Protecting Your Business from Underinsurance Risks

With the risk of underinsurance growing amid global uncertainty, businesses must act to ensure they have the right coverages in place.

Key Takeaways

-

Businesses that are underinsured risk receiving reduced claim payments, or having claims denied altogether, which can create major financial shortfalls after an incident.

-

Common causes of underinsurance include outdated or inaccurate valuations, failure to account for all relevant costs, and changes in business operations not reflected in coverage.

-

Regularly updating asset valuations and business exposures – alongside business changes and insurance limits – is essential to ensure insurance coverage remains accurate and sufficient.

Why Underinsurance Could be a Problem for Your Business and How to Prevent it

It is critical for all UK businesses to understand how underinsurance could lead to a damaging recovery shortfall following a claim. This article discusses the impact of property underinsurance and what businesses can do to protect themselves.

Underinsurance is an unseen problem for many businesses and often only makes itself known when submitting an insurance claim. If underinsured, the business will quickly realise that a claim for property theft or damage, for example, may not be fully covered by their insurer resulting in a potentially damaging recovery shortfall. According to the surveyor Charterfields, assets at eight out of ten business locations are underinsured, with four out of ten insured for less than half of what it could cost to restore the business back to where it was before a claim.1

So, what is underinsurance, how does it happen, and what can businesses do about it?

What is Underinsurance?

Underinsurance is when a business’s declared sums insured is not sufficient to cover the full cost of a claim. It can apply to a business’s buildings, plant and machinery, business interruption and even exposures like liability, with potentially severe consequences for the business’s financials.

Why Does Underinsurance Matter?

Not only might policy limits prove to be inadequate, which would leave a business short of funds, but in the case of asset insurance, insurers may also penalise the policyholder by applying ‘average’. This is where an insurer can proportionately reduce a claim payment to reflect the amount of underinsurance. For example, if a business only insured 63 percent of its buildings or plant and machinery by value, then the insurer may apply average for a claim and only pay 63 percent of the value of the loss. Also, be aware that deliberate underinsurance could invalidate the entire policy.

Why Does Underinsurance of Assets Happen?

Often underinsurance is simply a result of out of date or inaccurate valuations for buildings, plant and machinery. But there are other causes of underinsurance, such as a business declaring the market value of their premises rather than the rebuild costs; omitting debris removal and professional fees incurred in clearing and reinstating property; or not disclosing to its insurer the true valuations involved to try and reduce premium costs. Another cause of underinsurance commonly arises where a business has changed its operating model and has different levels of exposure than it had before. For example, it is still calculating values based on old figures, or has not updated values to reflect increased stock-holding on its premises to counter supply chain vulnerabilities.

Global Uncertainties Could Make Underinsurance Worse

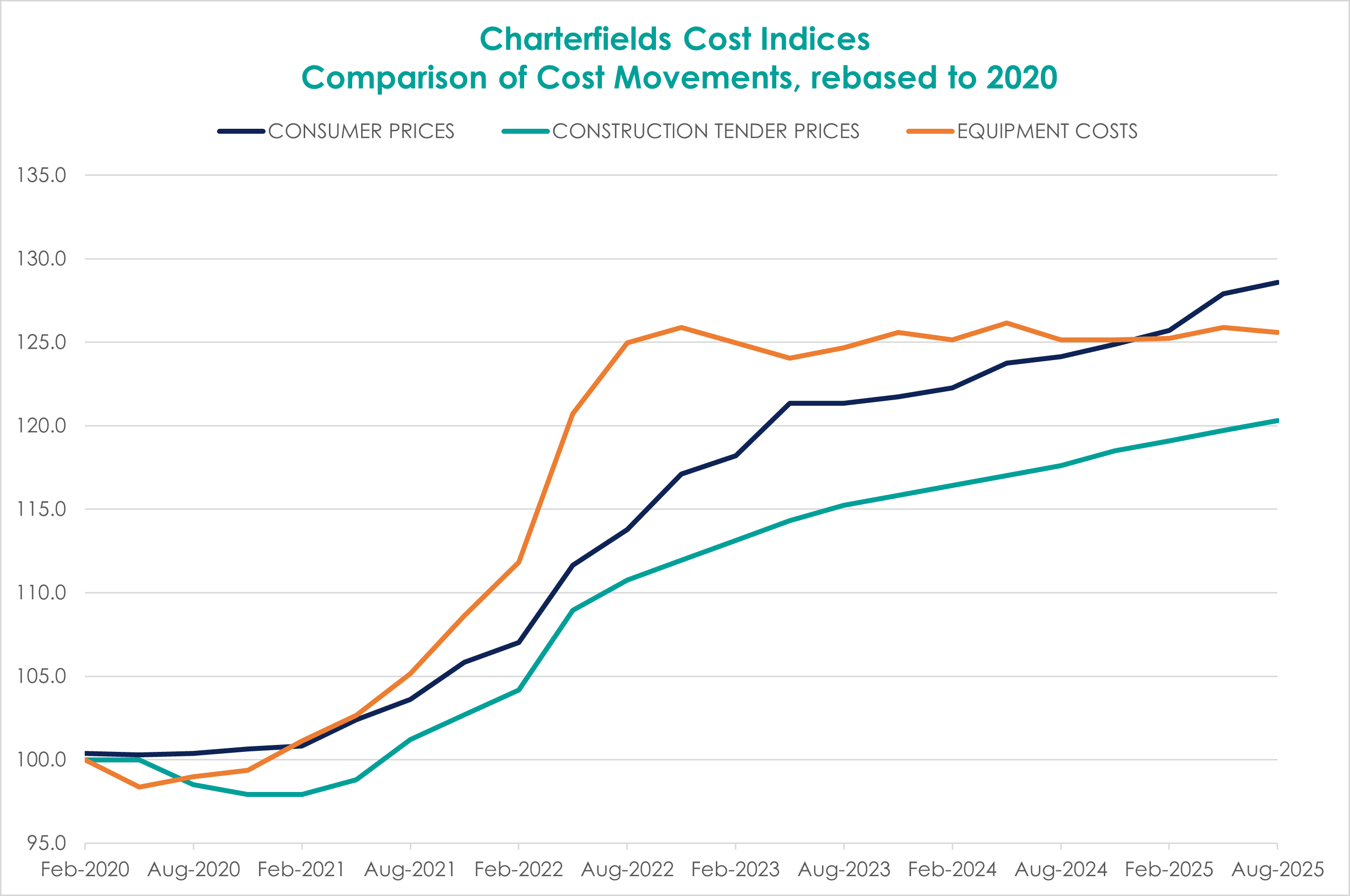

The underinsurance problem is likely to continue to escalate with the ongoing steep rise in costs of labour and materials making property repairs far more expensive than a year ago, as well as other global uncertainties around issues like trade that can push up the costs of materials as well as spare parts. This situation is illustrated with reference to the rebuilding cost index below, which shows that rebuilding costs have increased by 20 percent since 2020 and equipment costs by over 25 percent.

As global volatility rises, so does the unseen risk of underinsurance for many businesses. Now more than ever, it’s important to understand your business exposures so that you’re protected in the case of an event.

How Can Your Business Prevent Underinsurance?

-

Keep pace with valuations

Make sure your business instructs regular reinstatement valuations (the cost to rebuild or replace rather than the market or written down asset values) every three to five years for all your buildings, machinery and plant.

-

Consider any business changes

Adjust insured values to reflect changes in your business. (Policies may require you to do so immediately or within a defined period). At renewal take care to ensure that values declared are reassessed.

-

Review business interruption basis

Conducting a Business Impact Analysis will allow your business to understand the potential consequences of an incident and the true loss of earnings that would result allowing the most appropriate basis of cover to be selected whether this is insurable gross profit, increased cost of working or another measure, the indemnity period (period required to get things back to normal) and vulnerabilities to your supply chain.

-

Review your average clause

If an average clause applies to your policy, it may be possible to have it removed provided regular valuations are carried out. Otherwise you should be aware that it could apply and potentially reduce your claim if an insurer believes the values insured were not correct.

-

Review your insurance limits

With insurance premiums stabilising or even falling in some cases, you should revisit your existing cover limits and sub-limits – the maximum amount an insurer will pay out on a covered claim or for a particular covered claim. These are often overlooked and rolled over from one year to the next. During the soft market insurance cycle it may be possible to raise these limits at little or no extra premium in current market conditions to reflect the higher potential losses.

For more guidance on this topic or underinsurance more generally and how Aon can help protect your business from underinsurance, please speak to your Aon advisor or risk consultant.

General Disclaimer

The information contained herein and the statements expressed are of a general nature and are not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information and use sources that we consider to be reliable, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.

Terms of Use

The contents herein may not be reproduced, reused, reprinted or redistributed without the expressed written consent of Aon, unless otherwise authorized by Aon. To use information contained herein, please write to our team.

Aon UK Limited is authorised and regulated by the Financial Conduct Authority. Aon UK Limited is registered in England and Wales. Registered number: 00210725. Registered Office: The Aon Centre, The Leadenhall Building, 122 Leadenhall Street, London EC3V 4AN. Tel: 020 7623 5500. FP.AGRC.2025.420.SD.

Aon's Better Being Podcast

Our Better Being podcast series, hosted by Aon Chief Wellbeing Officer Rachel Fellowes, explores wellbeing strategies and resilience. This season we cover human sustainability, kindness in the workplace, how to measure wellbeing, managing grief and more.

Aon Insights Series Asia

Expert Views on Today's Risk Capital and Human Capital Issues

Aon Insights Series Pacific

Expert Views on Today's Risk Capital and Human Capital Issues

Aon Insights Series UK

Expert Views on Today's Risk Capital and Human Capital Issues

Client Trends 2025

Better Decisions Across Interconnected Risk and People Issues.

Construction and Infrastructure

The construction industry is under pressure from interconnected risks and notable macroeconomic developments. Learn how your organization can benefit from construction insurance and risk management.

Cyber Resilience

Our Cyber Resilience collection gives you access to Aon’s latest insights on the evolving landscape of cyber threats and risk mitigation measures. Reach out to our experts to discuss how to make the right decisions to strengthen your organization’s cyber resilience.

Employee Wellbeing

Our Employee Wellbeing collection gives you access to the latest insights from Aon's human capital team. You can also reach out to the team at any time for assistance with your employee wellbeing needs.

Environmental, Social and Governance Insights

Explore Aon's latest environmental social and governance (ESG) insights.

Q4 2023 Global Insurance Market Insights

Our Global Insurance Market Insights highlight insurance market trends across pricing, capacity, underwriting, limits, deductibles and coverages.

Global Risk Management Survey

Better Decisions Across Interconnected Risk and People Issues.

Regional Results

How do the top risks on business leaders’ minds differ by region and how can these risks be mitigated? Explore the regional results to learn more.

Top 10 Global Risks

Trade, technology, weather and workforce stability are the central forces in today’s risk landscape.

Industry Insights

These industry-specific articles explore the top risks, their underlying drivers and the actions leaders are taking to build resilience.

Human Capital Analytics

Our Human Capital Analytics collection gives you access to the latest insights from Aon's human capital team. Contact us to learn how Aon’s analytics capabilities helps organizations make better workforce decisions.

Human Capital Quarterly Insights Briefs

Read our collection of human capital articles that explore in depth hot topics for HR and risk professionals, including using data and analytics to measure total rewards programs, how HR and finance can better partner and the impact AI will have on the workforce.

Insights for HR

Explore our hand-picked insights for human resources professionals.

Workforce

Our Workforce Collection provides access to the latest insights from Aon’s Human Capital team on topics ranging from health and benefits, retirement and talent practices. You can reach out to our team at any time to learn how we can help address emerging workforce challenges.

Mergers and Acquisitions

Our Mergers and Acquisitions (M&A) collection gives you access to the latest insights from Aon's thought leaders to help dealmakers make better decisions. Explore our latest insights and reach out to the team at any time for assistance with transaction challenges and opportunities.

Natural Resources and Energy Transition

The challenges in adopting renewable energy are changing with technological advancements, increasing market competition and numerous financial support mechanisms. Learn how your organization can benefit from our renewables solutions.

Navigating Volatility

How do businesses navigate their way through new forms of volatility and make decisions that protect and grow their organizations?

Parametric Insurance

Our Parametric Insurance Collection provides ways your organization can benefit from this simple, straightforward and fast-paying risk transfer solution. Reach out to learn how we can help you make better decisions to manage your catastrophe exposures and near-term volatility.

Pay Transparency and Equity

Our Pay Transparency and Equity collection gives you access to the latest insights from Aon's human capital team on topics ranging from pay equity to diversity, equity and inclusion. Contact us to learn how we can help your organization address these issues.

Property Risk Management

Forecasters are predicting an extremely active 2024 Atlantic hurricane season. Take measures to build resilience to mitigate risk for hurricane-prone properties.

Technology

Our Technology Collection provides access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities of technology. Reach out to the team to learn how we can help you use technology to make better decisions for the future.

Trade

Our Trade Collection gives you access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities for international business. Reach out to our team to understand how to make better decisions around macro trends and why they matter to businesses.

Transaction Solutions Global Claims Study

Better Decisions Across Interconnected Risk and People Issues.

Weather

With a changing climate, organizations in all sectors will need to protect their people and physical assets, reduce their carbon footprint, and invest in new solutions to thrive. Our Weather Collection provides you with critical insights to be prepared.

Workforce Resilience

Our Workforce Resilience collection gives you access to the latest insights from Aon's Human Capital team. You can reach out to the team at any time for questions about how we can assess gaps and help build a more resilience workforce.

More Like This

-

Article 10 mins

Industrials and Manufacturing: A Risk Management Approach to Transform Workforce Risk into Workforce Resilience

Workforce-related risks — spanning health, benefits, safety systems, and data and analytics — are not just operational concerns but strategic drivers. When activated, they positively shape the total cost of risk and long-term resilience for industrials and manufacturing organizations.

-

Article 7 mins

Managing Technological Risk in the Age of Advanced Gas Turbines

As the digital economy accelerates, driven by AI and cloud computing, the U.S. power sector faces a new era of demand. Advanced gas turbines are at the heart of this transformation, but their rapid evolution brings complex risks.

-

Article 24 mins

Q4 2025: Global Insurance Market Overview

Soft market conditions, ample capacity and heightened competition continued across most geographies and lines in Q4 — giving insurance buyers opportunities to secure better pricing, improve terms and expand coverage.