More Like This

-

Product / Service

Property Risk Management

-

Insights

Weather

-

Article

5 Ways to Position Risk Capital as a Value Driver

This article is the first in a three-part series exploring property risk mitigation strategies in the current market.

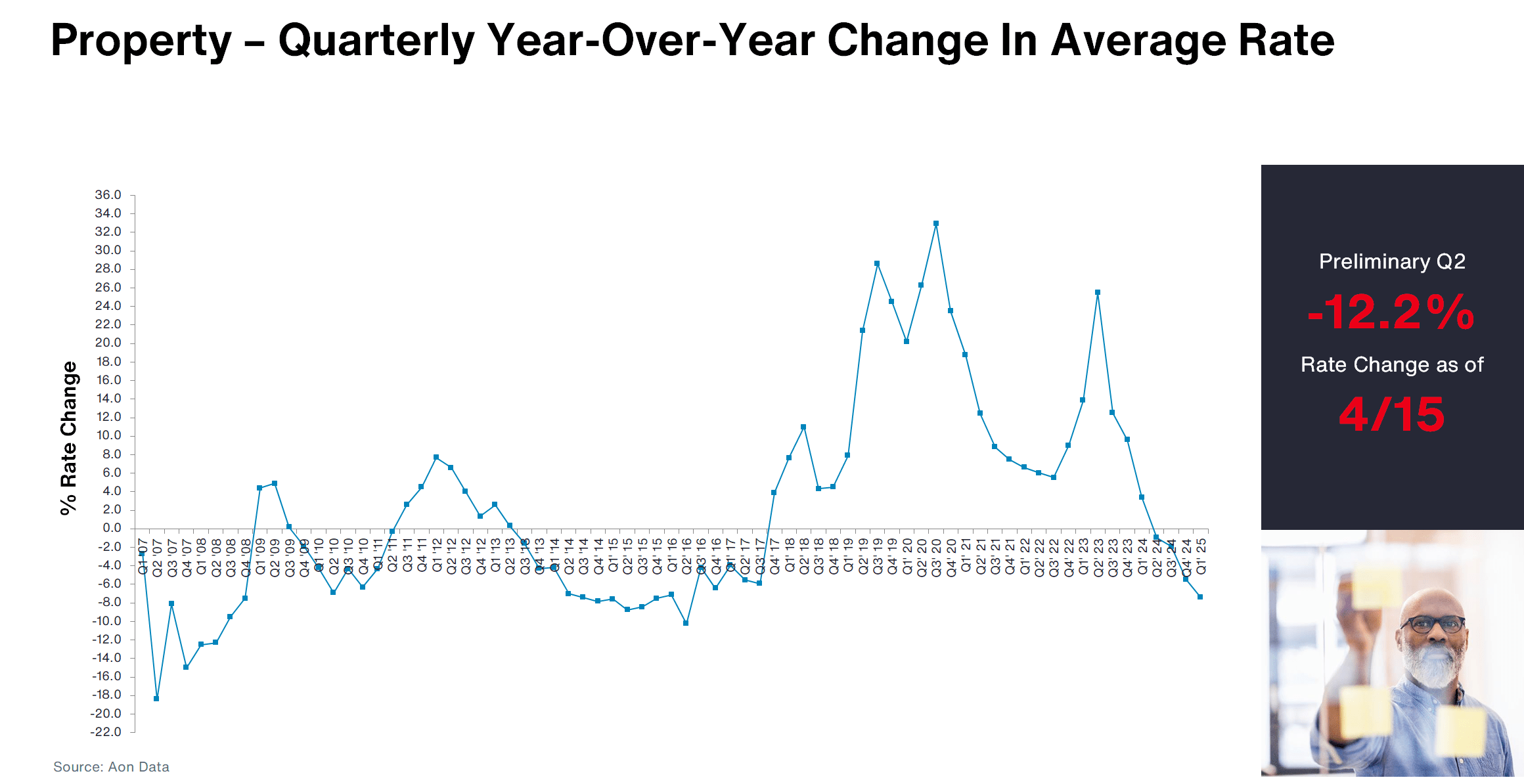

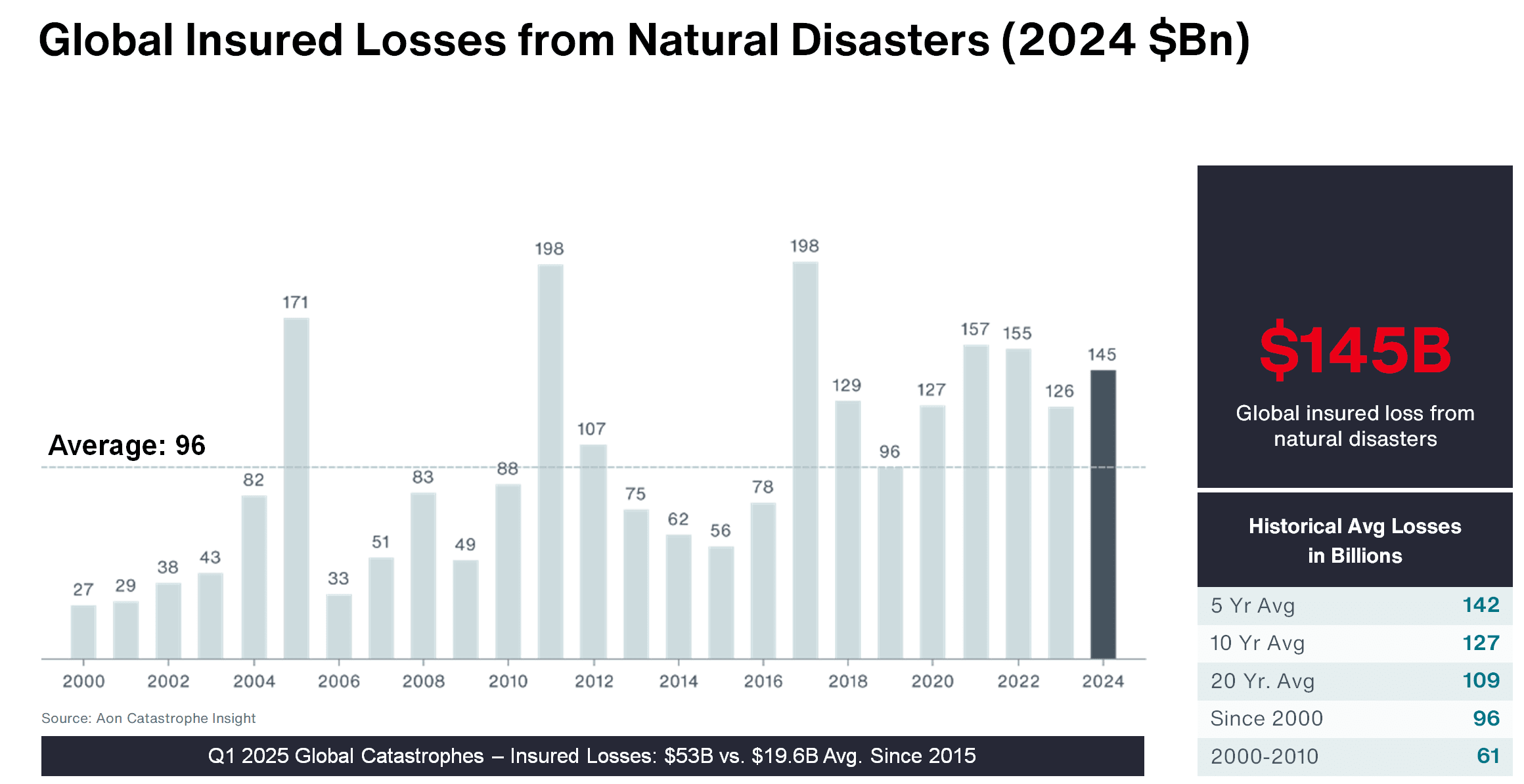

Despite steady growth in both the frequency and severity of global insured losses from natural catastrophes (nat cat), there is a trading window in the global property sector that has remained favorable for buyers.

Product / Service

Property Risk Management

Insights

Weather

Article

5 Ways to Position Risk Capital as a Value Driver

Over time, many variables could put pressure on rates, including an increase in nat cat losses, population growth in nat cat-prone areas, inflation and tariffs potentially increasing replacement cost and driving up losses.

“Buyers are benefiting from the softening market as insurers allocate additional capital to write more property insurance, given both the current rate environment and unprofitability of some other lines,” says Vincent Flood, head of property in North America.

However, as rates continue to decline in 2025, he warns that the market could be just one significant cat event away from a turn.

“Accounts renewing in Q3 or Q4 need to hope for a benign wind season,” adds Flood. “Absent an event, the soft market will continue to accelerate, with renewals reaping the benefit of a year-end push by insurers to hit growth targets.”

Pre-renewal strategies to negotiate better property renewals using risk analytics and modeling are essential to boost resilience. “Strengthen programs now to future-proof against market changes,” says Sean Rider, head of Risk Analytics in North America. “Focus on modern quantitative analytics to maximize resilience.”

While the current buyer-friendly property market provides some respite for risk managers, it can also obscure emerging risks and concerns that could confront risk managers in the long term.

Average decline of U.S. property rates in Q1 2025.

Source: Aon’s Q2 2025 Property Market Dynamics Report

01

The costliest peril is tropical cyclones. Secondary perils are also growing: There have been $1 trillion in losses since 2000 for earthquakes, severe convective storms and droughts.

Source: Aon's 2025 Climate and Catastrophe Insight

02

2024 insured losses reached $145 billion (slightly above the five-year average). Losses in 2000 were at $27 billion.

Source: Aon's 2025 Climate and Catastrophe Insight

03

Of the top 15 growing U.S. cities, nine are in Texas and Florida, putting more people and insured values at risk.

Source: U.S. Census Bureau

04

Global geopolitical trade pressures and tariffs have caused tensions and pressures for businesses and their supply chains. Risk managers must consider the potential effects on risk exposure.

“Now is not the time to introduce more volatility by reducing limits or think of risk in a more aggressive way,” adds Rider. “This is an opportunity to take advantage of the market by introducing more resilience.”

Talk to our experts about how to best navigate a soft property market while protecting your business and building resilience.

General Disclaimer

This document is not intended to address any specific situation or to provide legal, regulatory, financial, or other advice. While care has been taken in the production of this document, Aon does not warrant, represent or guarantee the accuracy, adequacy, completeness or fitness for any purpose of the document or any part of it and can accept no liability for any loss incurred in any way by any person who may rely on it. Any recipient shall be responsible for the use to which it puts this document. This document has been compiled using information available to us up to its date of publication and is subject to any qualifications made in the document.

Terms of Use

The contents herein may not be reproduced, reused, reprinted or redistributed without the expressed written consent of Aon, unless otherwise authorized by Aon. To use information contained herein, please write to our team.

Our Better Being podcast series, hosted by Aon Chief Wellbeing Officer Rachel Fellowes, explores wellbeing strategies and resilience. This season we cover human sustainability, kindness in the workplace, how to measure wellbeing, managing grief and more.

Expert Views on Today's Risk Capital and Human Capital Issues

Expert Views on Today's Risk Capital and Human Capital Issues

Expert Views on Today's Risk Capital and Human Capital Issues

Better Decisions Across Interconnected Risk and People Issues.

The construction industry is under pressure from interconnected risks and notable macroeconomic developments. Learn how your organization can benefit from construction insurance and risk management.

Our Cyber Resilience collection gives you access to Aon’s latest insights on the evolving landscape of cyber threats and risk mitigation measures. Reach out to our experts to discuss how to make the right decisions to strengthen your organization’s cyber resilience.

Our Employee Wellbeing collection gives you access to the latest insights from Aon's human capital team. You can also reach out to the team at any time for assistance with your employee wellbeing needs.

Explore Aon's latest environmental social and governance (ESG) insights.

Our Global Insurance Market Insights highlight insurance market trends across pricing, capacity, underwriting, limits, deductibles and coverages.

Better Decisions Across Interconnected Risk and People Issues.

How do the top risks on business leaders’ minds differ by region and how can these risks be mitigated? Explore the regional results to learn more.

Trade, technology, weather and workforce stability are the central forces in today’s risk landscape.

These industry-specific articles explore the top risks, their underlying drivers and the actions leaders are taking to build resilience.

Our Human Capital Analytics collection gives you access to the latest insights from Aon's human capital team. Contact us to learn how Aon’s analytics capabilities helps organizations make better workforce decisions.

Read our collection of human capital articles that explore in depth hot topics for HR and risk professionals, including using data and analytics to measure total rewards programs, how HR and finance can better partner and the impact AI will have on the workforce.

Explore our hand-picked insights for human resources professionals.

Our Workforce Collection provides access to the latest insights from Aon’s Human Capital team on topics ranging from health and benefits, retirement and talent practices. You can reach out to our team at any time to learn how we can help address emerging workforce challenges.

Our Mergers and Acquisitions (M&A) collection gives you access to the latest insights from Aon's thought leaders to help dealmakers make better decisions. Explore our latest insights and reach out to the team at any time for assistance with transaction challenges and opportunities.

The challenges in adopting renewable energy are changing with technological advancements, increasing market competition and numerous financial support mechanisms. Learn how your organization can benefit from our renewables solutions.

How do businesses navigate their way through new forms of volatility and make decisions that protect and grow their organizations?

Our Parametric Insurance Collection provides ways your organization can benefit from this simple, straightforward and fast-paying risk transfer solution. Reach out to learn how we can help you make better decisions to manage your catastrophe exposures and near-term volatility.

Our Pay Transparency and Equity collection gives you access to the latest insights from Aon's human capital team on topics ranging from pay equity to diversity, equity and inclusion. Contact us to learn how we can help your organization address these issues.

Forecasters are predicting an extremely active 2024 Atlantic hurricane season. Take measures to build resilience to mitigate risk for hurricane-prone properties.

Our Technology Collection provides access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities of technology. Reach out to the team to learn how we can help you use technology to make better decisions for the future.

Our Trade Collection gives you access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities for international business. Reach out to our team to understand how to make better decisions around macro trends and why they matter to businesses.

Better Decisions Across Interconnected Risk and People Issues.

With a changing climate, organizations in all sectors will need to protect their people and physical assets, reduce their carbon footprint, and invest in new solutions to thrive. Our Weather Collection provides you with critical insights to be prepared.

Our Workforce Resilience collection gives you access to the latest insights from Aon's Human Capital team. You can reach out to the team at any time for questions about how we can assess gaps and help build a more resilience workforce.

Article 6 mins

Addressing the retirement pay gap issue between men and women starts with first acknowledging it exists. Then companies can conduct further analysis and adjust their benefit plans accordingly.

Article 8 mins

AI acceleration, rising healthcare costs and changes to workforce skills are transforming organizations. Our analysis of financial services, life sciences and technology companies provides insights on how to redesign roles, reskill at scale and reimagine talent strategies to stay competitive.

Article 10 mins

Workforce-related risks — spanning health, benefits, safety systems, and data and analytics — are not just operational concerns but strategic drivers. When activated, they positively shape the total cost of risk and long-term resilience for industrials and manufacturing organizations.