not just operational concerns but strategic drivers. When activated, they positively shape the total cost of risk and long-term resilience for industrials and manufacturing organizations.