More Like This

-

Podcast

On Aon Podcast: Resilience and the Rising Stakes of Cyber Risk

-

Insights

Technology

-

Capability Overview

Cyber Risk

Cyber and tech errors and omissions (E&O) risks continue to evolve — not just in frequency, but in complexity. As threat actors adopt new tactics, insurers are adjusting their stance and early signs of market moderation are emerging. For risk leaders, the challenge is no longer just managing volatility, but anticipating how the risk environment will shape coverage decisions ahead.

Cyber risk continues to dominate the global risk agenda. Aon’s 2025 Global Risk Management Survey confirms that cyber attacks and data breaches remain the top concern for business and risk leaders worldwide. The rapid adoption of artificial intelligence (AI) and digital platforms is reshaping cyber risk — introducing new efficiencies, but also new vulnerabilities. These shifts are already influencing insurer behavior and underwriting scrutiny.

With pricing still favorable, risk managers have an opportunity to stay ahead of emerging threats. Aon recommends reinvesting capital to strengthen cyber controls and expanding cyber liability and E&O program limits now to prepare for the future.

Podcast

On Aon Podcast: Resilience and the Rising Stakes of Cyber Risk

Insights

Technology

Capability Overview

Cyber Risk

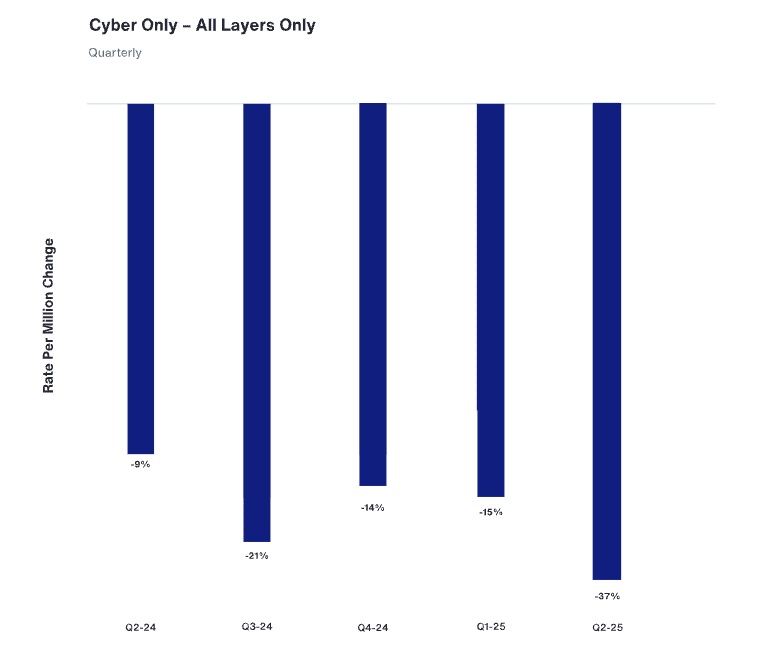

Cyber: Buyer-friendly pricing continues across North America and Europe, Middle East and Africa (EMEA), supported by low loss ratios and a well-capitalized marketplace. In North America, price reductions are slowing — with moderation beginning to take hold. In the EMEA region, competitive pressures are keeping rates soft, though insurers are increasingly advocating for firmer pricing.

Tech E&O: Globally, tech E&O pricing continues to stabilize. Through the first half of 2025, average global premium changes remained flat, driven by a 2% increase in primary layers and a 2% decrease in the first excess layer. Buyers continue to optimize their programs by expanding coverage, increasing limits and adjusting retention levels according to their risk tolerance.

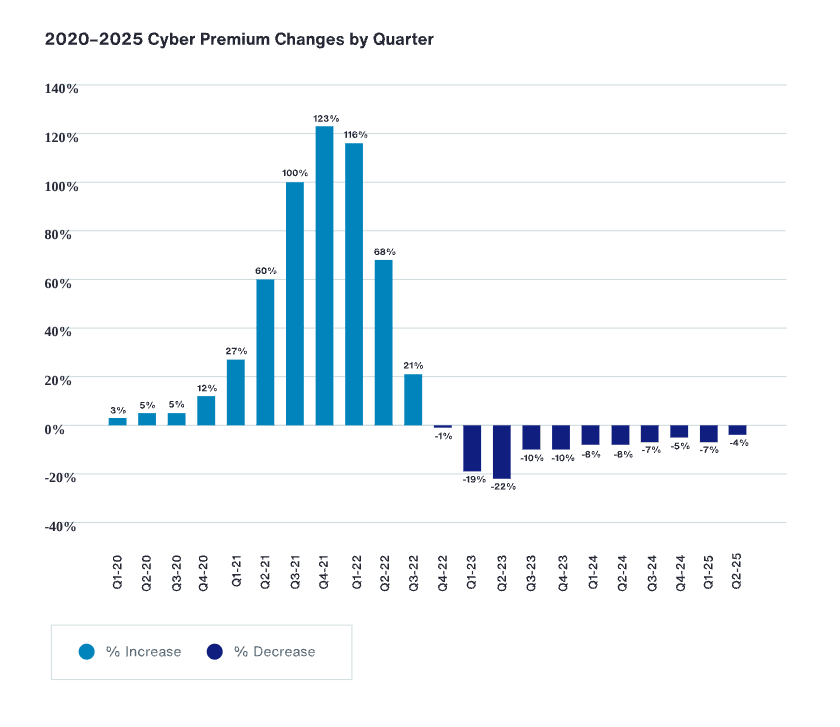

Pricing remained favorable in the first half of 2025, supported by a well-capitalized and competitive marketplace. Rate reductions slowed, with an average decrease of 4% in Q2 2025. Buyers continued to optimize their programs by expanding coverage, increasing limits, and adjusting retention levels to match their risk appetite.

Looking ahead, we expect to see flat to minimal premium decreases through 2025. However, certain industry classes, including healthcare, airlines and financial institutions, may face firmer conditions depending on controls and loss history.

Source: Aon data

Coverage enhancements and program structure stability, including long-term pricing agreements and rate guarantees, are helping insurers stand out in a competitive market. Given insurers’ desire to maintain their books of business and a well-capitalized excess marketplace, we expect buyer-friendly market trends to continue through the remainder of 2025.

“We continue to see carriers wanting to innovate, including bodily injury and property damage resulting from a cyber incident,” says Greg Sparacio, Middle Market Leader for Aon’s Cyber Solutions Practice in the United States. “There’s an appetite for that instead of offering more coverage for the same premium previously offered. It’s a favorable trend and good for buyers as they can cover more of their risk that was previously uninsurable as part of cyber.”

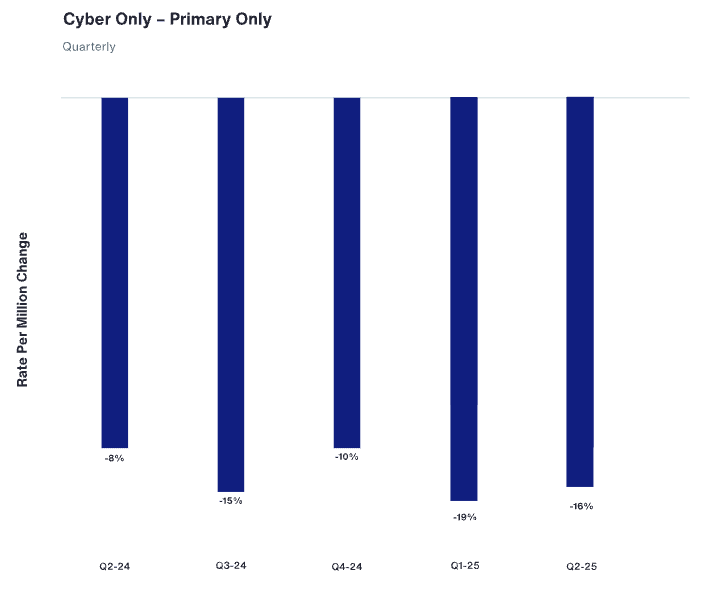

In Canada, the market remains highly competitive. Rate reductions averaged 19% in Q1 2025 and 16% in Q2, with insurers continuing to offer attractive terms across most segments.

Source: Aon data

“We have been hearing of loss developments across insurer cyber portfolios and believe more neutral market conditions are ahead,” says Katie Andruchow, Aon’s Cyber Broking Practice Leader in Canada. “We have heard about rate increases for large, complex tech E&O accounts. It seems that there may be some pockets being identified where rate erosion has been too great and flat to moderate increases are being asked.”

Pricing remains soft and loss ratios low, although market conditions are beginning to diverge by country.

“There are insurers starting to have discussions around rate increases, although they don’t have the loss data to back that up,” says Søren Stryger, Chief Broking Officer for Aon in Europe, the Middle East and Africa. “Accordingly, there are no signs of moderation in market conditions in EMEA, however, we may have seen minimum rates for certain risks and excess layers being offered.”

The collective concern in EMEA is underinsurance. Aon data shows that 70% of EMEA businesses reported vulnerability scans covering less than 100% of their enterprise — compared to 58% globally.

“Underinsurance is almost as big a concern as having no insurance at all,” says Alistair Clarke, Aon's Managing Director of Cyber Broking in the United Kingdom. “It is important that clients are made aware of what a bad day looks like for them without proper coverage. With the market still soft, many are increasing limits while they can.”

Cyber insurance markets have generally been flexible with terms and conditions, working with the broker and client to build a program that is right for the business.

“It’s no longer a binary yes or no,” says Catalina Esteban Loring, Aon's Executive Director for Cyber and Commercial E&O in the United Kingdom. “Insurers are more open to negotiation, and this is a direct result of the soft market and its move toward maturity.”

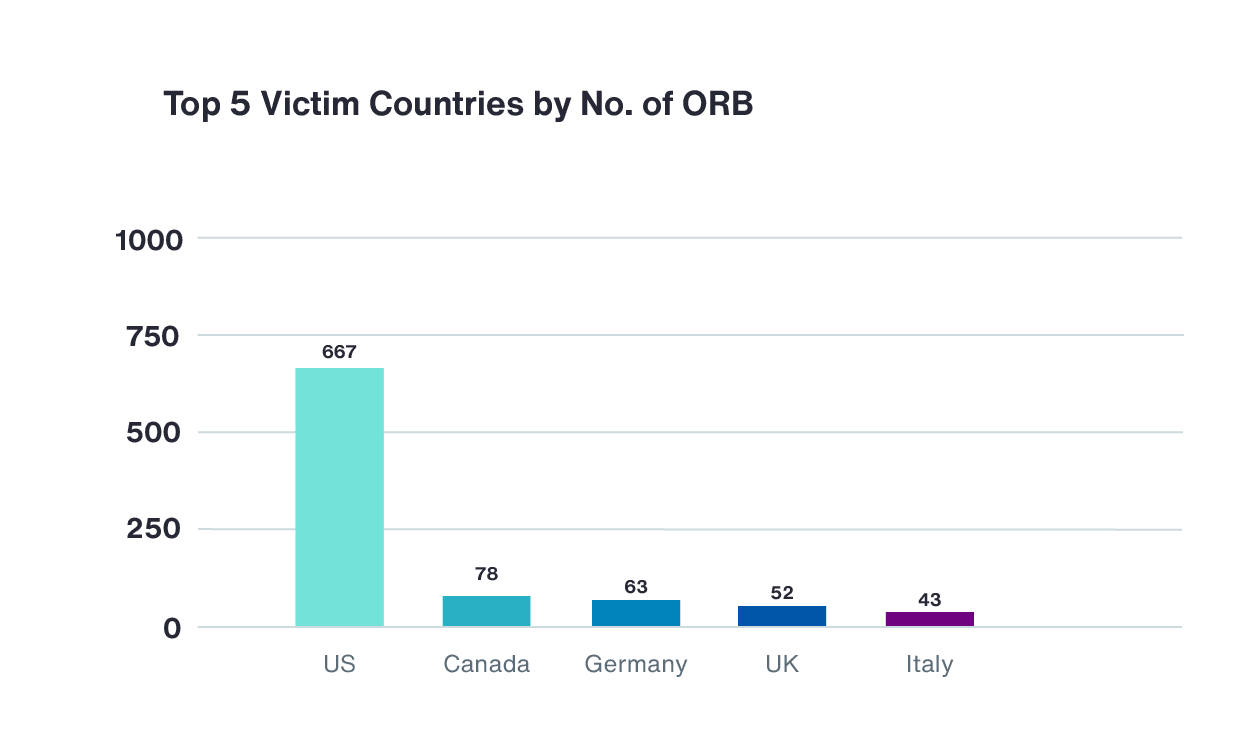

After three years of increasing frequency and declining severity, trends flipped in early 2025. Global ransomware incident volumes fell 6% in Q2 2025, but average demand payments jumped 104% to $1.13 million, according to Aon data.

“Even though ransomware frequency is down, the actual average ransomware demands are up, and it is a major loss driver on insurers’ books of business,” says Matt Chmel, Aon's Chief Broking Officer, Cyber Solutions in North America.

Ransomware attacks grab the headlines — not just for their scale, but for their ability to disrupt lives and critical systems in real time. It’s this intersection of operational impact and public exposure that keeps ransomware front and center for business and cyber security leaders. Globally, the U.S. continues to harbor most of the incidents, according to Aon data.

Source: Aon data

AI is accelerating defense capabilities while simultaneously arming threat actors with new tools to automate and scale attacks. It’s this dual-use nature that makes AI one of the most disruptive forces in cyber today.

It is certainly a growing concern among business and risk leaders. AI is now a top-10 future risk according to Aon’s 2025 Global Risk Management Survey. More than 70% of global businesses report an increased AI exposure, especially in social engineering and ransomware.1 By 2027 nearly one in five cyber attacks is expected to employ generative AI.2

Insurers are watching closely — not just how AI is used by attackers, but how organizations are deploying it to strengthen cyber resilience.

“If you are developing AI technology you need professional liability or tech E&O coverage to protect your organization,” adds Chmel. “Businesses also need to look at how they are using AI, ensuring business practices, processes, safeguards and compliance measures are strong.”

More than half of large organizations identified supply chain challenges as the biggest barrier to achieving cyber resilience,3 and for good reason. Several high-profile incidents, including CrowdStrike, CDK and Change Healthcare, have exposed the scale and severity of systemic risk, prompting heightened scrutiny from underwriters.

Supply chain or distribution failures continue to be among the top global risks in 2025, according to Aon’s Global Risk Management Survey of global business and risk leaders. The concern is not just operational — it’s financial, reputational and increasingly insurable.

“From a claims perspective we are seeing higher severity, but frequency remains stable,” says Pablo Constenla, Aon's Head of Cyber and Financial Lines Coverage and Claims in Europe, the Middle East and Africa. “Attacks against supply chain continue to be a concern. When claims hit, they’ve hit big. Threat actor groups are very aggressive at the moment.”

As privacy regulation tightens globally, litigation risk is rising, especially in the U.S. where class action lawsuits related to tracking technologies and wrongful data collection continue to impact the market. Insurers are responding by reassessing policy language and narrowing coverage around wrongful or unlawful data collection.

“Wrongful collection is a growing concern and many insurers are taking a firm stance on it,” adds Clarke. “We’re seeing a widening gap between insurers willing to offer coverage and those pulling back. It’s a signal to clients to review their exposure and ensure their programs are fit for purpose.”

Case Study

Leading organizations and risk leaders are using enhanced analytics to make better and faster decisions — building cyber resilience that’s both sustainable and scalable.

By moving beyond traditional benchmarking, brokers are helping risk managers align their insurance programs with actual risk tolerance.

“Data and analytics are helping risk managers think more about limits and adequacy vs. just limits and budget,” adds Andruchow. “Historically they have relied on benchmarking, cause of loss reports, publications and what peers were doing. We are able to enable them to make accurate decisions to protect their assets and build resilience.”

Aon’s Cyber Risk Analyzer and Cyber Quotient (CyQu) Evaluation tools offer the quantitative insights needed to understand exposure and optimize program structure.

“We’ve already seen around 20% of our clients increase their limits to capitalize on the soft market,” adds Chmel. “Others are proactively taking on high retentions after realizing through the tool that they have more risk tolerance.”

If you are ready to evaluate your cyber risk program, contact us to discuss tailored, actionable approaches for protecting your organization from cyber attacks and data breaches.

Katie Andruchow

Cyber Broking Practice Leader, Canada

Matt Chmel

Chief Broking Officer, Cyber Solutions, North America

Alistair Clarke

Managing Director, Cyber Broking, United Kingdom

Pablo Constenla

Head of Cyber Coverage and Claims, Europe, Middle East and Africa

Catalina Esteban Loring

Executive Director, Cyber and Commercial E&O, United Kingdom

Greg Sparacio

Middle Market Leader, Cyber Solutions, United States

Søren Stryger

Chief Cyber Broking Officer, Europe, Middle East and Africa

General Disclaimer

This document is not intended to address any specific situation or to provide legal, regulatory, financial, or other advice. While care has been taken in the production of this document, Aon does not warrant, represent or guarantee the accuracy, adequacy, completeness or fitness for any purpose of the document or any part of it and can accept no liability for any loss incurred in any way by any person who may rely on it. Any recipient shall be responsible for the use to which it puts this document. This document has been compiled using information available to us up to its date of publication and is subject to any qualifications made in the document.

Terms of Use

The contents herein may not be reproduced, reused, reprinted or redistributed without the expressed written consent of Aon, unless otherwise authorized by Aon. To use information contained herein, please write to our team.

Our Better Being podcast series, hosted by Aon Chief Wellbeing Officer Rachel Fellowes, explores wellbeing strategies and resilience. This season we cover human sustainability, kindness in the workplace, how to measure wellbeing, managing grief and more.

Expert Views on Today's Risk Capital and Human Capital Issues

Expert Views on Today's Risk Capital and Human Capital Issues

Expert Views on Today's Risk Capital and Human Capital Issues

Better Decisions Across Interconnected Risk and People Issues.

The construction industry is under pressure from interconnected risks and notable macroeconomic developments. Learn how your organization can benefit from construction insurance and risk management.

Our Cyber Resilience collection gives you access to Aon’s latest insights on the evolving landscape of cyber threats and risk mitigation measures. Reach out to our experts to discuss how to make the right decisions to strengthen your organization’s cyber resilience.

Our Employee Wellbeing collection gives you access to the latest insights from Aon's human capital team. You can also reach out to the team at any time for assistance with your employee wellbeing needs.

Explore Aon's latest environmental social and governance (ESG) insights.

Our Global Insurance Market Insights highlight insurance market trends across pricing, capacity, underwriting, limits, deductibles and coverages.

Better Decisions Across Interconnected Risk and People Issues.

How do the top risks on business leaders’ minds differ by region and how can these risks be mitigated? Explore the regional results to learn more.

Trade, technology, weather and workforce stability are the central forces in today’s risk landscape.

These industry-specific articles explore the top risks, their underlying drivers and the actions leaders are taking to build resilience.

Our Human Capital Analytics collection gives you access to the latest insights from Aon's human capital team. Contact us to learn how Aon’s analytics capabilities helps organizations make better workforce decisions.

Read our collection of human capital articles that explore in depth hot topics for HR and risk professionals, including using data and analytics to measure total rewards programs, how HR and finance can better partner and the impact AI will have on the workforce.

Explore our hand-picked insights for human resources professionals.

Our Workforce Collection provides access to the latest insights from Aon’s Human Capital team on topics ranging from health and benefits, retirement and talent practices. You can reach out to our team at any time to learn how we can help address emerging workforce challenges.

Our Mergers and Acquisitions (M&A) collection gives you access to the latest insights from Aon's thought leaders to help dealmakers make better decisions. Explore our latest insights and reach out to the team at any time for assistance with transaction challenges and opportunities.

The challenges in adopting renewable energy are changing with technological advancements, increasing market competition and numerous financial support mechanisms. Learn how your organization can benefit from our renewables solutions.

How do businesses navigate their way through new forms of volatility and make decisions that protect and grow their organizations?

Our Parametric Insurance Collection provides ways your organization can benefit from this simple, straightforward and fast-paying risk transfer solution. Reach out to learn how we can help you make better decisions to manage your catastrophe exposures and near-term volatility.

Our Pay Transparency and Equity collection gives you access to the latest insights from Aon's human capital team on topics ranging from pay equity to diversity, equity and inclusion. Contact us to learn how we can help your organization address these issues.

Forecasters are predicting an extremely active 2024 Atlantic hurricane season. Take measures to build resilience to mitigate risk for hurricane-prone properties.

Our Technology Collection provides access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities of technology. Reach out to the team to learn how we can help you use technology to make better decisions for the future.

Our Trade Collection gives you access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities for international business. Reach out to our team to understand how to make better decisions around macro trends and why they matter to businesses.

Better Decisions Across Interconnected Risk and People Issues.

With a changing climate, organizations in all sectors will need to protect their people and physical assets, reduce their carbon footprint, and invest in new solutions to thrive. Our Weather Collection provides you with critical insights to be prepared.

Our Workforce Resilience collection gives you access to the latest insights from Aon's Human Capital team. You can reach out to the team at any time for questions about how we can assess gaps and help build a more resilience workforce.

Article 6 mins

Addressing the retirement pay gap issue between men and women starts with first acknowledging it exists. Then companies can conduct further analysis and adjust their benefit plans accordingly.

Article 8 mins

AI acceleration, rising healthcare costs and changes to workforce skills are transforming organizations. Our analysis of financial services, life sciences and technology companies provides insights on how to redesign roles, reskill at scale and reimagine talent strategies to stay competitive.

Article 10 mins

Workforce-related risks — spanning health, benefits, safety systems, and data and analytics — are not just operational concerns but strategic drivers. When activated, they positively shape the total cost of risk and long-term resilience for industrials and manufacturing organizations.