Demand for construction and real estate has rebounded — even accelerated — in the years following the pandemic. But against this backdrop, the industry faces ongoing challenges, including supply chain disruption and scarcity of materials, a lack of available talent and the uncertainty of operating in a volatile economic landscape. Plus, perennial risks like cashflow management have not gone away.

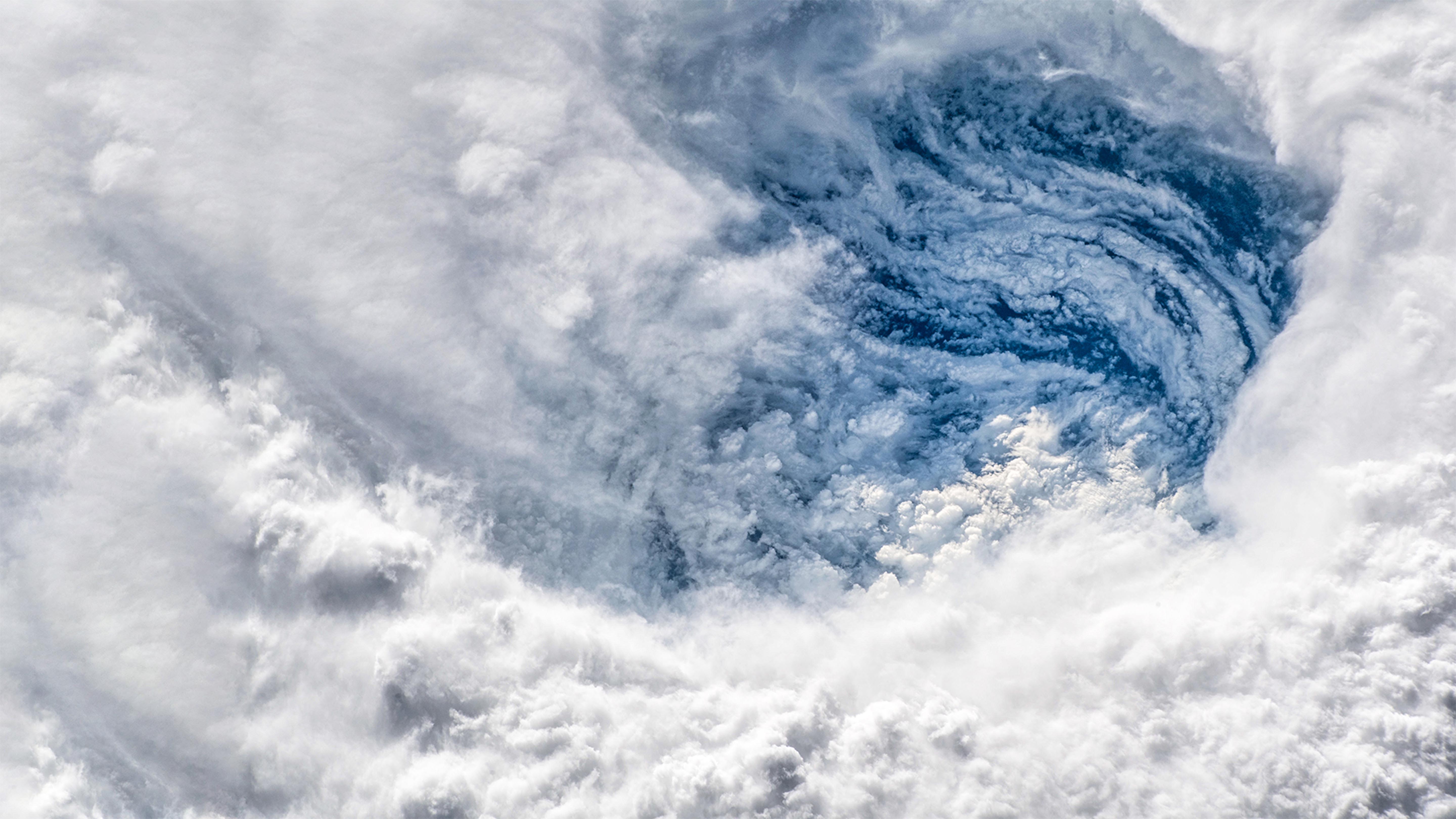

Of course, new challenges are always emerging. Cyber and intellectual property-related threats are rising, and climate considerations are rapidly growing in importance. This is not a moment where leaders can afford to stand still.

To address these challenges, Aon has vast experience in providing risk capital and human capital capabilities to contractors, developers, investors, and the full range of organizations that support the construction and real estate industry. We continue to innovate on behalf of clients, developing solutions such as environmental, social and governance benchmarking to help leaders reduce their overall cost of risk and manage their people and risks optimally.